Fujitsu Statistics By Operating Profit, Revenue, R&D Expenditure And Number of Employees

Updated · Nov 14, 2024

Table of Contents

- Introduction

- Editor Picks

- Fujitsu Revenue

- Fujitsu Operating Profit

- Fujitsu Total Assets

- Fujitsu Profit

- Fujitsu R&D Expenditure

- Fujitsu Consolidated Subsidiaries

- Fujitsu Revenue By Business Segment

- Fujitsu Operating Profit By Business Segment

- Fujitsu’s Number of Employees

- Fujitsu HPC Server Revenue

- Global Revenue of Server Market Globally

- Top Laptop Vendors in Japan

- Fujitsu Overview

- Conclusion

Introduction

Fujitsu Statistics: Fujitsu is a significant force in the global technology landscape, demonstrating remarkable versatility across multiple sectors, including cloud computing, hardware, software, and telecommunications. The company’s journey through recent years reveals a strategic shift towards service-oriented solutions while maintaining its traditional strengths in hardware and infrastructure.

By learning Fujitsu Statistics, one will learn how the company has gained a significant position on a holistic level. It will highlight the company’s transformation and current market position, setting the stage for a detailed analysis of its performance across various business segments.

Editor Picks

- Fujitsu’s revenue declined from 4.75 trillion Yen (2014) to 3.76 trillion yen (2023)

