Analog Devices Statistics By Net Income, Country, Operating Income And Revenue

Updated · Sep 23, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Analog Devices Revenue

- Property Plant And Equipment By Country

- Analog Devices' Operating Income

- Analog Devices Revenue By Region

- Analog Devices's Net Income

- Expenses On Research And Development

- Analog Devices Market Capitalization

- Analog Devicess's Dividend Yield

- Analog Devices Debt Equity Ratio

- Analog Statistics Total Debt

- Analog Devices Overview

- Conclusion

Introduction

Analog Devices Statistics: Analog Devices is an American semiconductor company focused on data conversion, signal processing, and power management. The company is headquartered in Wilmington, Massachusetts. The technologies associated with them are used to develop devices that consist of different signals that are used for a variety of activities.

For the most part, it has emerged as one of the most prominent names in the semiconductor industry. As we go forward, we will discuss the Analog Devices statistics to have an understanding of this company’s success.

Editor’s Choice

- Industrial products consistently generate the highest revenue for Analog Devices.

- The United States is the region with the highest revenue generation for the company.

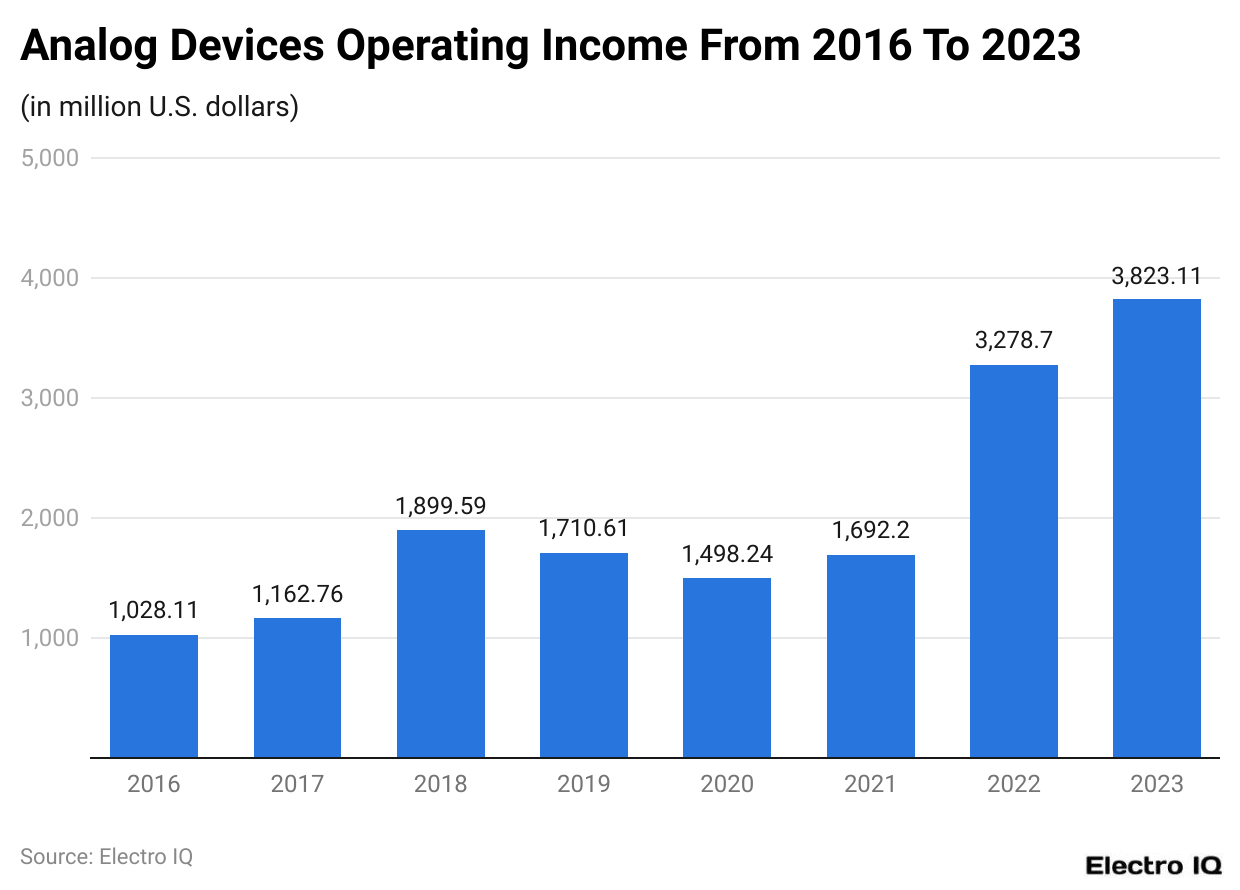

- Analog Devices’ operating income has more than tripled from USD 1,028.11 million in 2016 to USD 3,823.11 million in 2023.

