ServiceNow Statistics By Market, Revenue, Employees And Fact

Updated · Mar 05, 2025

Table of Contents

Introduction

ServiceNow Statistics: ServiceNow has been one of the foremost players in terms of cloud-based workflow automation solutions, and 2024 saw a significant rise and change in the company’s fortunes. This great company has now begun setting its mark on the enterprise software realm since a commitment to innovate, particularly in the field of artificial intelligence (AI).

Here are comprehensive reviews of ServiceNow statistics, financial angles, strategic initiatives, and market dynamics into the year 2024.

Editor’s Choice

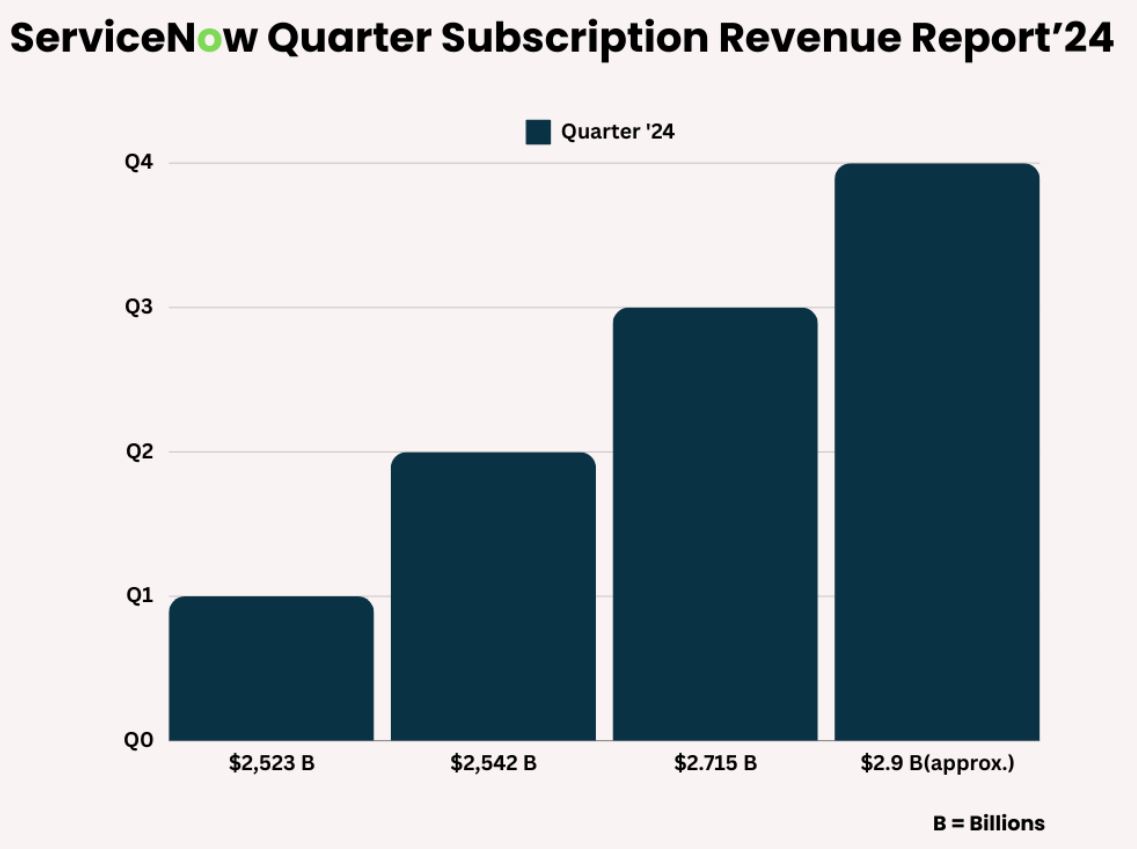

- According to ServiceNow statistics, moreover, according to the company in Q4 of 2024, subscription revenues were reported at US$2.866 billion, denoting a 21% constant currency year-on-year growth and current remaining performance obligations (cRPO) at US$10.27 billion.

