Wise (Formerly Transferwise) Statistics By Revenue, Gross Profit, Expansion And Innovation

Updated · Jul 02, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Wise Gross Profit

- Wise Underlying Income

- Wise Profit Before Tax

- Wise Revenue By Region

- Wise Currencies Accounts In Which Wise Accounts Are Held

- Wise Expansion And Innovation

- Wise Investment Growth

- Wise Active Customers

- Wise Volume Per Customer

- Wise Cross-Border Volume

- Wise Earning Per Share

- Wise Company Gender Breakdown

- Wise Representation Through Diversity And Leadership

- Conclusion

Introduction

Wise (Formerly Transferwise) Statistics: Wise is a London-hailing finance technology firm that propounded the idea of international amount transfer in a new light as Wise, previously TransferWise in 2010. It went further to become an easy alternative for people or corporations requiring value transfer across borders due to its transparent, cost-effective services.

For the financial year ending March 31, 2025, Wise continued with remarkable growth numbers, reaching new heights with customers added, transaction volume, and profits.

This article takes a look at Wise (Formerly Tranferwise) statistics based on growth and trends.

Editor’s Choice

- Wise (Formerly Tranferwise) Statistics show that gross profit grew by 71% every year and went from £638.2 million in FY2023 to a historical sum of £1,092.4 million in FY2024: achievement on Wise.

- Underlying income grew 31% YoY to £1,172.7 million in FY2024 from £892.0 million in FY2023.

- BPT (Profit Before Tax) increased considerably, hitting £481.4 million during FY2024, which was more than triple the growth from the £146.5 million recorded in FY2023.

- Total revenue surged from £846.1 million in FY2023 to £1,052.0 million in FY2024.

- In summary, the company’s total revenue has grown from £846.1 million in 2023 to £1,052.0 million in 2024, demonstrating the growing customer base and its extensive global footprint.

- Cross-border transaction value increased by 13% YoY at £118.5 billion in FY2024.

- Wise (Formerly Tranferwise) statistics reveal that personal transaction volume rose 14% to £87.2 billion, while business transactions increased 12% to £31.3 billion.

- Total active customers reached 12.8 million, which is a year-on-year increase of 29%, with 5.4 million of them registered in FY2024.

- Business users rose by 20% to 0.63 million, with business transaction volumes totaling £31.3 billion.

- Earnings per share (EPS) grew by 197%, reaching 34.20 pence in FY2024 as compared to 11.07 pence in FY2023.

- However, the average transaction amount per customer decreased by 12%, reaching £9,232, owing to a growing share of card-only customers.

- In FY2024, women accounted for 38% of new Director-level hires.

- More than half of Wise’s global teams have 50% or more of their pool of senior leaders comprising women.

- Wise (Formerly Tranferwise) statistics state that women constitute 51% of the workforce at Wise; however, only 32% fill senior leadership positions.

- In FY2024, the Wise Platform gained over 85 partners, Mox, Agoda, and Webexpenses being among them.

- Wise Assets ‘Interest’ was launched in five European countries, whereas Wise Assets ‘Stocks’ was launched in 11 European countries.

- To create greater global accessibility, new services were introduced for expatriates in China, Brazil, Indonesia, and Australia.

