GE Statistics By Revenue, Assets, Investment, Market Share and Stock Price

Updated · Sep 03, 2024

Table of Contents

- Introduction

- Editor’s Choice

- Global Aerospace Market By Services

- Aircraft Engine Market Size

- Global Automation Market Worldwide

- Medtech Technology Revenue

- Worlds Largest Conglomerates

- General Electric Revenue By Segment

- General Electric Total Assets

- By Research And Development Investment

- Number Of Employees Of General Electric

- General Electric Revenue By Region By Percentage

- General Electric Market Revenue By Region In Terms Of Total Revenue

- General Electric Total Assets By Segment

- Aircraft Engine Manufacturer Worldwide Demand By MRO

- Market Share Of Wind Electric Turbine Suppliers

- General Electric Stock Price History

- General Electric Essential Competitor Comparison

- General Electric Net Profit Margin

- General Electric Market Valuation

- General Electric’s Return On Assets

- General Electric Total Debt

- General Electric Products

- General Electric Appliance Range

- General Electric Overview

- Conclusion

Introduction

GE Statistics: General Electric is a multinational company headquartered in Boston. It is well-diversified in different industries, namely financial services, aerospace, healthcare, and energy. According to Forbes, it has recently been ranked as the 66th-largest company in the world. Likewise, it is one of the biggest names in the electric industry.

As a result, it would be interesting to glance at GE statistics to understand its growth and how it has had an influential role in the development of electric and electronic facilities worldwide.

Editor’s Choice

- General Electric is the 66th largest company in the world as of 2023, according to Forbes

- The global automation market grew from USD 71.2 billion in 2019 to USD 74 billion in 2021.

- With a market value of $109.16 billion, General Electric is the world’s 6th largest conglomerate.

- GE statistics reveal that it had invested USD 3.5 billion in research and development in 2023.

- 43% of all General Electric’s revenue comes from the United States alone.

- As of August 2024, the stock price of General Electric is USD 171 per share.

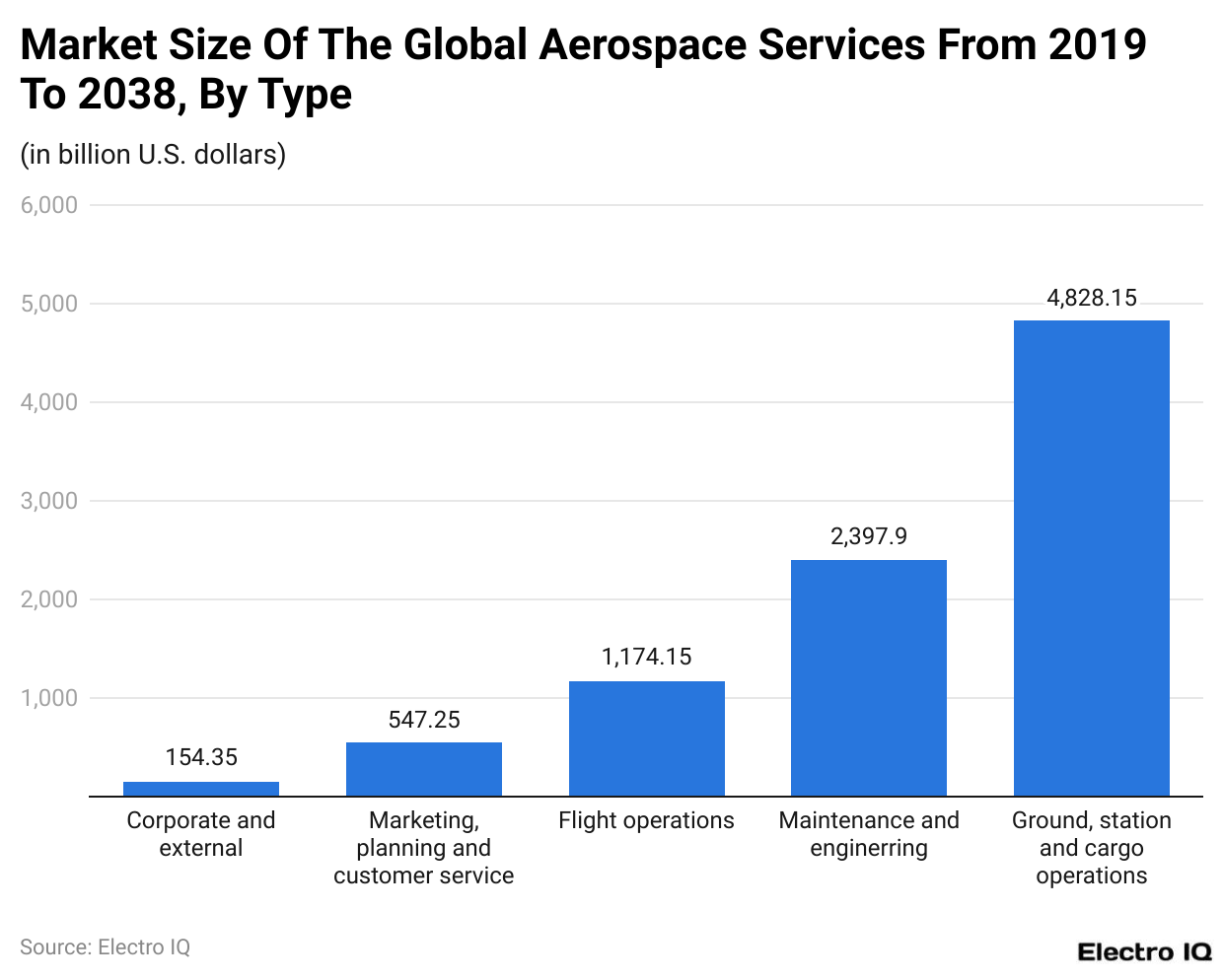

Global Aerospace Market By Services

(Reference: Statista.com)

- The graph shows that the global aerospace market can be categorized into five main categories: corporate and external, marketing planning, flight operations, maintenance, ground station, and cargo operations.

- General Electric, a big name in the aerospace industry, has significantly contributed to its growth.

- GE statistics show that ground station and cargo operations have the significant market size, with $4,828 billion, followed by maintenance and engineering operations, with $2,397.9 billion; flight operations, with $1,174,5 billion; and finally, marketing and corporate operations, with $547.25 billion and $154.25 billion, respectively.

