Smartwatch Statistics By Vendors, Revenue And Number Of Users

Updated · Mar 24, 2025

Table of Contents

- Introduction

- Editor’s Choice

- Top Smartwatch Vendors

- By Revenue

- Penetration Rate Of Smartwatches In The Consumer Market

- Number Of Smartwatch Users

- Users In The Digital Well-Being Segment

- Global Smartwatch Adoption

- Smartwatch and Fitness Tracker Adoption in the U.S.

- Projected Smartwatch Sales for 2024

- Smartwatch User Demographics

- Global Smartwatch Usage by Country

- Smartwatch Market Forecast

- Smartwatch Data Predicts Health Test Results

- Smart Devices and Health Data Sharing

- Apple Watch Sales

- Average Selling Price of Smartwatches

- Consumer Preferences and Trends

- Regional Analysis

- Sales by Operating System

- Financial Impact

- Competitive Landscape

- Marketing and Distribution Channels

- Environmental and Sustainability Considerations

- Smartwatch in Niche Markets

- Recent Developments

- Conclusion

Introduction

Smartwatch Statistics: A smartwatch is a wearable device that represents a miniature smartphone and is typically operated via a touch screen. Many of its settings are managed through mobile applications that connect the smartwatch and handle several core functions.

As of 2024, smartwatches are among the most popular gadgets in demand among digital consumers. It would be fascinating to gather valuable insights from Smartwatch Statistics, as they provide vital information about the behavior and market trends related to smartwatches.

Editor’s Choice

- Apple has been the leader in wearable shipments since Q1 2015, with its highest performance in Q4 2021.

- The global smartwatch market revenue is expected to reach USD 40.57 billion by 2029.

- The penetration rate of smartwatches is projected to reach 9.19% by 2029, with the global user count expected to hit 740.53 million.

- The digital fitness and well-being market is anticipated to serve 2,114.6 million users by 2029.

- The smartwatch market is growing at a compound annual growth rate (CAGR) of approximately 15.5% from 2023 to 2024.

- Health and fitness tracking features are key drivers of smartwatch sales, with 70% of consumers likely to prioritize these features by 2024.

- Online sales are predicted to account for 60% of total smartwatch sales by 2024.

- By 2024, around 20% of smartwatches are expected to be made from recycled or eco-friendly materials.

- Niche smartwatches designed for specific activities are expected to grow to 14% of total sales by 2024.

- There are 224.31 million smartwatch users worldwide as of 2024.

- Nearly 180 million smartwatches are forecasted to be shipped in 2024.

- The smartwatch market revenue is anticipated to reach $47.94 billion in 2024.

- The global smartwatch market is valued at around $50.57 billion as of 2024.

- Apple holds 30% of the global smartwatch market share.

- The penetration rate of smartwatch users is expected to be 2.89% in 2024.

- 23% of men and 21.8% of women globally own a smartwatch.

- In the United States, 12.2% of the population uses a smartwatch or a fitness tracker.

- 3 in 10 working-age internet users own a “smart wrist” device like a smartwatch or fitness tracker.

- 92% of smartwatch users utilize them to maintain their health and fitness.

Top Smartwatch Vendors

(Reference: Statista.com)

- By referring to Smartwatch statistics, one can gain valuable insights into top smartwatch vendors

- Apple's Market Leadership: Apple consistently leads in wearable shipments since Q1 2015, with peak performance in Q4 2021.

- Xiaomi's Rapid Growth: Xiaomi entered in Q1 2016 and quickly became a significant player, often ranking second in shipments.

- Steady Presence of Huawei: Huawei became noticeable around Q1 2017, with a peak in shipments by Q1 2020.

- Samsung's Consistent Growth: Samsung shows steady shipment growth, especially post-Q1 2018.

- Decline of Fitbit: Fitbit's early dominance (2014-2017) declines as Apple and Xiaomi rise.

- Emergence of BoAt and Imagine Marketing: These newer players show significant growth, especially after 2020.

- BBK's Significant Entry: BBK sees notable growth, particularly around Q4 2021.

- Overall Market Expansion: Wearable shipments proliferated, especially from Q1 2018, with significant spikes in Q4 2020 and Q4 2021.

- Seasonal Trends: Q4 shows the highest shipments annually, indicating strong holiday season sales.

- Smartwatch Focus: The chart reflects the growth and competition in the smartwatch market, with Apple leading and other brands making substantial gains.