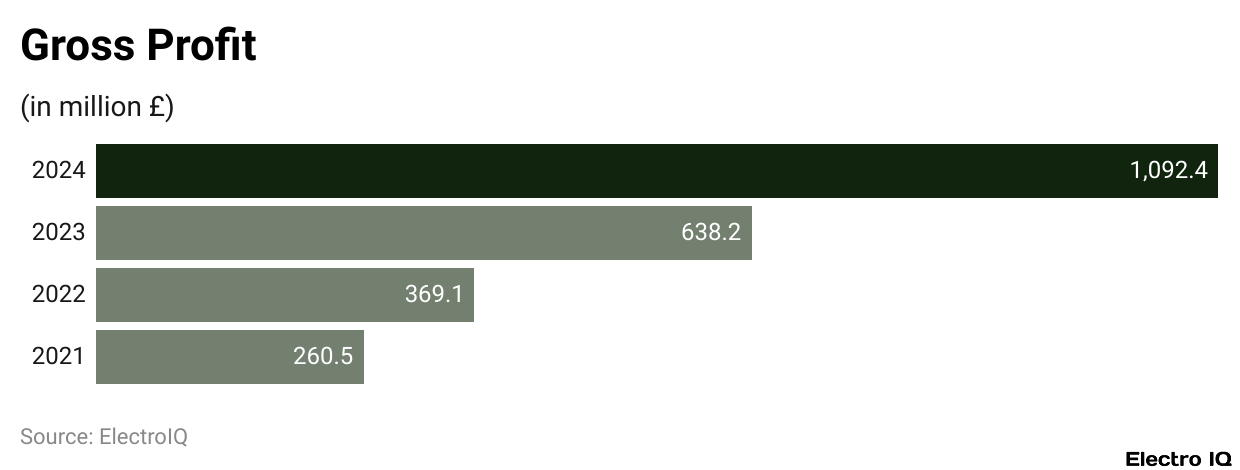

Wise Gross Profit

(Source: wise.com)

- In the fiscal year 2024, Wise posted an impressive 71% year-over-year gross profit growth of revenue at £1,092.4 million against £638.2 million in 2023.

- It could be attributed to a combination of additional revenue generated as well as improved cost management.

- As part of its overall improvement in operations, the company improved its operational process for important aspects beyond foreign exchange (fx) transaction management to cover chargebacks from customers, thus increasing its controllability under the cost of sales.

- Wise can run its operations profitably while offering its customers competitive and efficient services in optimized areas.

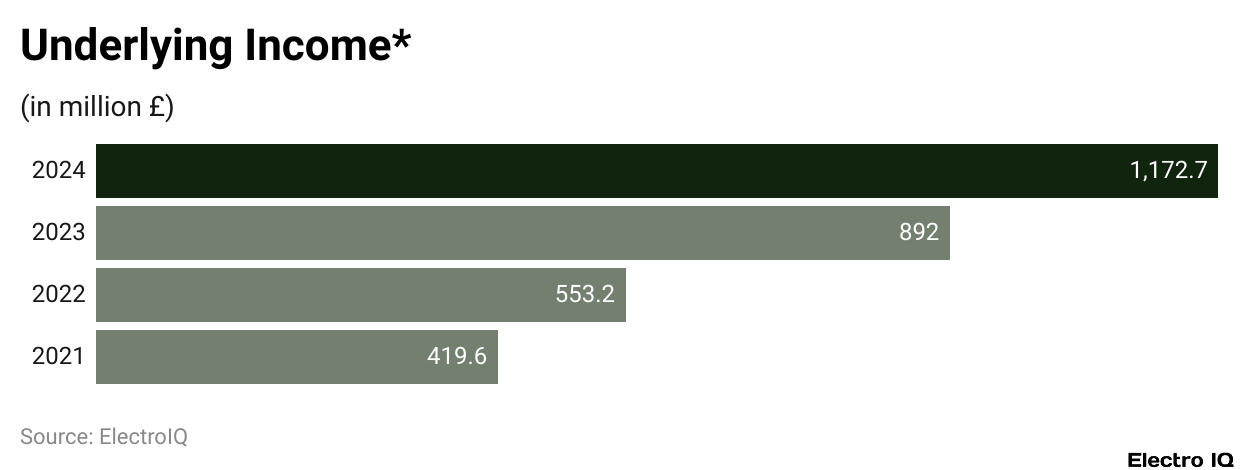

Wise Underlying Income

(Source: wise.com)

- Wise has grown to a large extent in the underlying income for the past four years, with an underlying income of £1,172.7 million reported in the financial year 2024, reflecting a substantial difference from the previous year, which was £892.0 million.

- Growth was steady from 553.2 million in 2022 all the way through to 419.6 million in 2021, with the initial figure being the one for the current year.

- So, previously, there has been growth across the years, and it can be seen that Wise is now being positively correlated with more clients, transactions, and continued steps towards improvement in its financial service offerings.

- Good performance on the financial front is due to Wise being able to scale efficiently while also maintaining cost control.

Wise Profit Before Tax

(Source: wise.com)

- Over the last four years, Wise’s profit before tax has seen a phenomenal increase.

- For 2021, the company reported a profit before tax of £41.1 million, which then saw a slight increase to £43.9 million in 2022, but in 2023, there was a substantial jump to £146.5 million, marking a strong improvement in financial performance.

- In 2024, the upward trend continued, with profit before tax of £481.4 million, rising by more than three times from the prior year.

- Such splendid growth is a reflection of Wise’s ability to efficiently scale its operations, generate revenue, and control its costs while expanding its global customer base.