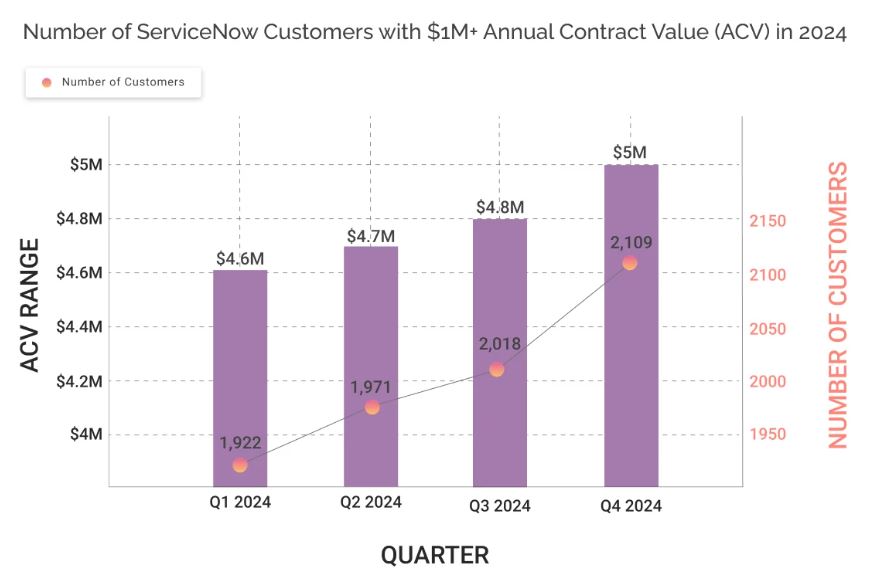

- During this time, the total of 2,109 customers included about 500 with an annual contract value above US$5 million.

- The subscription revenues for Q3 of 2024 have reported at US$2.715 billion, which reflects year-over-year growth of 22.5%, cRPO of US$9.36 billion and 15 new ACVs of more than US$5 million.

- In terms of subscription revenue, Q2 2024 brought in US$2.542 billion, up 23% year-on-year, as cRPO grew to US$8.78 billion.

- In Q1 of 2024, revenues from subscriptions stood at US$2.523 billion, with an increase of 25% over the previous year, having a cRPO of US$8.45 billion and eight deals representing greater than US$5 million in net new ACV.

- ServiceNow statistics state that ServiceNow maintained a subscription revenue of US$8.68 billion in 2023 by recording a year-on-year growth of 25.5%, realising US$2.7 billion from free cash flow.

- For the year 2024, the total annual revenue amounted to US$10.9 billion, comprising US$10.6 billion from subscription services and US$338 million from professional services and others.

