Smart Card Statistics By Market Size, Sales, Region And Transaction Volume

Updated · Aug 23, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Interesting Facts About Smart Card

- Evolution of Smart Cards

- Key Features of a Smart Card

- Smart Card Market Size Forecast

- General Smart Card Statistics

- Smart Card Market Type Share

- Smart Card Share By Region

- Rise Of Retail E-Commerce Sales

- Cashless Transaction Volume

- Smart Payment Card Shipments Statistics

- Recent Developments

- Conclusion

Introduction

Smart Card Statistics: A smart card is a pocket-sized plastic card embedded with an integrated circuit that controls resources. Typically, smart cards are contactless and used for a variety of applications, such as authentication, personal identification, data storage, and application processing. They offer organizations strong authentication sign-in. It is essential for businesses to review smart card statistics to fully understand this technological tool’s capabilities.

Editor’s Choice

- The global smart card market is expected to reach USD 29.6 billion by 2033.

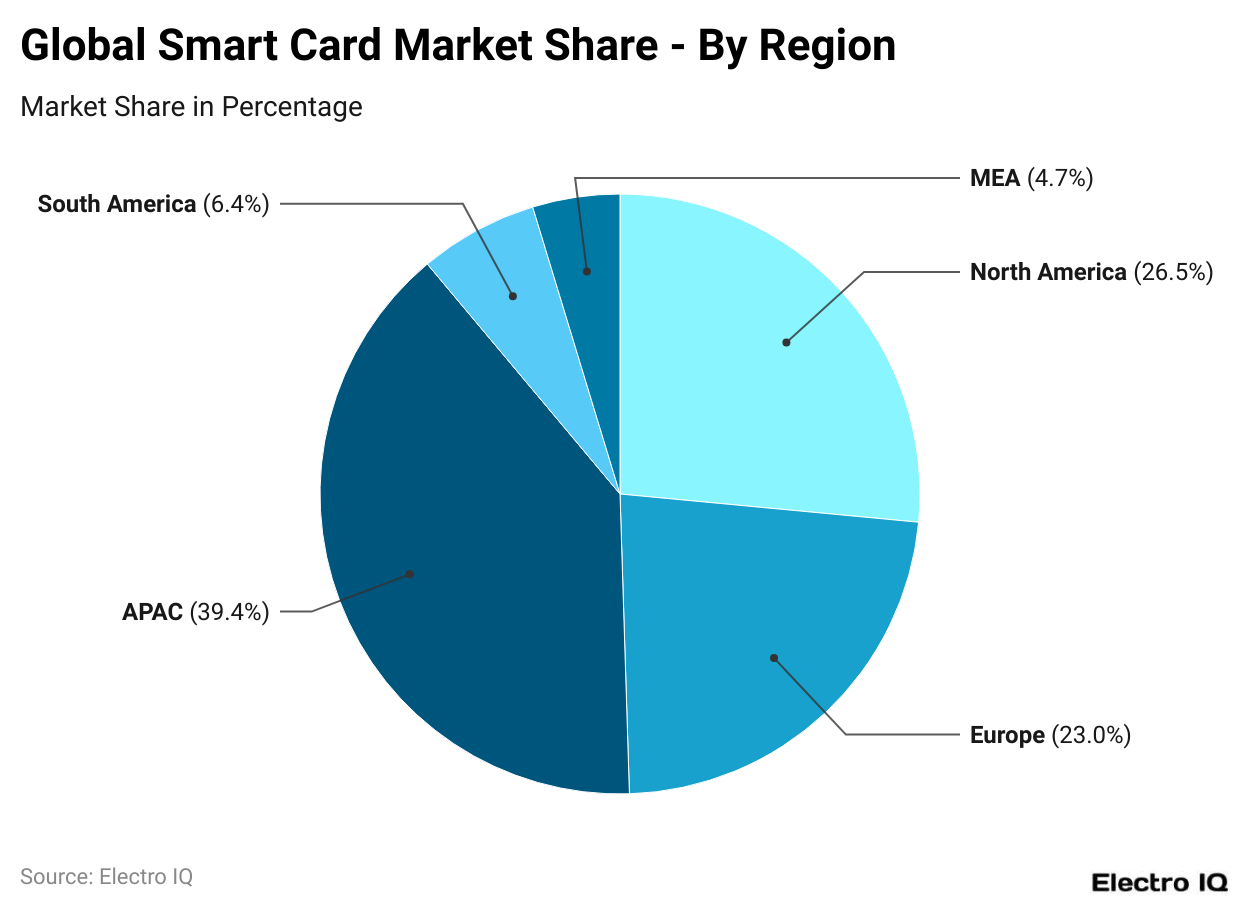

- The Asia-Pacific region holds the largest share of the global market at 39.4%.

- North America follows with a 26.5% market share, while Europe holds 23.0%.

- CPI Card Group Inc. leads the market with an 18% share, followed by American Express Company with 17%.

- Atos SE and NXP Semiconductors NV each control 9% of the market, while Inside Secure SA holds 10%.

- Giesecke & Devrient (G&D) GmbH and Infineon Technologies AG account for 8% of the market each.

- In 2008, Gemalto led the smart card manufacturing market with a 35% share, followed by Giesecke & Devrient and Oberthur Technologies, each holding 14%.

- The Federal Information Processing Standard (FIPS) 201-3 in the United States sets guidelines for Personal Identity Verification (PIV) cards, used by federal employees and contractors.