- The company’s net income has grown from USD 529 million in 2004 to USD 3.752 billion in 2024.

- Analog Devices’ market capitalization has increased from USD 14 billion to USD 108.2 billion over the past 20 years.

- The highest dividend yield of 4.4% was recorded in 2008.

- The company’s debt-to-equity ratio peaked at 1.29 in 2017 and has since decreased to 0.23.

- Analog Devices’ total debt reached its highest point of almost USD 13 billion in 2017.

- The automotive sector is expected to account for up to 35% of total revenue in 2024.

- The industrial sector is projected to contribute 33% of total revenue in 2024.

- Communications sector revenue is expected to grow to about 22% of total revenue by the end of 2024.

- Analog Devices’ gross margin stood at a competitive 67% in 2023.

- The company’s earnings per share (EPS) grew by 9% in 2023, reaching USD 7.65 per share.

- Automotive solutions of Analog Devices accounted for approximately 30% of total revenue in 2023.

- Healthcare solutions of Analog Devices contributed roughly 10% of total revenue in 2023.

Analog Devices Revenue

(Reference: Statista.com)

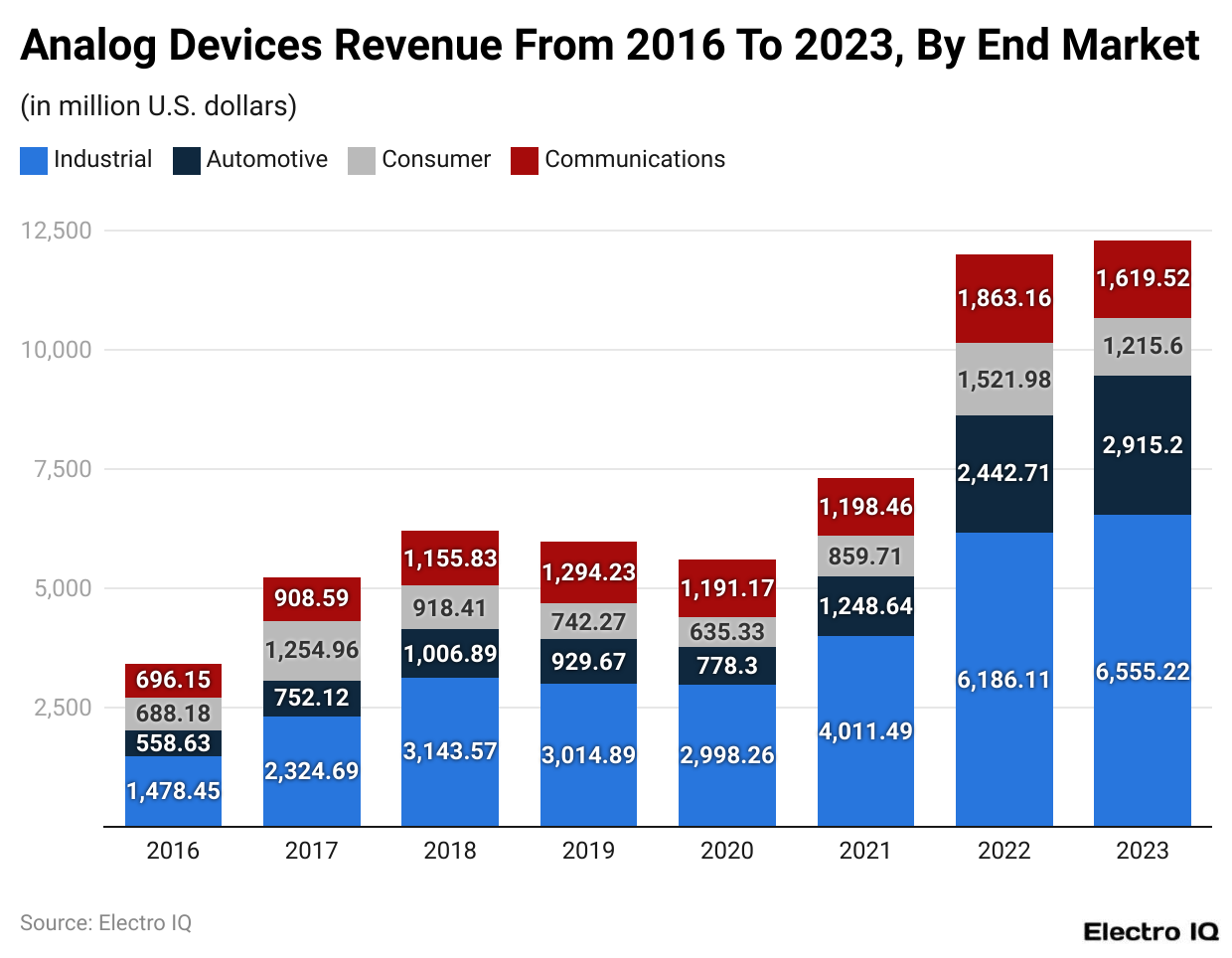

- Analog Devices statistics show that the company’s revenue can be categorized into Industrial, Automotive, Consumer, and Communications.

- Industrial products consistently generate the highest revenue.

- In 2023, the industrial component generated revenue of $6555.22 million.

- It is followed by Automotive, with $2,915.2 million in revenue; Communications, with $1,619.52 million; and Consumer, with $1,215.6 million.

Property Plant And Equipment By Country

(Reference: Statista.com)

- Analog Devices statistics showcase that the property plant equipment can be divided into the following regions: United States, Ireland, Philippines, Singapore, Malaysia, Thailand, and All other countries.

Analog Devices' Operating Income

(Reference: Statista.com)

- The Analog Devices statistics reveal that operating income has been increasing consistently over time.

- In 2023, the operating income of Analog Devices was $3823.11 million.

- It has significantly increased from the 2016 level when it was $1028.11 million.

Analog Devices Revenue By Region

(Reference: Statista.com)

- Analog Devices statistics showcase the revenue region, which can be categorized into the following areas: the United States, the rest of North and South America, Europe, Japan, China, and the rest of Asia.

- The United States has consistently been the region with the highest revenue generation.

- In 2023 the United States had $4,165.3 million, followed by Europe with $3,001.87 million, China with $2,229.63 million, Rest of Asia with $1,423.04 million, Japan with $1,397.12 million, Rest of North and South America with $88.58 million.

Analog Devices's Net Income

(Source: financecharts.com)

- The Analog Devices statistics showcase that the net income value has increased over time.

- Between the period (2006 - 2024), the net income of Analog Devices is $3.752 billion.

- There has been a significant increase since 2004 when the net income was $529 million.

Expenses On Research And Development

(Reference: Statista.com)