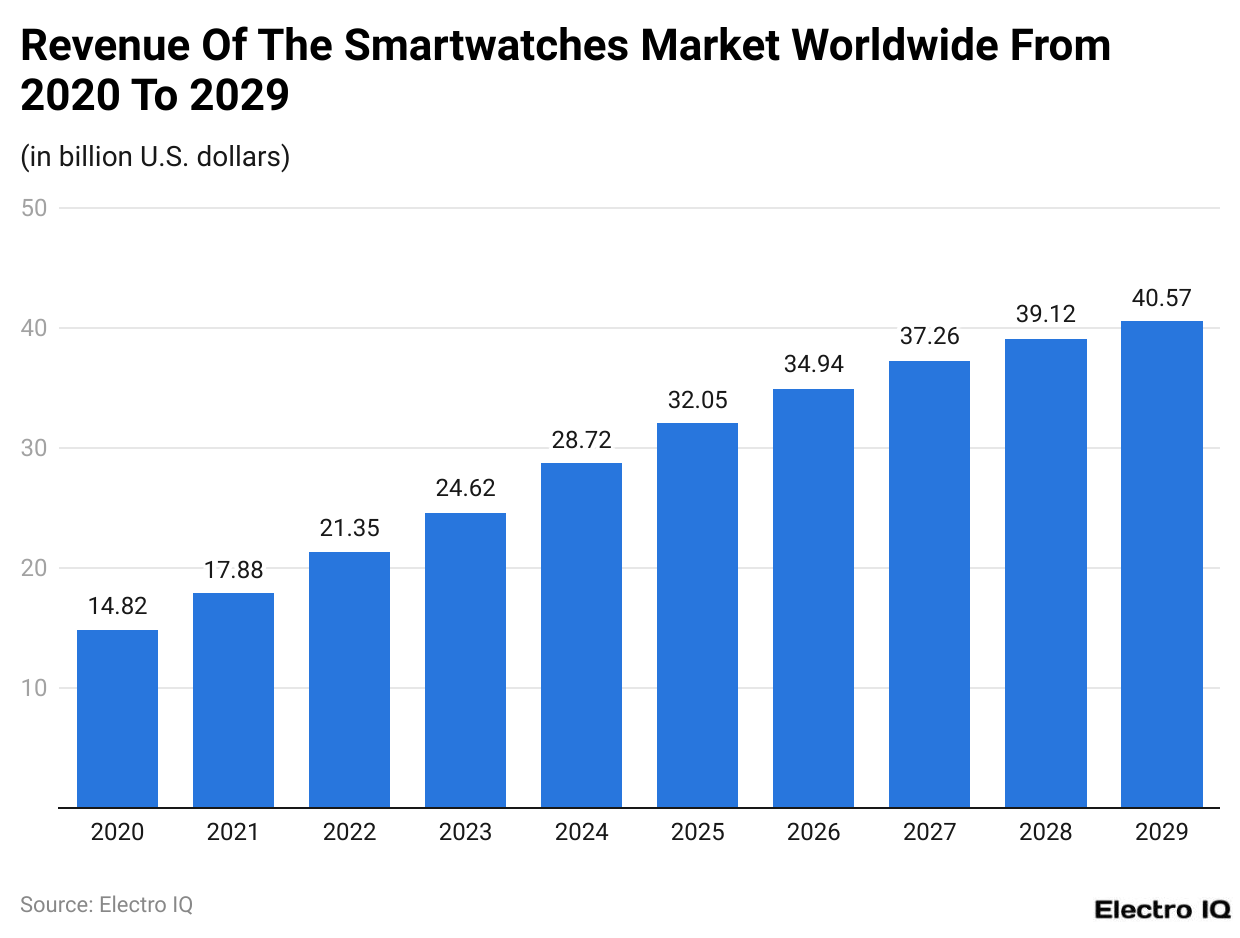

By Revenue

(Reference: Statista.com)

- Based on Smartwatch statistics, it is visible that the revenue of Smartwatch is growing consistently.

- In 2020, the smartwatch market was $14.82 billion, but it has reached an impressive $28.72 billion in 2023.

- It is predicted to reach $40.57 billion in 2029.

Penetration Rate Of Smartwatches In The Consumer Market

(Reference: Statista.com)

- As per Smartwatch statistics, the penetration rate is impressive, and there is rising popularity among consumers.

- In 2020, the penetration rate was 1.3%.

- In 2023, the penetration rate reached 4.22%.

- According to trends, the penetration rate is expected to reach 9.19%.

Number Of Smartwatch Users

(Reference: Statista.com)

- If one refers to the Smartwatch statistics, the global user base in the 'Smartwatches' segment of the digital health market is projected to grow significantly from 2024 to 2029.

- The number of users is expected to increase by 285.8 million, marking a 62.86% growth.

- By 2029, the user count is estimated to reach a new peak of 740.53 million users, marking the ninth consecutive year of growth.

