Hopper Statistics By Revenue, Users, Market Share and Facts (2025)

Updated · Nov 17, 2025

Table of Contents

Introduction

Hopper Statistics: Just picture it – the next flight or hotel that you would book at the most favourable time, leading to a savings of hundreds of dollars, a feeling of being in a great deal, and all that being done through your smartphone. This is the vision of Hopper, the travel-booking app that relies on predictive analytics, thus being perfect for today’s mobile-first traveller.

In 2025, Hopper is in a unique position; the overall travel app market is experiencing a boom, with intense competition, and Hopper is not only pushing forward but also scaling in new ways. This article is a comprehensive overview of Hopper statistics in 2025—its accomplishments, its position, and the trends to be observed.

Editor’s Choice

- Hopper’s US$45 million in revenue in 2019 increased to US$850 million in 2024, representing almost a 19-fold growth.

- Hopper’s bookings climbed from US$0.4 billion in 2017 to US$7.5 billion in 2024, reflecting a steady recovery after the pandemic.

- The number of app downloads increased from 7.7 million in 2018 to 18.7 million in 2023, and then dropped to 4.5 million in 2024.

- Hopper debuted Hopper Homes in 2022, giving access to over 2 million managed rentals in 200 countries and 90,000 cities.

- Hopper’s Carrot Cash loyalty program gives 1%–5% cash back on every reservation for future travel usage.

- Hopper Cloud, the B2B segment, allows travel companies such as airlines and OTAs to incorporate Hopper’s fintech solutions.

- The adoption of travel fintech tools is estimated to increase annual consumer spending by a total of US$200 billion.

History of Hopper

- 2007: Hopper was founded in Montreal by Frederic Lalonde and Joost Ouwerkerk to build a large travel-data platform.

- 2012: The company received USD 12 million in Series B funding; Dakota Smith joined the founding team.

- 2014: Public launch of Hopper’s web product after years of data collection; a New York Times piece highlighted its research approach to lowering travel costs.

- 2015: Hopper released its mobile app with flight price prediction and real-time price monitoring, establishing a mobile-first strategy.

- 2016: Hopper raised USD 62 million to advance its airfare prediction technology.

- 2017: Expansion into hotel booking began, adding a second major product line to flights.

- 2018: A further USD 100 million financing round supported international expansion.

- 2019: Hotel price monitoring moved from beta to a global rollout, extending prediction tools beyond airfares.

- 2019: Initial fintech-style protections were introduced to help travelers manage price volatility and disruption risk.

- 2021: Hopper announced its B2B platform, later branded HTS, and a strategic partnership to power Capital One Travel; a USD 170 million round led by Capital One made Hopper a unicorn.

- 2021: An additional USD 175 million growth round was raised to scale fintech and B2B distribution.

- 2022: Launch of Hopper Homes added short-term rentals to the app, with more than 2 million properties at debut; a secondary sale valued the company at USD 5 billion.

- 2022: Hopper expanded “Price Freeze” and other flexibility products; Capital One invested USD 96 million to deepen the long-term partnership.

- 2022: Multi-year agreement with Travelport advanced distribution and collaboration on Hopper Cloud capabilities.

- 2023: Hopper’s B2B unit was rebranded as HTS (Hopper Technology Solutions) and launched HTS E-commerce; Hopper Cloud also powered “Flights on Uber” in the UK.

- 2023: Independent research coverage profiled Hopper’s evolution from OTA to fintech-driven platform, underscoring its shift toward protections and B2B distribution.

Fun Facts About Hopper

- Hopper was founded in 2007 by Frederic Lalonde, Joost Ouwerkerk, and Dakota Smith, with headquarters in Montreal, Canada.

- The app has registered 120+ million downloads worldwide, making it a top travel app in many markets.

- Hopper’s platform processes about 20 billion priced itineraries per day, or roughly 7 trillion a year, to power price prediction and fintech features.

- In 2023, Hopper’s revenue reached about US$700 million, reflecting strong growth in travel and fintech sales.

- Hopper popularized “Price Freeze,” letting users hold fares for a period before booking; the flight product typically allows holds up to 7 days.

- Fintech add-ons such as Price Freeze and Flight Disruption Guarantee have become central, accounting for about 50% of revenue at one point.

- Hopper launched a B2B arm called Hopper Technology Solutions (HTS), enabling white-label travel portals and fintech distribution for partners.

- A long-term partnership with Capital One led to the creation of Capital One Travel, powered by Hopper’s prediction and flexibility technology.

- Sustainability has been highlighted through Hopper Trees, which funds tree planting linked to bookings, with nonprofit partners like Eden Reforestation Projects and veritree.

- The company reported around 1,200 employees in 2023, reflecting substantial scale for a mobile-first travel marketplace.

