Agricultural Robots Statistics and Facts

Updated · Jul 02, 2025

Table of Contents

Introduction

Agricultural Robots Statistics: The transition that agriculture, the backbone of human civilization, is currently experiencing is largely driven by advanced technology. Among the technological innovations in agriculture, agricultural robots—often referred to as “bots”—are at the forefront of this change, disrupting traditional farming practices. Agricultural robots are autonomous machines that perform various tasks, including planting, harvesting, monitoring crop health, and managing livestock.

Their increasing acceptance is due to their ability to enhance efficiency, address the shortage of agricultural labor, and meet the rising demand for food with higher productivity. This article will present statistics on agricultural robots for 2025, highlighting key trends in the market and the factors contributing to their growth.

Editor’s Choice

- The global agricultural robots market is projected to grow from USD 13.4 billion in 2023 to USD 86.5 billion by 2033 at a CAGR of 20.5%.

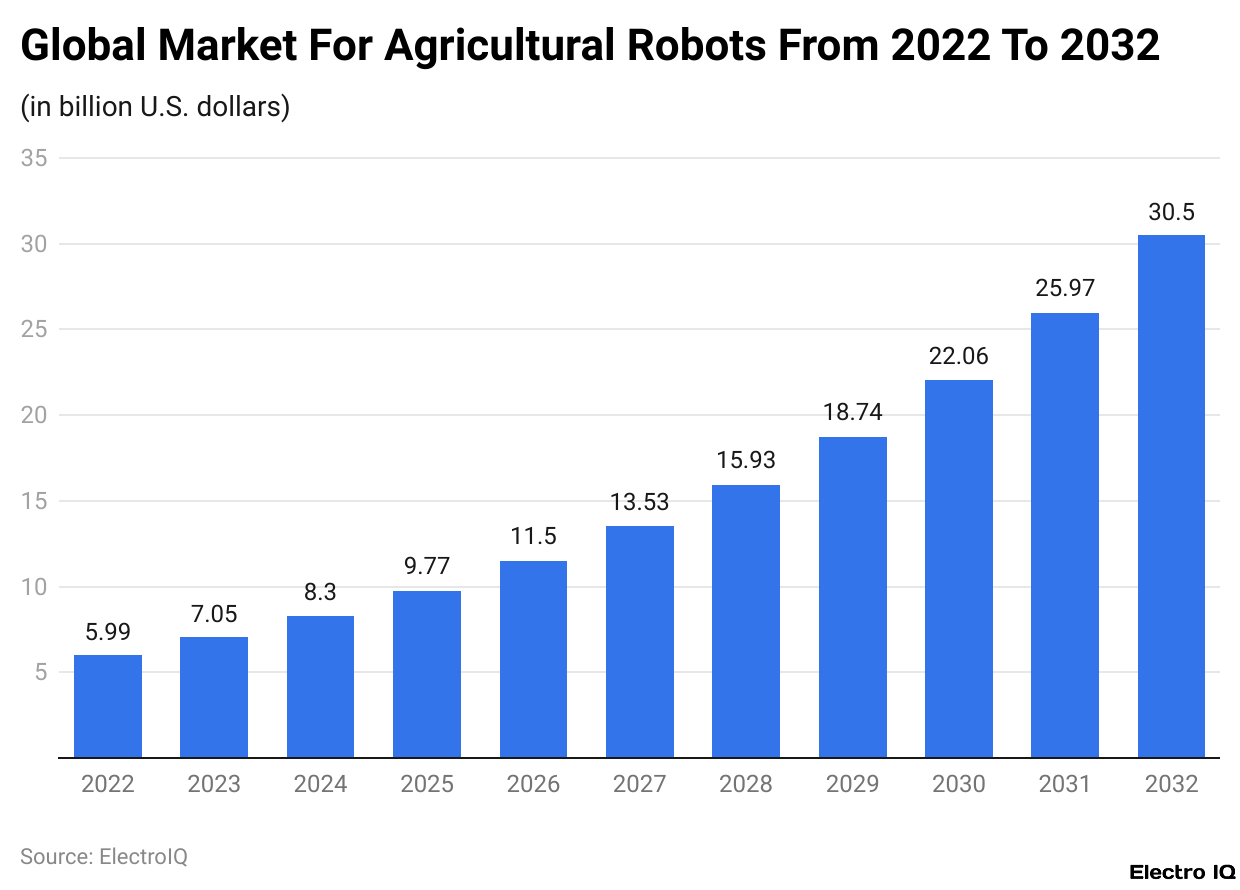

- By 2032, the market is expected to reach approximately USD 30.5 billion, driven by automation in planting, harvesting, weeding, and livestock management.

- By 2030, the total number of agricultural robots worldwide is estimated to reach 36 billion units.

- In 2023, the agriculture technology-as-a-service market was valued at USD 1.8 billion, with software-as-a-service (SaaS) contributing USD 1.1 billion.

- Hardware, including automated tractors and drones, accounted for over 55% of the agricultural robots market, while software and services played a key role in enhancing performance.