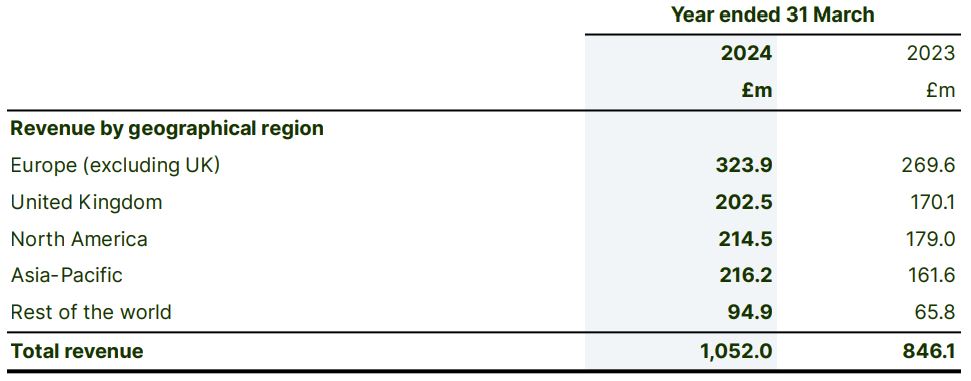

Wise Revenue By Region

(Source: wise.com)

- Wise saw significant, very strong growth in revenue across all regions in 2024 when contrasted with 2023.

- Europe, excluding the UK, continued to be Wise’s largest market by revenue, increasing between 2023 and 2024 by £54.3 million to £323.9 million.

- United Kingdom also grew strongly from £170.1 million to £202.5 million, while North America similarly increased from £179.0 million to £214.5 million.

- Asia-Pacific gained one of the higher increases, up to £216.2 million from £161.6 million. Other parts of the world contributed to Wise’s growth, too, increasing revenues from £65.8 million to £94.9 million.

- Overall, the company’s total revenues increased from £846.1 million in 2023 to £1,052.0 million in 2024, showcasing its expanding global footprint and growing customer base.

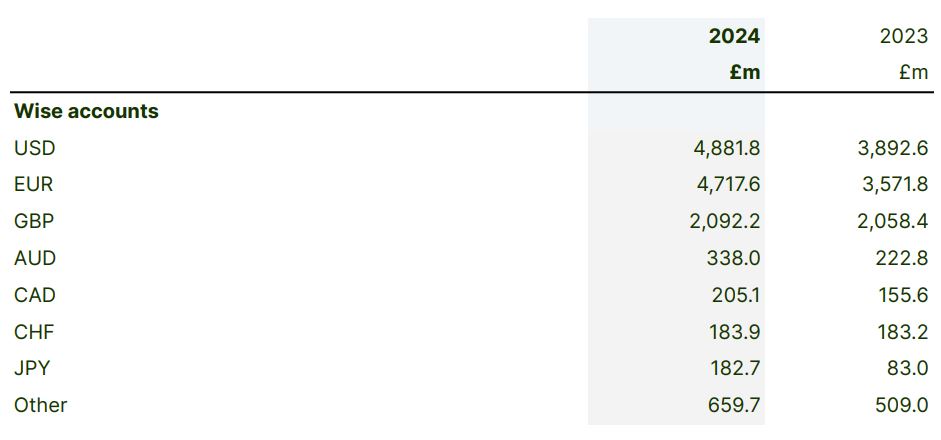

Wise Currencies Accounts In Which Wise Accounts Are Held

(Source: wise.com)

- Wise (Formerly Tranferwise) Statistics reveal that wise customers throughout 2024 had their account balances across various currencies worth noting in comparison to 2023.

- The most notable were that of US dollars (USD), which grew from £3,892.6 million in 2023 to £4,881.8 million in 2024.

- Euro (EUR) balances had also grown significantly, increasing from £3,571.8 million to £4,717.6 million, while British pounds (GBP) consistently increased slightly from £2,058.4 million to £2,092.2 million.

- Among continued strong currencies, Australian dollars (AUD) balances went up from £222.8 million to £338.0 million, while Canadian dollar (CAD) increased from £155.6 million to £205.1 million.

- Swiss francs (CHF): a little uptick in trading as £183.2 million moved to £183.9 million. Japanese yen (‘JPY’) was one of the most impressive leaps, going from £83.0 million to £182.7 million.