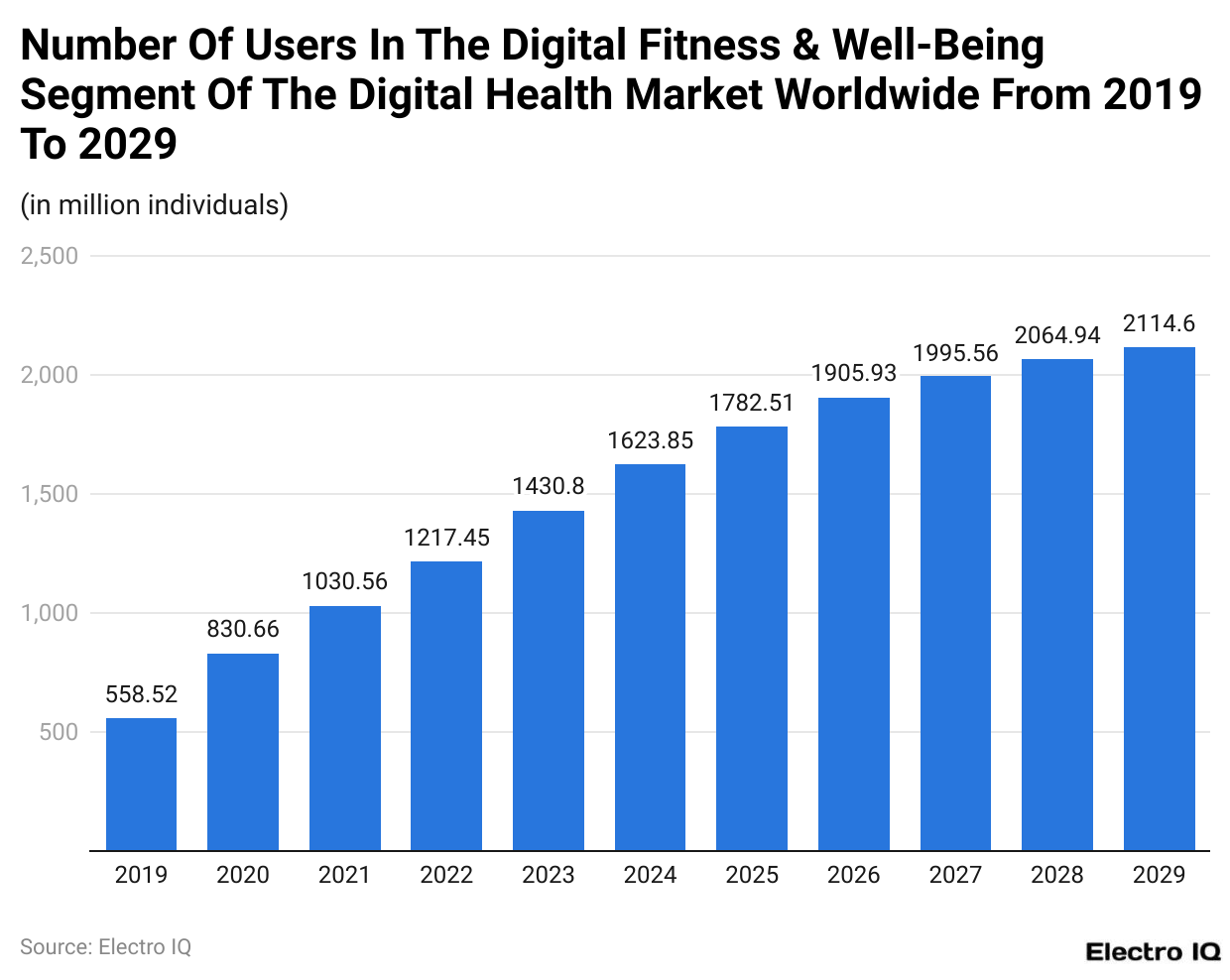

Users In The Digital Well-Being Segment

(Reference: Statista.com)

- Based on smartwatch statistics, one can infer that there is rising growth in smartwatch usage.

- In 2023, the smartwatch had 1,403.8 million users.

- Going by this trend, the usage will reach 2,114.6 million users by 2029.

Global Smartwatch Adoption

- Smartwatch Ownership: Approximately 22.5% of global internet users, or 1.2 billion people, now own a smartwatch, marking a 9% increase from the previous year.

- Country-Specific Adoption Rates:

- United Arab Emirates: Leads globally with 33.4% of internet users owning a smartwatch (around 3.1 million people).

- Czech Republic: 31.6% adoption rate among internet users, representing 3 million people.

- Hong Kong: 30.6% of internet users own smartwatches, equating to 2.1 million users.

- India: 29.1% adoption rate, which translates to 201.4 million users.

- Poland: 28.8% of internet users, or approximately 10.6 million people, own a smartwatch.

- United States: 26% of internet users own a smartwatch, equating to roughly 80.9 million people, slightly above the global average.

- Canada: Shows a lower adoption rate with 21.8% of internet users owning a smartwatch.

- Low Adoption Countries:

- Japan: Despite high internet penetration, only 8.6% of internet users own a smartwatch.

- Morocco: 6.4% adoption rate among internet users.

- Ghana: 5.9% adoption rate among internet users.

- Demographics: The primary group adopting smartwatches includes internet users aged 25 to 34, with 27.2% of females and 26.9% of males owning these devices.

- Market Leader: Apple dominated the smartwatch market in 2022, selling 50 million units globally.

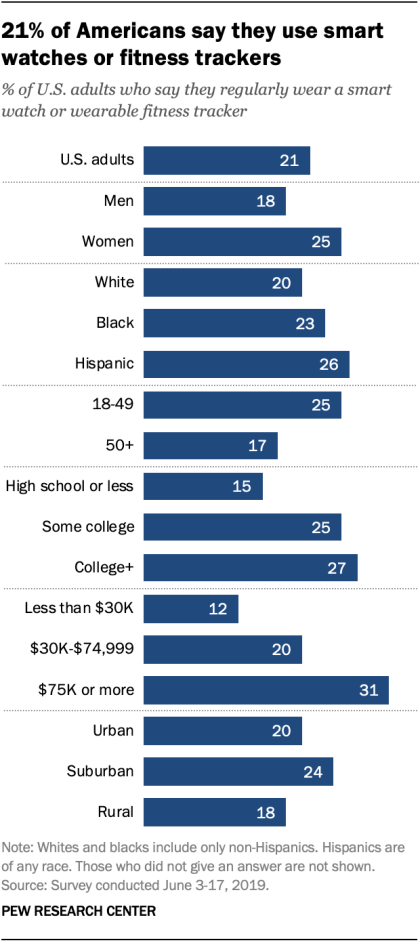

Smartwatch and Fitness Tracker Adoption in the U.S.

- As of 2020, about 21% of U.S. adults regularly use smartwatches or fitness trackers, according to a survey by the Pew Research Center conducted in mid-2019.

- Usage of these devices varies significantly by income and education. For instance, 31% of Americans earning $75,000 or more annually use these devices, compared to only 12% of those earning below $30,000.

- College graduates are more likely to adopt smartwatches or fitness trackers compared to those with only a high school education.

- Gender differences exist, with 25% of women using these devices regularly, compared to 18% of men.

- Hispanic adults show higher usage rates (26%) compared to white adults (20%) and black adults (23%).

