Huawei Statistics By Market Share, Revenue and Facts (2025)

Updated · Nov 07, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Fun Facts About Huawei

- History of Huawei

- Huawei Market Share

- Huawei Financial Highlights

- Huawei Revenue By Region

- Huawei Revenue By Segment

- Huawei Phone Statistics By Region

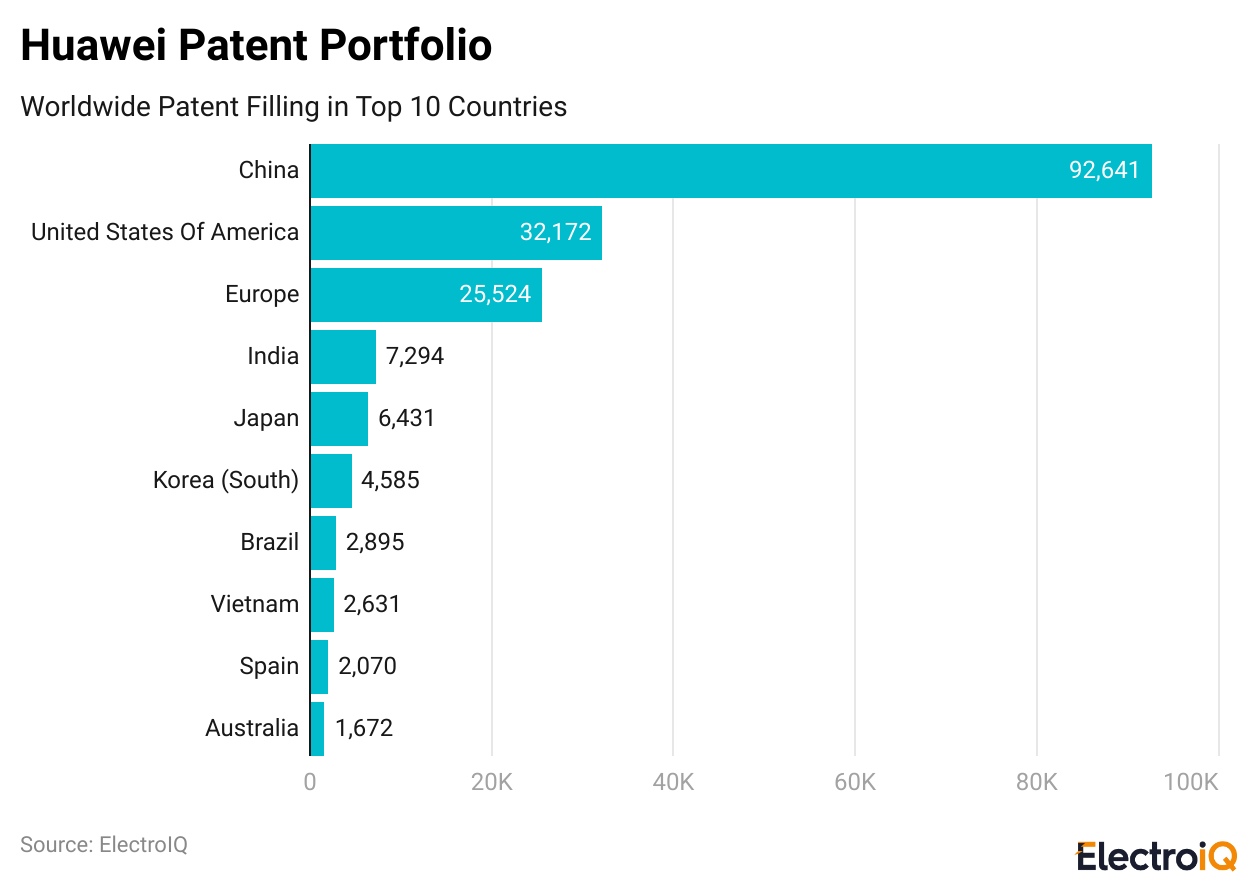

- Huawei Patent Portfolio

- Huawei ICT Technologies Integration Across Sectors

- Huawei’s Contributions To Digital Education Transformation

- Huawei Consumer Business Performance

- Huawei’s Global Impact Of Digital Intelligence Across Industry

- Huawei’s Advancements In Basic Research

- Huawei Industry Trends

- Huawei’s 2024 Technological Innovations And Performance Statistics

- Conclusion

Introduction

Huawei Statistics: Surprisingly, in the period 2024-2025, the tech giant Huawei managed to recover, and even more so: the company achieved its highest sales ever, invested a significant amount in research and development, and continued to hire new employees — all this while facing trade restrictions and intense competition. In other words, Huawei’s business was flourishing, as they increased their R&D budget and expanded into new areas (such as cloud, cars, and digital power) to shape their future.

Recently, the firm has made a significant impact on the international market. The use of Huawei statistics, which are now quite prevalent, includes insights from various sectors that shed light on the industry’s tremendously fast growth in different parts of the world.

Editor’s Choice

- In 2024, Huawei’s total revenue reached CNY 862,072 million (approximately US$118.16 billion), representing a 22.4% increase from CNY 704,174 million in 2023.

- The Chinese market accounted for 71.4% of Huawei’s total revenue in 2024, with a generated amount of CNY 615,264 million, an increase from CNY 471,303 million in 2023.