- Other currencies have now risen from a total of £509.0 million to £659.7 million.

- They add to the increasingly progressive customer base of Wise worldwide and the use of its multi-currency accounts across different regions.

- This continuous progression in account balances for various currencies is a testament to the belief customers have in Wise to hold and manage their funds from international ends.

Wise Expansion And Innovation

- Wise has three main products for its customer base: Wise Account for personal users, Wise Business for SMEs, and Wise Platform for banks and other financial institutions.

- In the financial year 2024, the company carried on the development of various products and some of the key events included launching the service that helps expatriates in China send money back home.

- The fee to hold a balance in Australia was also removed; businesses can now receive from Wise customers in Brazil up to US$10,000, and transfer limits to Indonesia increased to 2 billion IDR. Further improving its financial services.

- Wise has deployed Wise Assets ‘Interest’ in five European countries, allowing for earning from its euros (EUR) and the British pound (GBP) balances through low-risk government-backed investments.

- Wise Assets “Stocks” was rolled out into 11 European countries, allowing customers to own balances as equity ownership in some of the largest public companies in the world.

- Wise Platform, which enables banks, enterprises, and financial institutions to integrate Wise’s infrastructure into their services, also continued to grow cross-border volumes in FY2024.

- Onboarded into cross-border volumes were partnerships that include Mox, Agoda, and Webexpenses, bringing the total number of partners to over 85.

- Additional features were included for platform partners, such as Wise-issued cards for Tiger Brokers customers in Singapore and Parpera’s customers in Australia.

- This is yet another example of the continuation of accessibility, efficiency, and financial inclusion across different global markets.

Wise Investment Growth

- In the three years before FY2024, Wise has seen massive results from ongoing growth investments. The active customer count grew at a compound annual rate (CAGR) of 29%, while cross-border volume grew at a similar 30% CAGR to £118.5 billion.

- Customer balances rose at an impressive 53% CAGR to £13.3 billion, a direct result of increasing service adoption and a growing customer base, with higher central bank rates contributing to the 31% rise in underlying income to £1172.7 million in FY2024 compared with the previous year.

- Having met operational expenses, a bulk of the cash generated was then reinvested in marketing, enhancement of service delivery, product development, infrastructure, and pricing cuts that foster customer expansion.

- The underlying profit before tax in FY2024 soared by 226% over FY2023 after these investments, with an underlying PBT margin of 21%.

- Reported profit before tax soared to £481.4 million, while basic earnings per share went up to 34.2 pence, more than tripling relative to FY2023. Such a picture demonstrates the company’s bright financial performance during the year and the successful growth strategies deployed.

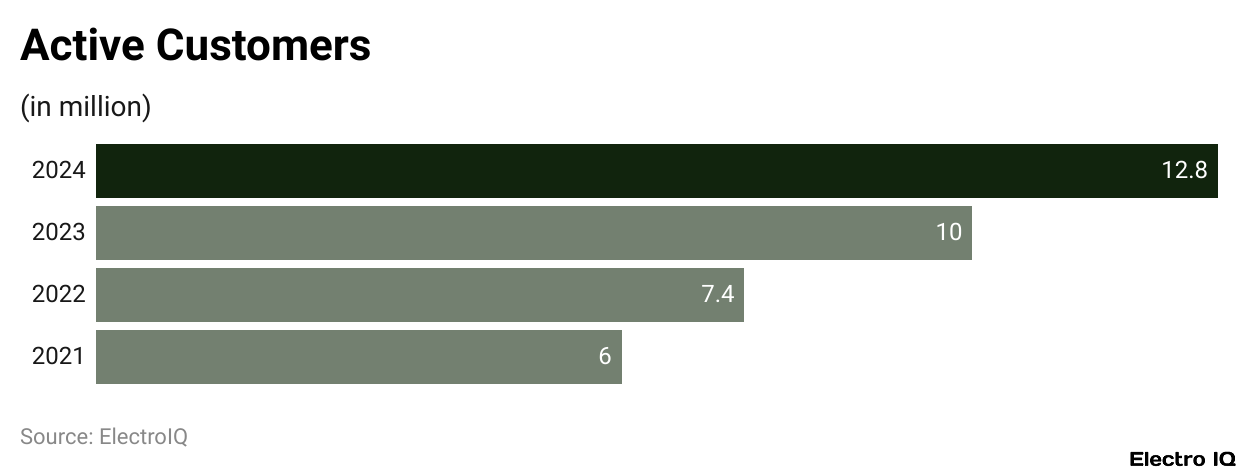

Wise Active Customers

(Reference: wise.com)

- According to Wise (Formerly Tranferwise) Statistics, the active customer base expanded by a total of 29 %, thereby increasing from around 10 million customers to 12.8 million, with 5.4 million enrolling in the course of the year.