- Fitness trackers collect various data on physical activities, which can be monitored via companion apps. This data collection has raised concerns about privacy, especially regarding who can access the data.

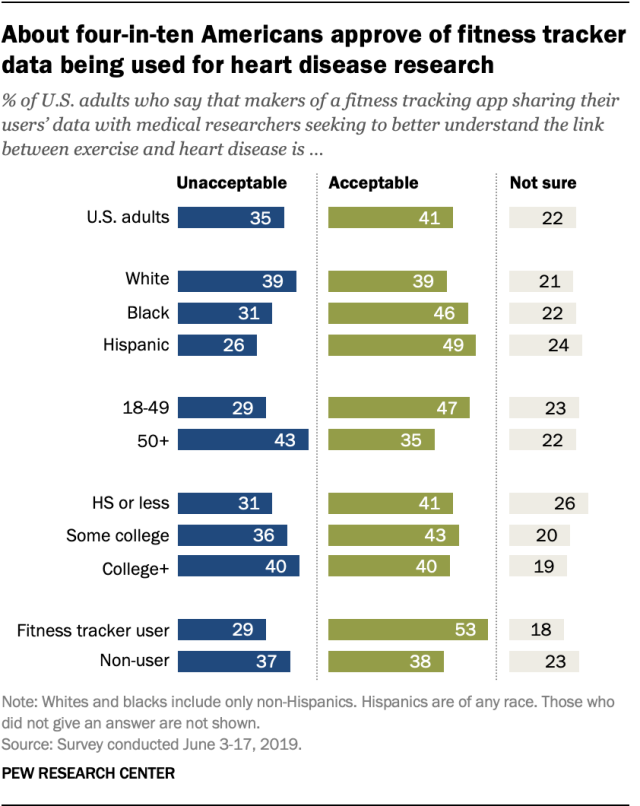

- Approximately 41% of Americans approve of fitness tracker data being used for heart disease research, while 35% find it unacceptable, and 22% are unsure.

- Younger adults (under 50) are more supportive (47%) of sharing data with researchers compared to those aged 50 and older (35%).

- Users of fitness trackers are more likely to approve of sharing their data with health researchers (53%) compared to non-users (38%).

Projected Smartwatch Sales for 2024

- Sales Projection for 2024: Approximately 180 million smartwatches are predicted to be shipped globally in 2024.

- Comparison to Previous Years:

- In 2023, the number of smartwatches sold was expected to be around 184 million.

- This represents a 16% increase compared to 2022, when 173 million units were shipped.

- Regional Growth: The demand in India is expected to rise significantly, with a projected 75% increase in smartwatch sales.

- Market Leaders: Companies like Apple, Google, Garmin, and Samsung continue to lead the market, despite a 7% decline in their sales in 2022. Their combined sales were expected to remain flat at 107 million units in 2023.

Smartwatch User Demographics

- 23% of men worldwide own a smartwatch, compared to 21.8% of women, indicating men are slightly more likely to own one.

- Men are generally early adopters of new technology and are influenced by technical specifications when making purchasing decisions.

- Women prioritize the practical value a smartwatch brings to their lives.

- Some women believe the size and design of smartwatches are not well-suited to their wrists.

- Among internet users aged 25 to 34, women are more likely to own a smartwatch than men.

- The overall ratio of smartwatch users is 60% male to 40% female.

- Age group breakdown of smartwatch ownership:

-

- 16 to 24 years: 19.6% female, 21.0% male

- 25 to 34 years: 27.2% female, 26.9% male

- 35 to 44 years: 24.5% female, 25.5% male

- 45 to 54 years: 18.6% female, 20.9% male

- 55 to 64 years: 12.7% female, 16.1% male

| Age Group | Percentage Of Female Smartwatch Users | Percentage Of Male Smartwatch Users |

|---|---|---|

| 16 to 24 years | 19.6% | 21.0% |

| 25 to 34 years | 27.2% | 26.9% |

| 35 to 44 years | 24.5% | 25.5% |

| 45 to 54 years | 18.6% | 20.9% |

| 55 to 64 years | 12.7% | 16.1% |

Global Smartwatch Usage by Country

- 14.4% of the global population uses smart wristbands or smartwatches.

- In Poland, 26.5% of internet users wear a smart wristband, making it the country with the highest usage rate.

- China follows with 20.9% of internet users using smart wristbands.

- In the United Kingdom, 15.0% of internet users use a smart wristband.

- Germany has a usage rate of 14.5%.

- India reports 13.8% of internet users with smart wristbands.

- In the United States, 12.2% of internet users use a smartwatch or fitness tracker.

- France has a similar usage rate of 12.1%.

- Japan shows a lower usage rate, with only 2.4% of internet users using smart wristbands.

- Morocco has the lowest usage rate at 2.1%.

| Country | Share Of Internet Users Using Wristbands |

|---|---|

| Poland | 26.5% |

| China | 20.9% |

| United Kingdom | 15.0% |

| Germany | 14.5% |

| India | 13.8% |

| United States | 12.2% |

| France | 12.1% |

| Japan | 2.4% |

| Morocco | 2.1% |

Smartwatch Market Forecast

- Market Size and Growth: The global smartwatch market is projected to reach USD 138.7 billion by 2033, up from USD 39.1 billion in 2023, growing at a CAGR of 13.5% from 2024 to 2033.

- Definition and Functionality: A smartwatch is a wearable device that functions as both a traditional wristwatch and a smartphone. It offers features such as timekeeping, fitness tracking, message notifications, and app integration.