- The EMEA region accounted for CNY 148,355 million, representing a 2% increase compared to 2023.

- The revenue from ICT Infrastructure was CNY 369,903 million, while Consumer Business increased 38%, reaching CNY 339,006 million in 2024.

- The revenue of Intelligent Automotive Solutions went up by more than 474%, rising from CNY 4,588 million to CNY 26,353 million in just one year.

- Digital Power sales increased by 24.3%, and they amounted to CNY 68,678 million in 2024.

- In China, Huawei was granted 92,641 active patents in 2023 — the company held the highest number worldwide.

- The operating profit of Huawei in 2024 was US$10.88 billion (CNY 79.36 billion) with a 9.2% margin.

- Huawei’s collaboration with over 200 power companies worldwide, particularly in China, resulted in a 56% reduction in power interruption duration.

- In the oil and gas industry, the use of Huawei’s AI technology increased the speed of seismic data processing by 10 times its original rate. It simultaneously reduced energy consumption by 25.7% per metric ton produced.

- Huawei’s products have topped global sales of wearables for three consecutive quarters, while the sales of the Huawei Watch GT 5 reached 2 million units in just 20 days.

- The number of developers for HarmonyOS 5 reached 7.2 million, and there were over 20,000 apps available, thus winning China’s smart home market.

- In 2024, more than 430,000 vehicles equipped with HIMA technology were sold, and they became the best-selling ones in China’s premium EV market.

- Huawei’s AI research had a significant impact on the accuracy of reasoning by an average of 14% and in certain cases even by up to 50%.

- The complexity of the massive MIMO sywas stem reduced by 25%, and the throughput of the fine-tuning of the LLM was improved by 20%.

- The Chaspark platform of Huawei gave access to 190 million patents and assisted in solving more than 300 global research problems.

Fun Facts About Huawei

- Founded in 1987 in Shenzhen by Ren Zhengfei; it remains a private company.

- Ownership is held by employees through an internal scheme, with 161,749 employee and retiree beneficiaries; Ren’s stake is about 0.65% as of December 31, 2024.

- Revenue reached CNY 862.1 billion in 2024, with net profit of CNY 62.6 billion.

- R&D investment was CNY 179.7 billion in 2024 equal to 20.8% of revenue; cumulative R&D over the last decade topped CNY 1.249 trillion.

- The company reports about 208,000 employees worldwide and operations in 170+ countries and regions.

- A research-heavy workforce is evident, with 113,000 employees in R&D equal to 54.1% of staff at the end of 2024.

- Active granted patents exceed 150,000, and more than 230 patent licensing and cross-licensing agreements have been signed.

- A rotating chair system is used for top leadership; for example, Sabrina Meng served from Oct 1, 2024 to Mar 31, 2025, and Eric Xu from Apr 1, 2025 to Sep 30, 2025.

- HarmonyOS reported 1 billion active users by October 22, 2024, with continued expansion into 2025.

- HarmonyOS entered retail infrastructure with a smart cash register rollout to 40,000+ Meiyijia stores in China.

- Smartphone sales in China rose sharply during the 618 shopping period, with Huawei up 42.4% year over year.

- Huawei ranked at or near the top of global 5G standard-essential patent leadership in 2024; CAICT estimated a 12.42% share, while a 2025 LexisNexis analysis credited Huawei with leading contributions though Qualcomm ranked first by patent value.

- The Ox Horn R&D campus in Dongguan is European-themed, opened in 2019, cost about US$1.5 billion, and accommodates roughly 25,000 people.

- The firm remains privately held and is not publicly listed for direct share purchase by retail investors.

- In 2024, regional revenue was led by China at CNY 615.3 billion, followed by EMEA at CNY 148.4 billion.

History of Huawei

- 1987: Huawei was founded in Shenzhen by Ren Zhengfei with registered capital of 21,000 yuan, initially acting as a PBX sales agent.

- 1990: The firm began building 40-gate switchboards for hotels as it shifted toward its own R&D.

- 1993: Development of the C&C08 2,000-gate digital switch marked its entry as a telecom equipment vendor.

- 1996: First international exposure came at the 8th International Telecoms Expo in Moscow.

- 1999: The first overseas R&D center opened in Bangalore, focused on software engineering.

- 2001: Huawei became an ITU sector member, advancing participation in global standards.

- 2004: A compact base station solution was created for a Dutch mobile network, reducing site footprint and costs.

- 2006: The first joint innovation center with Vodafone was established in Spain.

- 2007: High-altitude mobile sites were deployed on Mount Everest at 5,200 and 6,500 meters.

- 2011: Network restoration support was provided after Japan’s March 11 earthquake and tsunami.

- 2012: Huawei surpassed rivals to become the world’s largest telecom equipment supplier.

- 2013: The Honor smartphone brand was set up to target online and youth segments.

- 2014: Honor expanded internationally; shipments of Honor devices reached 20 million by year end.

- 2016: Revenue growth accelerated on strong 4G demand across carrier and enterprise businesses.

- 2018: Huawei rose to the world’s No. 2 smartphone vendor by shipments in Q2, ahead of Apple.

- 2019: The U.S. Department of Commerce placed Huawei and 68 affiliates on the Entity List in May; Huawei unveiled HarmonyOS on August 9.