- Milking robots contributed 48.6% of the market in 2023, while drones and driverless tractors are experiencing rapid growth.

- Planting and seeding are among the leading applications of agricultural robots, with soil management expected to grow significantly due to the rise of mobile robots for fertilization and weeding.

- The NAFTA region leads in agricultural drone sales, benefiting from favorable policies, while the EU is seeing strong growth in robotic pesticide applications due to regulatory shifts.

- Leading companies, including AGCO Corporation and John Deere, are driving innovation in precision spraying and route planning technologies.

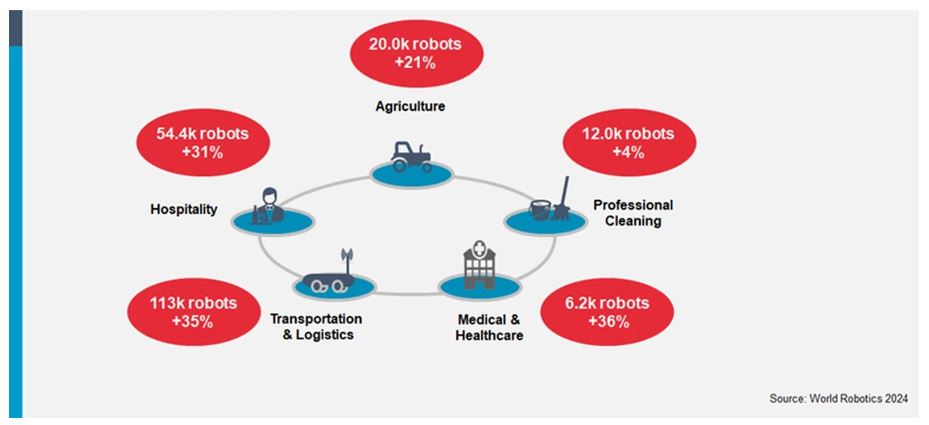

- In 2023, global sales of agricultural robots increased by 21%, reaching 20,000 units.

- Sales of transportation and logistics robots grew by 35%, with 113,000 units sold due to ongoing labor shortages.

- Medical robot sales surged by 36%, reaching 6,100 units, with rehabilitation and non-invasive therapy robots experiencing an increase of 128%.

- The hospitality robot market expanded by 31%, with 54,000 units sold, mainly for mobile guidance, telepresence, and food preparation.

Facts About Agricultural Robots

- In 2023, milking robots fell into just about every major category of these products and accounted for 48.6% of the market.

- According to agricultural robots statistics, by the type of product, the hardware component accounts for over 55% of the market, including the likes of heavy-duty automated machinery such as tractors and drones.

- Yet software and services play a key role in enhancing function and operational efficiency.

- Planting and seeding are among the prime applications demanding precision, while soil management will grow maximally due to mobile robot innovations aimed at fertilising and weeding.

