Texas Instruments Statistics By Assets, Revenue, Operating Profit And Net Income

Updated · Sep 23, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Total Assets Of Texas Instruments

- Texas Instrument Revenue In Recent Years

- Texas Instruments Revenue By Segment

- Texas Instruments Operating Profit

- Texas Instruments Research And Development Expenses

- Net Income Of Texas Instruments

- Texas Instrument Revenue By Quarter

- Texas Instrument Net Revenue By Quarter

- Texas Instruments Semiconductor Market Revenue Worldwide

- Texas Instrument Semiconductor Market Share Worldwide

- Semiconductor Industry Market Revenue Worldwide

- Semiconductor Market Share Worldwide

- Texas Instrument Stock Prices

- Texas Instruments Market Capitalization

- Texas Instruments Total Debt

- Texas Instruments Return Of Assets

- Texas Instrument's Net Profit Margin

- Texas Instrument Dividend Yield

- Texas Insturments PE Ratio

- Texas Instrument Overview

- Conclusion

Introduction

Texas Instruments Statistics: Texas Instruments is a multinational company that produces semiconductors. It is headquartered in Dallas, Texas, and is one of the largest names in the semiconductor industry worldwide. The company is focused on developing analog chips and embedded processors.

It was founded in 1951, and since then, it has achieved significant milestones in the world of semiconductors, such as developing the world’s first silicon transistor. Going through the Texas Instruments Statistics, we will discover similar interesting facts about the company.

Editor’s Choice

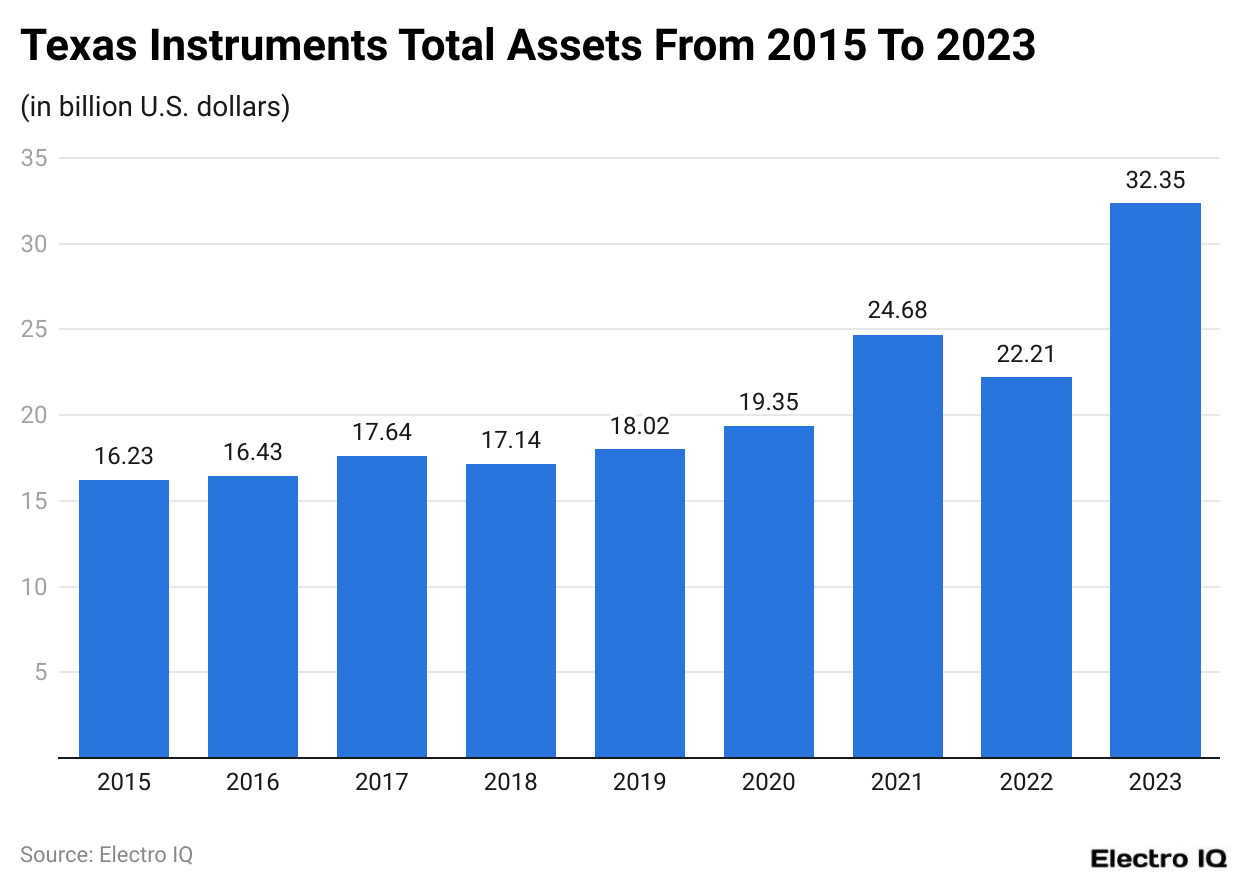

- Texas Instruments Total Assets Increased from USD 16.23 billion in 2015 to USD 32.35 billion by 2023.

- Texas Instrument’s operating profit Peaked at USD 10.14 billion in 2022 and dropped to USD 7.33 billion in 2023.