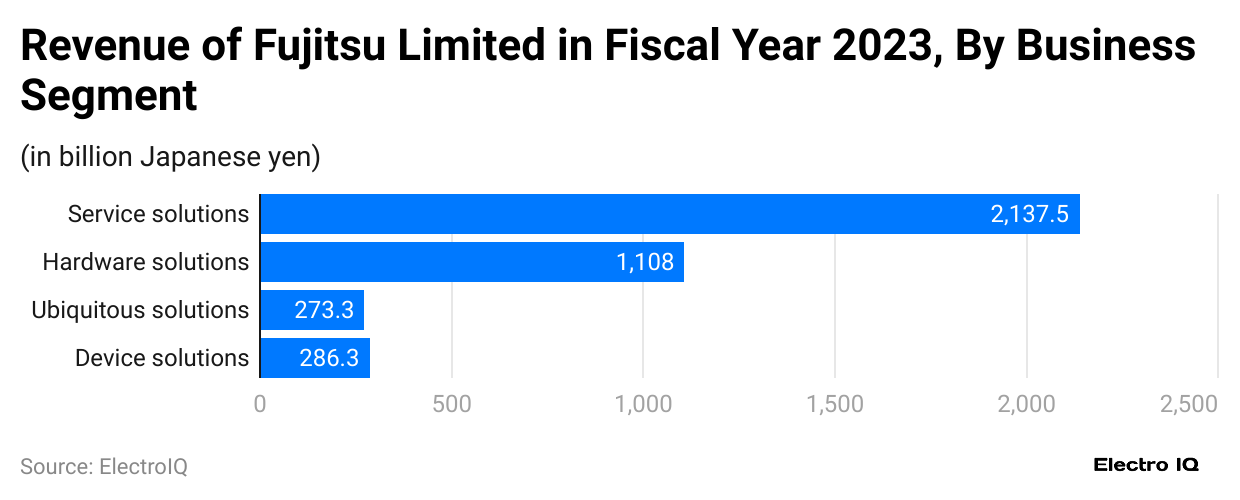

- Service solutions dominate revenue generation at 2,137.5 billion yen

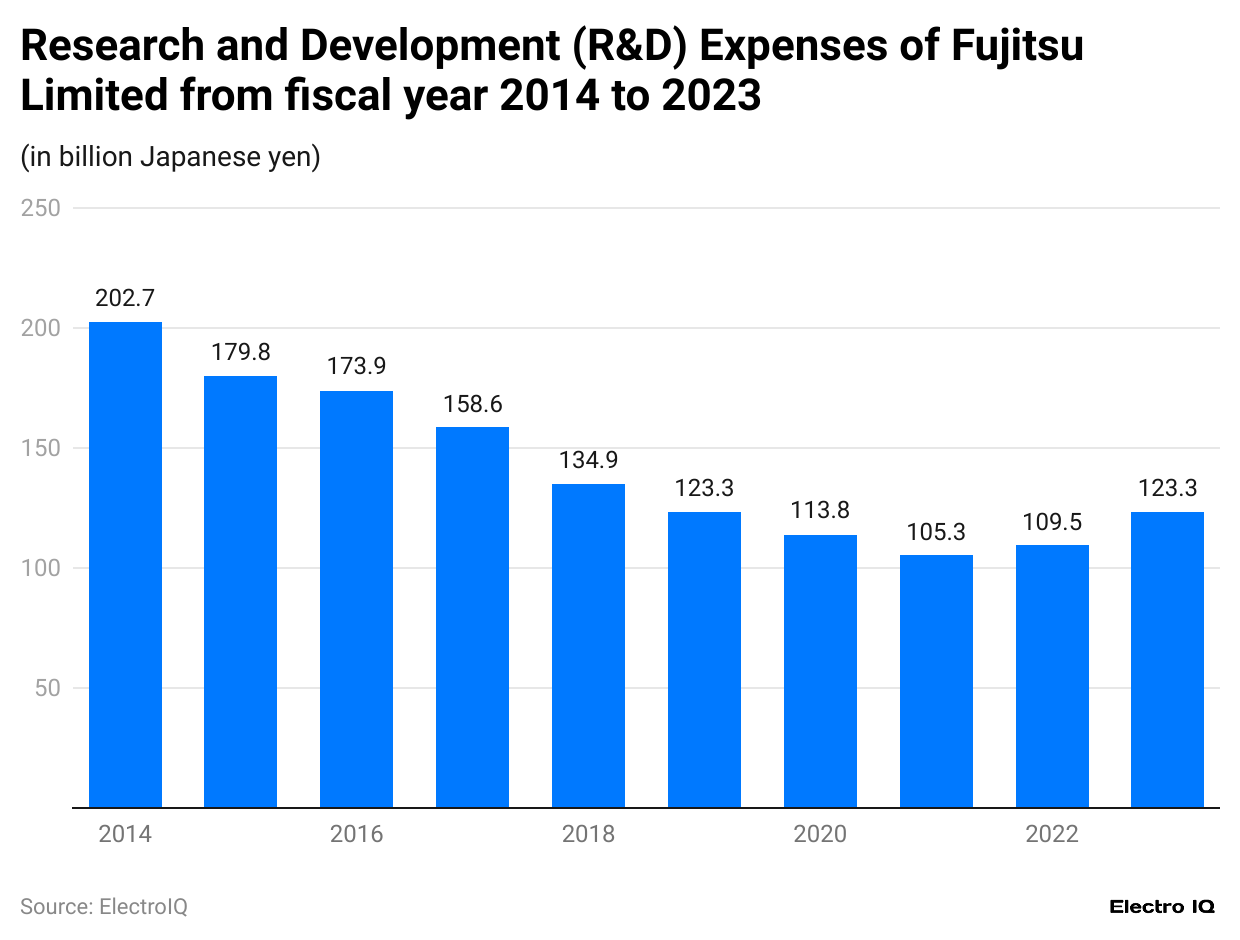

- R&D expenditure decreased from 202.7 billion yen to 123.3 billion yen over a decade