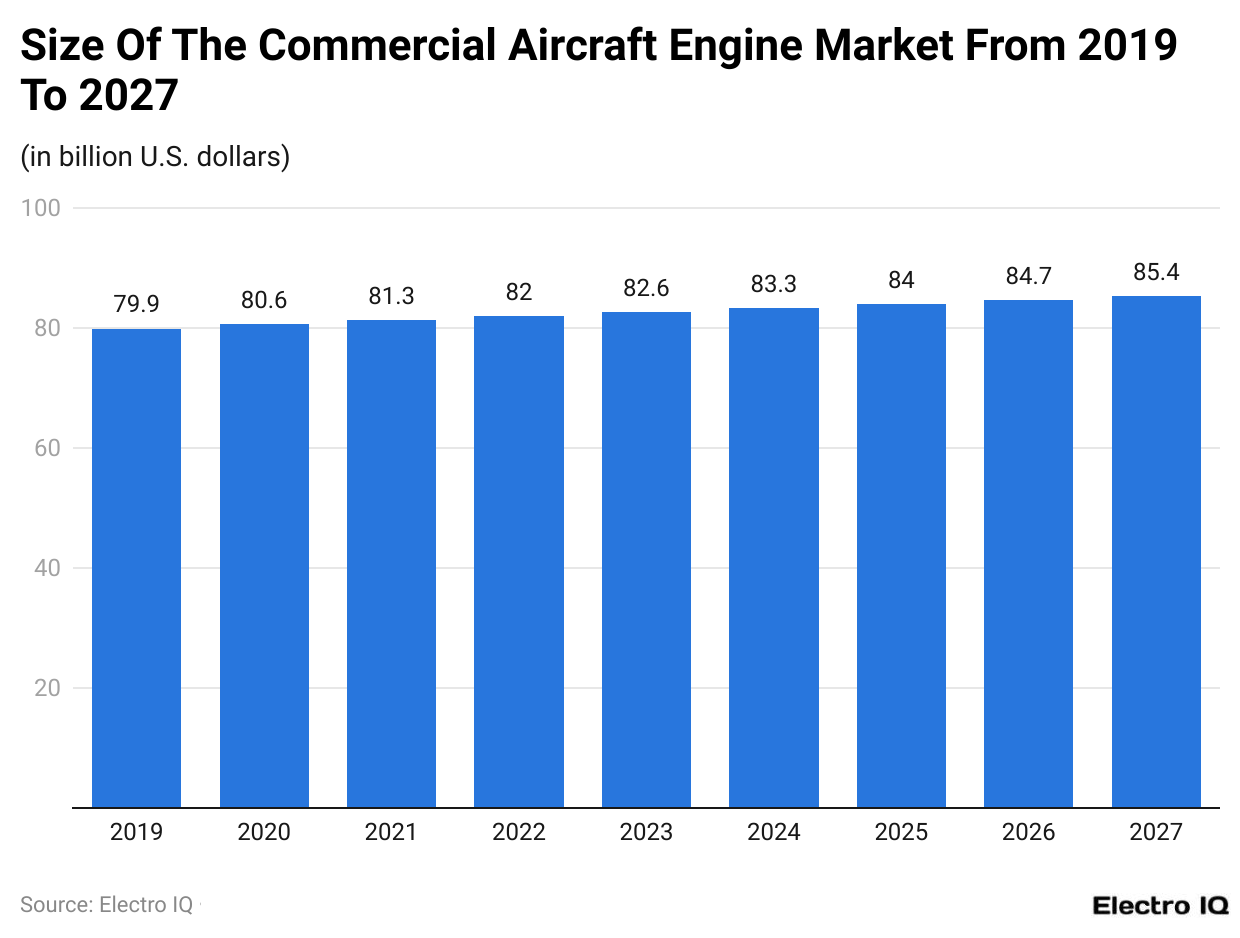

Aircraft Engine Market Size

(Reference: Statista.com)

- The GE statistics reveal that there has been consistent growth in commercial aircraft market engines.

- As of 2023, the size of the commercial market engine is $82.6 billion.

- By the end of 2027, the size of the aircraft market engine is expected to reach $85.4 billion.

- With the increase in the popularity of air travel, businesses are expected to consistently at a rapid pace.

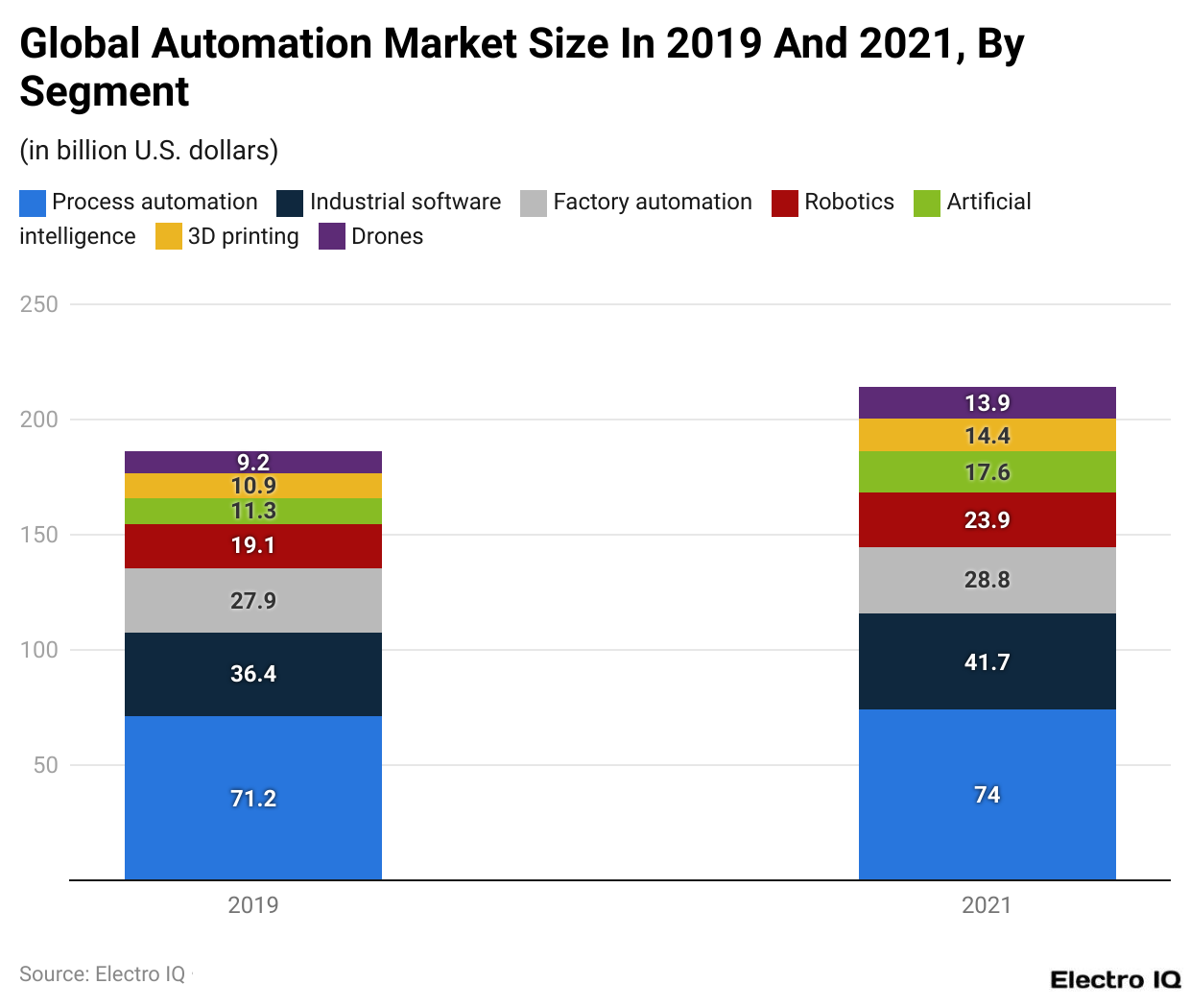

Global Automation Market Worldwide

(Reference: Statista.com)

- The global automation market has grown significantly with the rise of AI chatbots and generative AI tools such as Chat GPT.

- The process automation market increased from $71.2 billion in 2019 to $74 billion in 2021.

- The industrial software market has showcased the 2nd highest level of market size, with $36.4 billion in 2019 and $41.7 billion in 2021.

- Other aspects that have shown substantial growth among businesses are factory automation, robotics, artificial intelligence, 3D printing, and drones.