- Texas Instrument statistics show that the highest recorded net income was in 2022, with USD 8.75 billion.

- Texas Instrument has the highest Return on Assent of 35.59% in June 2022.

Total Assets Of Texas Instruments

(Reference: Statista.com)

- The Texas Instruments statistics showcase that there is a consistent increase in the number of assets of the company.

- In 2015, the number of assets was $16.23 billion. By the end of 2023, the asset value of Texas Instruments was $32.35 billion.

- This graph shows the impressive growth of the company in recent years

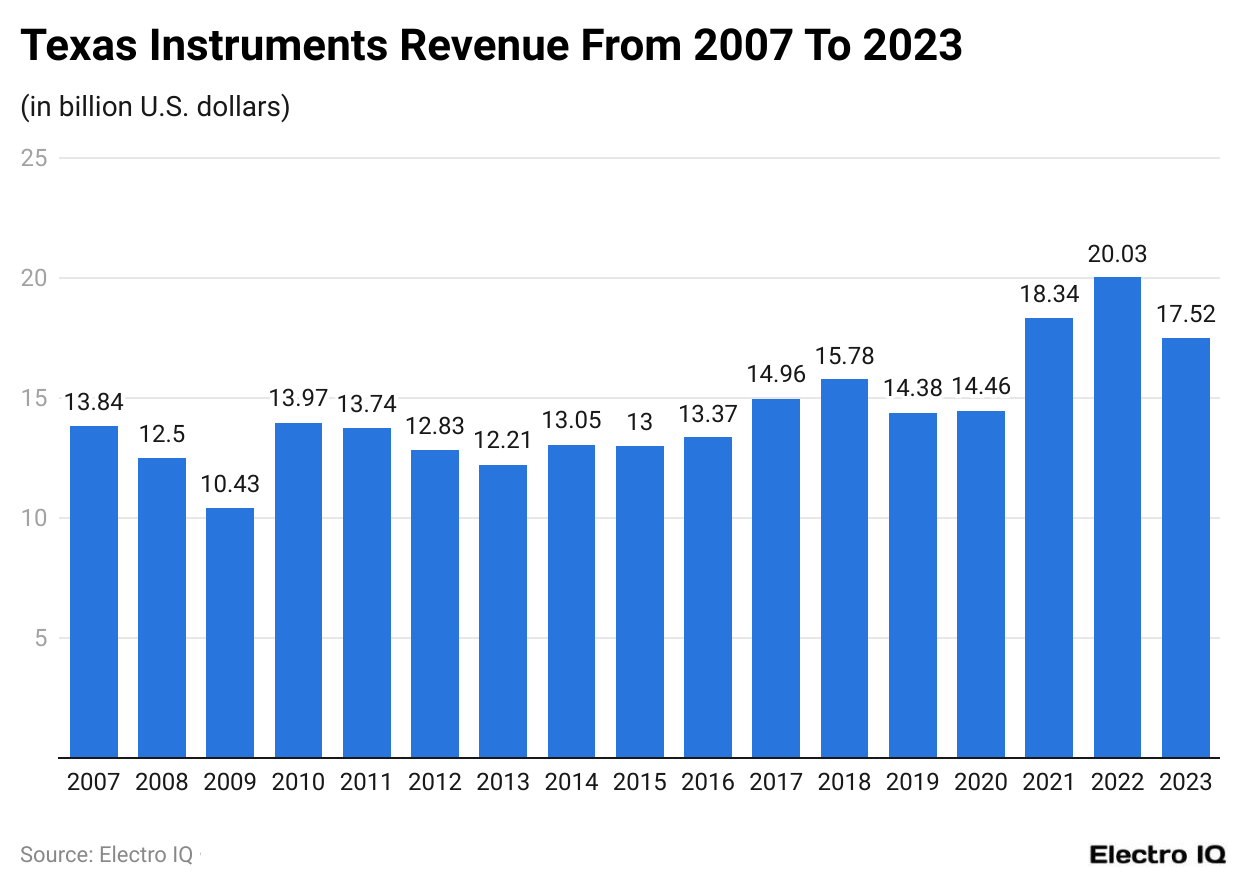

Texas Instrument Revenue In Recent Years

(Reference: Statista.com)

- The Texas Instruments Statistics showcase that the company’s revenue has been steady.

- Between 2007 – 2023, the company had the highest annual revenue of $20.3 billion by the end of 2022.

- By the end of 2023, Texas Instruments had recorded revenue of $17.52 billion.