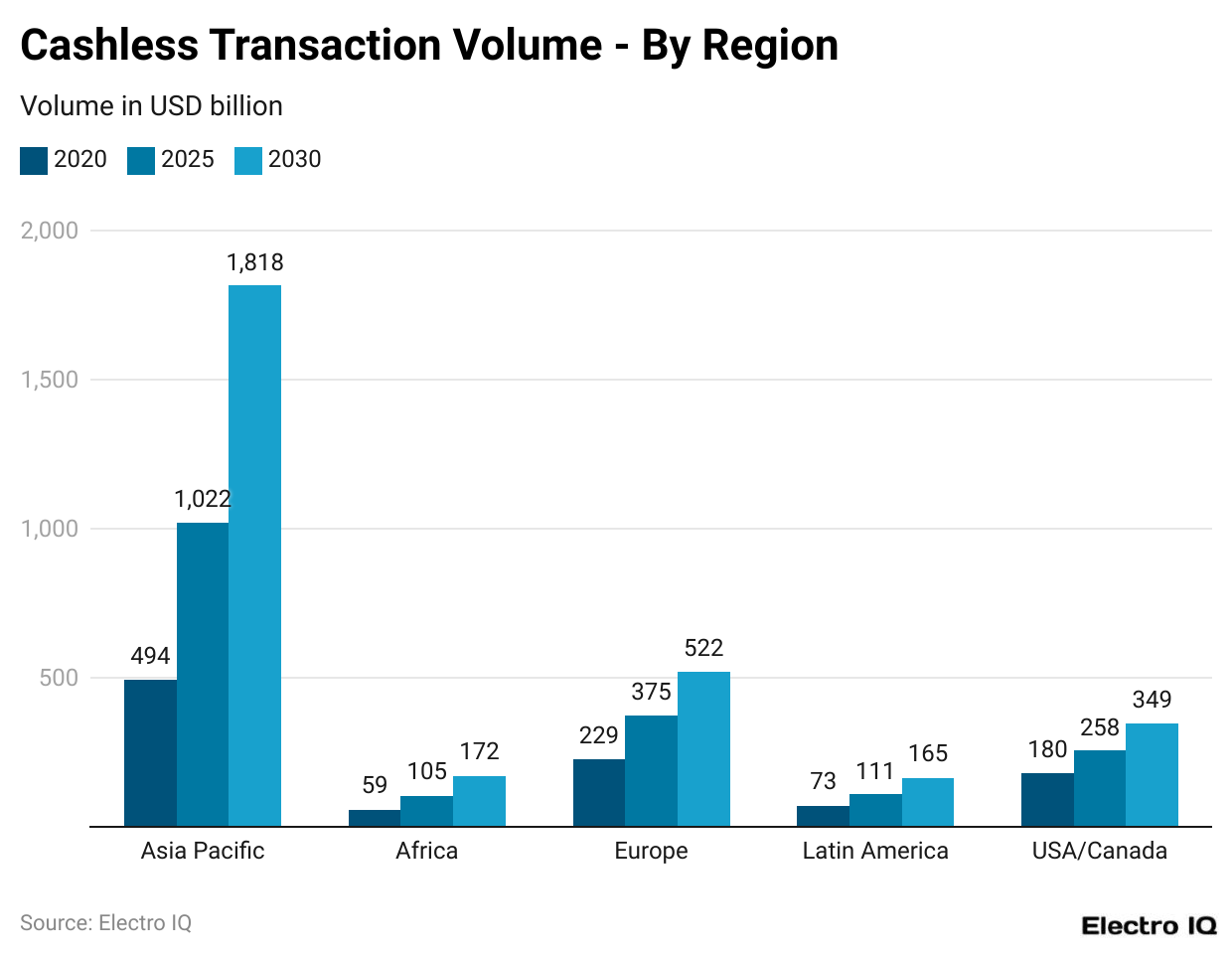

- Cashless transactions are expected to grow significantly across all regions from 2020 to 2030.

- In the Asia-Pacific region, cashless transaction volume was USD 494 billion in 2020 and is projected to reach USD 1,818 billion by 2030.

Interesting Facts About Smart Card

- Smartcards were introduced in public during the 1970’s

- Smartcard statistics reveal that during the 1980s, smartcards became popular with the introduction of ATMs.

- During the 1990s, there was explosive growth in the Smartcard market with various prepaid product applications in Denmark.

- Since the 21st century, smart cards have been used in various industries, such as BFSI, telecom, and public transportation systems.

- The data stored in the smartcard ranges up to 256kb RAM.

- There are several international standards, such as AES, DES, and RSA, that ensure optimal data security for their respective applications.

- In 2023, the first GSMA-certified iSIM was launched.

Evolution of Smart Cards

- In 1974, Roland Moreno patented the first memory card.

- By 1977, companies like Bull CP8, SGS Thomson, and Schlumberger began developing smart card products.

- In March 1979, Michel Hugon from Bull CP8 created the first microprocessor-based smart card, combining a processor and memory.

- In 1979, the banking sector began exploring the use of smart cards.

- In 1995, the first SIM cards were introduced.

- In 1999, Finland issued the first national electronic ID card.

