Introduction

Drone manufacturers are companies that design, build, test, and sell unmanned aircraft, along with the parts and software that make them fly. They create different drone types of quadcopters, fixed-wing, and VTOL that target market segments like hobby users, businesses, and government needs. Their work includes airframes, motors, batteries, cameras, sensors, GPS, flight controllers, and remote apps. They also provide training, repairs, spare parts, and firmware updates.

Many handle safety features and rules compliance, like geofencing and ID systems. These makers support uses such as filming, mapping, farming, inspections, deliveries, security, and research, often working with camera, chip, and battery suppliers to complete the drone ecosystem worldwide.

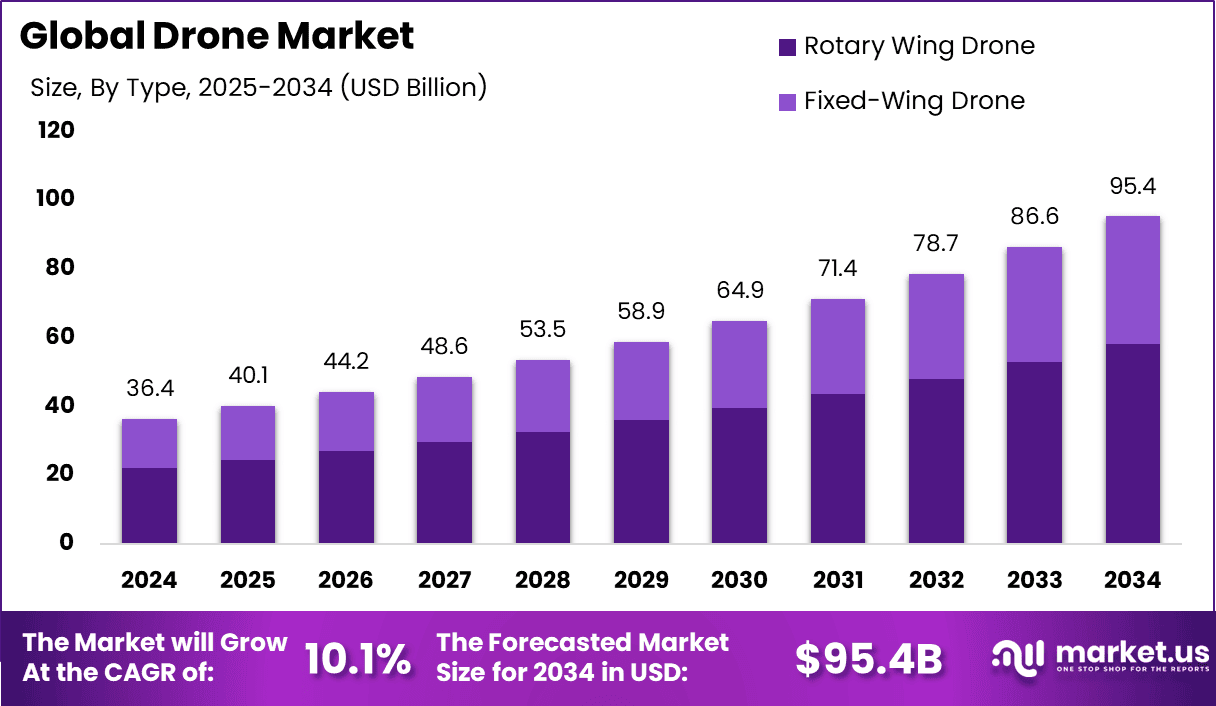

Drone Market Size

- The global drone market is expected to reach USD 95.4 billion by 2034, growing from USD 36.4 billion in 2024, with a CAGR of 10.1% during 2025–2034.

- In 2024, the Asia-Pacific (APAC) region dominated the global market, holding over 40.2% share, which was equal to USD 14.63 billion in revenue.

- The strong performance in APAC was driven by increasing drone use in China, Japan, and India for commercial and military purposes.