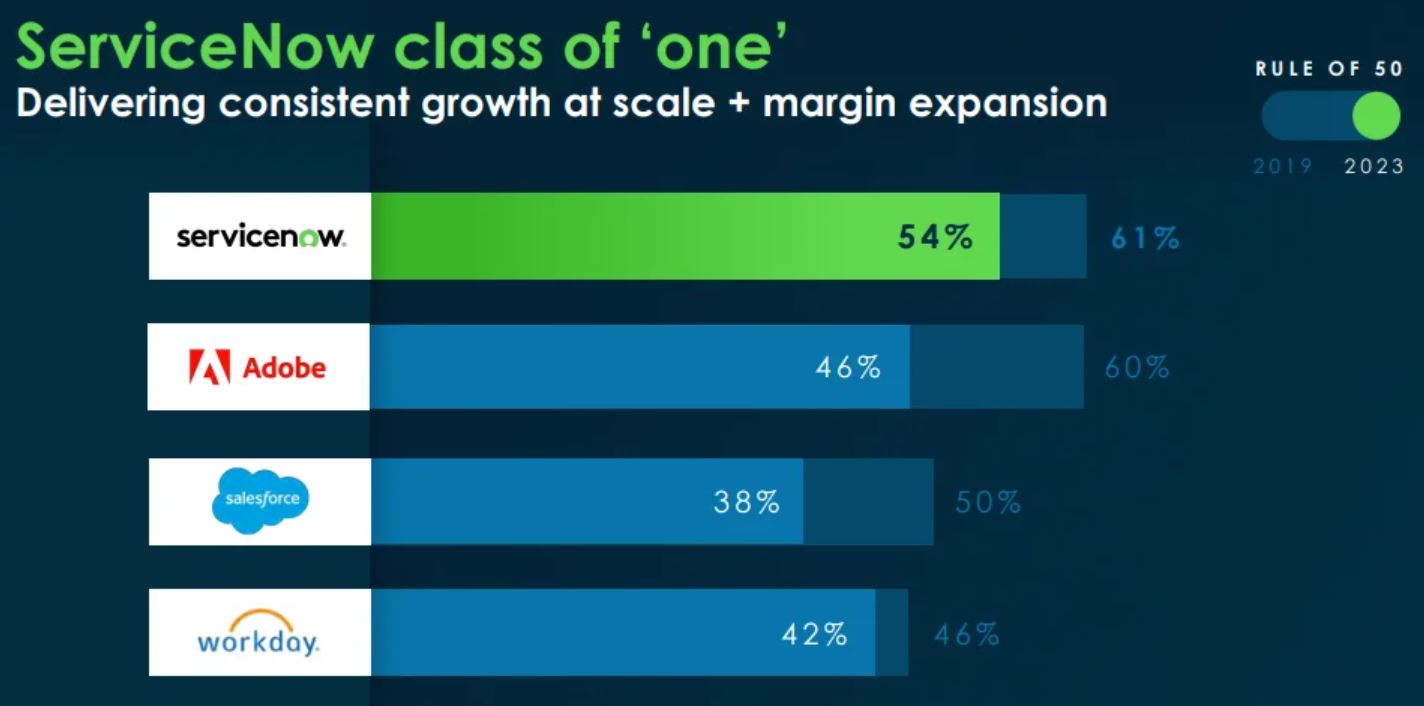

- ServiceNow boasted of a growth rate of 54% with a profit margin of 61%, ahead of its rivals Adobe, at 46% growth and 60% margin; Salesforce, at 38% growth and 50% margin; and Workday, at 42% growth and 46% margin.