- In 1999, smart cards were introduced for transport systems.

- In 2001, the US Department of Defense began using Military CAC credentials for secure access and authentication.

- In 2003, the UK started issuing Chip and PIN cards.

- In 2003, Micro-SIM technology was introduced.

- In 2005, Norway issued the first ICAO-compliant electronic passport.

- In 2010, smart credit cards were launched in the US.

- In 2012, Nano-SIM cards were introduced.

- In 2018, the first biometric contactless payment card was launched, and eSIM technology was introduced.

- In 2019, the first 5G SIM cards became available.

- In 2021, the first voice payment card was introduced.

- In 2023, the first GSMA-certified iSIM was launched.

Key Features of a Smart Card

- Secure Identification and Authentication: Smart cards allow secure identification and authentication of the cardholder and third parties using methods like PIN codes or biometric data.

- Data Storage and Protection: They securely store data on the card and protect communications using encryption techniques.

- Portability: Smart cards are compact and easy to carry, providing convenience in various applications.

- Memory Capacities: Smart cards come with memory types such as EEPROM (up to 128 KB), Flash memory (up to several MB), and RAM (up to 256 KB).

- Microprocessors: They are equipped with microprocessors ranging from 8-bit to 32-bit, enabling various computing tasks.

- Operating Systems: Smart cards operate on systems like Java Card, MULTOS, or proprietary operating systems.