- 2020: Huawei announced it would roll out HarmonyOS 2.0 to phones in 2021 and later sold the Honor business to Shenzhen Zhixin on November 17.

- 2021: HarmonyOS 2 launched and began shipping on new devices, with upgrades rolling out to legacy phones.

- 2023: The Mate 60 Pro debuted with a domestically made advanced chip, signaling a significant supply-chain shift; sales exceeded 1.6 million units for the Mate 60 series within six weeks.

- 2024: The Pura 70 series launched in April and sold out quickly; Huawei’s full-year revenue rose 22.4% to CNY 862.1 billion with R&D spending at CNY 179.7 billion.

- 2025: Leadership reported 2024 revenue above CNY 860 billion (about USD 118 billion) as the consumer and smart-auto businesses rebounded; the annual report confirmed revenue of CNY 862.1 billion and net profit of CNY 62.6 billion.

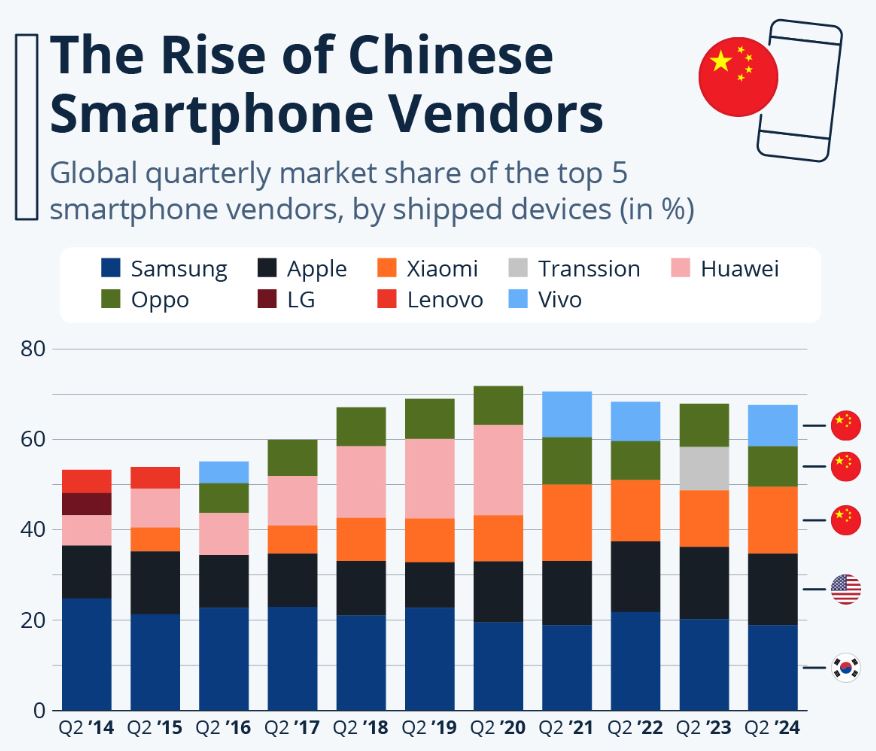

(Source: statista.com)

- Apple and Samsung have been the main influencers in the global smartphone market for a long time, always being the most famous brands.

- Coming to the present, though, it appears that Chinese technology companies are right behind them, and Huawei is even ahead of the South Korean and U.S. brands sometimes.

- Based on the IDC Quarterly Mobile Phone Tracker, from April to June 2024, Samsung’s share of the global shipment of 285 million smartphones was about 19%, while Apple had 15.8% and Xiaomi was very close at 14.7%, which corresponds to around 42 million smartphones being shipped in the second quarter of this year.

- Vivo and Oppo took the next two places in the ranking of smartphone sellers during this period, capturing around 9% each of the global market share.

- Simultaneously, Transsion, which was making one of every ten smartphones sold in the first quarter of 2024, lost its position in the top five between April and June.

- The Chinese company was, however, ranked fifth in IDC’s top five for the first time in the second quarter of 2023, which was mainly due to its growing popularity in developing regions, especially Africa.

- Looking back at the market shares of smartphone vendors for the last ten years, Apple and Samsung have been the most prominent players in almost all the second quarters since 2014.

- The only exceptions were Xiaomi and Huawei.

- Huawei, more so, experienced a very rapid escalation in the late 2010s and was even able to overtake Samsung, becoming the best-selling smartphone brand in the world during the second quarter of 2020.

- Earlier in that year, they had already come within 3.3 percentage points of the top spot.

- Nonetheless, the sanctions imposed by the U.S. on Huawei had a significant impact, causing its growth to be abruptly halted in 2020.

- After that, their market position had more and more shared by other Chinese players such as Xiaomi and Oppo, which together accounted for a market share of 22 to 27% in the second quarters of 2021, 2022, 2023, and 2024.