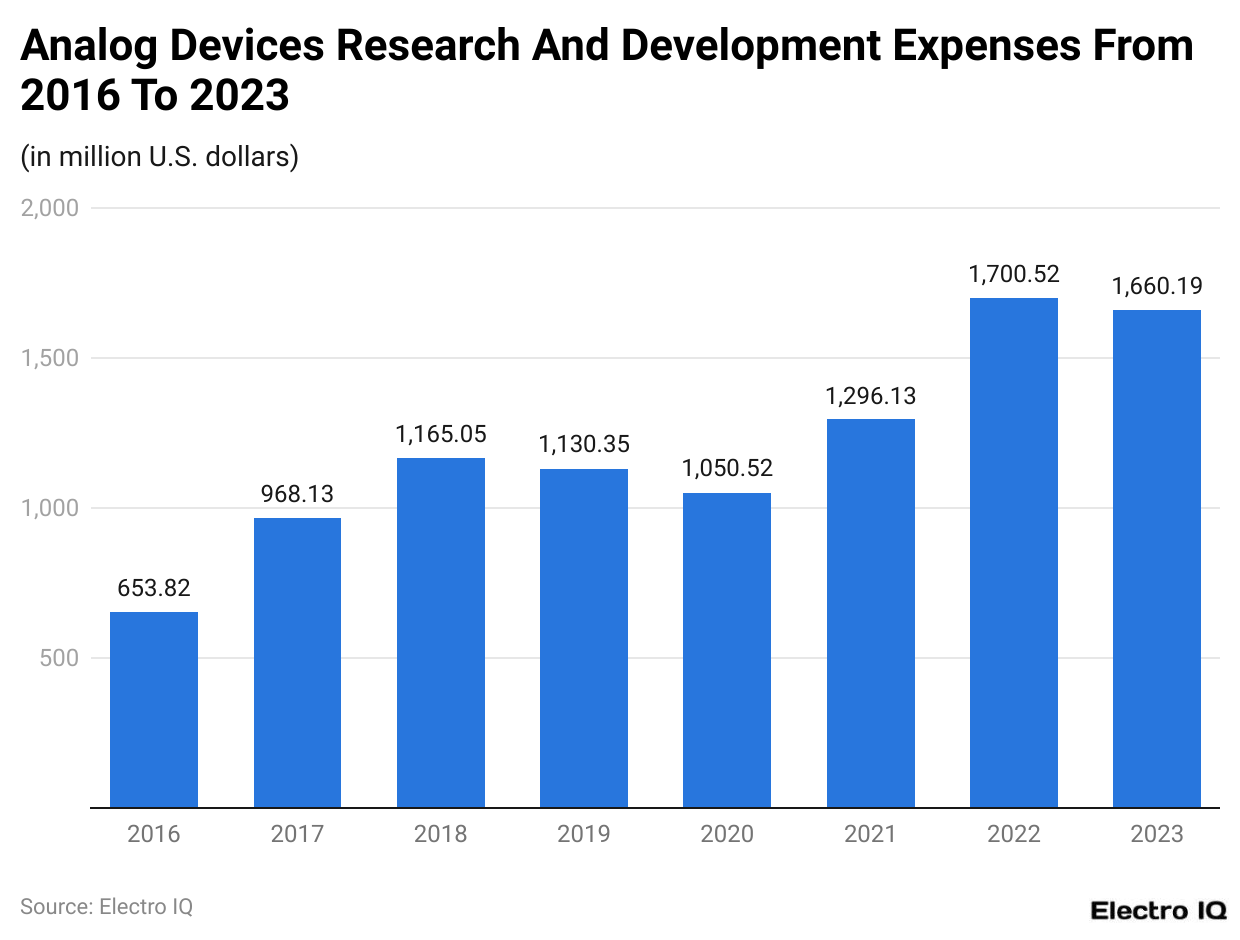

- The investment of a tech company in research and development is a vital component of the company’s success.

- As of 2023, the investment of Analog Devices in research and development was $1660.19 million.

- Between the period (2016 - 2023), Analog Devices had the highest expense on research and development in 2022 with $1700.52 million.

Analog Devices Market Capitalization

(Source: financecharts.com)

- Market capitalization is an essential metric for understanding a company's success and instilling it in investors.

- As of September 2024, the market capitalization of Analog Devices is $108.2 billion.

- It has been a significant increase from 20 years ago when the market capitalization was $14 billion.

Analog Devicess's Dividend Yield

(Source: financecharts.com)

- The Analog Devices' statistics showcase the dividend yield has been inconsistent and unpredictable over time.

- Between the period of (2004 to 2024), the highest dividend yield was witnessed in 2008 with a 4.4% yield.

- As of September 2024, the dividend yield was 1.66%.

Analog Devices Debt Equity Ratio

(Source: financecharts.com)

- The information about the debt-to-equity ratio provides vital information about how the company is faring.

- The highest debt of equity ratio between the period (2004 - 2024) was 1.29 in 2017.

- As of September 2024, the debt-to-equity ratio of Analog Devices is 0.23.

Analog Statistics Total Debt

(Source: financecharts.com)

- The information about total debt provides valuable information about how the company is faring.

- In the past 20 years, analog statistics recorded the highest debt of almost $13 billion in 2017.

- As of September 2024, Analog Statistics has a debt of $8.1 billion.

Analog Devices Overview

