OnePlus Statistics By Market Share, Revenue, Users and Facts (2025)

Updated · Nov 10, 2025

Table of Contents

Introduction

OnePlus Statistics: OnePlus began its journey as a no-frills phone manufacturer in 2013 and subsequently rose to become a global smartphone brand that offered “fast, smooth” devices and flagships at a reasonable price. By 2025, it will no longer be a small contender; instead, it will be part of the BBK family (along with OPPO, realme, and others) and will actively participate in both the mid-range and premium sectors.

This article summarises the various critical OnePlus Statistics for the years 2024-2025: users, market share, revenues, product strategy, and stores.

Editor’s Choice

- Revenue reached US$3.5 billion in 2022 (+25%), US$4.2 billion in 2023 (+20%), and US$5.0 billion in 2024 (+19%), proving consistent five-year growth.

- The global user base of OnePlus increased from 50 million in 2020 to 130 million in 2024, representing a 160% growth over the four-year period.

- The brand experienced a 40% increase in users in 2021,followed by 28.6% in 2022, 22.2% in 2023, and 18.2% in 2024, demonstrating strong global acceptance.

- Pushing consumer enthusiasm towards the impending OnePlus flagship phones to around 71%, only Apple could rank above in user anticipation.

- 91% of smartphone users consider performance as the most important aspect of new models, while 87% want innovation, and 76% expect high specifications.

- OnePlus’s ownership of exclusive retail outlets in India increased from over 30 stores to more than 200 stores between 2020 and 2024, with a notable expansion of its presence in tier 2 and tier 3 cities.

- The company’s global market share was 2.0% in 2020 and increased to 2.8% in 2022; however, it declined to 2.3% in 2024 due to intense market competition.

History of OnePlus

- 2013 → OnePlus was founded on December 16 by Pete Lau and Carl Pei in Shenzhen to build a flagship phone running Cyanogen OS.

- 2014 → The OnePlus One was unveiled on April 23 and sold initially by invite only, before moving to wider availability; its India launch triggered a legal dispute over Cyanogen rights.

- 2015 → OnePlus announced OxygenOS as its own Android ROM to replace Cyanogen on international units, formalizing the in-house software path.

- 2016 → The OnePlus 3 introduced Dash Charge fast charging, becoming a signature hardware-software feature for the brand’s flagships.

- 2017 → The company iterated on its rapid release cadence with the OnePlus 5 and 5T, strengthening its premium mid-price position; Dash Charge branding continued across the lineup.

- 2018 → The OnePlus 6T launched with an in-display fingerprint reader and, for the first time, U.S. carrier sales through an exclusive partnership with T-Mobile; OnePlus moved to rebrand Dash Charge due to EU trademark issues.

- 2019 → The OnePlus 7 Pro debuted a 90 Hz “Fluid AMOLED” display, and OnePlus TV Q1/Q1 Pro marked entry into televisions in India on September 26.

- 2020 → The mid-range OnePlus Nord series launched (July/August 2020), while Carl Pei exited the company in October to start a new venture.

- 2021 → A three-year camera partnership with Hasselblad was announced and shipped first on the OnePlus 9 series; deeper integration with Oppo followed, including a shared OxygenOS-ColorOS codebase.

- 2022 → OnePlus previewed OxygenOS 13 alongside the OnePlus 10T launch, signaling the unified codebase direction while keeping the OxygenOS brand for global devices.

- 2023 → The company unveiled its first foldable, the OnePlus Open, globally on October 19, co-developed with Oppo.

- 2024 → The OnePlus 12 and 12R received a global launch on January 23; the OnePlus Watch 2 was introduced at MWC 2024 with a dual-engine architecture and extended battery life.

- 2025 → OnePlus confirmed a pause on new foldables for the year and later ended the Hasselblad partnership, shifting to an in-house imaging engine; OxygenOS 16 began rolling out to current flagships.

Fun Facts About OnePlus

- OnePlus was founded on 16 December 2013 in Shenzhen by Pete Lau and Carl Pei.

- The first phone, OnePlus One, launched on 23 April 2014 at US$299 for 16 GB and US$349 for 64 GB, undercutting rival flagships by about half at the time.