- Communication Interfaces: Smart cards support contact (ISO/IEC 7816 standard), contactless (ISO/IEC 14443 or ISO/IEC 15693 standards), or dual-interface communication methods.

- Data Encryption: Encryption methods such as AES, DES, 3DES, RSA, and ECC are used to protect data.

- Digital Signatures: Smart cards can generate digital signatures using RSA, DSA, or ECDSA algorithms.

- Cryptographic Protocols: They support secure communication protocols like TLS and SSL.

Smart Card Market Size Forecast

- The global smart card market is projected to reach USD 29.6 billion by 2033, up from USD 16.7 billion in 2023, with a steady annual growth rate of 5.9%.

- Global smart card shipments surpassed 2.6 billion units in 2022, indicating the increasing dependence on this technology across various industries. By 2025, smart card usage in the transportation sector is expected to reach 78%.

- Contactless smart cards held over 56% of the global market share in 2023 due to their convenience and security, particularly in retail, banking, and public transportation.

- The telecommunications segment dominated the market in 2023, capturing over 41% of the market. Smart cards, especially SIM cards, are essential in mobile communications for subscriber authentication and network connectivity.

- Asia-Pacific led the market in 2023, accounting for 38% of the share, driven by technological advancements, digital transactions, and government initiatives.

- In North America, the demand for smart cards reached USD 6.3 billion in 2023, with significant growth anticipated in the coming years.

- In January 2023, Delhi Metro Rail Corporation partnered with Airtel Payments Bank to introduce a smart card top-up service, enhancing digital transactions and public transportation convenience in Delhi.

General Smart Card Statistics

- There are between 30 to 50 billion smart cards in use today, including credit cards and SIM cards. These are some of the most widespread IT devices globally.

- Smart cards have microprocessors or memory chips that enable them to perform various tasks when used with a smart card reader.

- Over the past 30 years, smart cards have quietly transitioned us into a digital world more than any other technology.

- Smart credit cards handle daily transactions worth trillions of dollars.

- SIM cards connect billions of conversations daily, linking our social and economic activities.

- Smart cards are also used as access-control devices, such as company badges or university IDs, ensuring data access is restricted to authorized users.

- As national ID cards, health cards, residence permits, or electronic passports, smart cards provide secure identification and authentication for both authorities and citizens.

- This technology contributes to road safety by being used in driver’s licenses and tachograph cards.

- In 2022, over 10 billion smart cards were shipped, reflecting a stable and mature market.

- The smart card market is expected to remain stable in 2023, with a slight growth of 0.2%.

- Telecom, including SIM cards, accounts for 43% of the market, with financial services (payments and banking cards) holding 44.6%.

- In 2022, the financial services segment saw 81% of its shipments as contactless cards, showing continued growth in contactless technology.

- The government and healthcare sector grew to 550 million units in 2022, driven by the adoption of contactless features in identity and health cards.

- The transport sector saw an increase in demand in 2022, reaching 225 million units.

- The use of sustainable materials in payment cards and SIM cards took off in 2022, with an estimated 350 million units.

- For 2023, the government and healthcare market is expected to grow by 4.5%, reaching 575 million units due to increased digitalization and public policies.

- The transport sector is forecasted to grow by 11% in 2023, driven by urbanization and sustainability concerns.

- Continued growth is expected in sustainable payment cards and SIM cards throughout 2023.

(Reference: imarcgroup.com)