Analog Devices, Inc. (ADI) is one of the leading semiconductor companies specializing in data conversion and signal processing technologies. ADI’s products are widely used in industries such as automotive, communications, healthcare, and industrial applications. This company has maintained a strong position in the market by continuously innovating and adapting to changing industry demands. In this analysis, we will focus on the financial and market performance of Analog Devices in 2023 and 2024, with an emphasis on key metrics such as revenue, net income, and market trends.

Financial Performance in 2023

In 2023, Analog Devices reported robust financial growth. According to their financial statements, the company achieved a total revenue of approximately 12.2 billion US dollars, reflecting a 6% increase compared to the previous year. This growth was driven by strong demand in key sectors such as automotive and industrial applications, which accounted for the majority of the company’s revenue.

One key highlight of Analog Devices' performance in 2023 was its strong profit margins. The company's gross margin stood at 67%, which is quite competitive in the semiconductor industry. Net income for 2023 reached 3.3 billion US dollars, a substantial figure that underscores the company's efficient cost management and high demand for its products.

The company's earnings per share (EPS) also grew significantly in 2023, reaching 7.65 US dollars per share, which represented a 9% increase from the previous year. This growth in EPS reflects the company's ability to generate higher profits and provide value to its shareholders.

Market Trends Influencing 2023 Performance

Several key market trends contributed to Analog Devices' growth in 2023. First, the increasing demand for electric vehicles (EVs) and advanced driver assistance systems (ADAS) created a surge in demand for ADI’s automotive solutions. The automotive sector became a significant driver of revenue, accounting for approximately 30% of the company’s total revenue in 2023.