- Close to 1 million units of the OnePlus One were sold in 2014, far above an internal target of 50,000.

- Early sales used an invite-only model; this was ended with the OnePlus 3 launch on 14 June 2016, when open sales began from day one.

- OnePlus staged what it called the world’s first product launch in VR for the OnePlus 2 in July 2015, and followed with a global VR shopping experience for the OnePlus 3 in 2016.

- The company popularized fan pop-up events, where early buyers could purchase devices and receive exclusive merchandise before general availability.

- The Silk White OnePlus One used a special “baby skin” back coating derived from powdered cashew shells, giving it a distinctive soft feel.

- OnePlus partnered with Cyanogen for the OnePlus One’s software at launch, a collaboration that later led to legal disputes in India before the company moved to its own OxygenOS.

- “Never Settle” became the brand’s core slogan, positioned as a commitment to continuous improvement rather than perfection.

- Fast charging was first marketed as Dash Charge; after a 2018 EU trademark issue, the branding shifted to Warp Charge.

- In 2021, OnePlus deepened integration with Oppo, including a merged OxygenOS/ColorOS codebase to streamline updates.

- Also in 2021, a high-profile camera partnership was announced with Hasselblad; in 2025, OnePlus confirmed the partnership had ended and introduced an in-house DetailMax Engine for imaging.

OnePlus Revenue

| Year | Estimated Revenue (USD Billion) | Year-over-Year Growth |

| 2020 | 1.9 | — |

| 2021 | 2.8 | +47% |

| 2022 | 3.5 | +25% |

| 2023 | 4.2 | +20% |

| 2024 | 5.0 | +19% |

(Source: 99cashdeals.com)

- OnePlus was a company that exhibited significant financial growth with yearly increases in revenue.

- In 2020, it made around US$1.9 billion, indicating that it was a very strong player in the world smartphone market.

- The next year, 2021, revenues jumped to US$2.8 billion —+47% to the previous year, and the main reason was the great product launches that took place in various price ranges and regions.

- This upward trend continued through 2022, when OnePlus’s revenue reached US$3.5 billion, which is a 25% increase over the previous year. Year.

- This consistent growth demonstrated the company’s potential to attract new customers and, simultaneously, sell its premium phones effectively.

- Eventually, in 2023, OnePlus, still on the rise, reported $1 million of $ 4.2 billion in revenue—a 20% increase compared to the previous year—a sign of stable performance in an increasingly competitive market.

- OnePlus has achieved a significant milestone in 2024, with revenue of US$5.0 billion, marking a new and impressive 19% annual growth.

- This five-year period, marked by a consistent rise, is an indication of the company’s remarkable ability to identify consumer demand, expand its product range, and increase the brand’s global presence, thereby becoming a strong competitor in both the premium and mid-range segments.

OnePlus Revenue From Operations

- During the period from 2020 to 2024, OnePlus achieved steady and impressive revenue growth. The company’s revenue for 2020 totalled approximately US$1.9 billion.

- The company’s revenue for the next fiscal year, FY 2021, increased sharply to US$2.8 billion, representing a robust 47% rise.

- The surge was a reflection of the increasing global demand for the brand and the growing number of products it offered.

- The revenue of OnePlus continued to grow, and in FY 2022, it was reported at US$3.5 billion—a 25% increase compared to 2021.

- OnePlus had already reported revenue of US$5.0 billion by the end of FY 2024, representing an annual growth of 19% over the previous year.

- The constant increase in revenue year by year is an indication of the company’s ability to maintain its market position, strengthen its position in the high-end and mid-range smartphone markets, and capitalise on global sales growth despite increasing competition.

- All in all, the period from FY 2020 to FY 2024 was one in which OnePlus more than doubled its total revenue, resulting from very strong consumer demand and its effective global scaling of operations.

OnePlus Users

| Year | Estimated Users (Millions) | Year-over-Year Growth |

| 2020 | 50 | — |

| 2021 | 70 | +40% |

| 2022 | 90 | +28.6% |

| 2023 | 110 | +22.2% |

| 2024 | 130 | +18.2% |

(Source: 99cashdeals.com)

- Between 2020 and 2024, OnePlus experienced a continuous and gradual increase in its global user base.