Huawei Financial Highlights

| 2024 | 2023 | 2022 | 2021 | 2020 | ||

| (USD Million) | (CNY Million) | (CNY Million) | ||||

| Revenue | 118,162 | 862,072 | 704,174 | 642,338 | 636,807 | 891,368 |

| Operating profit | 10,878 | 79,361 | 104,401 | 42,216 | 121,412 | 72,501 |

| Operating margin | 9.20% | 9.20% | 14.80% | 6.60% | 19.10% | 8.10% |

| Net profit | 8,577 | 62,574 | 86,950 | 35,562 | 113,718 | 64,649 |

| Cash flow from operating activities | 12,119 | 88,417 | 69,807 | 17,797 | 59,670 | 35,218 |

| Cash and short-term investments | 51,021 | 372,232 | 475,317 | 373,452 | 416,334 | 357,366 |

| Working capital | 43,749 | 319,178 | 421,662 | 344,938 | 376,923 | 299,062 |

| Total assets | 176,837 | 1,290,149 | 1,263,597 | 1,063,804 | 982,971 | 876,854 |

| Total borrowings | 36,305 | 264,871 | 308,414 | 197,144 | 175,100 | 141,811 |

| Equity | 74,649 | 544,619 | 507,568 | 437,076 | 414,652 | 330,408 |

| Liability ratio | 57.80% | 57.80% | 59.80% | 58.90% | 57.80% | 62.30% |

(Source: huawei.com)

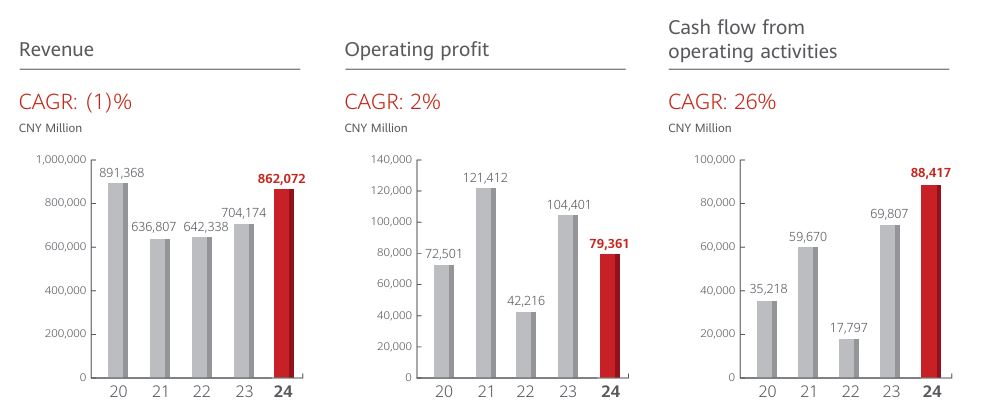

- The financial data illustrates Huawei’s performance over the past five years, highlighting steady revenue growth and gradual shifts in net income, assets, and debt between 2020 and 2024.

- In 2024, Huawei’s revenue reached nearly US$118.16 billion (CNY 862.07 billion), representing a significant increase from CNY 704.17 billion in 2023. This recovery marks a continuation of the trend from previous years, when revenue declined due to global trade restrictions.

- The company reported CNY 642.34 billion in 2021, compared to CNY 636.81 billion in 2020, a decrease from its peak year of CNY 891.37 billion in 2019, before the sanctions were enforced. This is indicative of the company’s return to the path of large top-line growth by 2024.

- The operating profit in 2024 was US$10.88 billion (CNY 79.36 billion), which is lower than the CNY 104.40 billion registered in 2023 but still represents substantial growth compared to the CNY 42.22 billion recorded in 2021.

- The peak profit in the five years was in 2020, with an amount of CNY 121.41 billion. This indicates that 2024 had great sales, but margins were reduced due to high investment and operating costs.

- The operating margin for 2024 was 9.2%, which is lower than the 14.8% of 2023 but is better than the 6.6% of 2021, thus illustrating the company’s fluctuating profitability that is related to the changing costs and market conditions.

- Huawei’s net profit followed a similar trend, reaching US$8.58 billion (CNY 62.57 billion) in 2024, which is lower than the CNY 86.95 billion in 2023 but still nearly twice the CNY 35.56 billion recorded in 2021.

- The net profit in 2020 was particularly high at CNY 113.72 billion, reflecting the company’s earlier global expansion before trade restrictions and supply challenges arose.

- The cash flow from operating activities of the company saw a remarkable rise in 2024, reaching US$12.12 billion (CNY 88.42 billion), which is a very positive sign in terms of cash generation compared to CNY 69.81 billion in 2023 and a marked increase from CNY 17.80 billion in 2021.

- Huawei has also gained a good position in terms of liquidity. The company’s cash and equivalent investments amounted to US$51.02 billion (CNY 372.23 billion) in 2,024, which is still lower than CNY 475.32 billion in 2023.

- The company’s working capital was US$43.75 billion (CNY 319.18 billion) in 2024, which is a decrease from the previous year when it stood at CNY 421.66 billion.

- It indicates that the company has been able to manage its operations effectively while simultaneously making strategic investments and R&D expenditures.

- With respect to assets, Huawei’s total assets reached US$176.84 billion (CNY 1.29 trillion) in 2024, an increase from CNY 1.26 trillion in 2023 and showing a steady increase since 2020, when assets were CNY 876.85 billion.

- This increase signifies the company’s strengthening financial base and continuous development in new technologies,centresenters, and product lines.

- The company had total borrowings of US$36.31 billion (CNY 264.87 billion), which is slightly lower compared to CNY 308.41 billion in 2023, indicating that the company relied less on external debt.