- Market growth has many propellants, especially labor shortages and high operational costs, which in return make automation desirable to support such a productive process. However, with the high upfront investments required, digitisation is going to be a challenge, especially for smaller farms.

- There is a great opportunity in livestock management robotics, where IoT and remote sensing can disrupt farm operations.

- Also, drones and robotic solutions create a streamlined way of delivering the agriculture process.

- Nevertheless, agricultural robotics has limited prospects for complete automation due to its complexity and associated costs.

- The development of fully autonomous tractors and other inspection robots will not fully reach their potential until after 2025.

- In the region, North America continues to lead in drone sales driven by supportive government regulations.

- Regulations that are essentially associated with selective spraying via robotics in the European Union have opened up the possibilities in the market.

- Industry frontrunners AGCO Corporation and John Deere have also engaged in high levels of innovation regarding precision spraying techniques and advanced route planning technologies, thus further catalysing the future of agricultural robotics.

Agricultural Robots Market

(Reference: statista.com)

(Reference: statista.com)

- The agricultural robots market has seen steady growth in automation and technology.

- By 2022, the market was already viewed to be on the ascent, with farmers requiring more efficient and cheaper options.

- The increasing demand for automation formed a basis on which the market grew further, being driven by diminished labor force availability, food requirements, and advancements in AI and robotics.

- With this great outlook, it is again anticipated that the market will continue to grow fairly in the next decade.

- Agricultural robots statistics indicate that the global agricultural robots market is estimated to reach about 30.5 billion U.S. dollars by 2032, reflecting increased reliance on robotics for different farming activities, such as planting, harvesting, weeding, and livestock management.

- As the sector progresses, agricultural robots will also be at the forefront alongside other instruments to enhance the productivity, sustainability, and efficiency of farming.