- The Rotary Wing Drone segment held the largest share at 61.1% in 2024, supported by its versatility and wide usage across industries.

- Fixed-Wing Drones gained popularity, increasing their share from 31.7% in 2019 to 38.9% in 2024, as demand grew for long-range and endurance missions.

- The Military Application segment dominated the market, capturing 48.8% of the global share in 2024, mainly due to rising adoption for defense, surveillance, and border control.

- According to SeedScientific, DJI, a Chinese company, leads the market with about 60% of the global and 80% of the U.S. drone market share.

- Businesses and government agencies together spent approximately USD 13 billion on drone-related products and services.

- The U.S. Federal Aviation Administration (FAA) reported 855,860 registered drones in 2024, with 96% of owners being men and 4% women.

- Around 270,183 people in the U.S. have obtained remote pilot certifications, indicating growing professional adoption.

- By 2025, the drone industry is expected to generate about 103,776 new jobs in the U.S. alone.

- Out of 853,857 registered drones, about 73% are used for recreational purposes, while commercial usage continues to rise.

- Global drone revenue is projected to reach USD 63.6 billion by 2025, highlighting strong growth prospects.

- In the U.S., over 40 companies are active in the drone industry, with DJI holding 77% and Intel 3.7% of the market.

- Agriculture is one of the fastest-growing drone applications, expected to account for 80% of drone usage in the near future.

- By 2030, more than 13 million non-military drones are anticipated to be in operation worldwide.

- The drone delivery market is expected to reach USD 27.4 billion by 2030, driven by logistics and e-commerce expansion.

- The average annual salary for drone pilots is around USD 77,101, making it a lucrative career field.

- The industry is predicted to create over 100,000 new U.S. jobs by 2025, emphasizing its employment potential.

- Drones improve infrastructure inspections, projected to grow by 50% in five years, and significantly reduce field mapping time from weeks to hours.

- The U.S. military operates over 10,000 drones, showcasing their extensive role in national defense operations.

Top Drone Manufacturers in the World

- DJI

- Autel Robotics

- Skydio

- Parrot

- XAG

- JOUAV

- Draganfly

- EHang

- AeroVironment

- Insitu

DJI (China)

| Field |

Details |

| Company Type |

Privately owned and operated (privately held). |

| Parent Organization |

iFlight Technology Company Limited (reported holding company). |

| CEO |

Frank Wang (Wang Tao), Founder & CEO. |

| Number of Employees |

About 14,000; 17 offices worldwide. |

| Established (Date/Year) |

January 18, 2006. |

| Subsidiaries |

Hasselblad (majority stake, 2017). |

| Products |

Consumer & enterprise drones (e.g., Mavic, Mini, Air, Matrice, Agras), handhelds/gimbals (Osmo, Ronin), payloads (Zenmuse), software & services. |

| Headquarters |

DJI Sky City, Nanshan District, Shenzhen, Guangdong, China. |

| Geographical Presence |

Offices in the U.S., Germany, Netherlands, Japan, South Korea, Beijing, Shanghai, and Hong Kong. |

| Website |

https://www.dji.com |

- DJI is the world’s largest civil drone maker and held about 70% of the global drone market in 2024, according to industry research.

- U.S. press also reports DJI around a 70% market share, underscoring its dominance in consumer drones.

- DJI launched the DJI Dock 2 on March 26, 2024, an automated “drone-in-a-box” system paired with the Matrice 3D/3TD for remote, scheduled missions.

- DJI expanded into logistics with the FlyCart 30 heavy-lift delivery drone, supporting cargo-box and winch modes; manuals show initial releases in January 2024 with updates through 2025.

- In precision agriculture, the Agras T50 carries up to 40 kg for spraying and 50 kg for spreading, reflecting DJI’s scale in ag-drone platforms.

- DJI describes itself as a privately owned and operated company.

- The company’s headquarters is at DJI Sky City, Nanshan District, Shenzhen, China.