- On the other hand, the company’s total equity has increased to US$74.65 billion (CNY 544.62 billion) in 2024 from CNY 507.57 billion in 2023, which shows a strong shareholder value and profitable reinvestment.

- The company’s liability ratio remained stable at 57.8% in 2024, representing a minor decline from 2022’s 59.8% and aligning with the pattern of the preceding years.

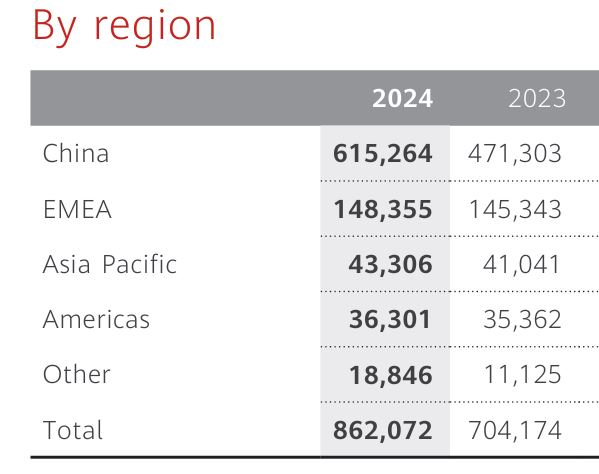

Huawei Revenue By Region

(Source: huawei.com)

- In 2024, Huawei reported a total revenue of CNY 862,072 million, representing a significant increase from CNY 704,174 million in 2023.

- The Chinese market remained the largest revenue source for the company, accounting for CNY 615,264 million, a significant increase from CNY 471,303 million, driven by growing demand for consumer devices, cloud services, and intelligent automotive solutions.

- The Europe, Middle East, and Africa (EMEA) region remained the second-largest market for Huawei, generating CNY 148,355 million, a slight increase from CNY 145,343 million.

- The Asia-Pacific region also had a small increase in revenue from CNY 41,041 million in 2023 to CNY 43,306 million.

- In the Americas, revenue increased a little from CNY 35,362 million to CNY 36,301 million, even though the company was still facing market challenges.

- The “Others” category also showed significant improvements.

- The figures grew from CNY 11,125 million to CNY 18,846 million, indicating that Huawei was not only penetrating the emerging markets but also diversifying its global operations.

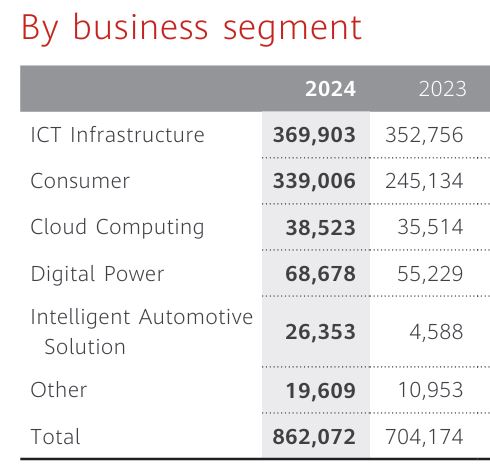

Huawei Revenue By Segment

(Source: huawei.com)

- Huawei’s total revenue increased to CNY 862,072 million in 2024, a notable rise from CNY 704,174 million in 2023, indicating the company’s robust growth across all business areas.

- The segment of ICT infrastructure continued to be the main contributor, bringing CNY 369,903 million, an increase compared to the previous year, when it was CNY 352,756 million.

- The Consumer Business also recorded an impressive increase, with revenue rising from CNY 245,134 million in 2023 to CNY 339,006 million in 2024, primarily due to the sales of smartphones and wearables.

- Cloud Computing gradually increased to CNY 38,523 million, while Digital Power experienced a significant rise from CNY 55,229 million to CNY 68,678 million, indicating Huawei’s commitment to green energy solutions.

- The Intelligent Automotive Solution experienced the highest growth rate, increasing from CNY 4,588 million to CNY 26,353 million, thereby confirming Huawei’s dominance in the smart mobility challenge.

- Revenue from Other items increased as well, going up from CNY 10,953 million to CNY 19,609 million, which a proof of the overall business growth through diversification.

Huawei Phone Statistics By Region

- The share of Huawei in the Asian smartphone market has exhibited varying patterns across different regions during the period from 2023 to the start of 2024.

- In Africa, the company maintained a relatively strong position, one that rivalled other regions.

- In the second month of the year 2023, Huawei accounted for 11.34% of the market, but soon this percentage dropped to 8.04% at the end of the same year.

- The market share of Huawei stood at 7.96% in January, which rose slightly to 8.43% in February, marking a small recovery in the territory.

- In Asia, the market share of Huawei was going down. The stock was at 4.93% in February 2023, descending to 3.59% by the end of the year.

- The first months of 2024 also brought down the share to 3.85% in January and 3.62% in February.

- Huawei’s European market was also a challenge. Its share was 6.39% in February 2023 but gradually reduced to 4.38% by December.

- The decline continued into 2024, with shares of 4.22% in January and 4.14% in February, highlighting the brand’s issue in maintaining its position in the European markets.

- Huawei’s market share in North America was still very small. It was at 1.12% in February 2023 and reduced to 0.82% by the end of the year.