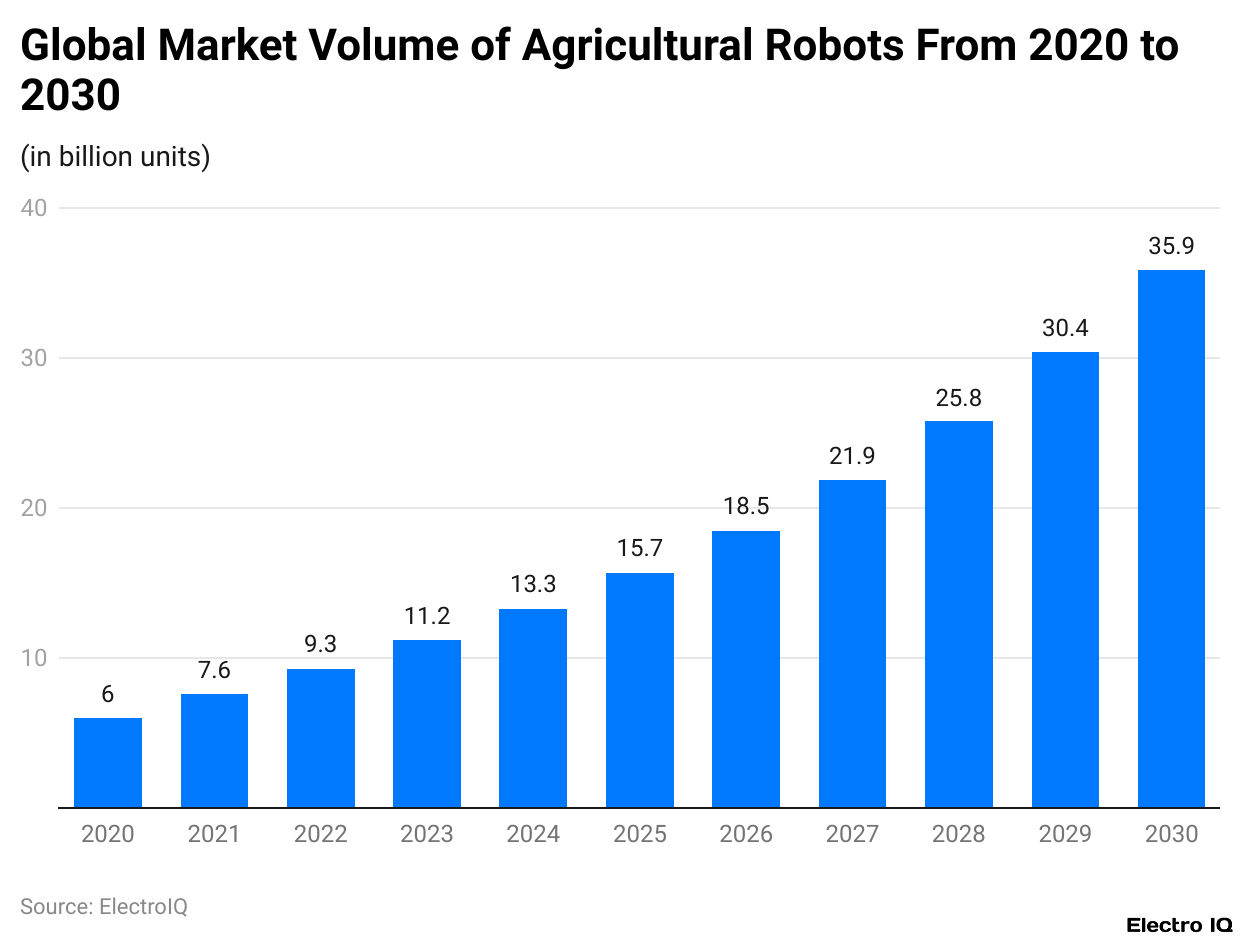

Agricultural Robots Market Volume

(Reference: statista.com)

(Reference: statista.com)

- The agricultural robot market remained in a steady growth mode since 2020, with promising growth prospects through 2030.

- This growth rate throughout the years has been the outcome of various technical advancements, an increasing desire for automation in farming, and the necessity to deal with labor shortages.

- A considerable expansion of market volume-which defines the different types of agricultural robots such as drones, automatic harvesters, robotic weeders, etc.-is expected in this segment.

- Agricultural robot statistics show that by 2030, the number of agricultural robots operating worldwide should reach approximately 36 billion units.

- Such growth depicts increasing reliance upon robotics for efficiency, productivity, and sustainability in modern agriculture.