- Hopper’s fintech and marketplace innovations helped it achieve a private valuation reported around US$5 billion in prior secondary and funding transactions.

- Younger traveler adoption has been strong, with Hopper citing a user base that is predominantly Gen Z and millennial in North America.

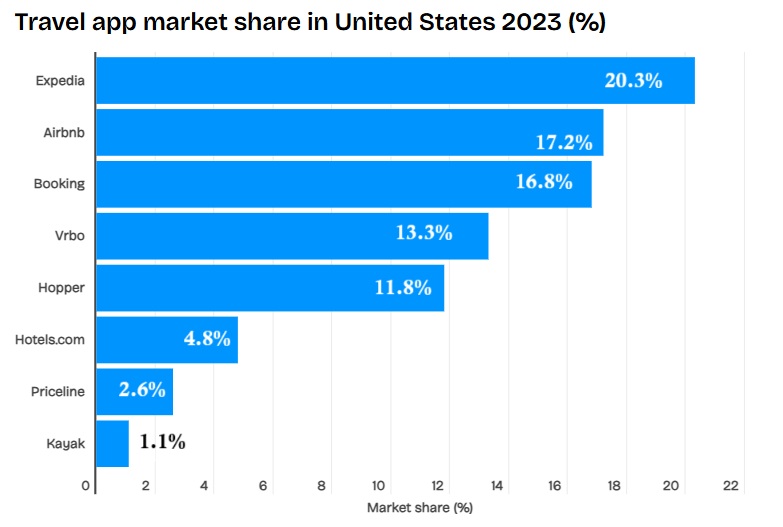

- Hopper holds 11.8% of the travel app market in the United States, placing it among the top five accommodation-booking apps, although its growth has not maintained the same momentum it once had.

- Expedia leads the market with a 20.3% share, making it the strongest competitor in this space.

- Airbnb follows with 17.2%, supported by strong demand for alternative lodging.

- Booking controls 16.8% of the market, keeping it close to the top rivals.

- Vrbo maintains a solid position with 13.3%, driven by interest in vacation rentals.

- Hotels.com accounts for 4.8%, reflecting steady usage among frequent travelers.

- Priceline holds 2.6%, showing a smaller presence in comparison to the leading brands.

- Kayak records 1.1%, indicating limited share in the booking app segment.

Hopper Revenue

| Year |

Revenue ($mm)

|

| 2019 | 45 |

| 2020 | 40 |

| 2021 | 150 |

| 2022 | 500 |

| 2023 | 700 |

| 2024 | 850 |

(Source: businessofapps.com)

- The figures clearly illustrate Hopper’s remarkable revenue growth path from 2019 to 2024.

- The firm’s annual revenue was US$45 million in 2019, followed by a slight decline to US$40 million in 2020, primarily due to the COVID-19 pandemic and its adverse effects on global travel.

- On the other hand, once flight started to recover, Hopper’s trade was quick to ride the wave.

- In 2021, revenue soared to US$150 million, representing a massive 275% increase compared to the previous year.

- Three factors contributed to this growth: the reopening of global travel, the increased use of apps for bookings, and Hopper’s aggressive entry into the hotel and car rental sectors.

- The upward trend did not stop in 2022, as revenues climbed to US$500 million, representing a 233% increase over 2021.

- During this period, the company attracted users through its fintech-style travel tools—like “price freeze” and “cancel for any reason”—which contributed to an increase in per-user revenue.

- Hopper’s output continued to rise in 2023 to the level of US$700 million, representing a relatively moderate +40% increase over the previous year.

- This means that Hopper was transitioning from a rapid post-pandemic recovery growth to a more steady and sustainable expansion phase.

- By 2024, Hopper’s revenue again increased to US$850 million, representing an additional 21% boost.

- Although the growth rate decreased slightly, the company’s continuous rise from day to day demonstrates its stronger position in the global travel-tech market.

- All in all, Hopper’s turnover went up by almost 19 times during the period of 2019 to 2024—an incredible uplift which highlights its transformation from a small travel prediction app to being a significant player in the online travel sector.

Hopper Inc. Overview And Position In The Market

- Hopper Inc., a travel agency on the internet, was founded in 2007 in Montreal, Canada. However, it took six years of development before the company officially launched its platform in 2014.

- The company, established by two former Expedia executives, primarily focuses on mobile travel bookings and offers various fintech-based services, including a price freeze option for flights and hotels.

- Hopper, over its 15-year period, has managed to accumulate funds worth over US$700 million, representing the total sum of its funding.

- In 2022, the company was valued at US$5 billion, which made it one of the highest-valued travel and tourism unicorns worldwide.

- The Hopper mobile application, launched in 2015, has been the primary platform for the company’s services, including flights, hotels, short-term rentals, and car bookings, which are exclusively available on mobile.