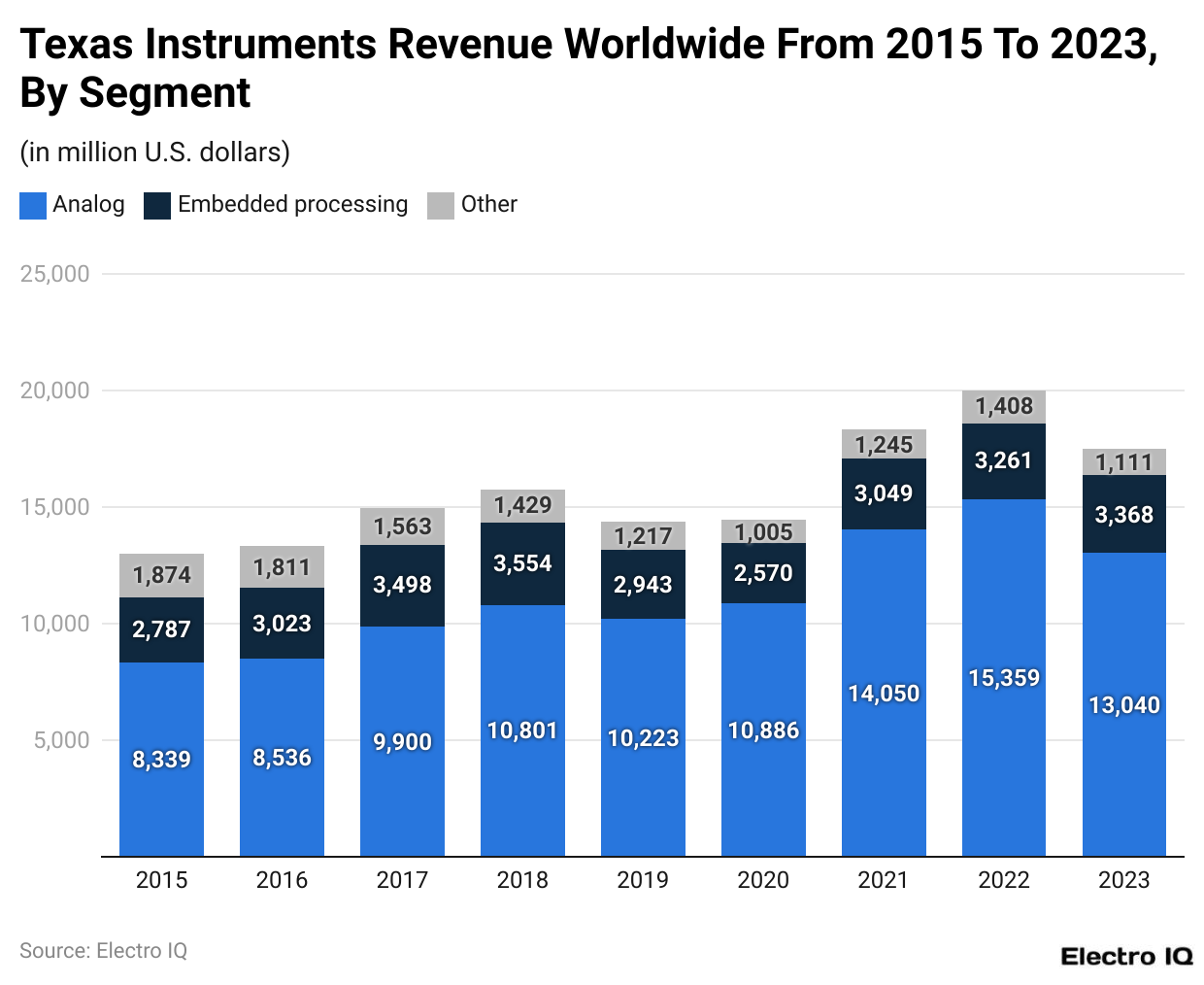

Texas Instruments Revenue By Segment

(Reference: Statista.com)

- Texas Instruments Statistics reveal that the company’s revenue can be broadly categorized into three segments: Analog, Embedded Processing, and Others.

- The Analog department consistently had the highest revenue grossing segment worldwide between the period 2015 – 2023.

- As of 2023, Analog contributed $13,040 million in revenue, followed by Embedded Processing with $3,368 million and, finally, other segments with $1,111 million.