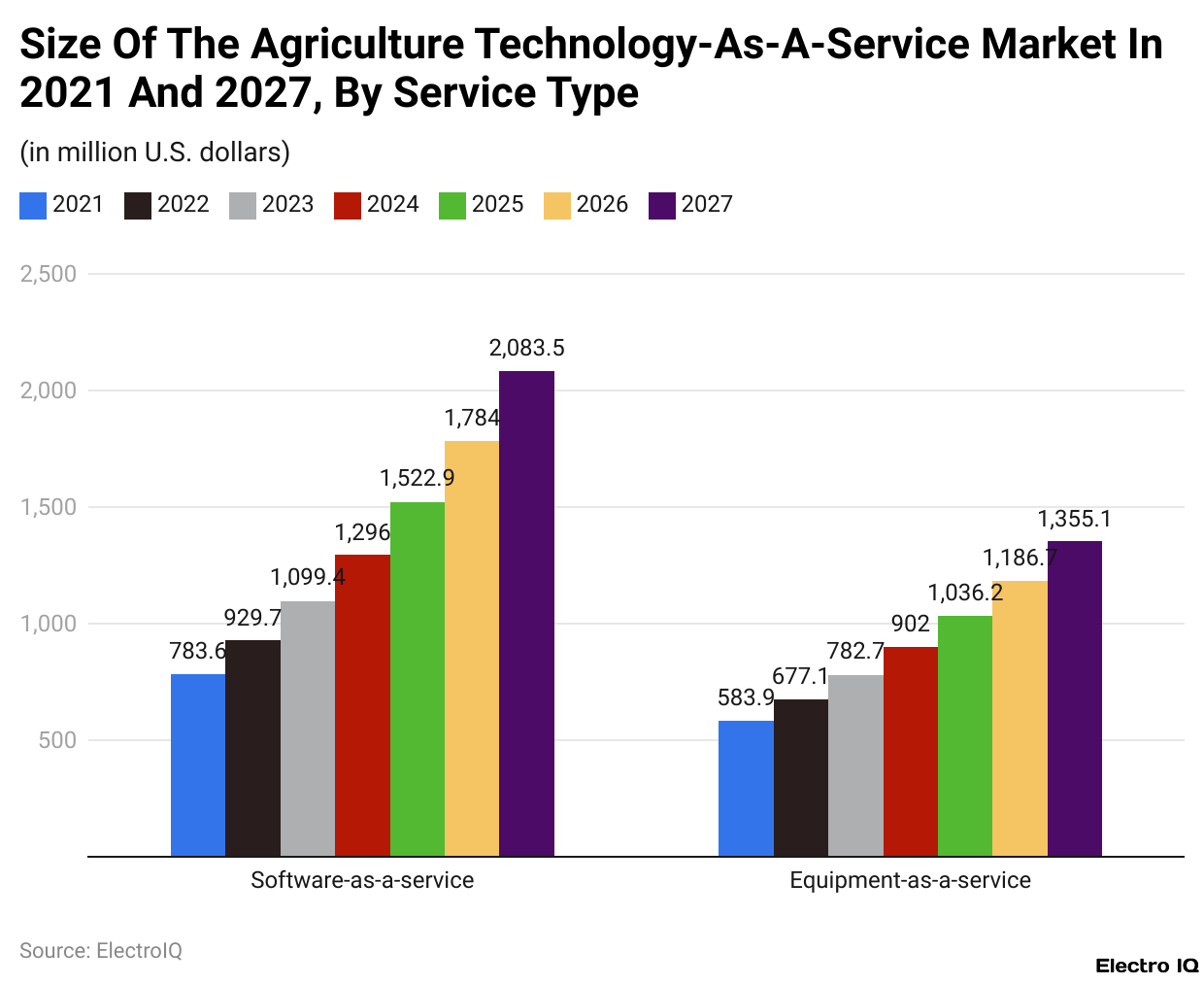

Agriculture Technology-As-A-Service Market Size By Service type

- Agricultural robots statistics estimated that the overall global market size for agriculture technology as a service was about US$1.8 billion in 2023.

- The technology solutions are delivered on subscriptions and pay-per-use routes to farmers, thereby discouraging the costs of high upfront investments for them.

- Of this, the SaaS space dominates, being responsible for nearly US$1.1 billion of that amount.

- With respect to agriculture, SaaS solutions have involved farm management, predictive analytics, and automated data processing to enhance the productivity, efficiency, and knowledge of farmers via digital applications.

- Additionally, the enhancement of the sector is progressively expressed in the growing prominence of SaaS solutions, implying that today, insights into farming must be data-driven and through cloud-based platforms.

Applications Of Sevice Robots By Unit Sold

(Source: ifr.org)

- In the year we are currently in, 2023, a little over half of all professional service robots sold were predominantly inclined to transportation and logistics applications.

- Sales for this category recorded significant growth of 35%, that is, near 113,000 units.

- A continued labor shortage means increasing demand for automation. Improvements through automated robotic solutions have been made in one of the most time-consuming areas for truck drivers: loading and unloading.

- User-friendly technology systems for casual, non-technical personnel are of vital importance for endorsement.

- The industry still sees an increased need for automation due to a lack of skilled workers who can operate in outdoor environments without interference from the public.

- Hospitality robots are booming with more than 54,000 units sold in 2023-an increase of 31%. Most of the robots are being used for mobile navigation, information, and telepresence.