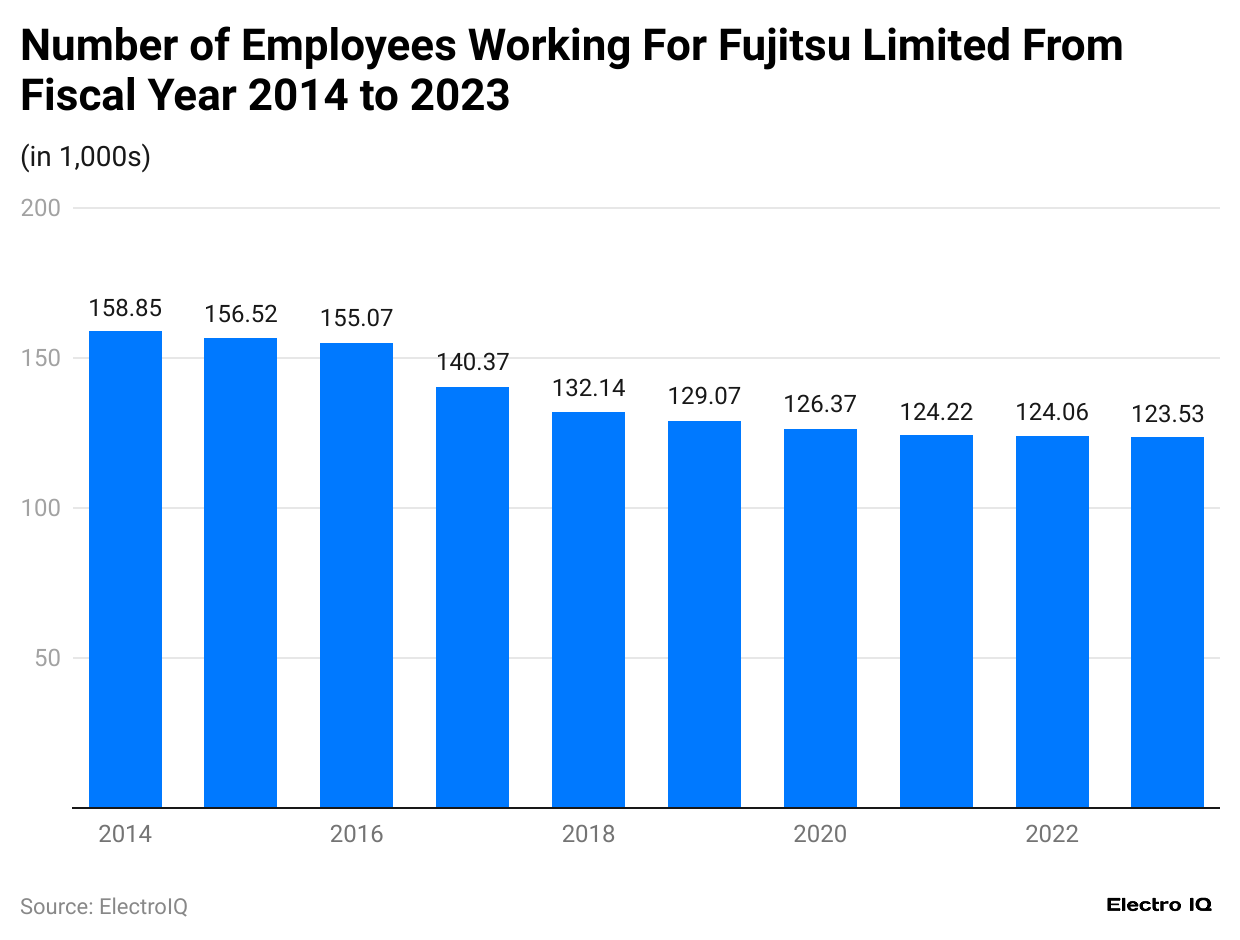

- Employee count reduced from 158.85k to 123.53k between 2014-2023

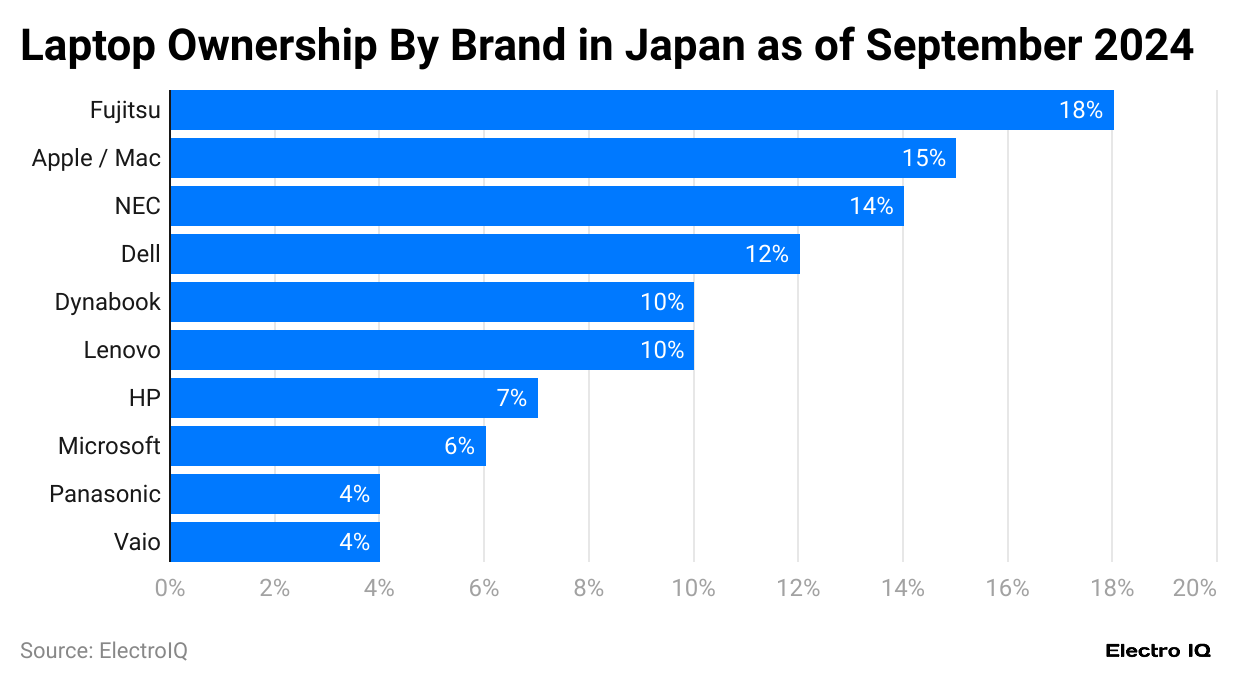