- Though transactions are made only on the app, the website hopper.com received more than 4 million visits in March 2023.

- The Hopper app has become very popular very quickly and was ranked as one of the most downloaded online travel agency (OTA) apps worldwide in 2022.

- The largest market for Hopper is in the United States, accounting for almost two-thirds of the company’s total global app downloads in 2022.

- Statista Digital Market Insights indicates that Hopper’s U.S. market share in 2022 was equal to that of Airbnb and Expedia; consequently, it was just behind Vrbo and Booking.com by a slim margin.

- In contrast, Hopper was not listed among the most popular travel applications in Europe for 2022, where Booking.com and Airbnb held a significant share, with approximately 14% and 7% of the region’s travel app revenue, respectively.

Hopper Bookings

| Year |

Bookings ($bn)

|

| 2017 | 0.4 |

| 2018 | 0.5 |

| 2019 | 0.8 |

| 2020 | 0.6 |

| 2021 | 1.1 |

| 2022 | 4.5 |

| 2023 | 5.9 |

| 2024 | 7.5 |

(Source: businessofapps.com)

- The data provides a vivid depiction of the total bookings of Hopper soaring to an impressive level from 2017 to 2024.

- This growth trajectory illustrates how the company changed its nature from a small travel app to a leading online travel provider with a global footprint.

- In 2017, Hopper’s bookings were worth US$0.4 billion; subsequently, they increased slightly to US$0.5 billion in 2018.

- The app’s total bookings of US$0.8 billion in 2019 were an indication of the rise in user base and the expansion of the choice given in flights and hotels; this was also the result of the app’s steady rise.

- The pandemic caused by COVID-19, combined with a simultaneous drop in global travel demand, made 2020 a challenging year for Hopper.

- The bookings figure decreased to US$0.6 billion, representing a 25% decline from the previous year’s figure.

- Nonetheless, the company did not take long to recover; they had come back strong in 2021 when the travel restrictions were lifted and mobile travel bookings once again gained momentum with US$1.1 billion in bookings—a return of +83% from 2020.

- 2022 was a year of exceptionally strong growth for Hopper, as it reached $ 4.5 billion in total bookings, representing a 309% increase over the previous year.

- The international travel recovery, Hopper’s innovative financial technology features like “price freeze” and “cancel for any reason”, and collaborations with airlines and hotels that brought new users were the main reasons for the rapid growth.

- The trend was similar in 2023, with bookings increasing to US$5.9 billion, representing a 31% growth compared to the previous year.

- Bookings were estimated at US$7.5 billion in 2024, indicating another +27% growth.

- The continuous upward trend is a clear indication of Hopper’s capability to scale its business and seize more market share in the crowded online travel industry.

Hopper Downloads

| Year |

Downloads (mm)

|

| 2018 | 7.7 |

| 2019 | 6.7 |

| 2020 | 4.4 |

| 2021 | 12.5 |

| 2022 | 15.2 |

| 2023 | 18.7 |

| 2024 | 4.5 |

(Source: businessofapps.com)

- The graph illustrates the change in the number of downloads of Hopper’s mobile application from 2018 to 2024, reflecting the company’s growth and the evolution of the travel industry.

- Hopper’s total for 2018 was 7.7 million downloads, which was a sign of strong acceptance of mobile-based travel bookings as a new convenience.

- In 2019, downloads decreased slightly to 6.7 million; the reasons could be either market competition or weaker marketing efforts that year.

- The year 2020 saw the biggest fall in downloads to 4.4 million, a decrease that corresponds to the drastic reduction in travel worldwide due to the COVID-19 pandemic.

- The travel app market was bolstered by travel restrictions on both international and domestic travel, resulting in a decline in travel demand.

- The market, however, was highly elastic and quickly rebounded as soon as travel restrictions were lifted again. In 2021, Hopper downloads increased to 12.5 million, nearly three times the number in 2020.

- The rebound was so strong that it lasted through 2022, when the number reached 15.2 million. By 2023, the count had increased to 18.7 million, thus confirming the post-pandemic trend and consumers’ acceptance of digital tools for travel.

- As for 2024, downloads dropped to 4.5 million, a significant decline compared to the previous year.

- This may mean the market is saturated, the demand for travel apps has decreased after the initial surge during recovery, or it may be that the new user acquisition is very limited as Hopper is now all about monetizing and retaining the users rather than expanding rapidly.

- The total number of downloads of Hopper between 2018 and 2023 increased by 143%; thus, this period was marked by tremendous success in user attraction in its peak years.

A Rapidly Growing AI-Powered Travel Tech Platform

- Stack Capital has invested US$6 million in Hopper Inc., one of the world’s fastest-growing AI-based travel tech platforms.