- Active personal customers increased in number by 29 % to 12.2 million, while active business customers increased by 20 % to 0.63 million.

- One key driver of very high growth, especially among the smaller volume per customer (VPC) segment in which personal users transact under £10,000 per quarter, was the increased adoption of the Wise Account.

- One interesting trend regarding Wise Account users is that they can be classified into two: card-only customers perform only cross-border transactions with their card within a quarter.

- They tend to have a cross-border VPC in a range of between £500 and £1,000.

- The share of these card-only customers increased rapidly from about 3 % of active personal customers in Q1 FY2021 to 17 % in Q4 FY2024.

- The Personal segment VPC hovered around £3,000 in Q4 FY2024, which shows an 11% decrease as compared to Q4 FY2023.

- Without considering the fast-growing, lower-VPC consumer segment that is ‘card-only’, the reported Personal VPC would have been about 15% greater in Q4 FY2024 and would have shown only a minor decline of about 6% compared to Q4 FY2023.

- This reduction can be attributed in equal measure to the currency translation into GBP and somewhat to the slower growth rate among higher-VPC customers (those transacting £10,000 or more per quarter) due to rising interest rates.

- Wise (Formerly Tranferwise) Statistics state that the active business customers stand at 0.63 million, up 20%, with 60% of these using the Wise Account. Business transactions amounted to £31.3 billion, an increase of 12%.

- New business customer on-boardings have slowed down in the latter half of FY2024 as a result of a temporary pause in new business on-boarding in the UK and EU to manage an operational capacity constraint in a high demand period.

- The phased opening is taking place in different countries, and refined criteria are applied to ensure better quality of applications.

- As FY2025 begins, business customer onboarding has resumed across all major markets.

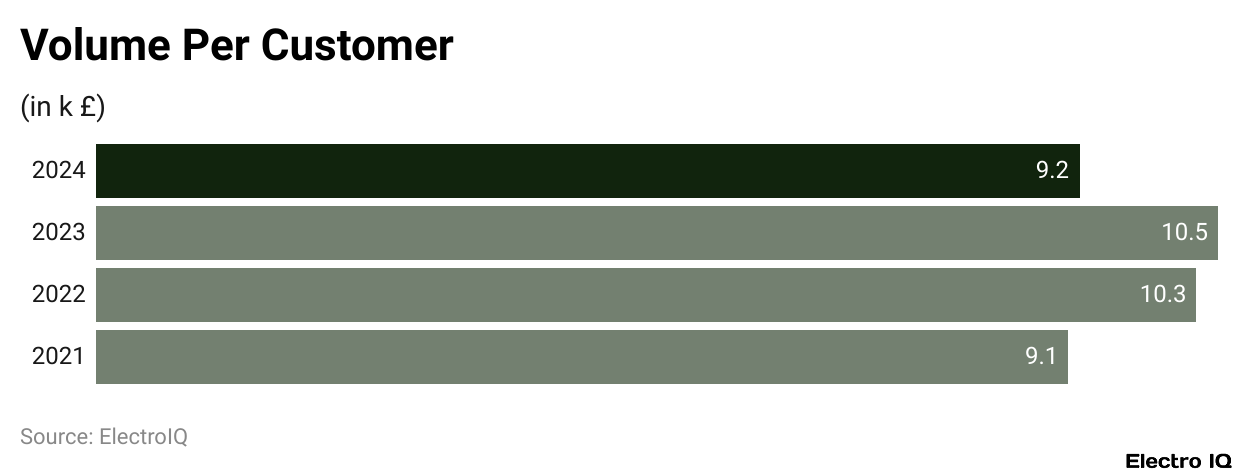

Wise Volume Per Customer

(Reference: wise.com)

- Wise (Formerly Tranferwise) Statistics indicate that the total transaction volume has grown by 13%, while the average volume per customer plummeted by 12%, coming in at £9,232 for the year.

- This fall has been strongly influenced by the rise of the Wise Account, encouraging an increasing number of customers to use the card for strictly cross-border transactions: lower transaction volumes per customer are typical for card-only customers, thereby resulting in an average volume per customer reduction compared to last year.