- Growth Drivers: Technological advancements, shifting consumer preferences, and a growing focus on health and fitness have significantly contributed to the market’s expansion.

- Technological Advancements: Improvements in processors, battery life, and sensors have enabled smartwatches to offer advanced features like heart rate monitoring, GPS, and health tracking.

- Market Challenges: A key challenge is the dependence on smartphone connectivity, which limits the functionality of many smartwatches. However, there is ongoing development of standalone smartwatches with built-in cellular connectivity.

- User Demographics: As of 2024, there are approximately 24.31 million smartwatch users globally. Users aged 35-54 represent around 30% of the market, while those aged 55 and above make up 15%. Approximately 35% of smartwatch users are male, and 28% are female.

- Regional Insights: China leads the global smartwatch market with a 60% share of cellular smartwatches. In the United States, smartwatch ownership has more than doubled since 2016, with 26% of households now owning a smartwatch.

- Popular Operating Systems: Android-based smartwatches held a dominant 37.7% market share in 2023, driven by the widespread use of Android smartphones and the flexibility of the Android platform.

- Display Technology: OLED displays dominated the market in 2023, capturing an 88.5% share due to their superior color reproduction, contrast ratios, and energy efficiency.

- Communication Features: In 2023, smartwatches with communication features, including calls and messaging, led the market with a 35.0% share, driven by the demand for real-time communication tools.

- Regional Market Leadership: North America held a 39.4% share of the global smartwatch market in 2023, supported by high smartphone penetration, advanced technology infrastructure, and consumer awareness of health and fitness benefits.

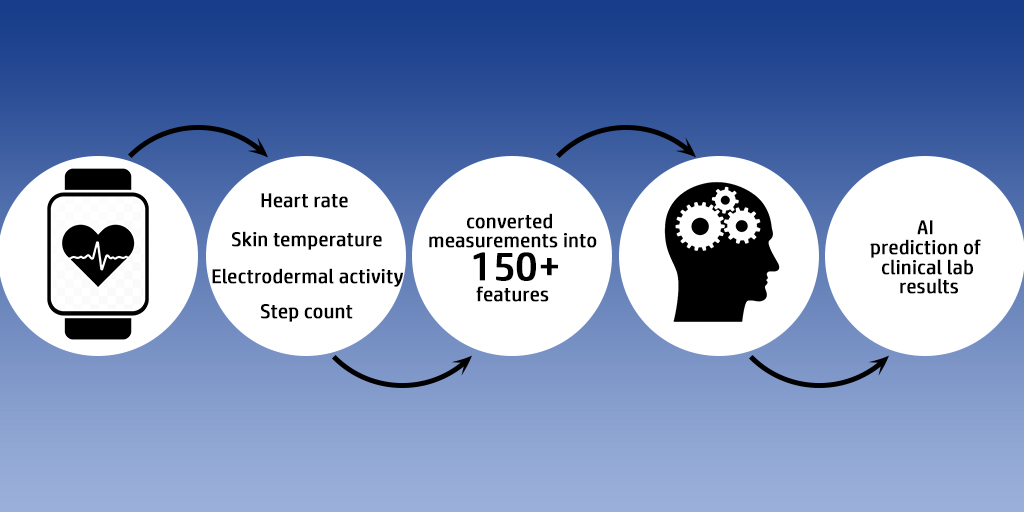

Smartwatch Data Predicts Health Test Results

- Wearable Devices and Health Monitoring: Researchers funded by the NIH are exploring how data from smartwatches can predict clinical test results, offering potential early warnings for health issues.

- Study Overview: The study followed 54 participants over three years, collecting data from smartwatches, including heart rate, skin temperature, step count, and electrodermal activity.

- Comparison with Clinical Data: The smartwatch data was compared with clinical measurements, revealing that heart rate readings from smartwatches were more consistent than those taken in clinical settings.

- Predictive Modeling: Using machine learning, researchers converted smartwatch data into over 150 features to predict clinical test results, including red blood cell count, hemoglobin levels, and more.

- Key Findings: Electrodermal activity, step count, and skin temperature were significant predictors for specific blood tests. The data from smartwatches could act as an early warning system rather than replacing clinical tests.

- Potential Impact: This approach could shift healthcare towards earlier detection of diseases, helping to intercept illnesses before they become severe.

Smart Devices and Health Data Sharing

- Smart devices like smartphones and smartwatches are rapidly being adopted, offering new opportunities for health monitoring and research.

- In the southeastern US, a study surveyed 1,368 patients from an academic health system about their smart device usage and willingness to share health data.

- Key Findings:

- Ownership: 98% of respondents owned a smartphone, and 59% owned a wearable device.

- Demographics: Ownership of wearables was higher among females, Hispanic individuals, Generation Z (ages 18-25), those with higher education, and full-time employees.

- Data Sharing: 50% of smart device owners were willing to share their health data for research, with 32% considering it.

- Usage of Data: Data sharing preferences varied based on gender, age, education, and employment status.

- The study suggests that the increasing adoption of smart devices could significantly contribute to digital health studies, helping to develop more equitable and effective healthcare technologies.

- Technological advancements in smart devices are enabling more sophisticated and affordable tools for health monitoring, with widespread ownership among the general population.

- Real-world data (RWD) from these devices offers a valuable resource for monitoring health, tracking diseases, and conducting clinical trials, particularly in areas like cardiovascular diseases, cancer, and diabetes.