- The company estimated its figures for the first year of this period to be around 50 million users globally.

- By the end of the second year of this period, this figure was already 70 million, thus adding 40% in one year, which is very impressive.

- The trend was still going upward in the third year, and the user base grew to 90 million, a further 28.6% rise, indicating that the brand was winning over consumers in the international markets.

- The global user count for OnePlus reached 110 million in FY 2023, a sign of 22.2% annual growth, indicating that the company was still attracting customers at a reasonably fast pace, even in a market more strained by competition.

- With the start of FY 2024, the total estimated user base worldwide was 130 million, representing an 18.2% growth compared to the previous year.

- OnePlus’ gradual but continuous user growth over a period of five years is a sign that the Company has been able to create a strong and enlarging base of customers, which is mainly the result of its continuous effort to provide high-performance devices at competitive prices, along with a strong brand presence in both developed and emerging markets.

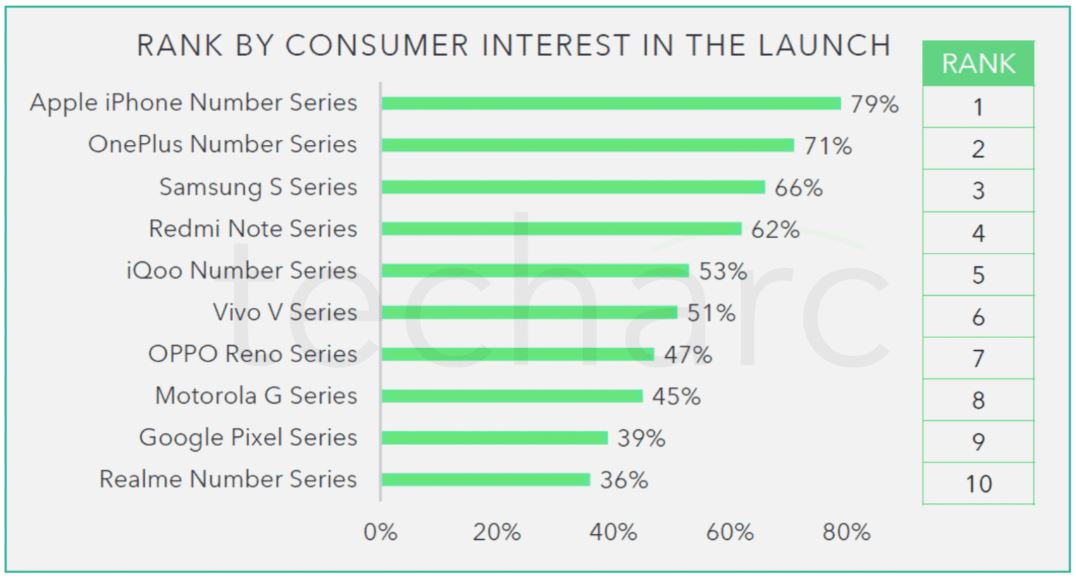

Top Smartphones Rank By Consumer Interest

(Source: techarc.net)

- Apple is still at the top of the smartphone industry and remains one of the most desirable and respected brands.

- A recent survey has shown that 79% of participants are looking forward to the next iPhone launch, indicating a strong emotional bond between the brand and its users.

- The iPhone 14 series, which is the latest addition available, is still very much in the limelight and is thus helping Apple to maintain its top position in consumer craving and brand loyalty.

- OnePlus is the most premium brand in the Android grid and has so far gained the second position overall, right after Apple.

- Approximately 71% of survey participants expressed their eagerness for the new OnePlus flagship launches, particularly the company’s “number series,” which is renowned for its high performance and stylish design.

- The OnePlus 11 series, the latest model, showcases the company’s commitment to creativity and quality, thereby enhancing its image in the Android community.

- Surprisingly, Google’s Pixel family, albeit not a blockbuster seller, has nonetheless made its way into the top 10 most-awaited smartphone launches.

- This is a telltale sign that consumers are becoming increasingly curious about the Pixel brand, and that Google could gain significantly from this through effective advertising and proper positioning.

- Faisal Kawoosa, Chief Analyst and Founder of Techarc, says that consumers strongly associate brands with specific product lines and consider them to belong to different price categories, namely entry-level, mid-range, premium, and luxury.