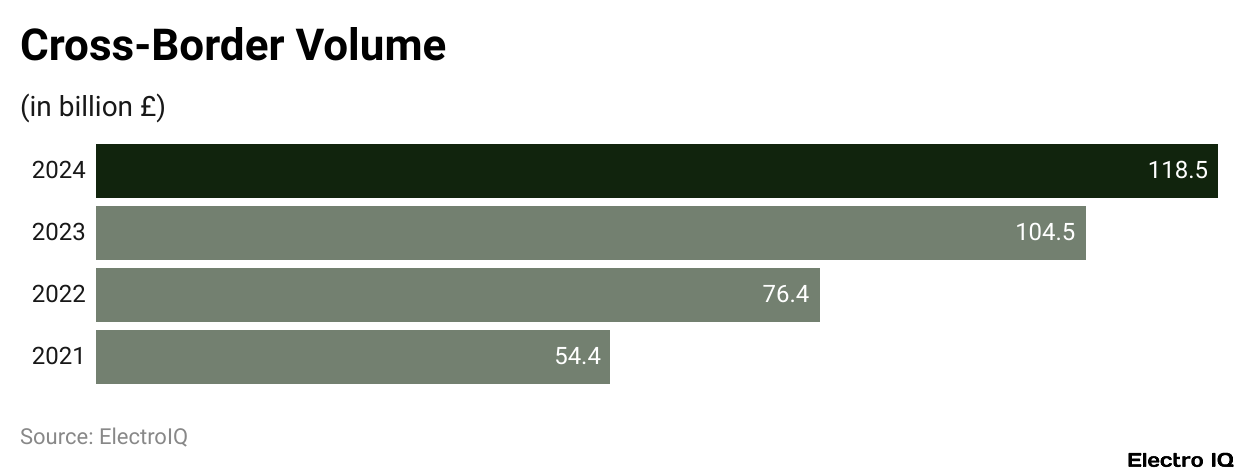

Wise Cross-Border Volume

(Reference: wise.com)

- Wise (Formerly Tranferwise) Statistics reveal that During the last financial year, the total volume of cross-border transactions increased to £118.5 billion at an annual growth rate of 13%.

- The transaction volume growth was a combination of personal and business transactions.

- Personal transaction volumes increased by 14% and amounted to £87.2 billion, while business transaction volumes grew by 12% and reached £31.3 billion.

- Both segments reflected an ever-increasing adoption rate of international money transfers by individuals and businesses, signifying an increased global presence and user trust in the platform.

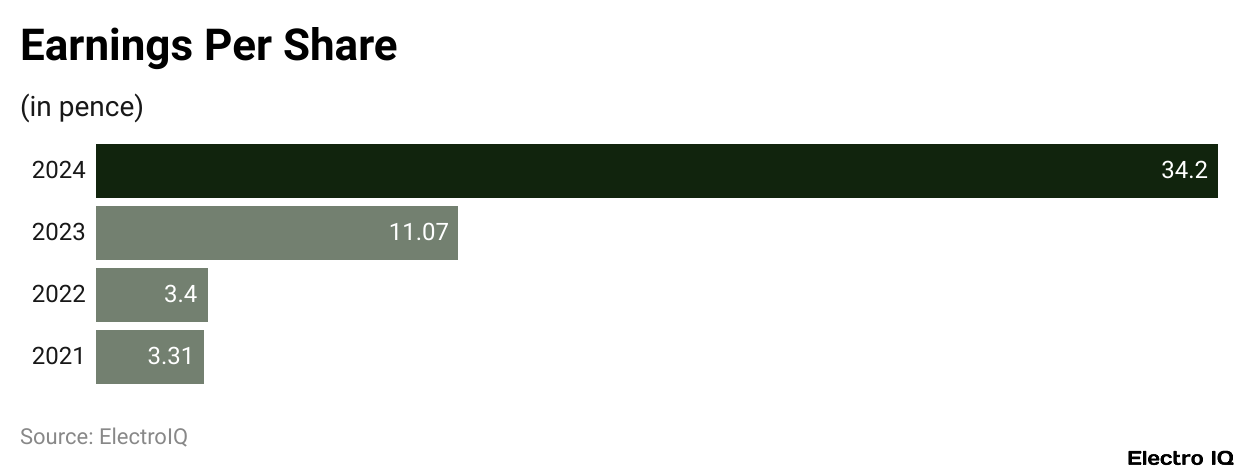

(Reference: wise.com)

- Wise (Formerly Tranferwise) Statistics show that Earnings per share (EPS) at Wise increased substantially in 2024 by 197%, hitting 34.20 pence compared to 11.07 pence in 2023.