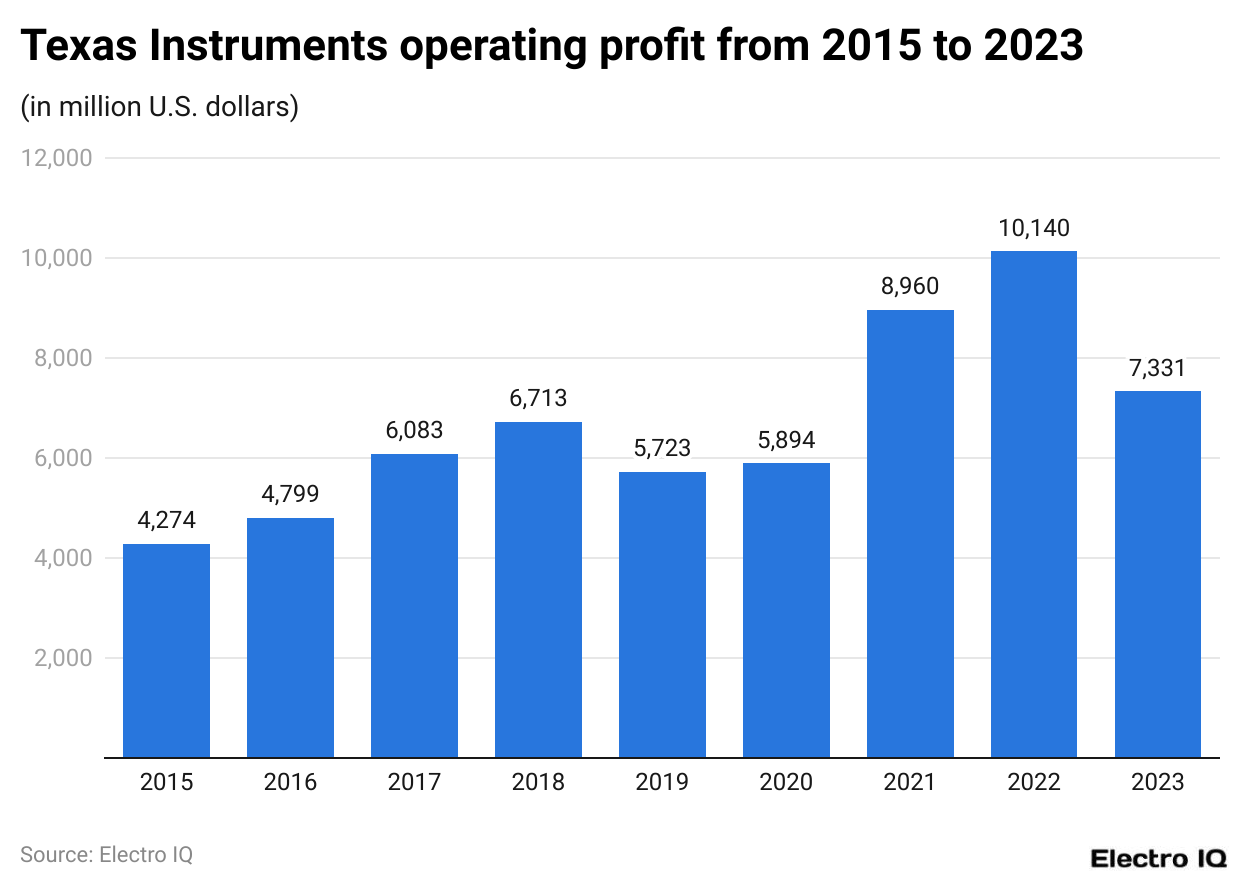

Texas Instruments Operating Profit

(Reference: Statista.com)

- The Texas Instruments Statistics reveal that the company has consistently generated high levels of profit.

- Between the period (2015 – 2023), the company generated the highest profit of $10,140 million in 2022.

- By the end of 2023, the company had posted revenue of $7,331 million.

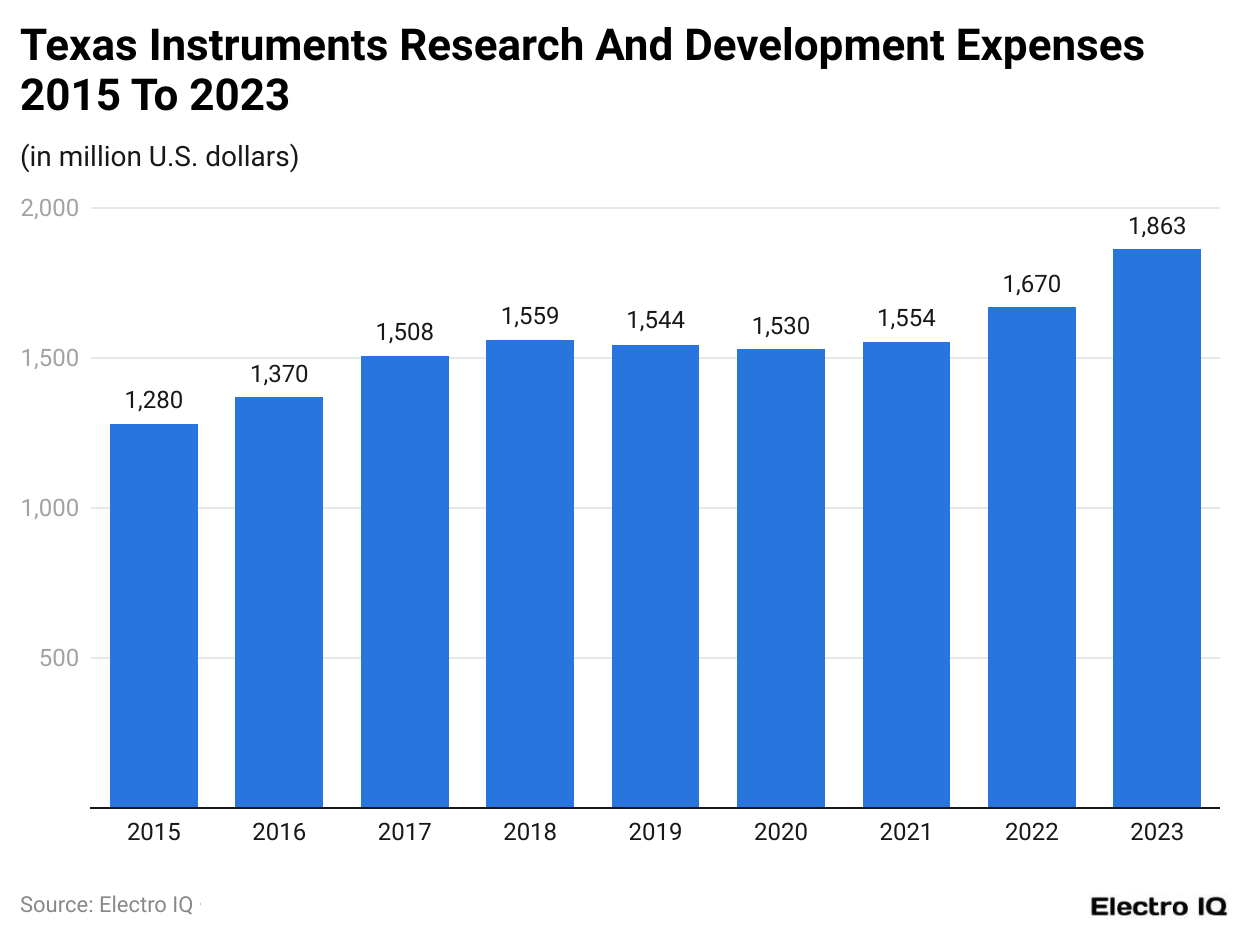

Texas Instruments Research And Development Expenses

(Reference: Statista.com)

- The Texas Instruments Statistics showcase that being a top name in the tech zone, it has increased the investment in research and development.