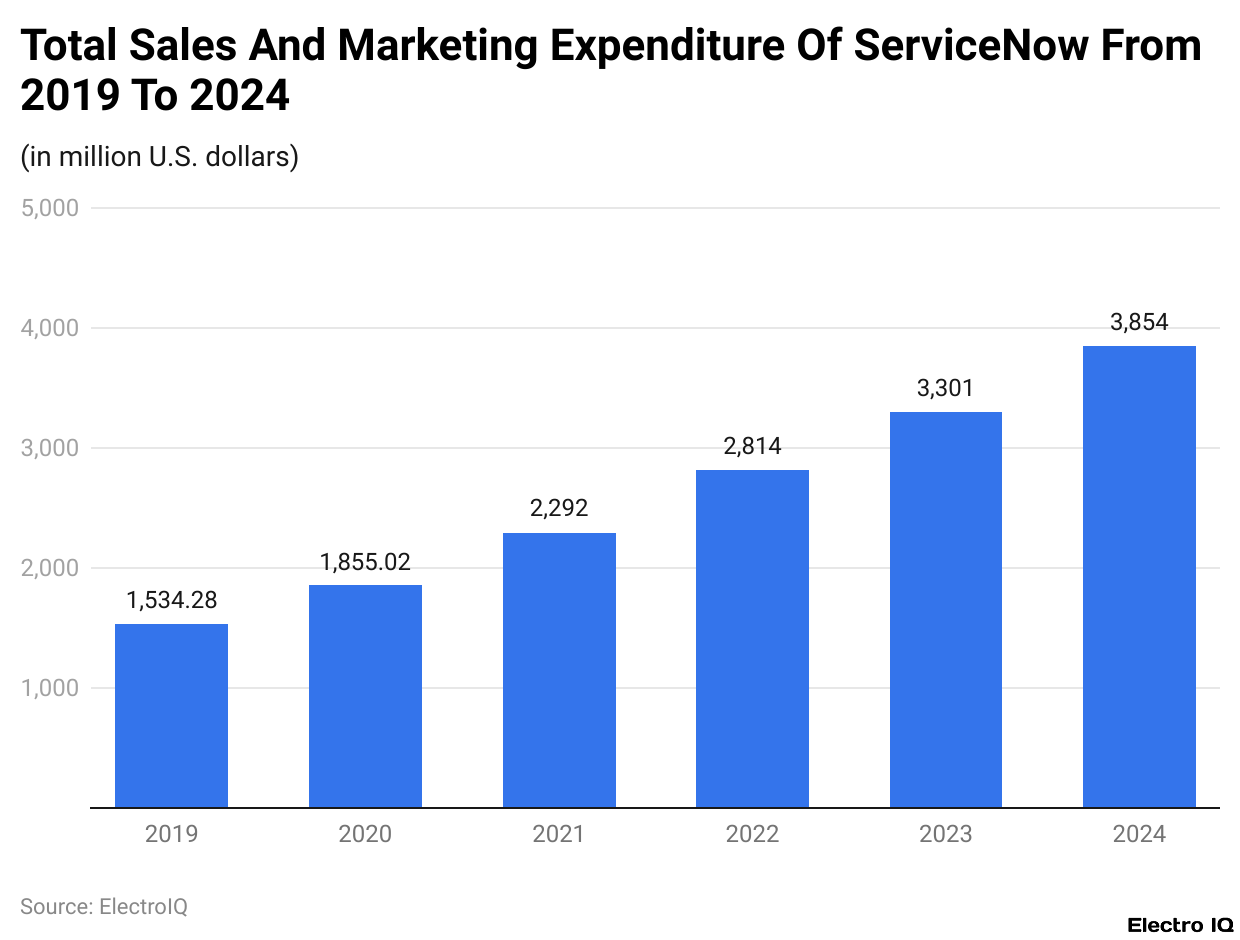

- Sales and marketing expenses shot up from US$3.3 billion to US$3.8 billion in 2024, in further climate of expansion and customer acquisition.

- According to ServiceNow statistics, Customers under its billing exceed 8,400 and include 85% of the Fortune 500 list, with a steady growth in numbers having annual contract values of over a million dollars.

- In Q4 2024, 2,109 customers had an average ACV of US$5 million each, a figure steadily rising from 1,922 in Q1 a year before.