- That jump is a testament to its high profitability and operational juggernaut.

- For the last few years, EPS has shown a consistent rise, hiked from 3.31 pence in 2021 to 3.40 pence in 2022, with a major leap in 2023 and a much bigger one in 2024.

- This trend is indicative of the company’s capacity to effectively scale its business operations while maintaining a strong balance sheet and delivering higher returns to its shareholders.

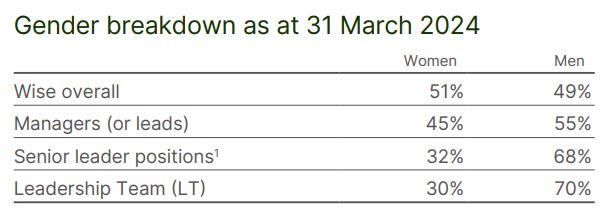

Wise Company Gender Breakdown

(Source: wise.com)

- According to Wise (Formerly Tranferwise) Statistics, the overall gender balance in Wise’s workforce shows about equal representation, with 51% female employees and 49% male employees.

- However, distribution varies at various levels of leadership.

- Women occupy 45% of the managerial or lead positions, whereas men occupy 55%. Senior leadership shows even lower representation, with women at 32% and men at 68%.

- These figures demonstrate a wider gap at the Leadership Team (LT) level, where women fill only 30% of the positions while men hold 70%.

- Therefore, these figures indicate that at the general level, Wise reflects a relatively inclusive workforce but leaves much to be done in terms of gender diversity in higher leadership roles.

Wise Representation Through Diversity And Leadership

- Several Wise teams have surpassed goals, making impressive strides for diversity and leadership representation.

- Wise (Formerly Tranferwise) Statistics state that for FY2024, women constituted 38% of new hires at the Director level and above. More than half of the global teams have 50% or more women in senior leadership roles.

- Where diversity goals have not yet been attained, targeted initiatives have started to encourage the hiring, retention, and career development of these previously chosen minority groups.

- This involves outreach to recruitment organizations focusing on diversity, particularly those supporting women, LGBTQIA+, and ethnic minority professionals.

- Steps are being taken to limit a variety of biases in the decision-making processes, while targeted graduate schemes are to attract early career talent, including women and non-binary individuals.

- Diverse candidates are also prioritized regarding succession planning and leadership development to ensure that women will be better represented in key roles.

Conclusion

As per Wise (Formerly Tranferwise) Statistics, Wise’s performance in 2025 is its successful strategy of combining customer-centric services with operational efficiency. The company’s significant growth in customer base, transaction volumes, and profitability, along with its global expansion efforts, underscore its commitment to making international money transfers faster, cheaper, and more transparent.

As Wise continues to innovate and expand, it is well-positioned to capture a larger share of the global cross-border payments market.

Sources

FAQ.

Total revenues rose from £846.1 million in FY2023 to £1,052.0 million in FY2024, which turned out to be a good growth of 24%. Similarly, gross profit has been increased by 71%, to £1,092.4 million, while profit before tax has more than tripled, going from £146.5 million in FY2023 to £481.4 million in FY2024.

Active customers grew by Wise up 29% year-on-year to a total of 12.8 million in FY2024, with 5.4 million customers added during that period. Business customers were up by 20% to 0.63 million.

Wise processed £118.5 billion in cross-border transactions, increasing by 13% YoY. Personal transaction volumes increased 14% to £87.2 billion, while business transactions increased 12% to £31.3 billion.

Newly launched offerings of Wise include Wise Assets ‘Interest’ in five European countries, Wise Assets ‘Stocks’ in 11 European countries, new tools for expats in China, Brazil, Indonesia, and Australia, and extended Wise Platform partnerships with Mox, Agoda, and Webexpenses for a total of over 85 partners.

Wise has made great strides in gender diversity at the company: there are 51%of women in the Wise workforce, but only 32% are in senior leadership. In FY2024, 38% of new Director-level hires were women. In over half of Wise’s global teams, women occupy over 50% of senior leadership roles.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.