- By the end of 2023, the company will have a research and development expense of $1,863 million.

- One of the major reasons why the company is one of the strongest tech companies is its consistent expenditure on research and development.

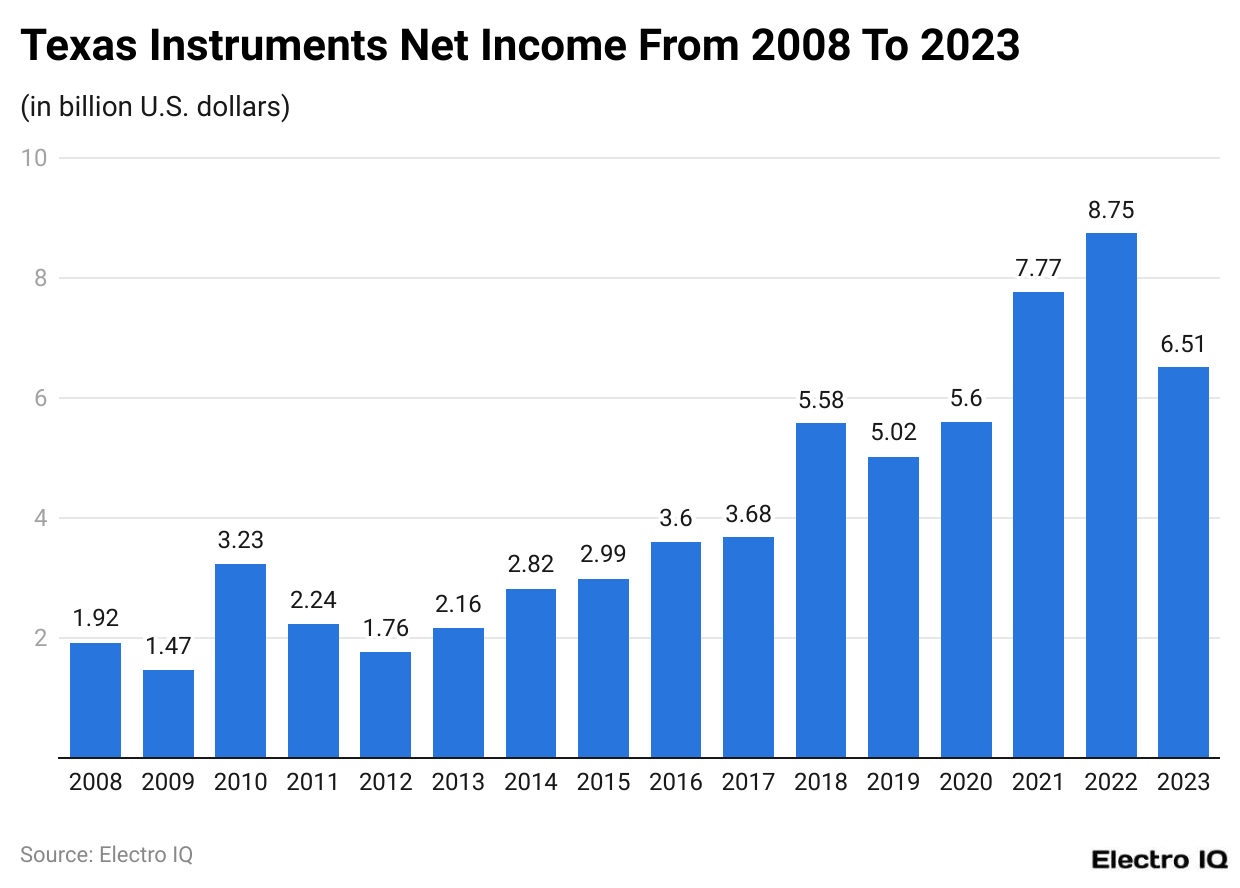

Net Income Of Texas Instruments

(Reference: Statista.com)

- Texas Instrument statistics reveal that the company’s net income is increasing at a constant pace.

- Between the period (2008 – 2023), the highest net income was recorded in 2022 at $8.75 billion.

- By the end of 2023, the company’s net income was $6.51 billion.

Texas Instrument Revenue By Quarter

(Reference: Statista.com)

- The Texas Instruments Statistics showcases that the company’s revenue is consistent in different quarters.

- Between the period (Q1 2008 - Q3 2023) the highest revenue was generated in Q3 2022 with $5.24 billion revenue.

- In Q3 2023, the company posted revenue of $4.08 billion.

Texas Instrument Net Revenue By Quarter

(Reference: Statista.com)

- The Texas Instruments Statistics showcase that the company’s net income has been consistent.

- Between the period (Q1 2008 - Q4 2023), the highest net income was recorded in Q3 2022 with $2,295 million net income.

- As of Q4 2023, the net income generated was $1,371 million.