- As the sector grows quickly, the application areas have key developments in food and beverage preparation and interactive guidance systems in public places.

- Agricultural robots statistics state that agricultural robots also performed well, with a 21% increase in sales to just under 20,000 units in 2023.

- Labor shortages caused by demographic changes, paired with the rapidly growing demand for sustainable precision agriculture, have made the utilisation of service robots very important in this domain.

- The market for professional cleaning robots grew by 4% in 2023, with almost 12,000 units being sold.

- Cleaning floors continues to be the major application for cleaning robots, making up approximately 70% of all motorised cleaning equipment sold.

- The World Robotics 2024 yearbook, by ISO classification, establishes medical robots as belonging to a category of their own, along with service robots and industrial robots.

- Medical robots saw their sales soar by 36% to approximately 6,100 units in 2023.

- The sales of rehabilitation and non-invasive therapy robots, in particular, soared by an impressive 128%, with surgical robots following at a 14% increase and diagnostic robots growing at a rate of 25%.

Agricultural Robots By Country

- The growth of agricultural robots varies by country, with different factors driving adoption in each region.

- Agricultural robots statistics reveal that in India, agricultural robots are expected to experience the highest Compound. It is assumed that data will be plus or minus 1 year after 2023. So we can take beyond the exhaustive plus or minus the year from here.

- Mechanisation, government support for smart farming, and the need to find solutions to labor shortages in the agricultural area are all factors fuelling this. China is not far behind, with a projected CAGR of 20.8%.

- Agricultural automation in the country and large investments in AI-driven farming technology have accelerated the adoption of robotics in agriculture.

- Another important growth driver is the increasing demand for food production efficiency. In the USA, agricultural robots are projected to have a CAGR of 19.2%.

- Rapid developments in precision farming, labor costs, and the integration of AI and IoT in agriculture have spurred growth.

- The presence of leading robotics companies and research institutes greatly aids the sector’s growth.

- Agricultural robots statistics state that the German market has a forecasted CAGR of 16.7%, continuing to see growth in agricultural robotics.

- Sustainable and technological farming solutions, together with a focus on a high level of automation in agribusiness, are the drivers for this trend. Innovations in technologies and policies that promote smart agriculture will further fuel the adoption in the region.

Conclusion

As per agricultural robots statistics, the agricultural robots market indicates a very dynamic and fast-changing environment. With huge market valuation and predicted growth rate, robots are set to be crucial in shaping future farming.

The role of robotics in agriculture will be fundamental in ushering in sustainable and efficient practices as the facets of technology develop, and the demand for food escalates worldwide.

Sources

FAQ.

The global agricultural robot market is projected to grow from US$13.4 billion in 2023 to US$86.5 billion by 2033, with a compound annual growth rate (CAGR) of 20.5%. The market is estimated to be worth US$30.5 billion by 2032 as a result of the improvement of automation for planting, harvesting, weeding, and livestock management.

The total number of agricultural robots will amount to 36 billion numbers by 2030, highlighting an increasing adoption of robotics for improving the efficiency, productivity, and sustainability of modern agriculture.

Milking robots additionally represent the market’s largest segment, with 48.6% of the market share in 2023, while drones and driverless tractors are being quickly developed into increasing segments contributing to the market.

Whilst labor shortages and costs are pressuring the industry into automation, another major hindrance is the initial high investment cost, which severely affects many smaller farmers. Added to that, in terms of complexity and costs, full automation is expected to be available with the introduction of fully operational autonomous tractors and inspection robots by 2025.

Due to support from government and mechanisation efforts, India has the highest projected CAGR of 22.5% (2024-2034). Massive investment in AI-assisted farming technologies is done in China, with a GDP of 20.8%. The USA, with a GDP of 19.2%, is leading in precision farming and AI/IoT interface applications. German high-tech agri-tech is thought of as the green and fast culture with a GDP of 16.7%.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.