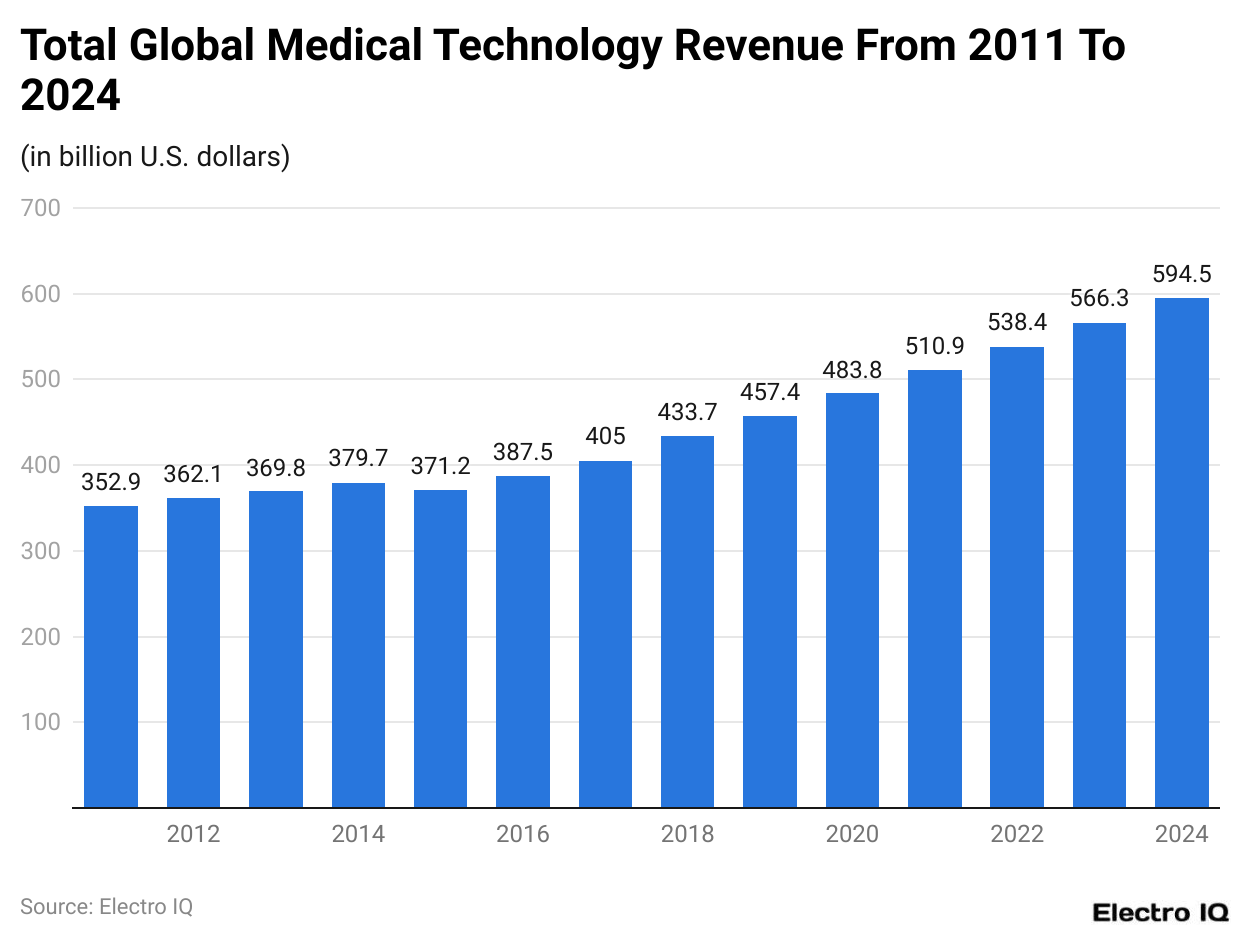

Medtech Technology Revenue

(Reference: Statista.com)

- Medical technology has been a vital component of general electricity, so it becomes essential to discuss its significance.

- GE statistics reveal that in 2011, the medical technology industry posted revenue of $352.9 billion.

- In 2023, the medical technology industry has posted revenue of $566.3 billion.

- By the end of 2024, the medical technology industry is expected to generate revenue of $594.5 billion.

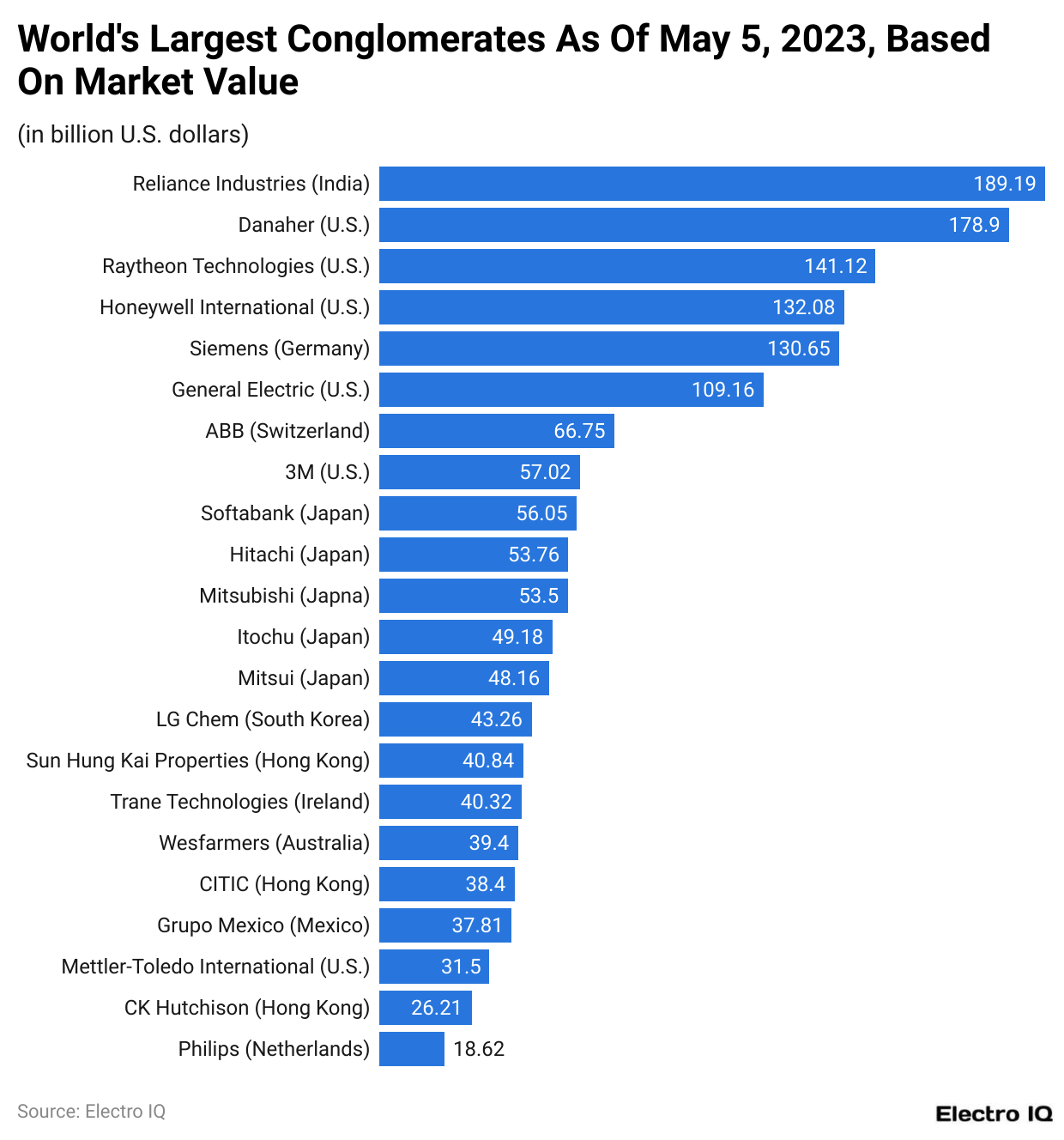

Worlds Largest Conglomerates

(Reference: Statista.com)

- The idea of the market value of conglomerates provides vital information on how the business is faring worldwide.

- As of 2023, Reliance Industries is the top-ranked conglomerate in the world, with revenue of $189.19 billion.

- It is followed by Danaher, Rayethon Technologies, Honeywell International and Simens, which have $178.9 billion, $141.12 billion, $132.08 billion, and $130.65 billion, respectively.