Texas Instruments Semiconductor Market Revenue Worldwide

![]()

(Reference: Statista.com)

- The Texas Instruments statistics reveal that the semiconductor segment of the company is growing consistently due to increasing net revenue.

- Between the period (2007 - 2023), the highest revenue was posted in 2022 with $18.84 billion.

![]()

(Reference: Statista.com)

- The Texas Instruments Statistics reveal that the company’s market share in the semiconductor segment is fluctuating continuously.

- Between the period (2008 - 2023), the company had the highest market share of 4.2% in 2008.

- During the same period, the lowest market share was 2.9% in 2020, 2021.

- By the end of 2023, the company had posted a 3.1% market share.

Semiconductor Industry Market Revenue Worldwide

(Reference: Statista.com)

- The Texas Instruments Statistics show that there has been a consistent increase in the market revenue overall.

- In 2023, Intel had the highest market revenue of $48.66 billion.

(Reference: Statista.com)

- The Texas Instrument Statistics showcases that Intel has the highest market share consistently.

- In 2023, Intel has a 9.1% market share, followed by Samsung Electronics with a 7.5% share and Qualcomm with 5.4%, making up the top 3 semiconductor companies.

Texas Instrument Stock Prices

(Source: financecharts.com)

- The Texas Instruments statistics showcase a considerable increase in the value of the stock price in recent years.

- As of September 2024, the value of the stock price of Texas Instruments is $197.45.

Texas Instruments Market Capitalization

(Source: financecharts.com)

- Texas Instruments statistics reveal that the company had a relevant market capitalization of $176.855 billion as of September 2024.

- The market capitalization has increased significantly since 2006, when the market cap was $37 billion.

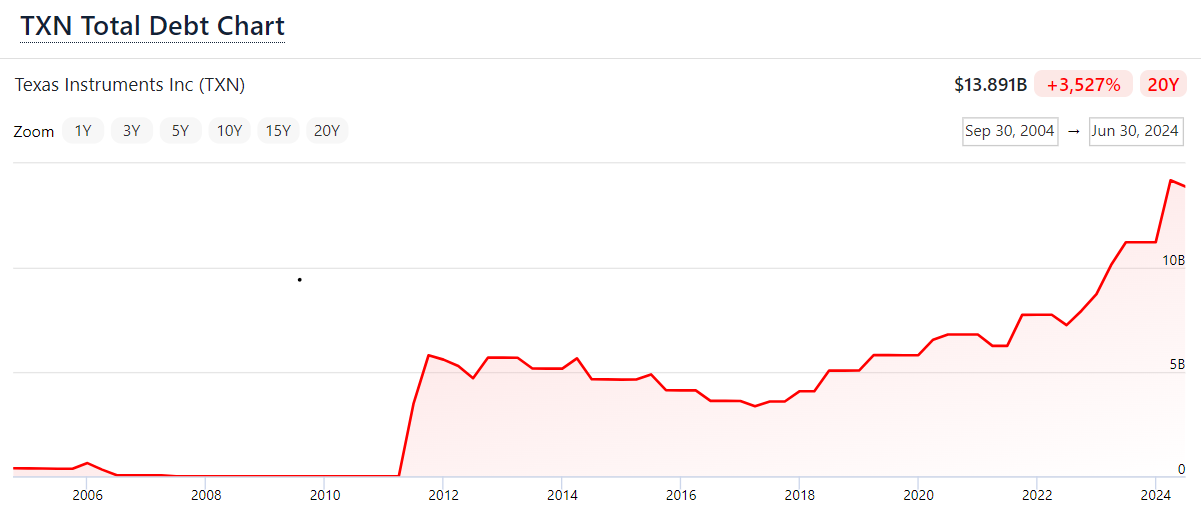

Texas Instruments Total Debt

(Source: financecharts.com)

- The Texas Instrument statistics showcase that the company has generated a substantial amount of debt value in recent times.

- As of September 2024, the company has a debt of $13 billion.

- This debt value is significantly higher in comparison to 2004 when the revenue was $383 million.