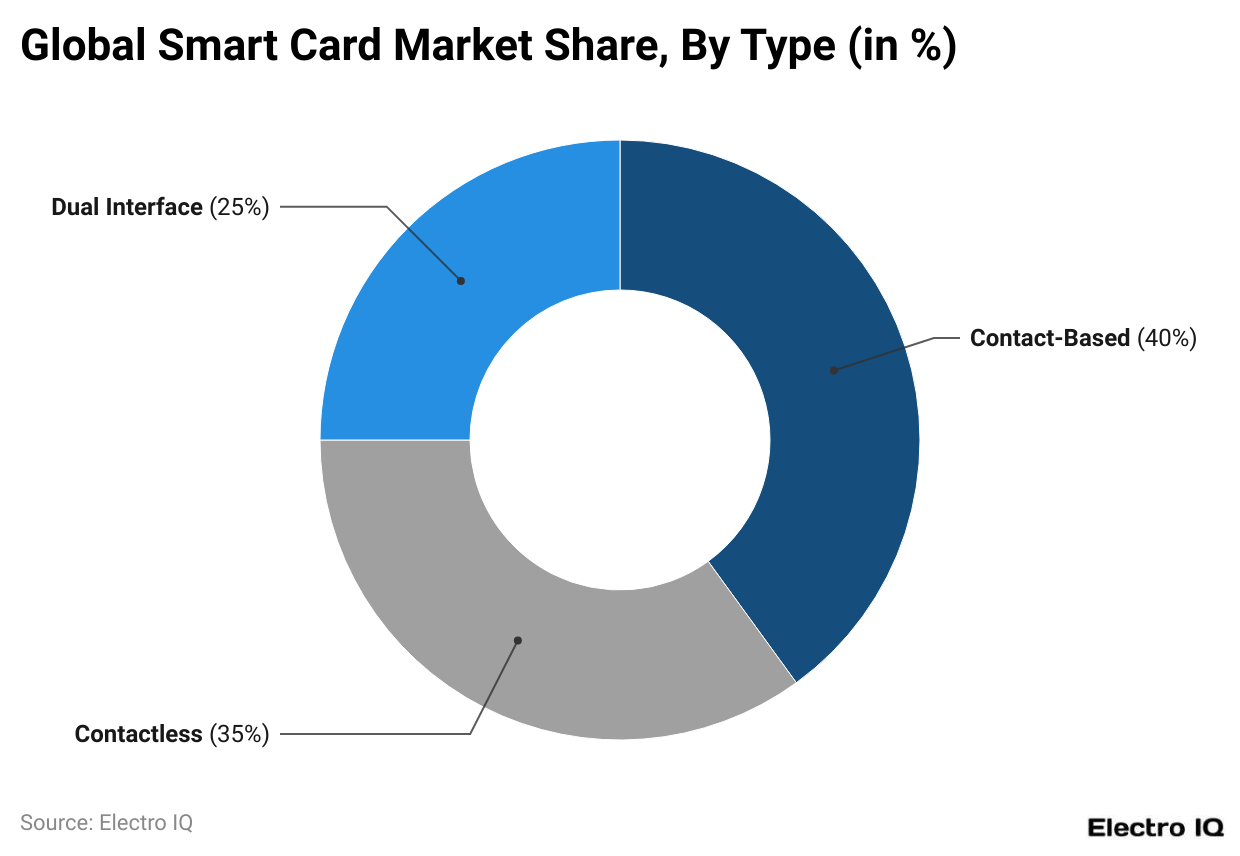

- By taking note of Smartcard statistics, one can trifurcate Smartcards into three categories: contact bases, contactless, and dual interface.

- Of all the smartcards, 40% are contact-based, 35% are contactless, and 25% are dual interfaces.

(Reference: scoop.market.us)

- The Asia Pacific region acquires a major % of the smartcard market share, 39.4%.

- Europe and North America follow it with 23% and 26.5%.

- Smart card statistics reveal that South America and MEA (Middle East and Africa) have the lowest margins in the smartcard market, with 6.4% and 4.7%.

Rise Of Retail E-Commerce Sales

(Reference: scoop.market.us)