- GE statistics reveal that General Electric is the world’s 6th largest conglomerate, with $109.16 billion.

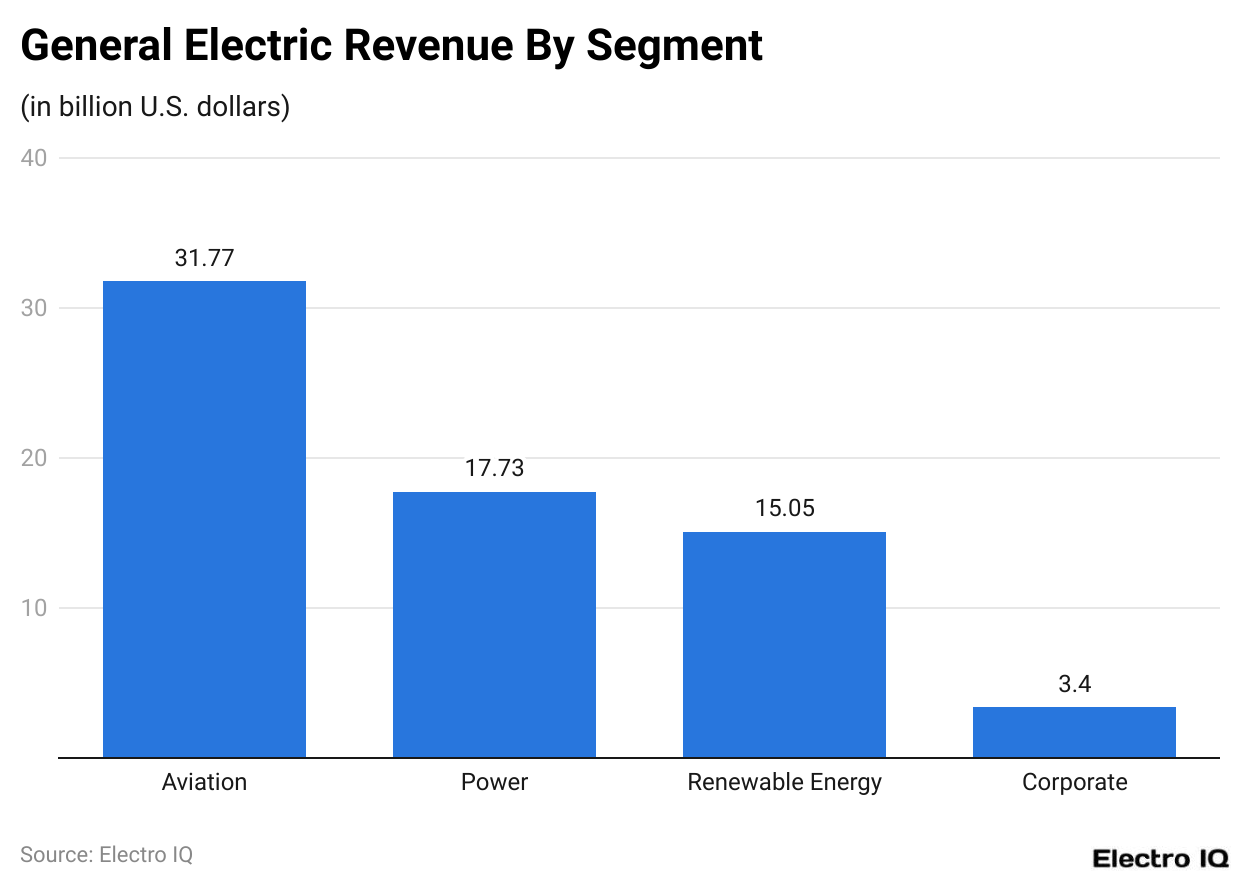

General Electric Revenue By Segment

(Reference: Statista.com)

- GE statistics show that the revenue segment can be divided into four categories: Aviation, power, renewable energy, and corporate.

- As witnessed, aviation has the highest revenue, posting $31.77 billion in revenue in 2023.

- It is followed by power, renewable energy, and corporate, with revenues of $17.73 billion, $15.05 billion, and $3.4 billion as of 2023.

- The growth in General Electric’s aviation segment can be attributed to the general public’s high interest in air travel.

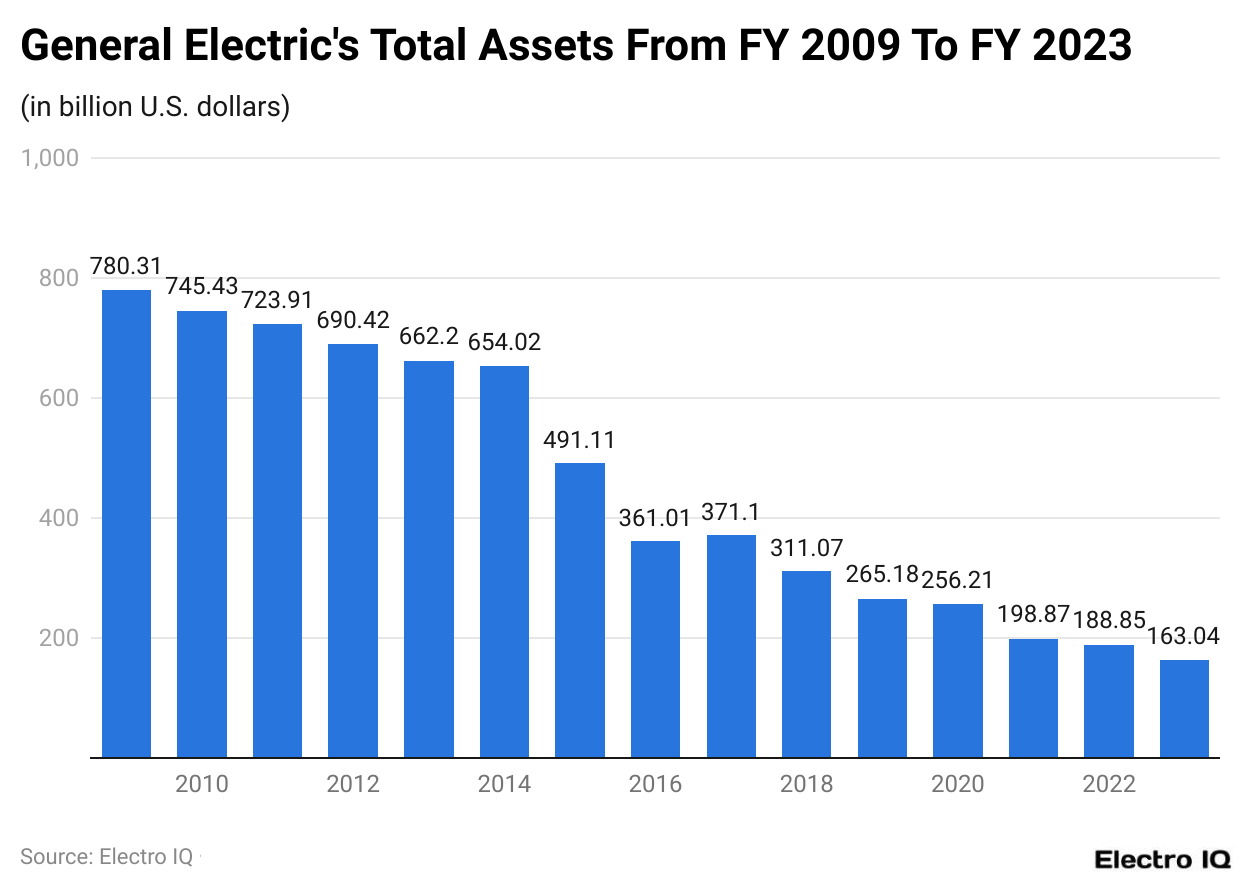

General Electric Total Assets

(Reference: Statista.com)

- The total assets of electric power have reduced significantly since 2009.