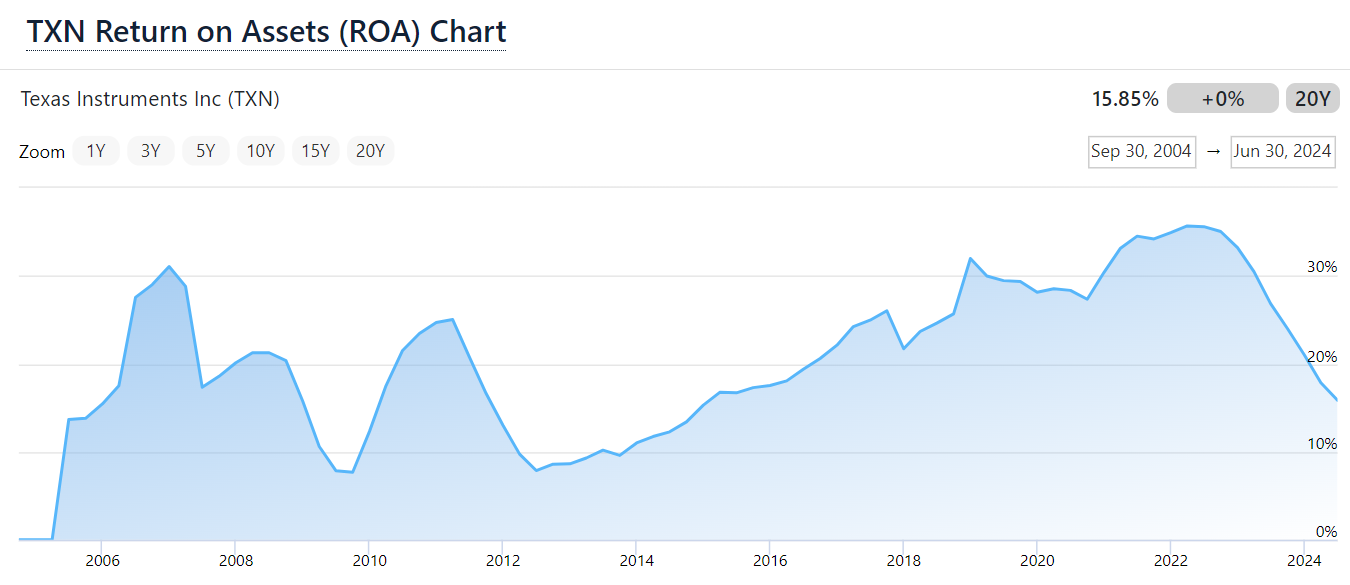

Texas Instruments Return Of Assets

(Source: financecharts.com)

- The Texas Instrument Statistics showcase that the return on investments data fluctuates regularly.

- The highest return on asset value in the last twenty years was 35.59% in June 2022. Since then, it has been consistently decreasing.

- As of September 2024, the return on assets is 15.85%.

- This information on the decreasing return on revenue of Texas Instruments signifies that the company needs to work on instilling faith among its shareholders.

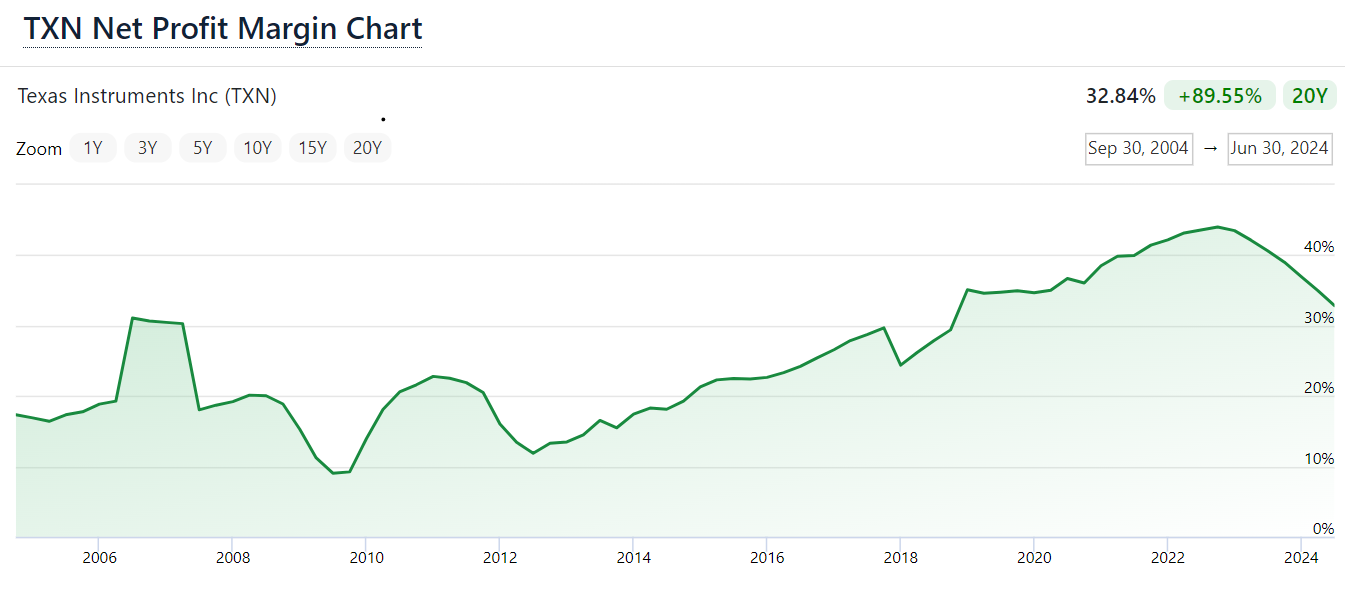

Texas Instrument's Net Profit Margin

(Source: financecharts.com)

- The Texas Instruments statistics showcase that the company's net profit increased consistently.

- In September 2022, the company's net profit margin was 44.01%, the highest it had been in 20 years.

- Since September 2022, the net profit margin has been decreasing, with it being 32.84% by September 2024.

Texas Instrument Dividend Yield

(Reference: Statista.com)

- The information about the dividend yield of the company signifies how successful is the company from the point of view of the investors.

- The Texas Instrument statistics reveal that in September 2023, it was 3.7%.

- In September 2024, according to Texas Instruments Statistics, the dividend yield was 2.63%.

- Based on the information about the dividend yield, one can understand that it is essential for the company to work on ensuring garnering faith among its shareholders and investors.

Texas Insturments PE Ratio

(Source: financecharts.com)

- The Texas Instrument statistics signify that the company has undergone significant changes in the PE ratio.

- By gaming information about the PE ratio, one can understand how expensive or inexpensive a company's share is.

- In 20 years, the PE ratio of the company was highest in 2009, with 34.49.