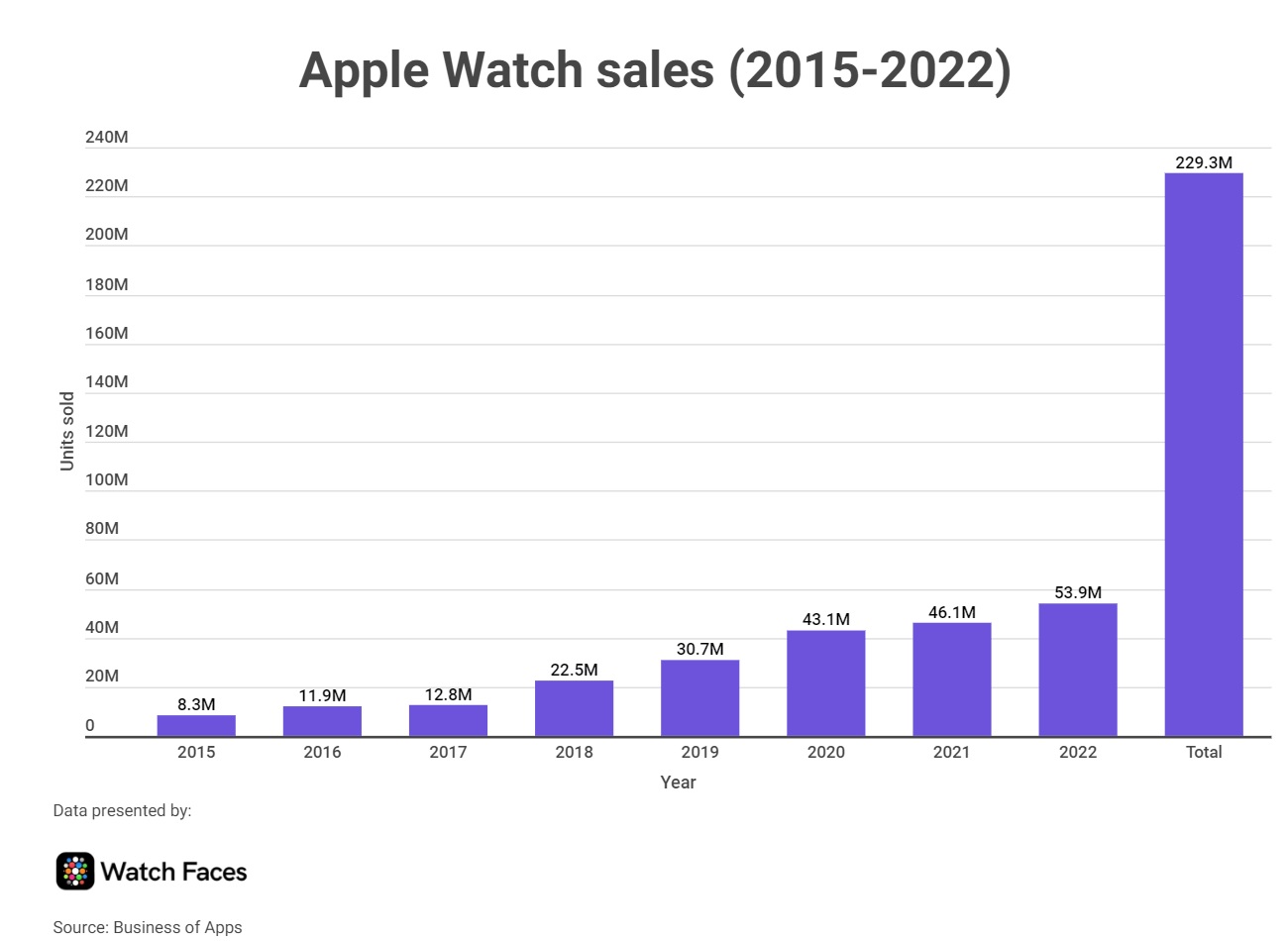

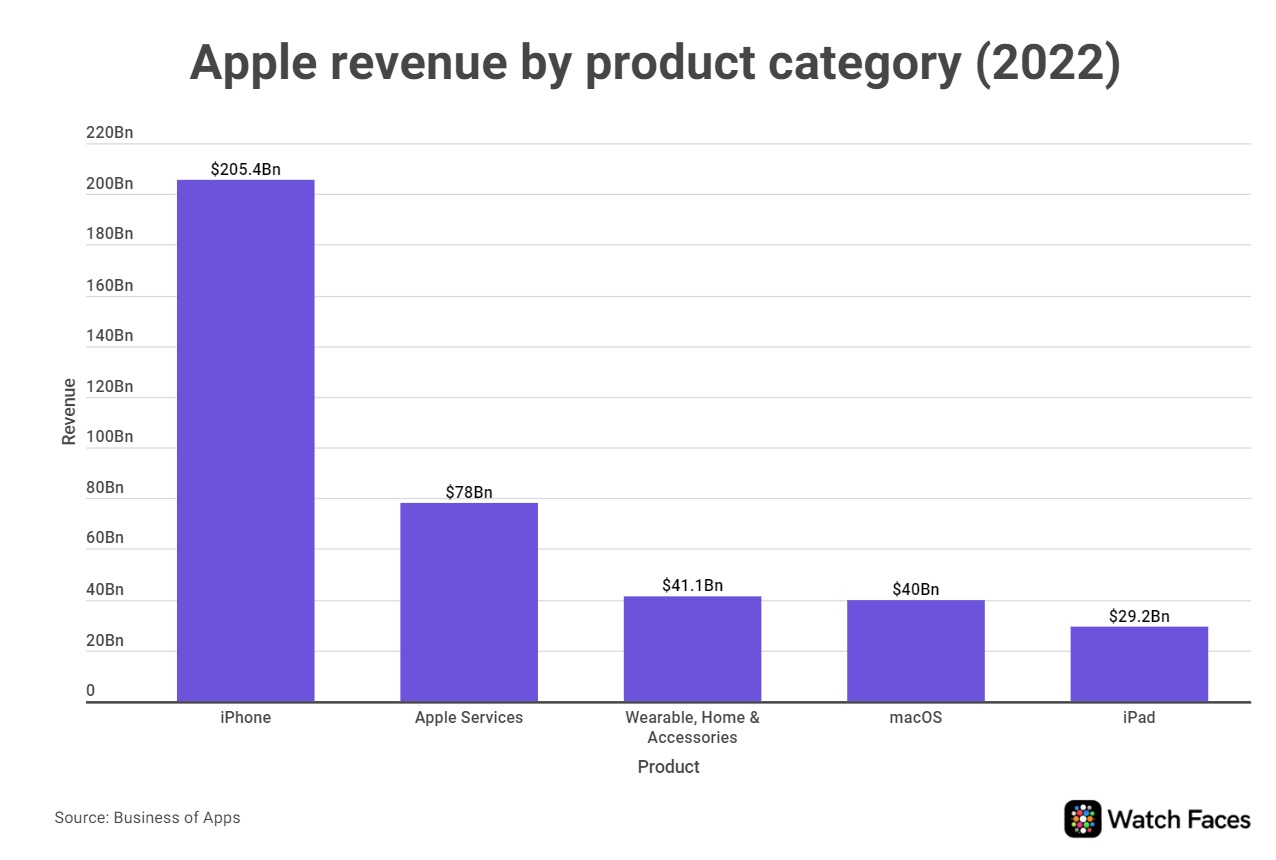

Apple Watch Sales

- Apple Watch sales reached 53.9 million units in 2022, marking the first time sales surpassed the 50 million mark.

- Since its launch in 2015, the Apple Watch has sold 229.3 million units globally.

- The Apple Watch is now Apple’s fourth best-selling product, following the iPhone, iPad, and AirPods.

- In 2022, Apple held 34.1% of the global smartwatch market in terms of shipments and captured 60% of the market's revenue.

- The Apple Watch’s success is attributed to its integration with the Apple ecosystem, offering a seamless user experience.

- In 2022, Apple’s Wearable, Home, and Accessory segment generated $41.1 billion in revenue, with the Apple Watch contributing an estimated $14 billion to $18 billion.

- Despite not inventing the smartwatch, Apple quickly surpassed competitors like Fitbit and Garmin, becoming the market leader.

- The Apple Watch's features, including health monitoring, fitness tracking, and customization options, have made it both a functional device and a fashion statement.

Average Selling Price of Smartwatches

- The average selling price (ASP) of smartwatches was around US dollars 259 in 2023. This reflects the diverse range of products available in the market, from high-end models like the Apple Watch Ultra to more affordable options from brands like Amazfit and Fitbit.

- In 2024, the ASP is expected to increase slightly to US dollars 265 as manufacturers introduce more premium models with advanced features such as better health monitoring, longer battery life, and enhanced durability. This increase in ASP also indicates a shift in consumer preference towards high-quality smartwatches that offer better value for money.

Consumer Preferences and Trends

- In 2023, health and fitness tracking remained the most sought-after feature among smartwatch users, with over 65% of consumers citing it as a primary reason for purchasing a smartwatch. Heart rate monitoring, sleep tracking, and step counting are the most popular health-related features. The integration of ECG and blood oxygen level monitoring in high-end models also contributed to the growing demand for smartwatches.