- GE statistics show that GE’s asset value was $780.31 billion in 2009.

- By the end of 2023, the asset value was relatively lower, with $163.04 billion.

- This aspect is mainly a point of concern for General Electric.

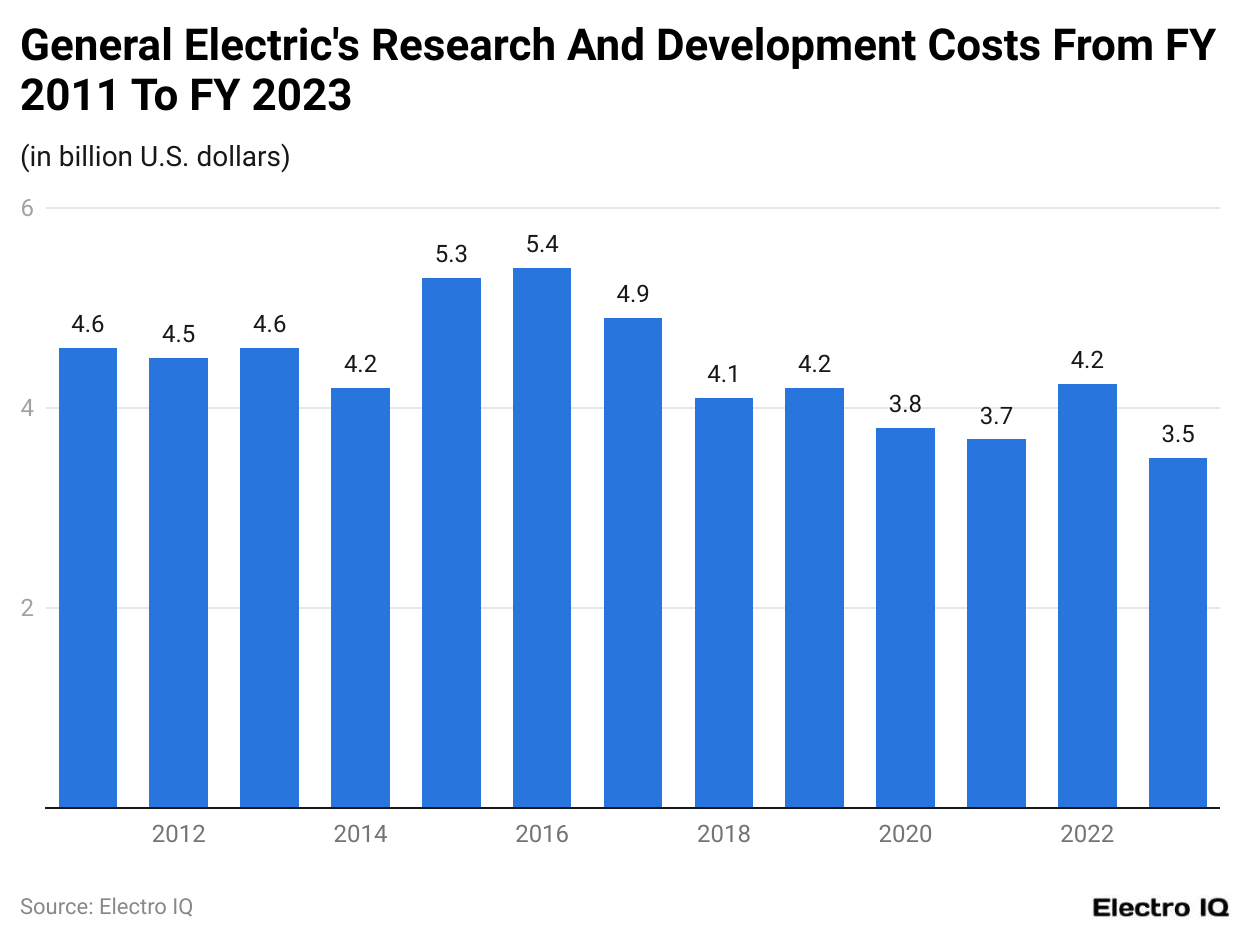

By Research And Development Investment

(Reference: Statista.com)

- Being a pioneer in a research company, it is essential to have comprehensive information about the research and development costs that General Electric invests in.

- GE statistics reveal that 2011 research and development costs were $4.6 billion.

- By the end of 2023, the amount invested in research and development had dipped to $3.5 billion.

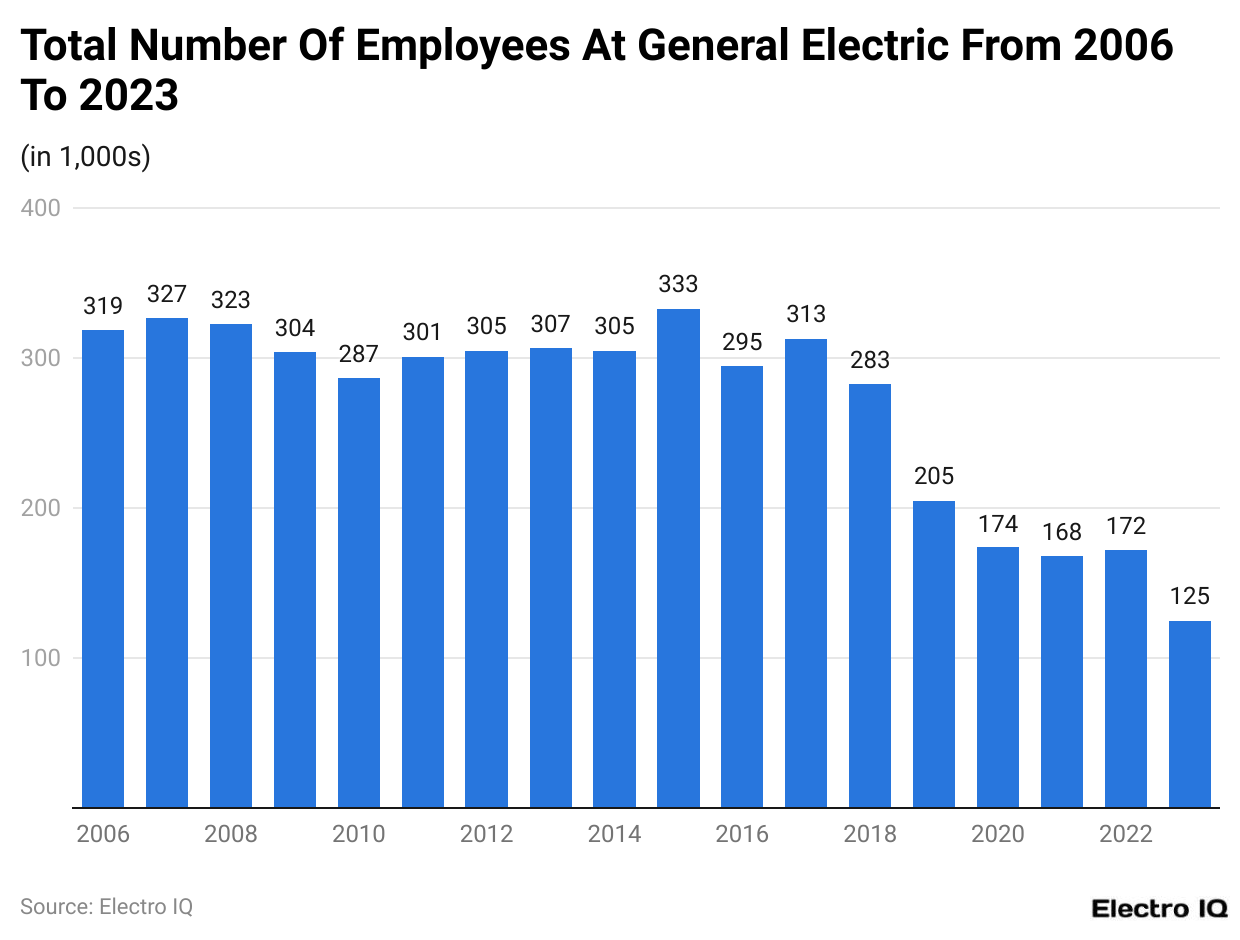

Number Of Employees Of General Electric

(Reference: Statista.com)

- According to GE statistics, the total number of employees at General Electric has significantly reduced.