- Fujitsu holds 18% market share in Japanese laptop ownership

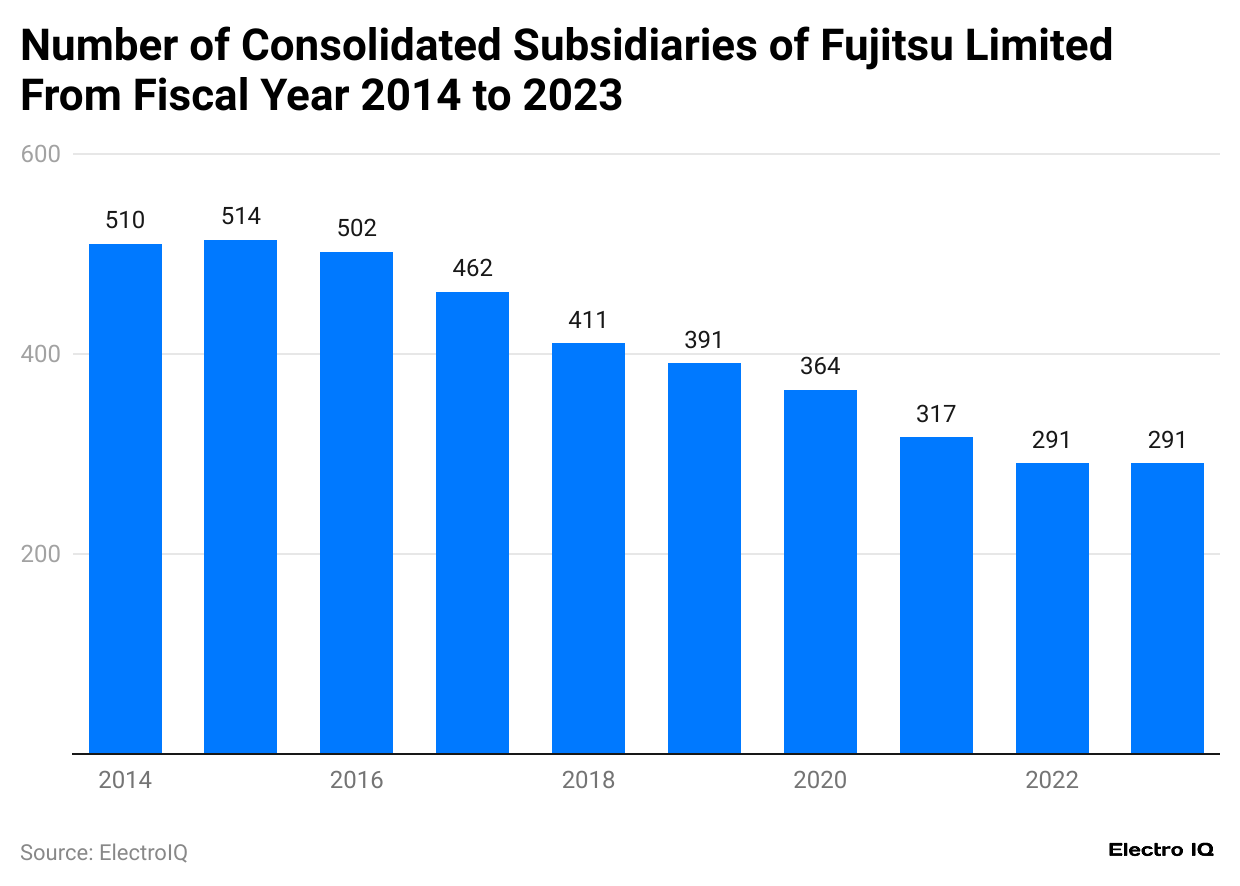

- The company’s consolidated subsidiaries decreased from 510 to 291 (2014-2023)