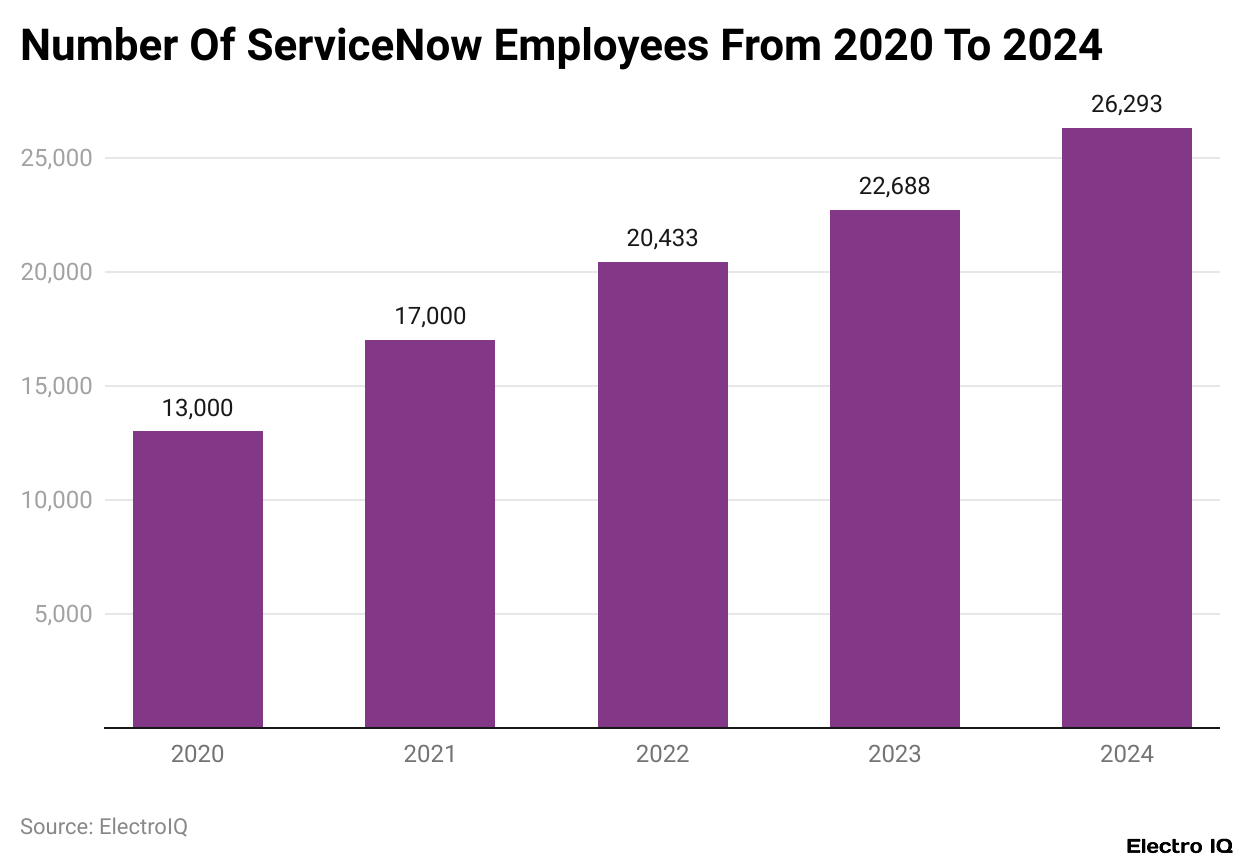

- ServiceNow statistics reveal that Employee numbers have fluctuated over the past years, peaking at 26,293 in 2021 and maintaining a consistent figure of about 17,000 in 2024.

- Operating margins reached 31.2% in Q3 2024, an increase from 30.4% in Q1 but down from the previous quarter.

- ServiceNow raised its annual guidance for 2024, projecting subscription revenue of US$10.66 billion, which is about a 23% year-over-year increase.

- In addition, the company hopes to maintain its “Rule of 50” performance, which is expected to grow revenue at a long-term level exceeding 20% annually.

- Strengthening the U.S. dollar presents an FX headwind of about US$175 million for 2025 subscription revenues and US$205 million for Q1 2025 cRPO.

Key Facts

- ServiceNow is a U.S.-based software company that provides cloud computing platforms for enterprise digital process management.

- The company was founded as Glidesoft, Inc. in 2003 by Fred Luddy, incorporated in 2004, and rebranded as ServiceNow Inc. in 2006.

- It became a public company in June 2012.

- ServiceNow operates as a PaaS provider for large enterprises in IT service management and helpdesk solutions.

- The company follows a SaaS business model to enable digital transformation by automating and structuring business services.

- From security to operations, customer support to hr, and it service management, its software solutions cover everything.

- ServiceNow delivers tools for managing projects related to service levels, production instances, and cloud-based IT needs.