- Public references note roughly 14,000 employees and 17 offices worldwide, indicating a large global footprint.

- In the U.S., new rules are being considered: the FY25 NDAA set up a one-year security review that could place DJI on the FCC “Covered List,” restricting approvals for new products if no review is completed by late 2025.

- Market dynamics in 2025 further favored DJI when competitor Autel Robotics exited the consumer-drone segment to focus on enterprise platforms.

Autel Robotics (China/USA)

| Field |

Details |

| Company Type |

Privately held drone manufacturer. |

| Parent Organization |

Formerly a subsidiary of Autel Intelligent Technology Co., Ltd.; spun off before the parent’s IPO (now operates independently). |

| CEO |

No global CEO publicly listed; Maxwell Lee is Owner & General Manager; Randall Warnas briefly served as CEO of Autel Robotics (North America) in 2021. |

| Number of Employees |

Approximately 501–1,000 employees. |

| Established (Date/Year) |

2014 (Shenzhen, China). |

| Subsidiaries |

Autel Robotics USA LLC (Bothell, WA); Autel Intelligent Software Development Co., Ltd. (Shenzhen). |

| Products |

EVO II V3 series, EVO Max 4T/4N, EVO II Enterprise V3, Dragonfish VTOL series, EVO/Dragonfish Nest ecosystem and enterprise accessories. |

| Headquarters |

Shenzhen, China (global HQ); Bothell, Washington, USA (U.S. office). |

| Geographical Presence |

Offices/subsidiary bases in China, United States, Germany, Italy, Singapore; R&D bases reported in Seattle, Silicon Valley, Munich. |

| Website |

https://www.autelrobotics.com |

- Autel Robotics employs approximately 501–1,000 people, indicating a mid-sized manufacturer in the drone sector.

- On July 18, 2025, Autel announced the lifecycle end of its EVO Nano and EVO Lite consumer series and shifted focus toward professional and enterprise drones.

- Independent coverage confirms Autel’s exit from consumer drones, with remaining Lite+ bundles winding down and support ending in 2030.

- The Dragonfish VTOL platform lists up to 120 minutes of flight time and a 6,000-meter service ceiling, highlighting long-endurance capabilities.

- The Dragonfish Nest enables remote operations with automatic takeoff/landing, battery swapping, and integrated weather monitoring for continuous missions.

- The EVO Max 4T integrates a 48-MP zoom camera with 10× optical and 160× hybrid zoom, plus thermal imaging and a laser rangefinder for enterprise use.

- The EVO Max 4N is optimized for low-light work and can perceive obstacles as small as 0.5 inches to reduce blind spots during night or rainy operations.

- The EVO Max 4T-XE variant advertises 12.4 miles (FCC) transmission range and 720° obstacle avoidance, supporting long-range industrial missions.

- In January 2025, Autel issued a statement after the U.S. Department of Defense listed the company among Chinese military enterprises.

- A 2024 Reuters report noted U.S. legislation under consideration that could restrict new product launches by DJI and Autel in the U.S., underscoring a shifting regulatory backdrop.

Skydio (USA)

| Field |

Details |

| Company Type |

Private company. |

| Parent organization |

None (independent, privately held). |

| CEO |

Adam Bry, Co-founder & CEO. |

| Number of Employees |

About 501–1,000 employees (LinkedIn range). |

| Established (date/year) |

2014 |

| Subsidiaries |

Skydio Ltd (UK); Skydio GK (Japan). |

| Products |

X10 drone, X10D defense variant, Dock for X10; software: Remote Ops, DFR Command, 3D Scan. |

| Headquarters |

3000 Clearview Way, San Mateo, CA 94402, USA. |

| Geographical Presence |

Operations and roles across United States (HQ), Japan, Korea, Singapore, Taiwan, plus expansion and deployments in Australia & New Zealand and a registered entity in the UK. |

| Website |

https://www.skydio.com |

- Skydio’s estimated revenue was about $180 million in 2024, roughly an 80% increase from 2023.