- In 2006, General Electric employed 319k employees.

- Between the period (2006 – 2023), General Electric had employed a peak value of 333k employees in 2015.

- By the end of 2023, General Electric will employ 125K workers.

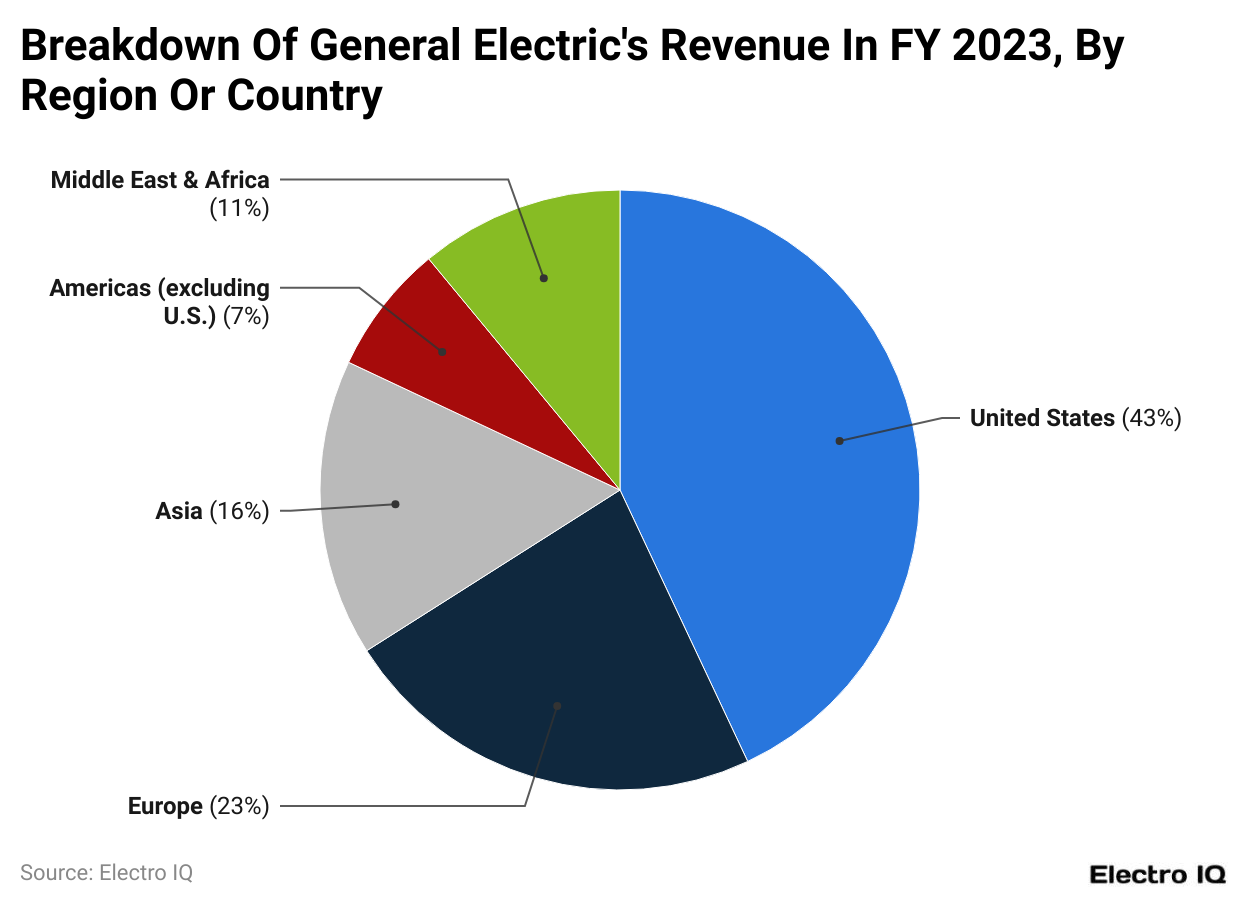

General Electric Revenue By Region By Percentage

(Reference: Statista.com)

- The GE statistics show that the United States dominates General Electric’s revenue, with 43% of its total revenue coming from this country alone.

- It is followed by regions of Europe, Asia, the Middle East, and the rest of the Americas with 23%, 16%, 7% and 11%.

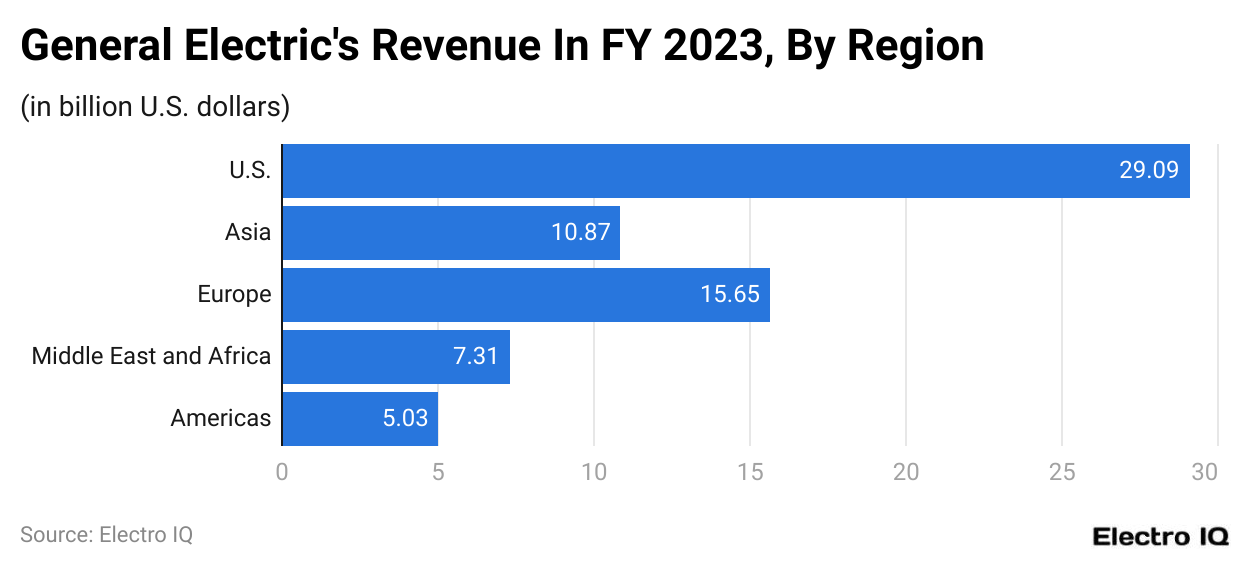

General Electric Market Revenue By Region In Terms Of Total Revenue

(Reference: Statista.com)

- Information about General Electric’s revenue by region as a percentage of total revenue provides an exciting perspective.

- GE statistics show the US has the highest revenue, with $29.09 billion.

- Europe follows it with $15.65 billion

- Then comes Asia with $10.87 billion

- Furthermore, the Middle East and Africa posted revenue of $7.31 billion

- Finally, there are Americas without the USA that posted revenue of $ 5.03 billion as of 2023.