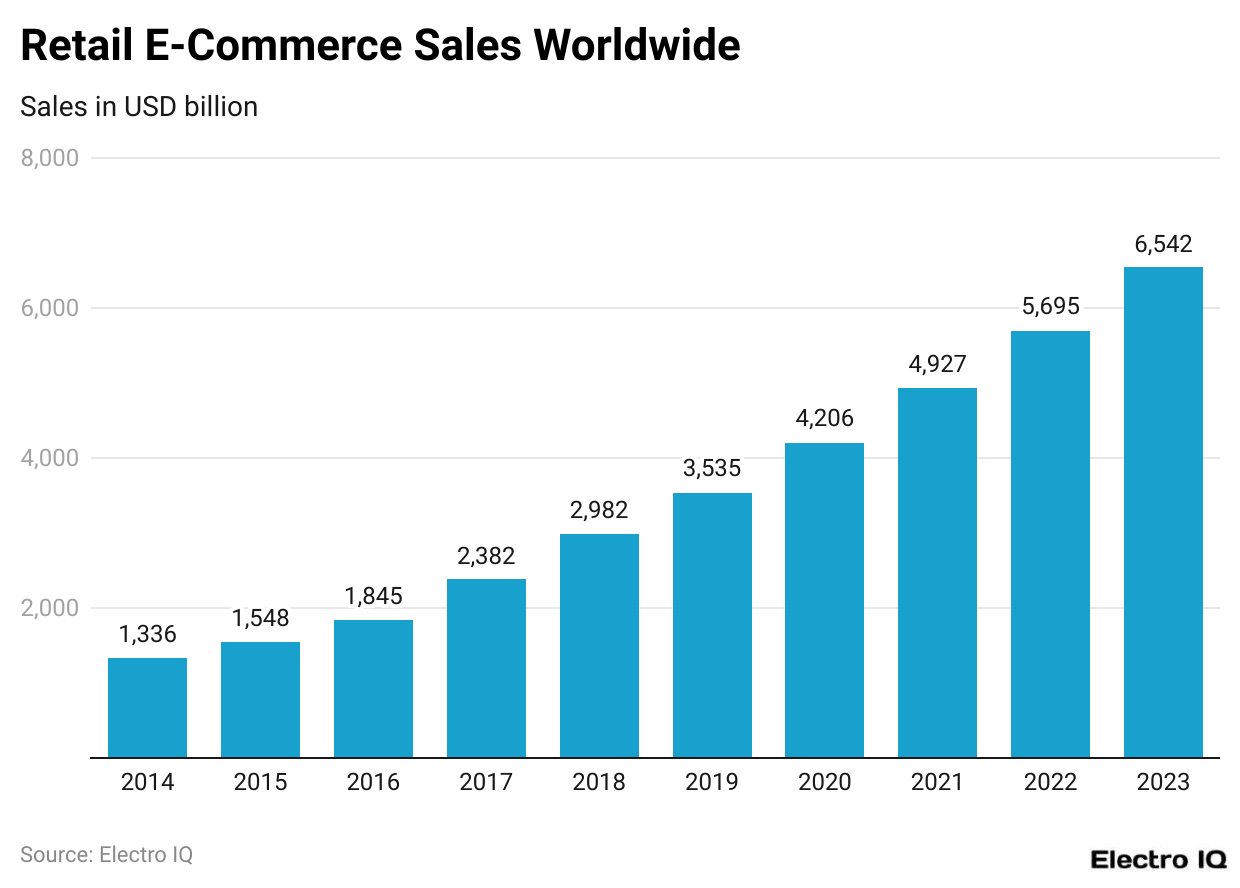

- Revenue based on retail E-commerce sales has been bolstered by an increase in Smart card usage.

- The Smart card statistics reveal a significant increase in retail e-commerce sales worldwide from 2014 till 2023.

- As of 2023, the retail e-commerce sales reached a high of $6,542 billion.

Cashless Transaction Volume

(Reference: scoop.market.us)

- Cashless transaction volume in the Asia Pacific region has shown exponential numbers compared to its contemporaries.

- Since 2020, the preference for cashless payment has increased significantly.

- By 2030, the revenue of cashless transactions is expected to reach $1,818 billion in transaction volume.

Smart Payment Card Shipments Statistics

- In 2022, 2.6 billion smart payment cards and modules were shipped globally, reaching pre-pandemic levels.

- Contactless cards made up 84% of all shipments, showing strong growth in touch-free payments worldwide.

- Despite a global chip shortage, payment card manufacturers managed to maintain shipments through careful inventory management and supplier collaboration.