- HPC server revenue peaked at $1,319 million in 2020

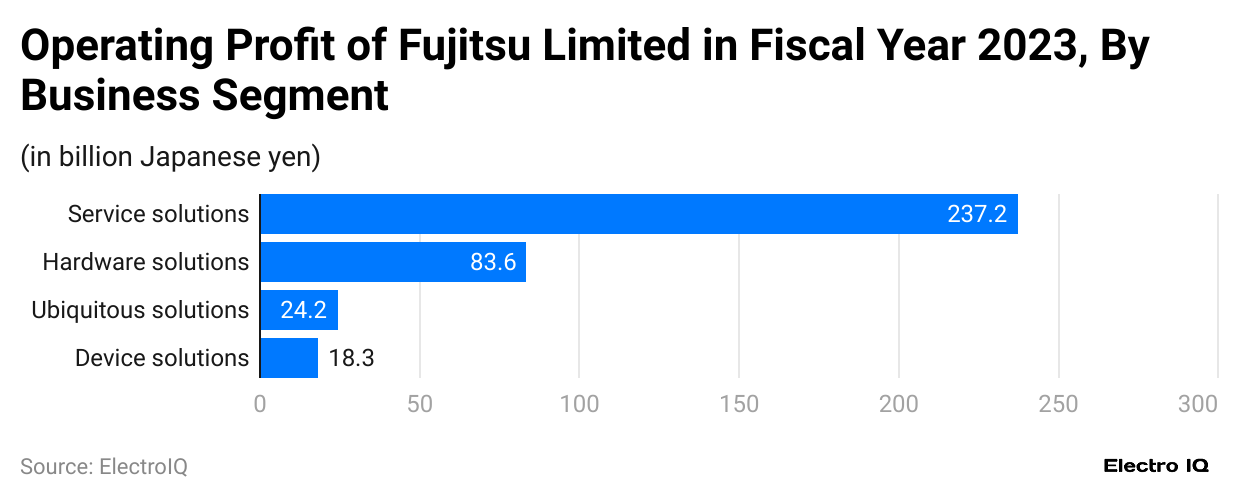

- Service solutions lead operating profit at 237.2 billion Yen

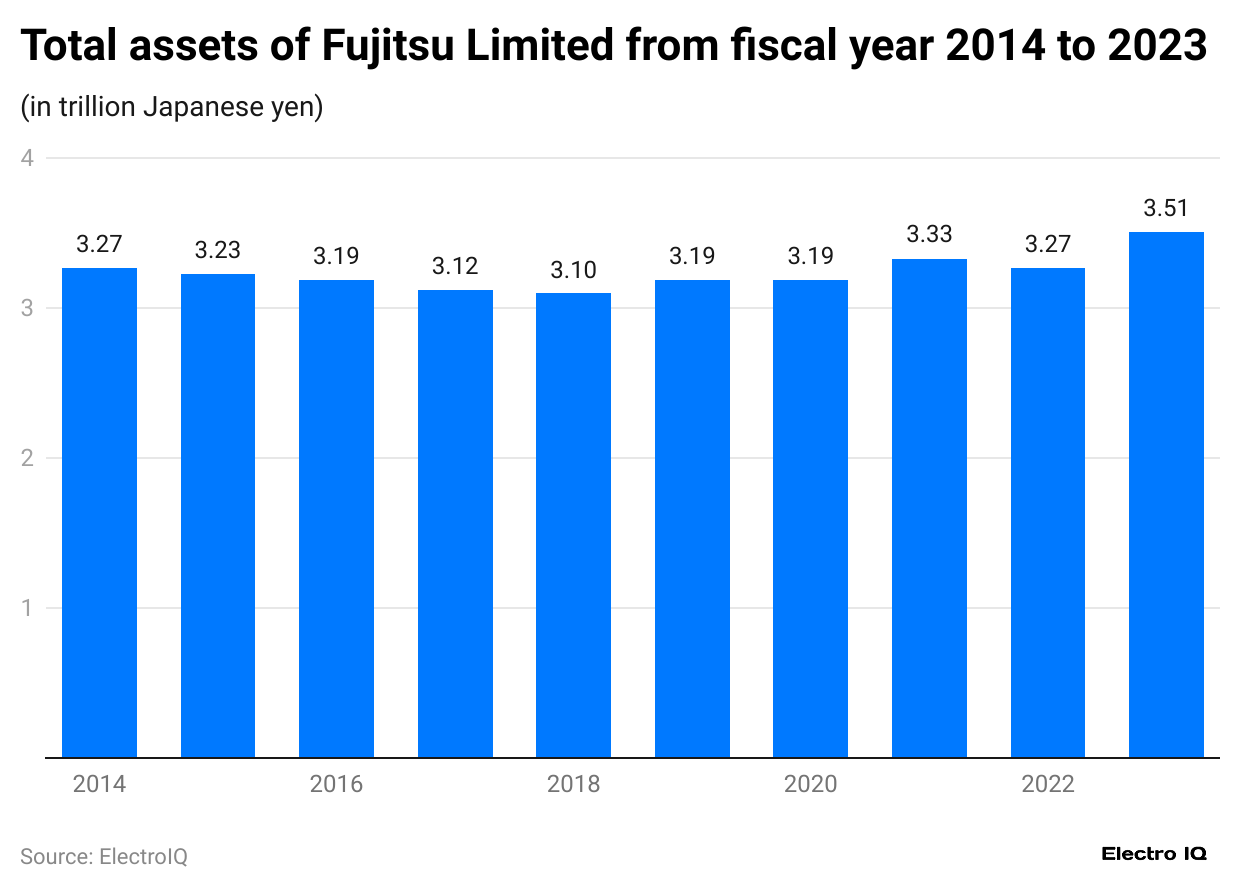

- Total asset value remained stable at around 3.5 trillion yen

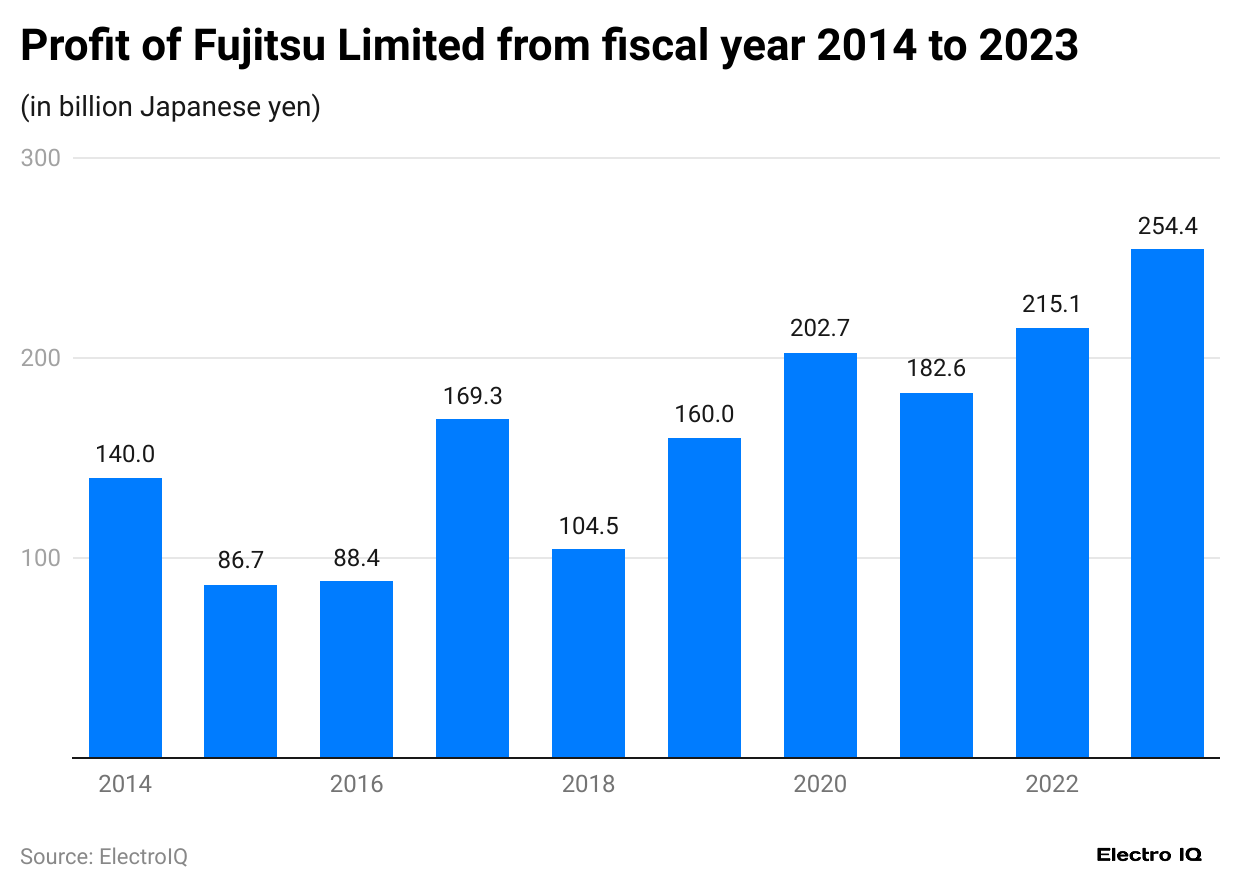

- Company profit increased from 140 billion to 254.4 billion yen (2014-2023)