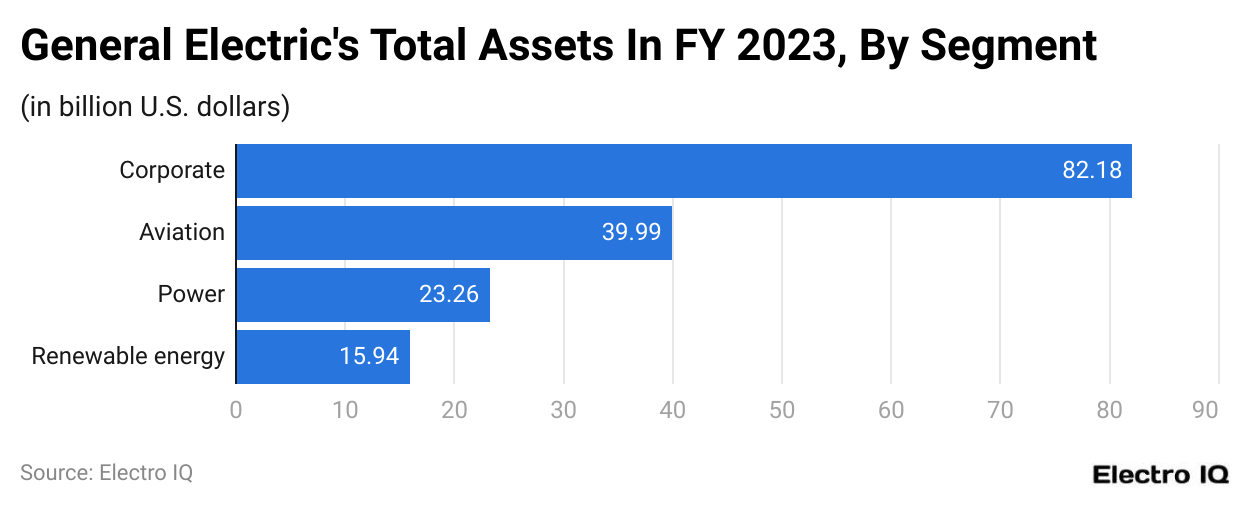

General Electric Total Assets By Segment

(Reference: Statista.com)

- GE statistics show that the company’s total asset value can be broadly divided into four categories: Corporate, Aviation, Power, and Renewable energy.

- Corporate has the highest number of assets, with $82.18 billion.

- It is followed by Aviation, power, and renewable energy, with assets amounting to $39.99 billion, power with $23.26 billion, and renewable energy with $15.24 billion.

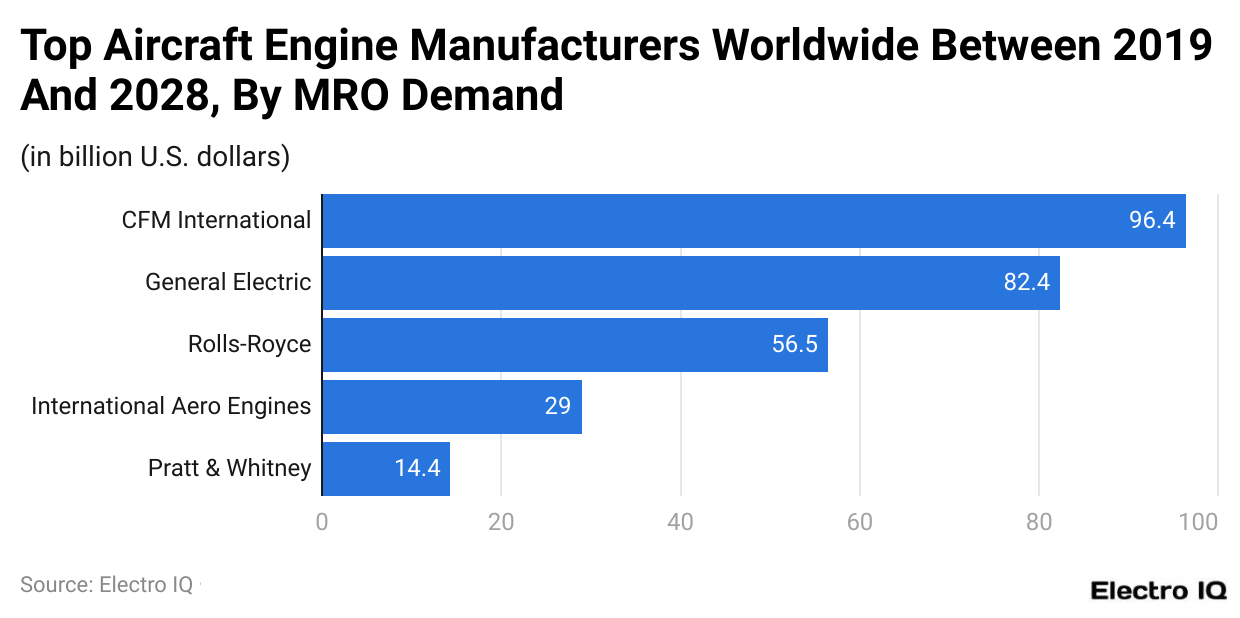

Aircraft Engine Manufacturer Worldwide Demand By MRO

(Reference: Statista.com)

- As mentioned, aviation demand among general audiences has prompted engine manufacturers to require relevant equipment.

- CFM International is the leader among engine manufacturers, with an MRO demand of $96.4 billion.

- GE statistics show that the general electric has 2nd highest demand value, with MRO at $82.4 billion.

- In terms of demand, it is followed by Rolls-Royce, International aero engines, and Pratt & Whitney with $56.5 billion, $29 billion, and $14.4 billion.