- By 2024, it is expected that the focus on health and wellness will continue to drive smartwatch sales, with an estimated 70% of consumers prioritizing these features. Additionally, the demand for smartwatches with extended battery life and advanced connectivity options, such as LTE and 5G, is expected to rise, reflecting the evolving needs of tech-savvy consumers.

Regional Analysis

- The Asia-Pacific region emerged as the largest market for smartwatches in 2023, accounting for 35% of global sales. This growth is primarily driven by the increasing adoption of smartwatches in countries like China and India, where consumers are becoming more health-conscious and tech-savvy. The presence of major manufacturers such as Huawei, Xiaomi, and Oppo also contributes to the region’s dominance.

- In 2024, the Asia-Pacific region is expected to maintain its lead, with a market share of 37%. The region's growing middle class, coupled with the availability of affordable smartwatches, will continue to fuel demand. North America is expected to follow, with a market share of 28%, driven by strong sales of high-end models from Apple and Fitbit.

Sales by Operating System

- As of 2023, watchOS, the operating system used by Apple Watch, held the largest market share, accounting for 32% of global smartwatch sales. Wear OS, used by Samsung and other Android-compatible smartwatches, followed with a market share of 25%. Proprietary operating systems used by brands like Fitbit and Garmin accounted for the remaining 43% of the market.

- In 2024, watchOS is expected to see a slight decline in market share to 31% as Wear OS continues to gain popularity, reaching a market share of 27%. Proprietary operating systems are expected to hold steady at 42% as brands continue to differentiate themselves through unique features and user experiences.

Financial Impact

- The financial impact of the growing smartwatch market is significant. In 2023, the industry generated revenue of approximately US dollars 23.1 billion, with an estimated profit margin of 12%. This reflects the profitability of high-end smartwatches, particularly those from Apple and Samsung, which command higher prices and enjoy strong brand loyalty.