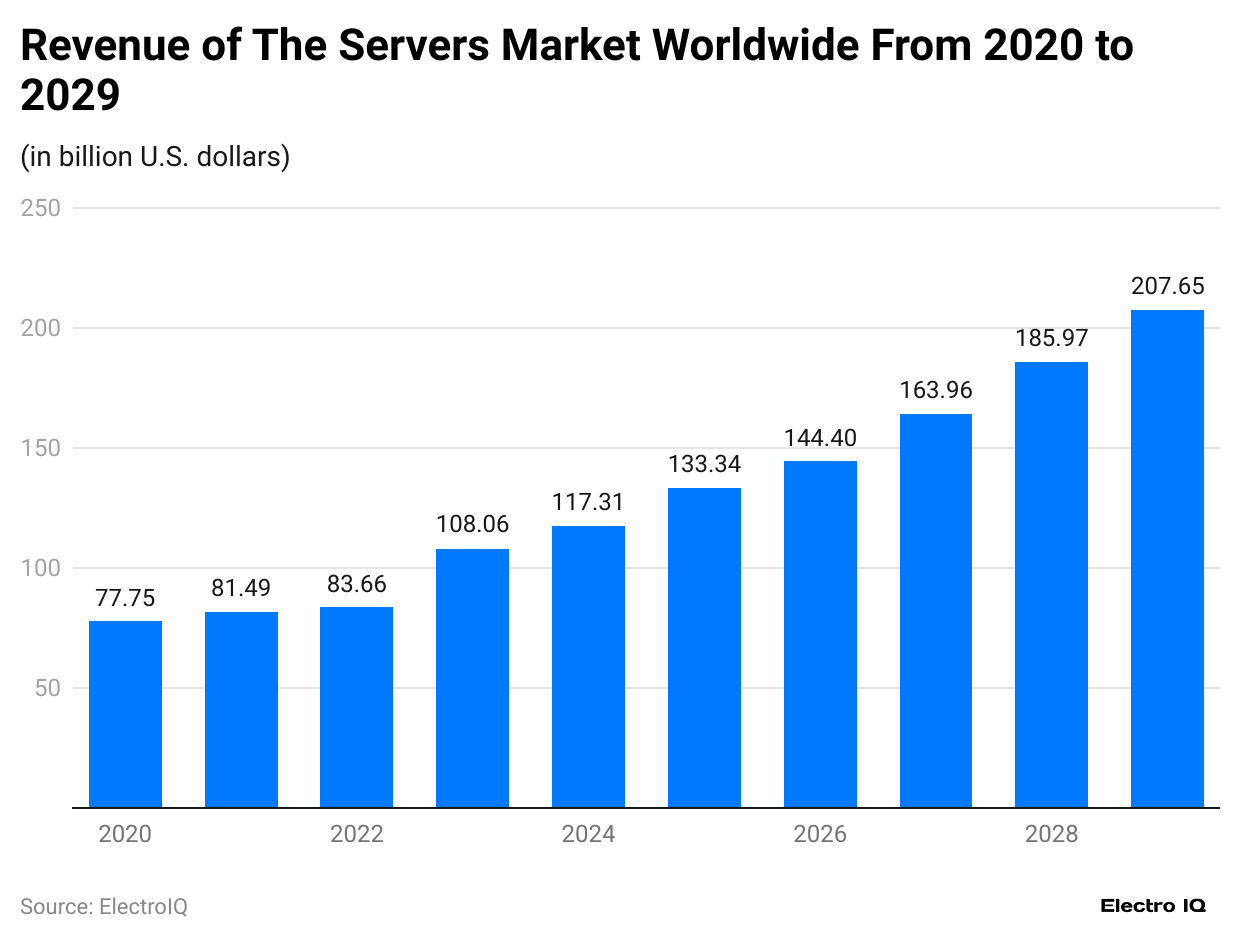

- Global server market revenue expected to reach $207.65 billion by 2029

- Cloud division contributed 20% of total revenue in 2023

- Japan remains the largest market, with a 40% revenue contribution

- Hardware solutions generate 33% of total revenue

- The services division accounts for 26.5% of the total revenue

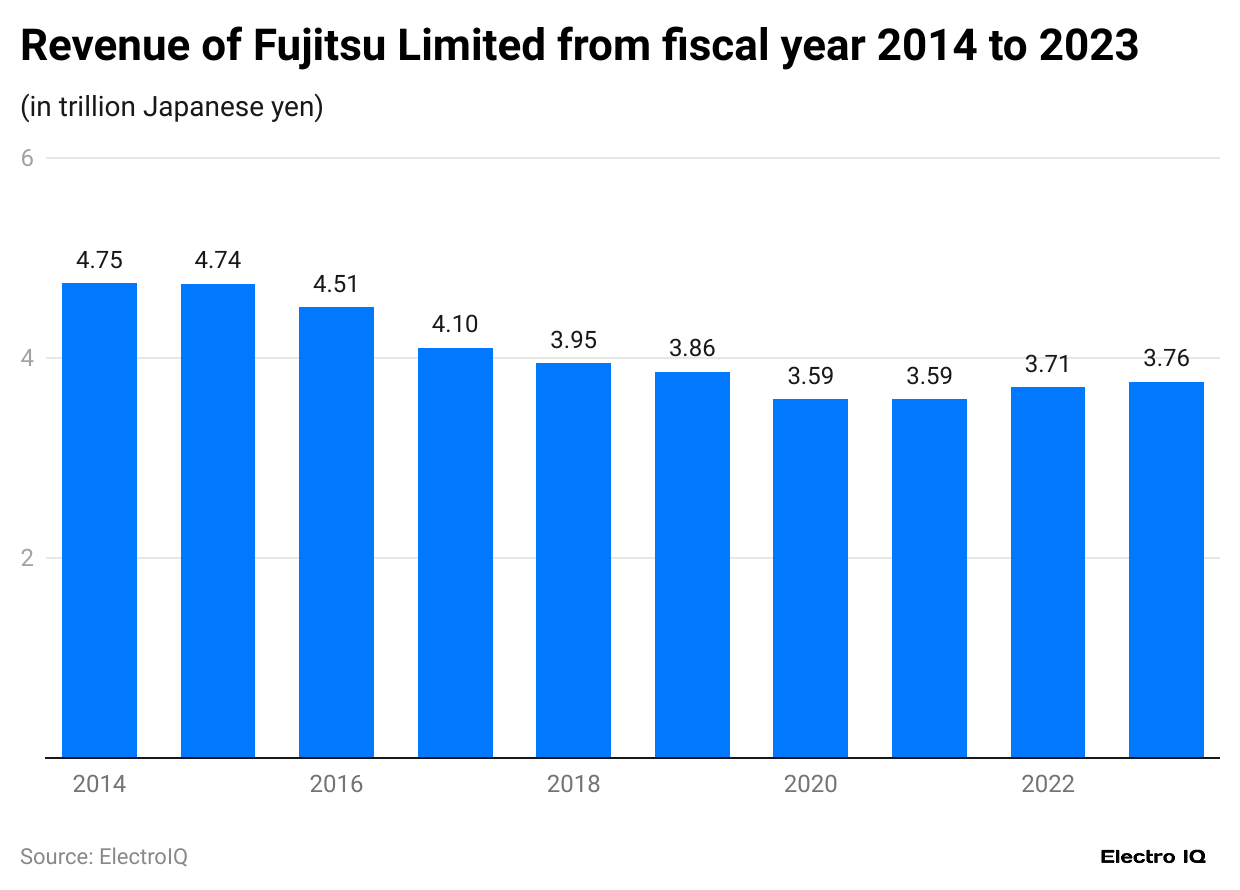

Fujitsu Revenue

(Reference: statista.com)

- Fujitsu Statistics show that the company’s revenue has decreased consistently.

- In 2014, the revenue was 4.75 trillion Yen, which decreased to 3.76 trillion yen by the end of 2023.

- This consistent decrease in revenue is a matter of concern for Fujitsu.

- Accordingly, the company is working to ensure this issue is resolved adequately.