- The company has also grown through acquisitions to strengthen its position in the field of digital workflow automation: they include Element AI, Lightstep, Gekkobrain, Swarm64, and Mapwize.

- Other competitors include Salesforce, Zendesk, Oracle, Jira, and Workday, all of whom sell enterprise automation solutions with AI integration.

- Unlike Salesforce, which offers an integrated process automation platform, ServiceNow will likely continue acquiring companies in establishing itself as a comprehensive enterprise solutions provider.

ServiceNow Revenue

(Source: aelumconsulting.com)

- According to ServiceNow statistics, Revenues from subscriptions were reported in Q4 2024 at US$2.866 billion, signifying 21% year-over-year growth in constant currency.

- The remaining performance obligations were reported at US$10.27 billion. ServiceNow had a total of 2,109 customers, about 500 of whom had an annual contract value (ACV) above US$5 million.

- The Q3 2024 subscription revenue was US$2.715 billion, with 22.5% year-on-year growth in constant currency. The cRPO was US$9.36 billion.

- ServiceNow statistics indicate that ServiceNow had 2,020 total customers, 44 of whom had ACV now assist contracts over US$1 million.

- Also, 15 deals with more than US$5 million in net-new ACV contributed to the 50% year-on-year increase.

- In Q2 2024, ServiceNow recorded subscription revenues of US$2.542 billion, up 23% year-on-year, with a constant currency growth of 23% as well.

- According to ServiceNow statistics, for the quarter, the company reported a total revenue of US$2.627 million, while cRPO increased to US$8.78 billion.

- ServiceNow maintained a customer base of 1,988, with 15% year-on-year growth over US$1 million in ACV, having closed 11 deals greater than US$1 million.

- ServiceNow reported subscription revenues for Q1 2024 of US$2.523 billion, representing a 25% year-over-year increase, including a 24.5% increase at constant currency.

- The cRPO was listed at US$8.45 billion. ServiceNow scored eight net new ACV deals above US$5 million, doubling year-over-year.

- Total customers include 1,933 customers with greater than US$1 million in ACV, up 15% from last year.

- ServiceNow statistics show that ServiceNow reported US$8.68 billion in subscription revenue in 2023, representing a growth rate of 25.5% year-over-year in constant currency.

- Free cash flow surged to US$2.7 billion for the company. ServiceNow has over 8,100 customers today, and 85% of Fortune 500 companies use its services.

- The Q4 subscription revenues reached US$1.86 billion in 2022, representing a 22% year-on-year increase, with a 27.5% increase considering currency fluctuations.

- ServiceNow statistics were reported at US$6.94 billion, representing a growth of 22% year on year and 25.5% when reported in constant currency.

- The company had more than 7,700 customers.

- In 2021, ServiceNow had US$1.523 billion in subscription revenues with cRPO at US$5.7 billion. ServiceNow reported impressive renewals at 98% and 80% penetration at Fortune 500 customers.

ServiceNow Market Leadership

(Source: aelumconsulting.com)

- Recognised as a “class of one” company, ServiceNow has shown consistent scalability and increasing profit margins.

- Competition with such performance is usually between other leading names in enterprise software monetisation.

- ServiceNow statistics state that such audacity was achieved at a whopping 54% growth and a 61% margin, ahead of all competitors.

- Adobe came second at a healthy growth of 46% and 60% margin. Such performance makes it follow ServiceNow as slightly trailing.

- Sales were announced to have reported a 38% growth rate with a 50% margin, indicating solid expansion but at a lower efficiency level than ServiceNow and Adobe.

- Workday had growth and margins of 42% and 46%, respectively, thereby being ranked lower in both cases.

- These indeed show ServiceNow’s capabilities to scale and be profitable at the same time while crystallising its enterprise software leader aura.

ServiceNow Total Sales And Spending

(Reference: statista.com)

- According to ServiceNow statistics, ServiceNow spent, at this point, about US$3.8 billion in sales and marketing expenses in 2024 as opposed to last year’s US$3.3 billion.