- The company’s performance in the region was unchanged at 0.85% in both January and February, suggesting that there was almost no change at all.

- The same situation was in Oceania, where the company started with 1.82% in February 2023 and gradually reduced to 1.28% by the end of that year.

- In the early part of 2024, their market share was consistent at 1.16% in both January and February, which suggests that they have reached a plateau instead of further decline.

- The presence of Huawei in South America was constantly decreasing, too. The company had a market share of 3.46% in February 2023, but it fell to only 2.17% by December.

- The erosion of the share continued into 2024 with 2.04% in January and 1.92% in February, which indicated that the company was still facing difficulties in maintaining its presence on the continent.

- The figures showed that, overall, in most regions, Huawei’s market share decreased from 2023 to the beginning of 2024.

- Africa was the area that had the strongest position and showed the mildest signs of recovery, while North America and Oceania continued to be the weakest markets for the brand.

Huawei Patent Portfolio

(Reference: coolest-gadgets.com)

- At the end of 2023, in the patent race, Huawei was the leader in the Chinese market with quite a lot of active patents in the country, around 92,641. This figure is a clear indication of the company’s focus on not only innovation but also on the security of its intellectual property in the home country.

- In fact, China remains the primary place for Huawei’s research, development, and technological breakthroughs.

- The large number tells us how the company is very deeply invested in the creation and protection of its innovations domestically.

- But patents were also outside China, where Huawei had a patent presence in many more countries and regions.

- The United States became the major foreign location for Huawei’s active patents, with about 32,172 in total.

- Europe came next in the ranking with 25,524 active patents, reflecting the company’s commitment to the protection of its intellectual property rights across many European markets.

- India’s patent count of 7,294 made India the leading country in Asia, while Japan and South Korea’s 6,431 and 4,585 patents, respectively, were regarded as showing Huawei’s strategic focus on these advanced technology markets.

- The company also occupied considerable patent positions in emerging and smaller markets —the number of active patents in Brazil was approximately 2,895, in Vietnam it was 2,631, in Spain it was 2,070, and in Australia it was 1,672.

Huawei ICT Technologies Integration Across Sectors

- One of the major triumphs of Huawei in 2024 was the remarkable accomplishment in the integration of ICT technologies into various sectors in industries such as the energy, chemical, mining, and metal production sectors.

- The company has provided the world’s digital solutions that are not only measurable in terms of efficiency but also in terms of safety and sustainability.

- Huawei has been collaborating with nearly 200 electric power companies worldwide in the power sector, promoting the adoption of digital and intelligent technology in the energy industry, thereby making it safer and more environmentally friendly.

- The Intelligent Distribution Solution (IDS), the product of Huawei’s partnership with the industry, was nothing less than a miracle.

- In China, this system was able to locate medium-voltage faults in 1 minute, notify about low -voltage faults in 3 minutes, and give real-time line loss analysis in 15 minutes, thus leading to a 56% reduction in the average duration of power outages.

- In the Asia-Pacific region, the company successfully limited power outages to less than 2 minutes and reduced line loss by 20%.

- Huawei was not the only one that benefited from the innovative fibre for multiple services business model; utility companies all over the world were able to lower fibre network deployment costs by 30% in comparison to traditional methods, thanks to this model.

- The AI weather model that the company developed for the renewable energy sector increased the accuracy of power generation prediction by 8%, thus facilitating the grid integration of renewables.

- The company’s Optical Transport Network (OTN) of fine granularity (fgOTN) reached the remarkable level of 99.9999% reliability, thus guaranteeing communications of ultra-stable quality.

- The deployment of NearLink, WLAN, HarmonyOS, ISDP, and edge intelligence technologies not only further solidified power plant operations but also marked a significant improvement in fault detection speed, with a 1-minute response time, and an increase in inspection efficiency of 60%.

- The oil and gas sector was introduced to Huawei’s revolutionary AI and cloud solutions.

- One of the company’s AI models, with 70 billion parameters, was going to be the next significant improvement in processing seismic data 10 times faster. Meanwhile, another model, the pipeline operator, protected 1 kilometre using optical sensing technology.

- The offshore activities experienced a 30% increase in productivity, whereas the onshore oilfields managed to bring down the number of well visits by 80% and, at the same time, cut the energy use per metric ton of the extracted liquid by 25.7%.

- Huawei’s Pangu Mining Models have paved the way for mining operations in 100+ cases and are already being put into practice in more than 60 mines.

- The MineHarmony platform, with 110 partners and 420 certified devices, is offering support for more than 50 intelligent mining projects.

- Additionally, Huawei made it possible to create the first underground coal mine in China with a single network that operates 900 meters below the surface, where at least 99% of the trucks are now controlled remotely.

- In the smelting process, Huawei implemented 5G, cloud, and AI technologies in 23 different scenarios across nine different domains, which led to the company receiving an award from the International Telecommunication Union (ITU).

- The chemical industry, in particular, benefited from the installation of its AI-driven real-time optimizer (RTO) that brought down coal consumption by 1.33% and led to a decrease of 20,086 metric tons in CO₂ emissions annually.

- To sum up, Huawei’s initiatives for industrial transformation in 2024 will demonstrate the company’s capability to be a leading factor in enhancing the efficiency, sustainability, and digital innovation of the world.