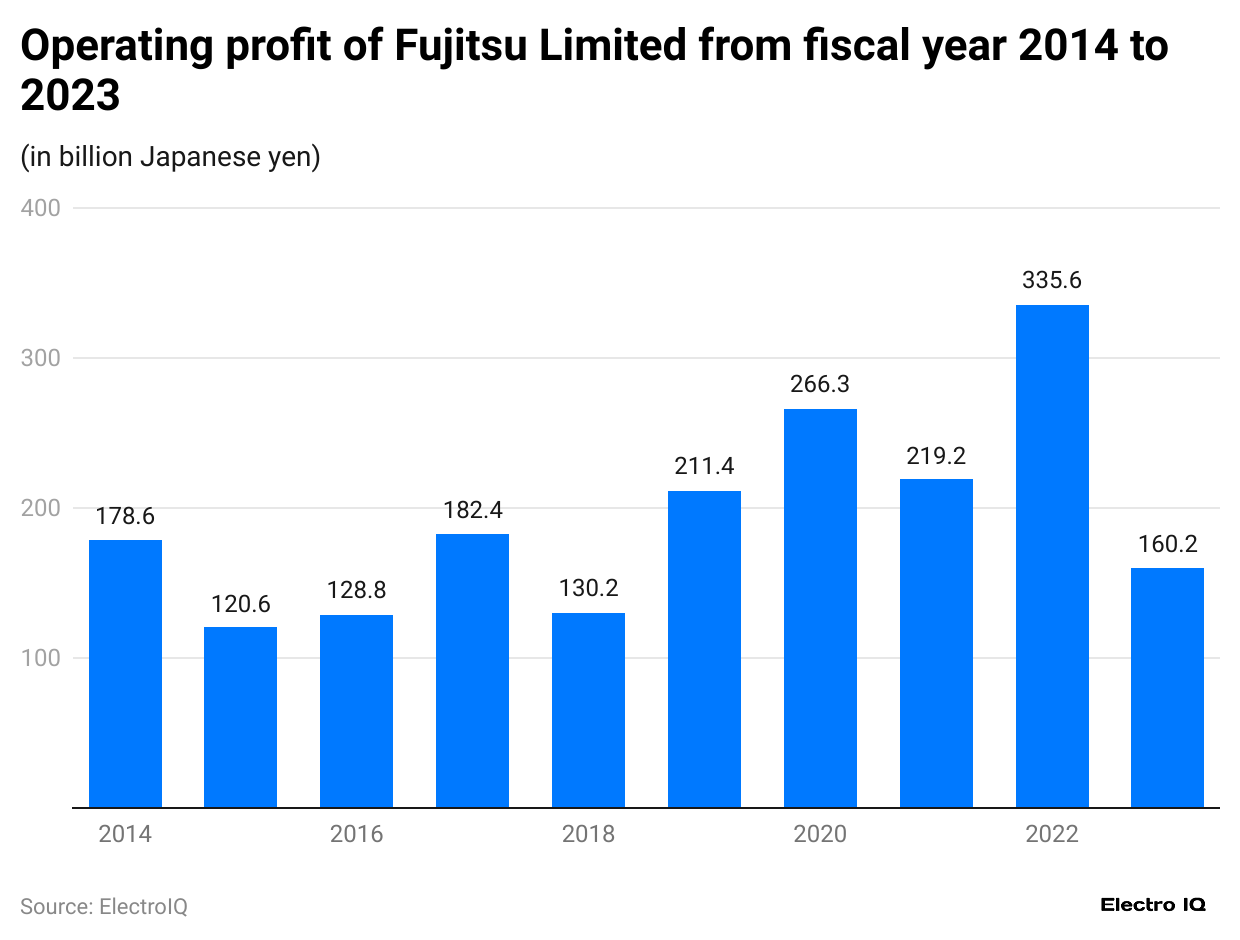

Fujitsu Operating Profit

(Reference: statista.com)

- Fujitsu Statistics show that the company’s operating profit has been inconsistent for a long time.

- In 2014, the operating profit was 178.6 billion yen, which decreased to 160.2 billion Yen by the end of 2023.

- Between 2014 and 2023, the highest net profit receded in 2022 at 335.6 trillion yen.

- Consistency in net profit is a good metric that showcases company growth.

Fujitsu Total Assets

(Reference: statista.com)

- Fujitsu Statistics show that the company’s total asset value has been constant.

- In 2014, the total asset value was 3.27 trillion yen; in 2023, the total asset value was 3.51 trillion yen.

- Fujitsu saw a steady increase in total assets between 2021 and 2023.

- There was a noticeable asset dip from 2014 to 2019, but a recovery began in 2020.

Fujitsu Profit

(Reference: statista.com)

- Fujitsu shows that the company’s profit has been increasing consistently over time.

- In 2014, the company’s profit was 140 billion yen, which has increased to 254.4 billion yen.

- The company saw a major rise in profit in 2020, reaching 7 billion yen.

- Profits steadily increased from 2021 to 2023, with continuous year-over-year growth.

Fujitsu R&D Expenditure

(Reference: statista.com)

- Fujitsu Statistics shows that research and development have been decreasing consistently over time.

- In 2014, the R&D expense was 202.7 billion yen, which decreased to 123.3 billion yen.

- The lowest R&D expenses were in 2022, at 5 billion yen.

- There was a slight recovery in R&D spending in 2021 and 2023.

Fujitsu Consolidated Subsidiaries

(Reference: statista.com)

- Fujitsu Statistics show that the company’s consolidated subsidiaries have decreased over time.

- In 2014, the consolidated subsidiaries were 510, which decreased to 291 by the end of 2023.

- By 2017, the number of subsidiaries dropped to 462.

- The number continued to decrease to 411 in 2018 and 391 in 2019.

Fujitsu Revenue By Business Segment

(Reference: statista.com)

- Fujitsu Statistics show that it follows segments from where the company generates revenue: Hardware solutions, Device solutions, Ubiquitous solutions, and Service solutions.

- Service solutions have the highest revenue at 2137.5 billion yen, followed by hardware solutions at 1,108 billion yen, device solutions at 286.3 billion yen, and ubiquitous solutions at 273.3 billion yen.

Fujitsu Operating Profit By Business Segment

(Reference: statista.com)

- Fujitsu Statistics show that the following segments have operating profit in following segments: Device solutions, Ubiquitous solutions, Service solutions, and Hardware solutions.

- Service solutions have the highest operating profit at 237.2 billion Yen, followed by Hardware solutions at 83.6 billion Yen, Ubiquitous solutions at 24.2 billion Yen, and Device solutions at 18.3 billion Yen.

Fujitsu’s Number of Employees

(Reference: statista.com)

- Fujitsu Statistics show that the number of employees consistently decreased over time.

- In 2014, the number of employees was 158.85k, which decreased to 123.53k by the end of 2023.

- The employee count remained stable at 42 thousand in 2021 and 2022.

- In 2023, the number of employees reached 53 thousand, the lowest in the given period.

Fujitsu HPC Server Revenue

(Reference: statista.com)

- Fujitsu Statistics show that the revenue of HPC servers has fluctuated over time.

- In 2011, the revenue of HPC servers was $120.35 million, which was $218 million at the end of 2023.

- Duriod 2011 - 2023, the highest revenue was recorded in 2020 at $1319 million.

- From 2013 to 2016, revenue remained relatively low, fluctuating between $127.99 million and $158.15 million.

- Revenue stabilized in 2022 and 2023, staying around $230 million and $218 million, respectively.

Global Revenue of Server Market Globally

(Reference: statista.com)

- Fujitsu Statistics reveal that the global server market has been increasing consistently. Lenovo is one of the prominent server shipment providers.

- In 2023, there was $108.96 billion in revenue for the server market.

- The revenue of the server market is expected to be $207.65 billion by the end of 2029.

- The server market is expected to continue growing, reaching $117.31 billion in 2025 and $133.34 billion in 2026

Top Laptop Vendors in Japan

(Reference: statista.com)

- Fujitsu Statistics show that Microsoft, Dynabook, Lenovo, ASUS, Fujitsu, Acer, HP, Panasonic, Dell, Vaio, NEC, and Apple / Mac are top brands in Japan.

- Fujitsu has the highest ownership among respondents, with 18%, followed by Apple / Mac with 15% ownership, NEC with 14% ownership, Dell with 12% ownership, Dynabook with 10% ownership, Lenovo with 10% ownership, HP with 7% ownership, Microsoft with 6% ownership, Panasonic with 4% ownership, Vaio with 4% ownership, ASUS with 3% ownership, Acer with 2% ownership.

(Source: Wikipedia.com)

Fujitsu Overview

Fujitsu is a well-established player in global IT and technology services. Fujitsu has shown significant growth in recent years. As a company that operates in multiple segments such as cloud computing, hardware, software, and telecommunicayearThishis arti, we will examine Fujitsu Statistics for 2023 and 2024, focusing on the company's performance, financial figures, and market presence.

In 2023, Fujitsu's global revenue reached approximately US$32 billion, a 5.2% increase from the previous year. This growth was primarily driven by the company in cloud computing and managed se performance vices, which accounted for a large portion of their revenue. According to Fujitsu Statistics, the company's cloud division alone generated US$6.5 billion in revenue in 2023, representing a growth of 10% compared to 2022.