- This is because they continued the efforts to penetrate the market more, gain absorption of more customers, and create an overall greater awareness of the brand.

- ServiceNow expected that by spending time on these things, they would drive revenues while improving customer engagement and solidifying retention against competition.

- Furthermore, expanding budgets do indicate scaling company ambitions and aspirations to reach a larger audience across the globe.

ServiceNow Number Of Customers

(Source: cyntexa.com)

- ServiceNow statistics reveal that, as for now, in 2024, as it stands, more than 8400 organisations around the world have signed up for ServiceNow, which, at its very limit, goes up to about 85% of Fortune 500 companies.

- Growth can also be seen in the figures of customers with an annual contract value exceeding US$1 million, who have been continuously increasing for the entire year.

- The first quarter of 2024 saw 1,922 customers with such contracts, whose respective average ACV was US$4.6 million. In the second quarter, the company got 49 new customers, totalling 1,971, with an increased average ACV of US$4.7 million.

- Such incline continued toward the third quarter, adding 47 additional customers, summing up 2,018 customers whose average ACV was US$4.8 million. And now, out of this number, by the closing of the fourth quarter, 2,109 customers amassed, with an average ACV of US$5 million, indicating steady and significant business expansion during the year.

ServiceNow Employees

(Reference: cyntexa.com)

- ServiceNow statistics state that ServiceNow’s workforce has had some twists and turns in the past years. The company, by the year 2020, had employed more than 13,000 people.

- There was a spectacular jump to 26,293 employees by 2021. However, this fell in 2022 to 22,688, showing reduced manpower.

- In 2023, the downward trend continued, with employee numbers now showing a figure of 20,433.

- By 2024, around 17,000 employees will comprise the workforce of ServiceNow.

- These changes seem to indicate a rapid growth followed by strategic corrections, perhaps in response to market conditions such as improved automation or a shift in company priorities.

- The numbers may not have been upward in recent years, but it is key that ServiceNow has a strong presence in a more than competitive market, continuing to pursue efficiency and growth in other key areas.

Service Margin Operating Margin

(Source: rijnberkinvestinsights.substack.com)

- According to ServiceNow statistics, ServiceNow has been experiencing fluctuations in the operating margin over the last few quarters due to the company’s operating efficiencies compared to performance across its business lines.

- Starting at 25.8% in Q1 2023, the operating margin dipped to 25.3% in the second quarter but surged in Q3 to 29.6%, only to retract to 29.4% in Q4 2023.

- At the beginning of 2024, the first quarter’s operating margin reached a high of 30.4% against the second quarter’s 27.4%.

- It climbed back to 31.2% in Q3, marking the highest margin attained yet over the period in question.

- Such variations also indicate the strategic initiatives company-wide and efficiency initiatives that helped profits across the whole timeframe of the year.

ServiceNow Valuation

- According to ServiceNow statistics, ServiceNow has once again raised guidance for the full 2024 fiscal year following strong Q3 results. The firm now expects subscription revenue to number between US$10.655 billion and US$10.66 billion, an increase of 23% year-on-year.

- The company also predicts achieving a gross margin of 84.5%, and an operating margin of 29.5%-150 basis points above the same figure a year ago, while still keeping free cash flow margin at 31%, above the 30% mark.

- ServiceNow statistics data would confirm once more that ServiceNow will follow through its “Rule of 50” performance for another year.

- Medium term, the company has been set for continuing to enjoy its Rule of 50 trend streak into the foreseeable future, and there do not appear to be any signs of slowing down that would be considered significantly major.

- It continues to surf the very strong tailwinds that are experienced within the industry, and in fact, IT spending is expected to rebound during the years 2025 and 2026. This should further help ServiceNow’s growth while offsetting damage incurred from the law of large numbers.

- Other key growth areas for AI advancements are probably going to account for several future years of growth at above 20% before gradually tapering off into the teens.