- The company, which was first recognized for its AI-supplemented flight price prediction app, has gradually transformed into a complete travel solutions provider – thereby giving a firm hand both over the revenue-generated base and the scalability aspect.

- Throughout its history, Hopper has shown nothing but creativity and growth. It gradually replaced aeroplane tickets with hotel rooms and car rentals – all these activities creating cross-selling chances within the company.

- The beginning of 2022 saw the launch of Hopper Homes, providing short-term home rentals that give customers access to more than two million professionally managed apartments and houses spread across 200 countries and 90,000 cities.

- According to AirDNA, the world’s short-term rental industry generated US$113 billion in revenue in 2021, representing a 5.3% increase from 2019. This indicates that the sector is undoubtedly a lucrative opportunity.

- Moreover, Hopper’s expansion strategy surrounding the fintech travel solutions, such as “Cancel for Any Reason,” “Price Prediction,” “Price Drop Guarantee,” and “Price Freeze”, has been one of the company’s most brilliant moves.

- All these features are now regarded as priceless in the post-pandemic era, and travellers are the ones demanding them the most. In addition to this, Hopper introduced a customer loyalty program called “Carrot Cash,” where users earn 1%–5% money back on every booking.

- Hopper Cloud enables partnerships to sell fintech tools to their customers, thereby increasing their average order value, making them more profitable, and enhancing customer satisfaction.

- If all global travel distributors were to use technology that supports payments, it is predicted that there will be a US$200 billion increase in annual consumer spending in the industry.

- Hopper’s B2B segment includes, among other things, a travel affiliate program and a customizable rewards program. Most significant in this area is the partnership with Capital One, a leading investor in Hopper.

- They jointly created Capital One Travel, an exclusive booking platform for Capital One cardholders, especially for its Venture X premium credit card—a direct competitor to Amex Platinum and Chase Sapphire Reserve, among others.

- In addition to Capital One, Hopper has also partnered with Kayak, Marriott, Trip.com, and Amadeus, thereby positioning itself as a significant player in both B2C and B2B travel markets.

- Hopper is on the right track in becoming a “super-app” for travel by offering an all-in-one solution that includes an award-winning mobile app, innovative fintech features, B2B cloud technology, and reward-based loyalty programs.

- With the company’s growing user population and product ecosystem, the value of integrated products is predicted to be the main factor that will keep and even strengthen Hopper’s leading brand position in the future digital travel experiences.

Conclusion

Hopper Statistics: Hopper’s metamorphosis from a flight predictor to a travel “super-app” has been nothing less than an embodiment of the company’s values: innovation, scalability, and customer satisfaction. Besides, Hopper Cloud, partnerships with Capital One and major travel companies, and a growing range of fintech products have led the company to take a prominent position in the B2C and B2B travel markets.

The rest of the industry may face market saturation and changing competition as obstacles; nevertheless, the frequent sales, bookings, and user interaction increases at Hopper are indicators of a very strong market presence. When the travel sector finally gets through its digitalisation, Hopper will be there and will even be the one to define the next generation of intelligent, tech-based travel experiences.

FAQ.

Hopper is an app primarily designed for mobile devices that enables users to book flights, hotels, car rentals, and travel houses at the best rates possible through the use of AI and predictive analytics. The application predicts the future prices of flights and hotels with a very high degree of accuracy, thus notifying users when they can book at the lowest rates. The app is the only platform for the entire transaction, and the app has been downloaded by millions of users worldwide.

Hopper has experienced a remarkable increase in revenue through the years, growing from US$45 million in 2019 to US$850 million in 2024, which is almost a 19-fold increase. The company’s revenue slightly decreased in 2020 due to the COVID-19 restrictions, but then quickly recovered in the travel sector. In 2022, Hopper was able to achieve US$500 million in revenue, which was mainly due to the company’s fintech features and the increasing number of customers.

The period between 2018 and 2023 saw a significant increase in the number of Hopper app downloads. Global acceptance was proven through the growth from 7.7 million to 18.7 million. The year 2020, which was the pandemic year, had a decline to 4.4 million; however, the downloads were very high as travel was allowed again. By 2024, the number of downloads was back to 4.5 million, which was probably a result of the market getting saturated as well as the company’s deliberate focus on keeping users rather than rapid growth through new users.

Hopper has not restricted itself to the area of booking only but has also involved itself in travel-related services like fintech and home rentals. The company launched its Hopper Homes feature in 2022, offering short-term rental of more than 2 million houses across 200 countries and 90,000 cities.

The future of Hopper appears to be bright as it gets transformed into the “travel super-app.” Hopper’s application of AI technology, fintech, and partnerships gives it a great opportunity to take the lead in digital travel innovation. Analysts predict that the adoption of travel fintech tools such as Hopper’s could result in US$200 billion extra yearly consumer spending across the board.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.