#1. Cloud Computing and Services Expansion

Cloud computing has a substantial growth area for Fujitsu. The company's cloud offerings, including its hybrid and multi-cloud solutions, saw a surge in demand due to the increasing shift of businesses towards digital transformation. Fujitsu Cloud IaaS and Fujitsu Cloud A5 for Windows Azure have gained popularity among global enterprises looking for scalable and secure cloud infrastructure. In 2023, Fujitsu Statistics revealed that the cloud computing segment contributes 20% of the company's total revenue.

Looking forward to 2024, the cloud segment is expected to grow even further. Market analysts predict Fujitsu's cloud computing division could surpass US$7 billion in revenue, representing around 21.5% of the company's total earnings. This growth is driven by increased investment in cloud infrastructure and services to meet demand for data storage and processing solutions.

#2. Hardware and Computing Products

Fujitsu's hardware business, particularly in computing products such as servers, supercomputers, and mainframes, significantly impacted the company's overall revenue. In 2023, Fujitsu Statistics showed that its hardware solutions generated approximately US$10.8 billion, accounting for 33% of the total revenue. Fujitsu's PRIMERGY servers and GlobalServer GS21 mainframes remain popular in large-scale enterprise environments. At the same time, supercomputers like the K Computer continue to be used in scientific research and advanced computing tasks.

The hardware segment is expected to experience moderate growth in 2024, with projected revenue reaching US$11 billion. Fujitsu is investing in developing next-generation computing products, focusing on energy efficiency and performance improvements. This includes the company's plans to enhance its quantum computing capabilities, which are anticipated to play a significant role in future revenue streams.

#3. Software and AI Solutions

Fujitsu is also making strides in software and artificial intelligence (AI) solutions. According to Fujitsu Statistics, the company's software division, which includes products like Interstage and Systemwalker, generated approximately US$3.2 billion in revenue in 2023. This sector represents around 10% of the company’s total income.

Fujitsu's investment in AI has also contributed to its growth. AI-driven solutions have been integrated into its offerings for various industries, including healthcare, manufacturing, and finance. By 2024, Fujitsu is expected to increase its revenue from AI and software to US$3.5 billion, maintaining a 10.5% share of total revenue. AI-driven innovations such as machine learning and automation are expected to be the key contributors to this growth.

#4. Telecommunications and Network Infrastructure

Fujitsu's role in telecommunications and network infrastructure is notable, particularly in Asia and Europe. In 2023, the telecommunications division earned US$5 billion, representing 15.6% of the company’s revenue. Fujitsu has provided network management solutions, multi-layer convergence technologies, and 5G infrastructure to telecommunication providers worldwide.

Fujitsu Statistics for 2024 suggest that the telecommunications segment is expected to see a slight increase in revenue, reaching US$5.2 billion. This growth will be driven by the continued deployment of 5G technology and the expansion of network infrastructure in developing markets. Fujitsu's partnership with critical telecommunications providers will further solidify its position in this segment.

#5. Microelectronics and Semiconductor Business

Fujitsu’s microelectronics and semiconductor division also contributed significantly to its revenue in 2023. Fujitsu's manufacturing department produces various ducts, including microcontrollers, ASICs, and optical components, used in multiple industries, such as automotive and industrial automation. Fujitsu Statistics show that this segment generated US$4 billion in revenue, making up 12.5% of the total.

With the global demand for semiconductors expected to remain high, Fujitsu projects moderate growth in this division in 2024. Revenues are expected to increase to US$4.3 billion, driven by the company’s focus on advanced semiconductor technologies and developing high-performance chips for use in artificial intelligence and 5G applications.

#6. Regional Performance

Fujitsu’s performance varies across different regions. In 2023, Japan remained Fujitsu’s largest market, contributing 40% of the company’s total revenue, which equates to approximately US$12.8 billion. Europe and North America contributed significantly, accounting for 25% and 20% of the total revenue, respectively. The remaining 15% came from regions such as Asia-Pacific and Latin America.

Fujitsu Statistics indicate that, by 2024, the company's revenue from Japan will remain stable, while the North American market is expected to growWithth increased demand for cloud and AI solutions. In the North American market, Fujitsu's revenue in the region could grow to US$7 billion, representing a 10% growth year-over-year.

#7. Services and Managed Infrastructure

Fujitsu’s services division, which includes consulting, customer support, and managed services, accounted for approximately US$8.5 billion in 2023. This represents 26.5% of the company’s total revenue. Services have been a vital growth area for Fujitsu, with its managed infrastructure services and cloud support playing critical roles in its overall strategy to 2024; Fujitsu expects its services division to grow by 5%, reaching US$8.9 billion. This growth will be driven by increased demand for outsourced IT services, particularly cloud management and infrastructure maintenance. The rise of digital transformation initiatives among global enterprises will continue to fuel demand for Fujitsu’s managed services.

The Fujitsu Statistics for 2023 and 2024 highlight the company's solid global position. Fujitsu continues to invest in key growth areas such as cloud computing, artificial intelligence, and network infrastructure. With steady growth across its various segments, Fujitsu is expected to see continued success in the coming years, driven by its diversified product and service offerings.

Conclusion

Fujitsu's statistical analysis reveals a company in transition, strategically pivoting towards high-growth areas while managing traditional business segments. Fujitsu Statistics showcases the decline in revenue from 4.75 trillion Yen in 2014 to 3.76 trillion yen in 2023, reflecting this transformation as the company streamlines operations and focuses on more profitable segments.

The strategic focus on cloud services, AI solutions, and managed services, coupled with stable asset management and targeted R&D investments, suggests a sustainable path forward in the competitive technology sector.

Sources

FAQ.

The service solutions segment generates the highest revenue at 2,137.5 billion yen.

Decreased from 158.85k in 2014 to 123.53k in 2023.

Leading position with 18% market share in Japan.

123.3 billion yen as of 2023, down from 202.7 billion in 2014.

Hardware solutions, Device solutions, Ubiquitous solutions, and Service solutions.

Japan, contributing 40% of total revenue.

Increased from 140 billion yen in 2014 to 254.4 billion yen in 2023.

Generated US$6.5 billion in revenue from cloud services in 2023, representing 20% of total revenue.

291 subsidiaries as of 2023, down from 510 in 2014.

Service solutions with an operating profit of 237.2 billion Yen.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.