- However, while revenue growth remains strong, margin expansion will more moderate than before. Future investments will be made to enable ServiceNow to grow, as operating efficiencies are plateauing. Thus, any further gains in the operating margin will probably be incremental over the next four years before perhaps accelerating again in the latter part of the decade.

- ServiceNow statistics state that ServiceNow is still on course to grow annually at over 20% across revenue and profit; that is indeed something impressive in its own right.

Financial Outlook

- Assuming values are expressed both in GAAP and non-GAAP. Non-GAAP growth rates for subscription revenues are constant currency-adjusted, thereby neutralising the impact of foreign exchange rate fluctuations as well as gains/losses from foreign currency hedge contracts.

- Similarly, non-GAAP growth rates for cRPO are adjusted only for constant currency, providing insights into more underlying business trends.

- ServiceNow statistics indicate that September 30, 2024, ServiceNow has been confronted by a strengthening U.S. dollar, creating an estimated FX headwind of around US$175 million on 2025 subscription revenues (US$40 million in Q1 2025) and US$205 million on Q1 2025 cRPO.

- Projections assume a heavier second-half weight for the U.S. Federal business due to seasonal patterns linked to presidential administration transition. We intend to lead a more consumption-based monetisation for our AI and data solutions in 2025.

- For example, new AI Agents will be incorporated in Pro Plus and Enterprise Plus SKUs – a shift from advancing incremental new subscriptions toward encouraging faster adoption and monetising increased usage over time.

- Going forward, we are also further refining our go-to-market strategy and introducing more integrated solutions; everything will be unveiled at Knowledge 2025. Our guidance is structured with the flexibility to facilitate these changes while continuing to deliver solid free cash flow.

- The free cash flow margin outlook assumes the incremental increase on top of the pipeline expected to carry on from 2024’s successful momentum.

Conclusion

As per ServiceNow statistics, ServiceNow’s operational achievements showcase its strategic emphasis on innovation, notably its integration of AI, along with a customer-centric orientation. With broad financial growth, a wider customer base, and strong partnerships, the company is well-poised for ongoing success as changes in enterprise software and AI-related business transformation are being witnessed.

FAQ.

In 2024, ServiceNow obtained total annual revenue of US$10.9 billion. Approximately US$10.6 billion of this revenue came from subscription services, with another US$338 million from professional services and miscellaneous revenue.

By the end of 2024, there were over 8,400 customers using ServiceNow’s products, and 85% of Fortune 500 companies are included. Customers with over US$5 million in Annual Contract Value grew to almost 500. The number of customers has been increasing every quarter, adding about 2,109 customers with an average ACV of US$5 million in Q4 2024.

ServiceNow registered significant financial growth in 2024 at a 54% growth rate, with 61% margin; thus, outperforming Adobe (46% with 60% margin) and Salesforce (38% with 50% margin). Substantial operating margin fluctuations were from a low of 31.2% in Q3 2024.

Sales and marketing expenditures for ServiceNow were increased in 2024 to US$3.8 billion (from US$3.3 billion in 2023), to back expansion and customer acquisitions. The company also focused investments in AI-driven solutions and strategic acquisitions to reinforce the market leadership of its enterprise software offerings.

ServiceNow increased its full-year 2024 guidance by projecting subscription revenues of approximately US$10.66 billion, reflecting a 23% increase year-on-year. The company expects to initiate consumption-based monetisation for AI and data solutions in 2025 and anticipates remaining strong with free cash flow. An FX headwind from the strengthening U.S. dollar is expected to cost US$175 million in 2025 subscription revenues.

Barry Elad is a tech enthusiast who loves diving deep into various technology topics. He gathers important statistics and facts to help others understand the tech world better. With a keen interest in software, Barry writes about its benefits and how it can improve our daily lives. In his spare time, he enjoys experimenting with healthy recipes, practicing yoga, meditating, or taking nature walks with his child. Barry’s goal is to make complex tech information easy and accessible for everyone.