- Salient features still lead the way as new smartphone models get launched, with 91% of users asking for faster and stronger devices.

- Additionally, 87% are seeking new features and innovations, 76% expect higher specifications, and 51% are looking for better design and build quality.

- The luxury phone market also has strong users’ requests for 120Hz displays, Wi-Fi 6, improved audio, e-SIMs, wireless charging, and IP67 water resistance.

- A total of 37% of consumers predict a 5-10% increase in the prices of new models; however, only a tiny portion of 4% prefer that the prices remain the same.

- In general, Apple and OnePlus take the lead in user expectations, which is a clear indication of their powerful brand allure and steady innovation amidst a highly competitive market.

OnePlus Stores

| Year |

Exclusive OnePlus Experience Stores

|

| 2020 | 30+ |

| 2021 | 45+ |

| 2022 | 100+ |

| 2023 | 150+ |

| 2024 | 200+ |

(Source: 99cashdeals.com)

- The period from 2020 to 2024 saw OnePlus attaining a phenomenal level of growth in its exclusive retail presence throughout India.

- The company had more than 30 exclusive experience stores mainly in the big metropolitan cities at the beginning of the year 2020.

- By the end of 2021, the number had increased to over 45 outlets, which was the manifestation of the company’s first move into offline retail expansion in the market.

- The rapid pace of expansion continued in 2022, the year when the number of exclusive stores went beyond 100, indicating the brand’s strategic move to new areas. This upward trend carried on in 2023, with over 150 stores operating, which enabled even more customers to avail OnePlus products and services through the physical medium.

- By the year 2024, the firm had around 200 exclusive experience stores in India. This drastic increase can be marked as a success of OnePlus’s penetration in second and third-tier cities, which had not seen a premium smartphone retailing experience before.

- OnePlus not only makes things easier by being more accessible but also brings the flagship experience to a wider audience, thus winning loyalty and engagement of the Indian consumer with the brand.

| Year |

Global Market Share (%)

|

| 2020 | 2 |

| 2021 | 2.5 |

| 2022 | 2.8 |

| 2023 | 2.5 |

| 2024 | 2.3 |

(Source: 99cashdeals.com)

- OnePlus faced both growth and challenges in its global market share from 2020 to 2024.

- In 2020, the company accounted for approximately 2% of the global smartphone market. Then, in 2021, the market share went up to 2.5%, thanks to the company’s effective expansion strategy and rising demand for the flagship and mid-range devices.

- The increase in market share also occurred in 2022. That year, OnePlus reached a global market share of 2.8%, which was the highest for the company during this period, owing to the successful launch of new products and the better availability of products in the international markets.

- Even though market conditions have matured to the point where OnePlus must constantly innovate, offering competitive prices and even stronger differentiations, the company is still considered a leading global player in the smartphone industry.

Conclusion

OnePlus Statistics: By 2025, it will have clearly established its position in the global smartphone market as a top company that can balance innovation, design, and price effectively. If we examine the company’s financial growth, which increased from US$1.9 billion in 2020 to US$5.0 billion in 2024, along with the addition of 130 million new customers, it would be easy to conclude that one part of the world is gaining a greater influence from the company.

OnePlus continues to attract discerning consumers by competing with its high-end products, offering premium experiences, and expanding its retail presence, despite tough competition and a slight decline in market share. The brand’s recent growth, its customers’ expectations, and the brand’s ability to adapt to market changes are factors that make OnePlus one of the most loved brands in the Android ecosystem.

Sources

FAQ.

In 2024, OnePlus recorded a total revenue of US$5.0 billion, marking a 19% annual growth from 2023.

OnePlus was projected to have around 130 million global users by the end of 2024, which is quite a significant increase from the 50 million users reported in 2020.

In terms of consumer anticipation, OnePlus is ranked just behind Apple, with 71% of users being very positive about the new flagship launches of the brand.

At the end of 2024, OnePlus had more than 200 exclusive experience stores in India, a rapid expansion into tier 2 and tier 3 cities where the brand is gaining popularity.

OnePlus had a 2.3% share of the global smartphone market in 2024, which shows the intense competition in the high-end Android segment.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.