- By 2024, the industry’s revenue is expected to increase to US dollars 26.8 billion, with a profit margin of 13%. The growth in revenue and profitability is driven by the continued expansion of the market, the introduction of new models with premium features, and the increasing adoption of smartwatches across different demographic groups.

Competitive Landscape

- The competitive landscape of the smartwatch market is becoming increasingly crowded, with both established brands and new entrants vying for market share. In 2023, Apple and Samsung continued to dominate the market, but Chinese brands like Huawei and Xiaomi made significant gains, particularly in the Asia-Pacific region.

- In 2024, competition is expected to intensify as more brands enter the market, offering a wide range of products at different price points. Startups and smaller companies are also expected to introduce innovative features and designs, challenging the dominance of established players. This competitive environment is likely to lead to more choices for consumers and potentially lower prices for entry-level models.

Marketing and Distribution Channels

- Marketing and distribution channels play a critical role in the success of smartwatch brands. In 2023, online sales accounted for approximately 55% of total smartwatch sales, reflecting the growing preference for e-commerce platforms among consumers. Brick-and-mortar stores accounted for the remaining 45% of sales, with strong performance in regions like North America and Europe.

- In 2024, the trend towards online shopping is expected to continue, with online sales projected to reach 60% of total sales. Brands are increasingly investing in digital marketing strategies, including social media campaigns and influencer partnerships, to reach a broader audience. Additionally, the use of direct-to-consumer (DTC) channels is expected to increase, allowing brands to maintain better control over pricing and customer experience.

Environmental and Sustainability Considerations

- Sustainability is becoming an increasingly important factor in the smartwatch market. In 2023, several brands, including Apple and Garmin, introduced smartwatches made from recycled materials and with eco-friendly packaging. These initiatives are part of a broader trend toward sustainability in the consumer electronics industry.

- In 2024, it is expected that more brands will adopt sustainable practices, with an estimated 20% of smartwatches being made from recycled or eco-friendly materials. Consumers are increasingly considering the environmental impact of their purchases, and brands that prioritize sustainability are likely to gain a competitive advantage.

Smartwatch in Niche Markets

- While the mainstream smartwatch market continues to grow, there are also opportunities in niche markets. In 2023, the market for smartwatches designed for specific activities, such as diving, hiking, and extreme sports, accounted for 12% of total sales. These niche markets are characterized by higher price points and specialized features, such as enhanced durability and water resistance.

- In 2024, the market share of niche smartwatches is expected to increase to 14% as consumers seek products tailored to their specific needs. Brands that focus on these niche markets are likely to benefit from higher profit margins and strong brand loyalty among enthusiasts.

Recent Developments

Product Launches

- Apple Watch Series 10: Apple is expected to release the Apple Watch Series 10 in 2024, marking a decade since the launch of the original Apple Watch. The new model is rumored to feature a slightly larger display and improved health tracking capabilities.

- Samsung Galaxy Watch 7 and Ultra: Samsung is set to launch the Galaxy Watch 7 and a higher-end Galaxy Watch Ultra in 2024, featuring advancements in battery life, health sensors, and AI-focused functionalities.

- CMF by Nothing: In September 2023, CMF, a sub-brand of Nothing, launched the CMF Watch Pro, featuring a sleek aluminum alloy frame, a large 1.96-inch AMOLED display, and extensive health tracking features, including real-time heart rate and blood oxygen saturation monitoring.

- Fire-Boltt Dream Wristphone: Launched in January 2024, this Android-based smartwatch comes with a 2.02-inch display and offers functionalities akin to a smartphone, aiming to redefine wearable technology.

Mergers and Acquisitions

- Google's Potential Acquisitions: In 2024, Google is anticipated to make strategic acquisitions in the smartwatch sector to bolster its position in the wearables market, particularly focusing on expanding the capabilities of its Pixel Watch lineup.

Technological Advancements

- NoiseFit Grace: In February 2024, Noise launched the NoiseFit Grace smartwatch, featuring AI voice assistance, Bluetooth calling, and an AMOLED display with high brightness, targeting tech-savvy consumers looking for advanced wearable options.

Conclusion

In conclusion, the Smartwatch Statistics for 2023 and 2024 highlight a dynamic and rapidly evolving market. With continued growth expected in both revenue and unit sales, the smartwatch industry presents significant opportunities for brands that can innovate and adapt to changing consumer preferences.

The integration of advanced health features, the shift towards sustainable materials, and the expansion of niche markets are all likely to shape the industry's future. As competition intensifies, brands must focus on differentiation and value creation to maintain their market position. With the market projected to reach US dollars 26.8 billion in 2024, the future of smartwatches looks promising, offering exciting possibilities for both consumers and manufacturers.

FAQ.

The global smartwatch market is expected to reach US dollars 26.8 billion in 2024.

Apple leads the smartwatch market with a 31.2% market share in 2023.

The average selling price of smartwatches in 2023 is US dollars 259.

The Asia-Pacific region is the largest smartwatch market, accounting for 35% of global sales in 2023.

Health and fitness tracking is the most sought-after feature, with 65% of consumers citing it as a primary reason for purchase.

Pramod Pawar brings over a decade of SEO expertise to his role as the co-founder of 11Press and Prudour Market Research firm. A B.E. IT graduate from Shivaji University, Pramod has honed his skills in analyzing and writing about statistics pertinent to technology and science. His deep understanding of digital strategies enhances the impactful insights he provides through his work. Outside of his professional endeavors, Pramod enjoys playing cricket and delving into books across various genres, enriching his knowledge and staying inspired. His diverse experiences and interests fuel his innovative approach to statistical research and content creation.