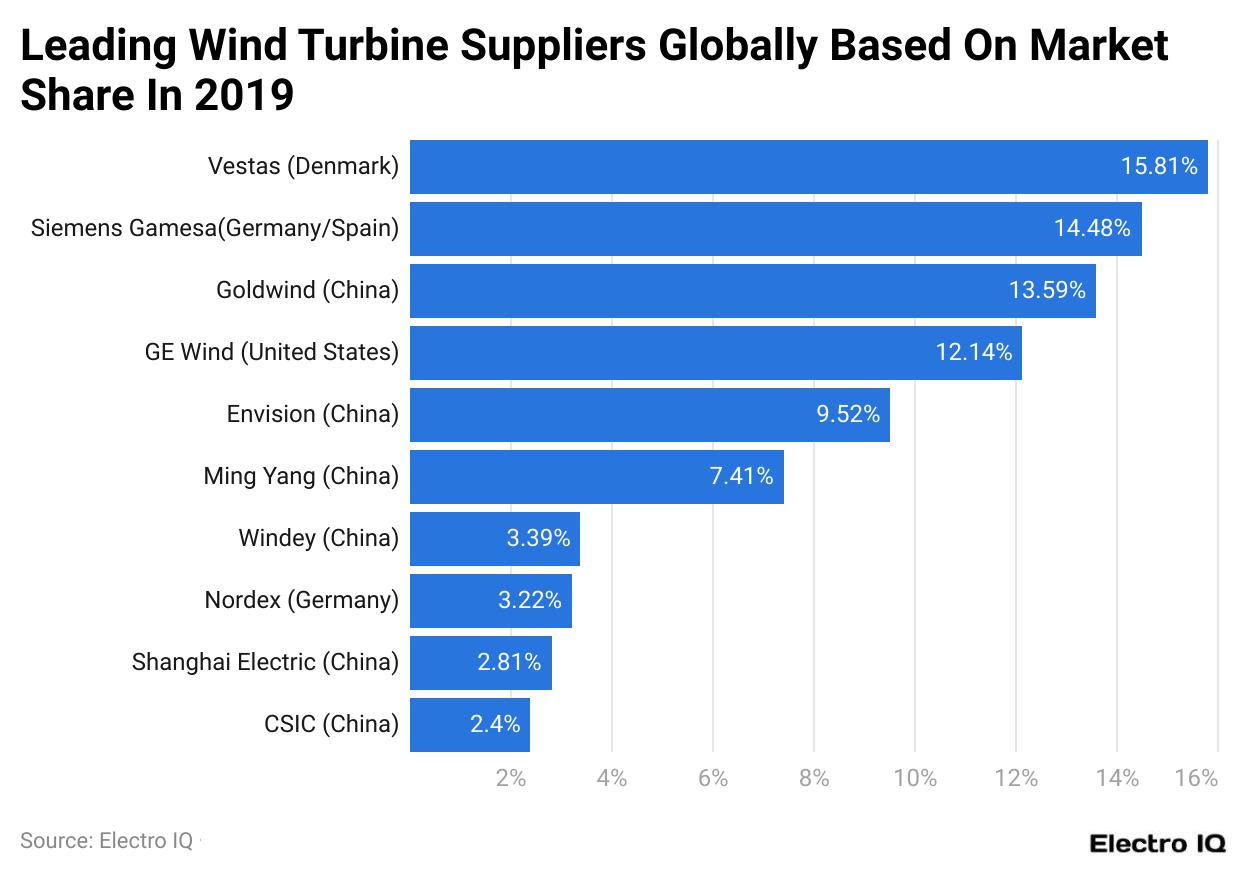

(Reference: Statista.com)

- As displayed in GE statistics, Vestas from Denmark is the leader in wind turbine suppliers globally based on a market share of 15.81%

- It is followed by Siemens from Germany and Goldwind from China, which have 14.48% and 13.59% market shares.

- GE wind has the 4th most significant market share with 12.14%.

General Electric Stock Price History

(Source: financecharts.com)

- Looking at the GE statistics, it is clear that the company’s stock price has fluctuated significantly over the past twenty years.

- In 2007, General Electric reached a peak stock price of around $200 per share.

- As of August 2024, the share price of General Electric is $171.

General Electric Essential Competitor Comparison

(Reference: financecharts.com)

- The GE statistics show how the competitor metrics between its rivals have changed over time.

- In terms of market cap, General Electric has a wide variety of rivals that have considerably higher market capitalization.

- After a holistic analysis of its competitors, Lockheed Martin has the highest market capitalization, around $134k.

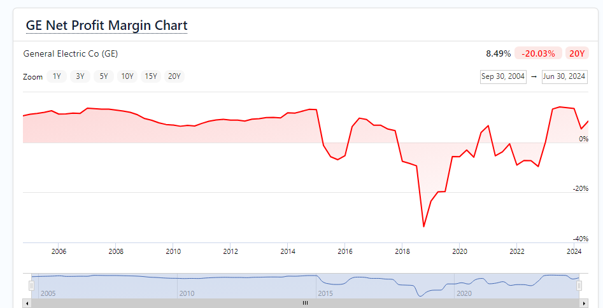

General Electric Net Profit Margin

(Source: financecharts.com)

- The GE statistics reveal that General Electric’s profit margin has fluctuated significantly recently.

- Between 20 years, GE’s net profit was at an all-time low in 2018 with -34% net profit.

- Likewise, the company attained an all-time high in 2006 with +14% net profit.

- As of August 2024, the company’s net profit was +8.49%, thus showing positive signs of recovery for years to come.

General Electric Market Valuation

(Source: financecharts.com)

- GE statistics showcase how the enterprise value has changed in the coming years.

- In 2008, the company had the highest market valuation, at $712 billion.

- In the past twenty years, the company’s market valuation was at its lowest point in 2020, at $37 billion.

- As of August 2024, the company’s market valuation was $184 billion.

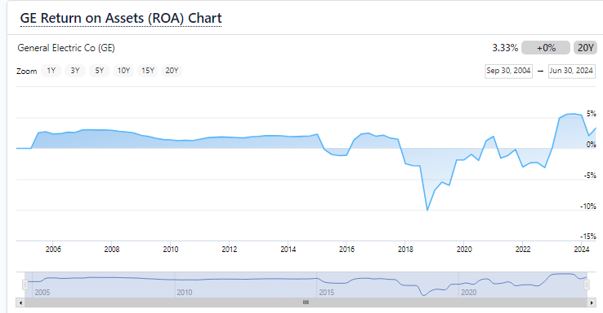

General Electric’s Return On Assets

(Source: financecharts.com)

- The return on assets is a valuable metric to show how much a company excels in asset management.

- Referring to GE statistics, it is evident that the company has a fluctuating history in asset management.

- The company experienced a -10% return on assets in 2018.

- In the past 20 years, the company’s highest return on assets was in 2014, with a 5% return on assets.

- As of August 2024, the company’s return on assets has been 3.33%.

General Electric Total Debt

(Source: financecharts.com)

- By understanding the company’s total debt, the overall perception of how well the company is doing financially is showcased.

- GE statistics reveal that the company’s debt was at an all-time high in 2008, rising to over $550 billion.

- Since 2018, the company has managed to substantially reduce its debt and ensure that it performs well from a business perspective.

- As of August 2024, the debt of General Electric is around $18 billion.

General Electric Products

Commercial

- GEnx

- Engines

- GE90

Defense

- GE9X

- F108

- CF34

- F110

- CF6

- F138

- CFM LEAP

- F404

- CFM56

- F414

- CT7

- T408

- T700

- T901

- XA100

(Source: geaerospace.com)

General Electric Appliance Range

As per GE statistics, the following products are offered by General Electric

Kitchen Appliances

- Small Appliances

- Refrigerators

- Ranges

- Dishwashers

- Cooktops

- Wall Ovens

- Freezers

- Ice Makers

- Microwaves

- Advantium Ovens

- Range Hoods & Vents

- Designer Hoods (Chimney & Canopy)

- Warming Drawers

- Trash Compactors

- Garbage Disposals

Laundry Appliances

- Washer Dryer Combos

- Washers

- Dryers

- Stacked washer-dryer units

- Commercial Laundry

General Electric Overview

General Electric (GE) maintained its impressive success in 2023 across all its business segments, including energy, healthcare, and aviation. In 2023, the company’s revenue came to over $76.5 billion, indicating a roughly 5% rise from the year before. The aviation industry, which experienced a comeback as international travel recovered from the pandemic, was a major factor in this expansion. The aviation business was the biggest contributor to GE’s financial performance, accounting for approximately $32 billion of the company’s total revenue.

Analysts believe that GE will continue on its current growth track through 2024, with a roughly 4% increase in revenue. It is expected that the aviation industry will maintain its robust performance, with estimated revenues of $34 billion. The healthcare industry is also anticipated to expand, especially given the continued need for cutting-edge diagnostic and imaging tools. Approximately $79.5 billion is projected to be GE’s total revenue in 2024.

GE’s biggest task in 2024 will be controlling the escalating labor and raw material prices, which could affect profitability. Despite this, the business is still confident it will turn a profit margin of 6.8% and generate a net income of roughly $5.4 billion.

In terms of profitability, GE recorded $5.1 billion in net income for 2023 or a 6.7% net profit margin. Compared to the prior year, when the net profit margin was marginally lower at 6.2%, this represented a significant improvement.

Conclusion

Since its inception in the 19th century, General Electric has diversified into a wide range of businesses, namely energy, health care, and aviation. As of 2023, the GE statistics showcase that the company is on a positive track towards growth and development and is expected to regain its reigning position in years to come. Although the company faces a wide variety of challenges, such as rising labor and material costs, It has shown good signs of recovery. Its profit margin in the healthcare sector rose to 15% in 2022.

Sources

FAQ.

According to GE statistics, the main general electric segments include aviation, power, renewable energy and health care.

GE’s net profit margin in 2023 was 6.7%.

The aviation segment is the largest contributor, accounting for approximately $32 billion in 2023.

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.