Huawei’s Contributions To Digital Education Transformation

- Huawei is using its information and communication technology expertise to advocate for the digital equity and competency development of teachers in the education sector globally.

- With Huawei’s Smart Classroom, Smart Campus, and Digital Training Solutions, the education system is transforming both higher and primary education, serving over 7,800 customers from more than 120 countries.

- Partnering with Huawei for intelligent transformation are more than 40 of the world’s top 100 universities.

- Huawei is concentrating on connectivity and accessibility in primary and secondary education.

- For example, in the Middle East, it was a part of the national intelligent education platform creation that can support 1,400 K–12 schools along with 29 universities, and it is also responsible for the annual training of more than 9,000 digital and ICT professionals.

Huawei Consumer Business Performance

- The year 2024 marked the beginning of a new decade for Huawei’s Consumer Business Group (BG), with a continued focus on delivering an exceptional, intelligent experience across all consumer scenarios.

- Huawei was able to position itself as a brand that combines high-end, trendy, and technology-driven elements that the global market can relate to.

- Flagship Huawei smartphones were able to reestablish their strong positions, and regular product launches, along with major brand upgrades, have led to overall competitiveness improving.

- The Pura Series of Huawei has become the new standard-setters in the photography and design sectors, and the Huawei Mate XT | Ultimate Desire has been recognised by TIME magazine as one of the Best Inventions of 2024.

- Global sales of Huawei wearables soared, and the devices became the best sellers in the market with the biggest market share in more than 10 countries and regions, and also came first in worldwide sales for three consecutive quarters.

- The shipment of the Huawei Watch GT 5 Series alone reached 2 million units within just 20 days of its launch.

- Moreover, the Huawei tablets have been at the top of the list in the Chinese market for a whole year, which is an excellent achievement.

- The introduction of HarmonyOS 5 was a milestone in the evolution of the operating system, which had 20,000+ apps, 7.2 million developers, and China’s top Smart Home system.

- In smart mobility, more than 430,000 HIMA-powered cars were delivered in 2024, leading the luxury automobile segment in China for five consecutive months.

Huawei’s Global Impact Of Digital Intelligence Across Industry

- Huawei remains a leader in digital intelligence and technology adoption in multiple sectors.

- To this end, it has entered into cooperation with over 1,400 organisations, enabling it to provide quality services to more than 8,000 customers across various fields, including manufacturing, retailing, hospitality, real estate, and others, in over 60 countries and regions.

- Huawei has leveraged its over 30 years of R&D experience in the manufacturing sector to integrate data management engines and an AI tool into settings that digitalise R&D systems, thereby increasing research efficiency for companies by 30% or more.

- Additionally, its common digital production platforms are the reason for no data silos that connect R&D, production, and supply chains.

- For example, a Chinese carmaker was assisted by Huawei to set up an intelligent factory that allowed flexible manufacturing, which led to producing different brands on a single line.

- This move, in turn, led to a 20% increase in productivity while the costs and energy used were cut by 20% and 19% respectively.

- In the retail sector, Huawei, along with its partners, introduced the Smart Retail Store and Retail Cloud solutions that consist of AI, cloud, and big data.

- With these, 1,000 stores can be connected on the same day, which in turn lowers the cost of operations by 80% and raises the satisfaction of users.

- In the domains of hospitality and real estate, the solutions for Huawei’s smart campus and building networks have enabled businesses to operate more efficiently by 50%, run their networks faster by 38%, and reduce their power consumption by 15%.

Huawei’s Advancements In Basic Research

- Huawei’s fundamental research fields in 2024 made major progress as the company focused on mathematical logic as its key research area to strengthen innovation and business growth in the long run.

- The company also pointed out that every scientific breakthrough is a step forward for innovation and technology.

- Huawei’s new game theory includes a new prophet inequality that helps in closing the gap between the integrality and infinite-dimensional mixed-integer problems that are getting a tight 3-approximation in the long-standing problem of revenue maximization—a first major breakthrough in 15 years, which was presented at the 2024 IEEE FOCS Conference.

- Huawei has made great strides in artificial intelligence research by developing a reinforcement learning and tree-search framework, which, in its turn, improved reasoning accuracy in mathematical and gaming tasks by 14% on average and up to 50% in some instances.

- Besides that, they have also introduced LEGO-Prover as an AI-based theorem-proving system, which has already increased success rates by 5–10% on miniF2F benchmarks.

- Among other notable accomplishments were the reduction of the computational complexity in Massive MIMO systems by more than 25%, the increase of large language models (LLMs) fine-tuning throughput by over 20%, and winning the t+e challenge in decoding Reed-Solomon (RS) codes.

- The collaboration in the academic field further grew through Huawei’s Chaspark platform, which provides access to 190 million patents, 8,000 conferences, and 570 industry channels, thus helping to resolve over 300 research problems globally.

Huawei Industry Trends

- The new energy vehicle (NEV) market experienced a rapid rise in sales in 2024, largely attributed to the increasing penetration of intelligent transformation.

- China’s NEV market witnessed a penetration of 52%, along with th, is over 70% of the vehicles in the CNY 200,000 and above category had L2 or higher autonomous driving systems.