- As of September, the PE ratio is 28, which is closer to the peak level of the PE ratio achieved.

Texas Instrument Overview

Texas Instruments is a leading technology company known for its innovative semiconductor products, including calculators, microcontrollers, and processors. From a market researcher’s perspective, examining Texas Instruments statistics helps in understanding its financial health, market position, and future growth prospects. In 2023 and 2024, Texas Instruments has shown notable financial performance, driven by its strong focus on analog and embedded processing products, which are critical components in a wide range of electronic devices.

Financial Performance and Revenue

Texas Instruments has consistently generated robust revenue, which reflects its strong market demand. In 2023, Texas Instruments reported a total revenue of approximately 20.03 billion US dollars. This was a slight increase compared to 2022, highlighting steady growth despite global economic uncertainties. The company's focus on innovation and maintaining strong relationships with its customers has played a crucial role in sustaining this growth. In 2024, Texas Instruments is projected to continue this upward trend with an estimated revenue increase of around 4%, bringing the expected revenue to approximately 20.83 billion US dollars. This anticipated growth indicates that the company's strategic initiatives, such as expanding its product portfolio and enhancing its operational efficiency, are paying off.

Profitability and Margins

Texas Instruments statistics show that the company is not only growing its revenue but also maintaining healthy profitability. In 2023, the company achieved a gross profit margin of about 68%, which is a significant indicator of its ability to manage production costs while maintaining a premium pricing strategy. The operating profit margin stood at around 48%, reflecting the company's efficient operational management and cost control measures. For 2024, Texas Instruments is expected to maintain similar profit margins, with projections suggesting a slight increase to a 49% operating profit margin. This stability in profitability showcases the company's strong business model and effective cost management strategies.

R&D and Capital Expenditures

Investment in research and development (R&D) is crucial for Texas Instruments, as it drives innovation and helps the company stay competitive in the semiconductor industry. In 2023, Texas Instruments allocated approximately 1.7 billion US dollars to R&D, which represented about 8.5% of its total revenue. This commitment to innovation allows Texas Instruments to develop new products and improve existing ones, catering to the evolving needs of its customers. In 2024, the company plans to slightly increase its R&D investment by 5%, reaching around 1.785 billion US dollars. This continued focus on R&D is expected to contribute to Texas Instruments' long-term growth and market leadership.

Additionally, Texas Instruments has been actively investing in capital expenditures to expand its manufacturing capacity and enhance its production capabilities. In 2023, the company invested approximately 3 billion US dollars in capital expenditures, focusing on building new facilities and upgrading existing ones. This investment is critical for meeting the growing demand for semiconductors across various industries. For 2024, Texas Instruments is expected to maintain a similar level of capital expenditures, ensuring it has the necessary infrastructure to support future growth.

Market Position and Future Outlook

Texas Instruments statistics indicate that the company holds a strong position in the global semiconductor market. Its focus on analog and embedded processing products has allowed it to carve out a significant market share. In 2023, Texas Instruments commanded about 20% of the analog semiconductor market, making it one of the leading players in this segment. The company's diversified customer base, spanning industries such as automotive, industrial, and personal electronics, provides a stable revenue stream and reduces its exposure to market fluctuations.

Looking ahead to 2024, Texas Instruments is expected to benefit from the increasing demand for semiconductors in emerging technologies such as electric vehicles, renewable energy, and smart devices. The company’s strategy of continuous innovation, coupled with its strong financial foundation, positions it well for future growth. Texas Instruments statistics project that the company's market share in the analog semiconductor segment could increase to 21%, driven by its ongoing efforts to expand its product offerings and enhance its customer relationships.

Conclusion

Texas Instruments has established itself as a dominant player in the semiconductor industry. Since the company’s beginning in 1951, it has strived to become one of the largest names in this industry. By looking at the Texas Instruments statistics, it is evident that the company has undergone significant growth in recent years. The company's strong market share in the analog semiconductor segment, coupled with its focus on operational efficiency, has enabled it to maintain healthy profit margins despite global economic challenges. As we go forward, texas instruments is working to attain a market leadership position in the semiconductor industry in the coming years.

Sources

FAQ.

Texas Instruments is known for its semiconductor products, including analog chips, embedded processors, and calculators.

Texas Instruments is headquartered in Dallas, Texas, USA.

Texas Instruments was founded in 1951.

In 2023, Texas Instruments reported a revenue of approximately $20.03 billion.

The main business segments are Analog, Embedded Processing, and Others.

Texas Instruments invested about $1.7 billion in R&D in 2023.

Texas Instruments held about 20% market share in the analog semiconductor segment in 2023.

Texas Instruments is projected to see a revenue increase of around 4% in 2024.

Texas Instruments’ operating profit margin was around 48% in 2023 and is expected to increase slightly to 49% in 2024.

Texas Instruments serves industries such as automotive, industrial, and personal electronics.

Maitrayee Dey has a background in Electrical Engineering and has worked in various technical roles before transitioning to writing. Specializing in technology and Artificial Intelligence, she has served as an Academic Research Analyst and Freelance Writer, particularly focusing on education and healthcare in Australia. Maitrayee's lifelong passions for writing and painting led her to pursue a full-time writing career. She is also the creator of a cooking YouTube channel, where she shares her culinary adventures. At Smartphone Thoughts, Maitrayee brings her expertise in technology to provide in-depth smartphone reviews and app-related statistics, making complex topics easy to understand for all readers.