Another important trend was the growing adoption of 5G technology, particularly in the telecommunications sector. ADI's communication products, which enable 5G infrastructure, saw higher demand as global telecom operators accelerated their 5G deployment plans. In 2023, communications accounted for about 20% of Analog Devices’ total revenue.

Healthcare also emerged as a strong growth sector for ADI in 2023. With the increasing digitization of healthcare and the rise in wearable medical devices, ADI’s healthcare solutions experienced heightened demand, contributing roughly 10% of total revenue.

Financial Performance Outlook for 2024

Looking ahead to 2024, Analog Devices is expected to continue its strong growth trajectory. According to market forecasts, the company’s revenue is projected to reach 13 billion US dollars, which represents a 6.5% increase over 2023. This growth will likely be driven by continued demand for semiconductors across various industries, particularly in automotive and industrial applications.

One of the main factors influencing Analog Devices' growth in 2024 is its expanding presence in the renewable energy sector. The company’s products are being increasingly integrated into renewable energy systems, such as solar and wind power solutions. As governments around the world implement policies to support the adoption of clean energy, ADI is well-positioned to benefit from this shift.

In 2024, net income is expected to rise to 3.6 billion US dollars, marking a 9% increase compared to 2023. This growth will likely be supported by the company’s strong pipeline of new products and its ongoing efforts to improve operational efficiency. The EPS for 2024 is forecasted to reach 8.10 US dollars per share, which represents another year of solid profit growth.

Market Trends Shaping 2024 Performance

Several key market trends are expected to shape Analog Devices' performance in 2024. First, the continued growth of the electric vehicle market will likely drive further demand for ADI’s automotive solutions. Industry analysts predict that the automotive sector could account for up to 35% of Analog Devices' total revenue in 2024.

In addition, the global rollout of 5G technology is expected to accelerate in 2024, leading to increased demand for ADI’s communication products. This trend will likely boost the company’s revenue from the communications sector, which is expected to account for about 22% of total revenue by the end of 2024.

The industrial sector is also poised for significant growth, with increasing investments in automation, robotics, and industrial IoT (Internet of Things) solutions. Analog Devices’ products play a critical role in enabling these technologies, and as a result, industrial applications are expected to contribute 33% of total revenue in 2024.

Challenges and Risks

Despite the positive outlook, Analog Devices may face certain challenges in 2024. One potential risk is the ongoing supply chain disruptions in the semiconductor industry. These disruptions could impact ADI’s ability to meet growing demand, particularly in high-growth areas such as automotive and industrial applications.

Additionally, competition in the semiconductor industry remains fierce. Analog Devices faces strong competition from companies like Texas Instruments, Qualcomm, and NXP Semiconductors, which may put pressure on its market share and profit margins.

Conclusion

Over time, Analog Devices has established itself as the leading player in the semiconductor industry. Analog Devices statistics show that the company's financial performance has shown consistent growth, with revenue reaching $12.2 billion in 2023, a 6% increase from the previous year. Going forward, the company is expected to showcase consistent growth and has a projected revenue of $13 billion with a net income of $3.6 billion. However, challenges such as supply chain disruptions and fierce competition in the semiconductor industry may pose risks to its performance. Despite challenges, it is expected to have a strong market position.

Sources

FAQ.

Data conversion, signal processing, and power management technologies are the business focus of analog statistics.

Analog Devices is headquartered in Wilmington, Massachusetts, USA.

The Analog Devices’s revenue was approximately $12.2 billion in 2023.

The industrial sector generated $6,555.22 million in 2023, making it the highest revenue-generating sector in 2023.

$3,823.11 million was Analog Devices’ operating income in 2023.

Analog Devices spent $1,660.19 million on research and development in 2023.

Analog Devices’ market capitalization is $108.2 billion as of September 2024.

Analog Devices’ dividend yield as of September 2024 is 1.66%.

Analog Devices’ debt-to-equity ratio as of September 2024 is 0.23.

The projected revenue for Analog Devices in 2024 is $13 billion.

Saisuman is a skilled content writer with a passion for mobile technology, law, and science. She creates featured articles for websites and newsletters and conducts thorough research for medical professionals and researchers. Fluent in five languages, Saisuman's love for reading and languages sparked her writing career. She holds a Master's degree in Business Administration with a focus on Human Resources and has experience working in a Human Resources firm. Saisuman has also worked with a French international company. In her spare time, she enjoys traveling and singing classical songs. Now at Smartphone Thoughts, Saisuman specializes in reviewing smartphones and analyzing app statistics, making complex information easy to understand for readers.