- With the advent of advanced driving technologies like Navigation Cruise Assist (NCA), consumers have begun to prioritise smart driving and an intelligent cockpit in their vehicle choices.

- Through its Intelligent Automotive Solution (IAS) unit, Huawecooperates with the ecosystem to provide creative, secure, and high-quality automotive experiences that possess the desired cutting-edge and value-driven characteristics, while prioritising safety and delivering quality.

- The Huawei industry depicts growth trends throughout various sectors. Advanced intelligent driving technologies, such as navigation, cruise, and assist, are becoming increasingly available singly and making smart driving.

Huawei’s 2024 Technological Innovations And Performance Statistics

- The year 2024 was a remarkable one for Huawei in terms of technology and performance, as the company not only proved its capabilities in R&D but also got the recognition of being the market leader in different business domains.

- The most impressive wireless communication feat was the introduction of the A-Core network architecture, which was totally Aagent-baseded, by Huawei.

- It was able to perform AI RF-MAP and full-rank computation in ultra-low-dimensional latent spaces, thus increasing spectrum efficiency by nearly five times.

- It also enhanced signal coverage through self-healing orbital-angular-momentum effects by over 10 dB and made it possible for smartphones to connect directly to Low Earth Orbit (LEO) satellites, which resulted in five times higher capacity density.

- As far as optical networking is concerned, Huawei made important contributions to the IEEE standards for 800G optical interconnect, ion to developing 240GBd ultra-low-drive-voltage thin-film lithium niobate (TFLN) modulation technology, which helped in reducing data center costs.

- Moreover, the company’s MEMS-based Optical Cross-Connect (OXC) innovations were able to support the large-scale scheduling of computing clusters with millions of cards.

- In the area of networking, Huawei’s new algorithms not only managed to produce a network throughput of more than 95% but also improved communication performance by over 55% along with the new collective communication solutions.

- On the AI side, Pangu models expanded to over 400 scenarios across more than 30 industries, incorporating reasoning and perception for the Celia AI assistant, resulting in a 90% task success rate.

- In 2024, Huawei’s ADS 3.0 system covered 1.4 billion kilometres of intelligent driving—approximately 30% of total vehicle mileage—and recorded 100 million AI-enabled parking events, with one user achieving over 100,000 kilometres of fully autonomous driving.

- In the realm of computing, Huawei unveiled its Atlas 900 A3 Cluster, which integrates compute, storage, and networking capabilities, enabling enhanced inference of LLMs through the use of CANN 8.0 and new communication methods.

- Among the consumer innovations were the launch of the world’s first Advanced Precision Hinge System, a tri-fold UTG-glass display with dimensions of 322 cm², and the Ultra Chroma Camera, which was claimed to have 120% colour accuracy.

- A few foundational software improvements have collectively taken HarmonyOS 5 performance up by 30%, openEuler productivity has been increased by 15%, and GaussDB has been awarded an EAL4+ certific which all point to Huawei’s extensive security, performance, and innovation focus.

Conclusion

Huawei Statistics: Huawei’s performance in 2024–2025 not only indicates an impressive recovery but also shows expansion over many sectors. The company has gained solid revenue growth, which amounted to CNY 862,072 million (US$118.16 billion), and proved to be a leader in ICT, AI and digital transformation, even under the global challenges and trade restrictions.

With over 92,000 patents in China, huge demand for wearables and smartphones, and cutting-edge industrial digitalization, Huawei has once again claimed to be a global innovation powerhouse. Continuous spending on AI, R&D, and sustainability has exhibited a crystal clear perspective of Huawei’s long-term growth and technological leadership in the global digital economy.

FAQ.

Total revenue of Huawei in 2024 amounted to CNY 862,072 million (US$118.16 billion), which was a 22.4% increase compared to the previous year. This increase was mainly attributed to the excellent performance of the company in four sectors, namely, ICT infrastructure, consumer devices, cloud computing and digital power, together with a tremendous growth in intelligent automotive solutions.

In 2024, China accounted for the largest share of Huawei’s revenue, with CNY 615,264 million coming from the Chinese market, which represented approximately 71.4% of the total revenue. The growth of the market was energized by the increasing demand for smartphones, HarmonyOS devices, and smart automotive solutions. The EMEA region was in second place with CNY 148,355 million, while the Asia-Pacific and Americas regions had a small but positive contribution.

Huawei’s Consumer Business Group had a fantastic year. The Pura Series smartphones and Mate XT | Ultimate Design got worldwide recognition, and the wearables were number one in the markets of more than ten countries. The Huawei Watch GT 5 Series had a remarkable sale of over two million units in only 20 days, while the number of developers for HarmonyOS rose to 7.2 million, which in turn strengthened the ecosystem.

Huawei achieved significant advancements in AI, game theory, and mathematical logic. The firm put forth an innovative proof technique, created LEGO-Prover for AI-based theorem proving, and improved LLM performance by 20%. The Chaspark platform of the company linked researchers worldwide, overcoming 300 practical problems, and making available 190 million patent records.

Huawei was the frontrunner in the digital transformation of the energy, mining, chemicals, and oil & gas industries. The use of its AI models and intelligent systems resulted in the reduction of power outages by 56%, the increase of oilfield productivity by 30%, and the attainment of 99.9999% network reliability.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.