- North America, Europe, and Latin America saw significant increases in smart card shipments, with North America up by 12%, Europe by 11%, and Latin America by 8%.

- The preference for contactless payments led to a sharp increase in contactless card shipments. In the Middle East and Pakistan, 97% of all cards issued were contactless. Africa saw 85% of all shipments as contactless.

- Dual interface cards, supporting contactless payments, were dominant in India (88%), Brazil (76%), and Mexico (70%).

- Eco-friendly payment cards saw a massive increase, with 267 million shipped in 2022, marking a 180% rise from 2021.

- Europe led the charge in eco-friendly card adoption, with 30% of all cards shipped being made from sustainable materials.

- The Americas accounted for 44% of the total eco-card shipments.

Recent Developments

Thales Group (2023)

- New Product Launch: Thales introduced a new range of eco-friendly smart cards made from recycled plastic. This new product line aims to meet the growing demand for sustainable solutions in the payment card industry. The company reported that these eco-friendly cards can reduce carbon footprint by up to 50%.

- Acquisition: Thales completed the acquisition of the cybersecurity firm OneWelcome for approximately EUR 100 million. This acquisition is expected to strengthen Thales’ digital identity and security offerings, including advanced smart card technologies.

IDEMIA (2023)

- Strategic Partnership: IDEMIA formed a strategic partnership with Zwipe, a biometric technology company, to develop next-generation biometric payment cards. This collaboration focuses on integrating Zwipe’s biometric solutions into IDEMIA’s secure payment card portfolio.

- Funding: IDEMIA secured a $150 million investment from private equity firms to accelerate the development of new smart card technologies and expand its global market presence, particularly in the APAC region.

Giesecke+Devrient (2023)

- New Product Launch: Giesecke+Devrient launched a dual-interface smart card featuring advanced security features such as enhanced encryption and biometric authentication. This card is designed for both contact and contactless payments, addressing the growing demand for secure, multi-purpose payment solutions.

- Expansion: The company expanded its production facility in Asia, increasing its annual smart card production capacity by 25% to meet rising demand in the region.

Entrust (2023)

- Acquisition: Entrust acquired the digital security company nCipher Security for $135 million. This acquisition enhances Entrust’s capabilities in secure payment solutions, including smart cards, by integrating nCipher’s encryption technologies.

- Sustainability Initiative: Entrust announced its commitment to producing 100% eco-friendly payment cards by 2025, with a focus on reducing the environmental impact of its production processes.

Infineon Technologies (2023)

- Funding: Infineon received a $200 million grant from the European Union to support the development of next-generation smart card chips. This funding is part of the EU’s broader initiative to boost the continent’s semiconductor and smart card manufacturing capabilities.

- Product Innovation: Infineon introduced a new line of ultra-secure smart card chips designed for contactless payments. These chips feature advanced cryptographic algorithms that enhance security against potential cyber threats.

NXP Semiconductors (2023)

- New Product Launch: NXP launched a new series of contactless smart card chips with improved performance and reduced power consumption, targeting the mass transit and payment card markets. The company expects these new chips to significantly increase its market share in the smart card sector.

- Partnership: NXP entered into a partnership with Tappy Technologies to develop wearable payment devices integrated with smart card technology. This partnership aims to tap into the growing market for contactless payment wearables.

Conclusion

Smartcards have proven to be an integral part of a variety of industries. This aspect can be attributed to the fact that the global market is expected to reach USD 28.22 billion by 2029 as the market is driven by increased levels of adoption in financial services, transportation, and government sectors.

In terms of global market share, Asia Pacific is the leader, with a thriving share of 39.4%, followed by North America and Europe. With external aspects such as the COVID-19 pandemic, the rise of contactless smartcard payments has increased significantly over the years.

FAQ.

A smart card is a pocket-sized plastic device that has an embedded integrated circuit used for authentication, identification and data storage.

Smartcards were introduced during the 1970’s.

Smart card statistics show that the Asia Pacific region has the highest market share with 39.4%.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.