- The company has roughly about 800 employees (PitchBook lists about 812; LinkedIn shows a 501–1,000 headcount range).

- In financing, Skydio announced a $230M Series E in Feb 2023 (bringing reported total funding to $562M and a valuation above $2.2B); later reporting has put total capital raised nearer $700–740M with valuation estimates up to about $2.5B.

- On product development, Skydio launched Dock for X10 (an autonomous “drone-in-a-box” system) in September 2024, and Docks are now generally available while the X10 Gen-2 line has started shipping.

- Skydio’s business mix has shifted strongly toward government and defense customers — over 50% of its business was tied to military customers by late 2024, and it has supplied systems to U.S. and allied forces.

- The company continues to win U.S. defense work and multi-year programs (examples of recent DoD awards and SRR program support have been reported), underscoring growing defense revenue.

- Skydio faced supply-chain pressure in 2024–25 after Chinese export restrictions limited access to some components (notably batteries), forcing the firm to diversify suppliers and seek government support.

- Skydio is widely regarded as the leading U.S. autonomous-drone maker and a strategic domestic alternative to Chinese vendors like DJI, particularly for public-safety, utilities, and defense customers.

Parrot (France)

| Field |

Details |

| Company Type |

Public company (Société anonyme), listed on Euronext Paris (Ticker: PARRO, ISIN FR0004038263). |

| Parent organization |

None — Parrot SA is the group holding company. |

| CEO |

Henri Seydoux, Chairman & CEO. |

| Number of Employees |

395 (Group headcount, FY 2024). |

| Established (date & year) |

1994 (reported incorporation date Feb 28, 1994). |

| Subsidiaries |

Parrot Drones SAS (FR, 100%), Parrot Korea (100%), Parrot Inc. (USA, 100%), Pix4D (CH/US/ES/DE/RO/JP, 95%), Outflier SAS (FR, 50%), Iconem (FR, 45%), Dendra Systems (UK, 6%). |

| Products |

Professional micro-UAVs (ANAFI Ai, ANAFI USA) and photogrammetry software via Pix4D. |

| Headquarters |

174 quai de Jemmapes, 75010 Paris, France. |

| Geographical Presence |

Subsidiaries in Switzerland, United States, South Korea, United Kingdom, Australia, Japan, Germany, Spain; products developed in Europe; manufacturing in USA & South Korea; serves 50+ countries. |

| Website |

www.parrot.com |

- Parrot recorded consolidated revenues of €78.1 million in 2024, a 20% increase from 2023.

- The company’s professional micro-UAV (commercial drone) business grew by about 45% in 2024, which was the main driver of that revenue rise.

- Parrot reported 395 employees at December 31, 2024, and the workforce rose to 451 people by June 30, 2025.

- At year-end 2024 Parrot held €33.6 million in cash and the Group returned to profitability in the second half of 2024.

- The company invested heavily in R&D, spending about €39.7 million in 2024 to develop next-generation products.

- Parrot is majority owner of Pix4D (≈95% stake), giving it an in-house photogrammetry and mapping software capability.

- In 2025 Parrot unveiled the ANAFI UKR (and the CHUCK 3.0 autopilot) as a mission-ready micro-UAV aimed at defence and public-safety users.

- Public coverage and Parrot materials describe the ANAFI UKR with extended endurance, with reported flight times quoted between about 38 minutes (standard battery) and claims up to 56 minutes depending on configuration and testing.

- Parrot’s Q3 2024 revenue was €21.0 million, up 39% year-on-year, with the professional micro-UAV business growing roughly 70% that quarter.

- The group serves 50+ countries from a European R&D base, with subsidiaries and manufacturing links in places such as Switzerland, the United States, South Korea, the UK, Australia, Japan, Germany and Spain.

- Recent investor materials show Parrot is sharpening its position in sovereign / defence markets, investing in optical navigation and GPS-denied autonomy to win renewals and new sales with NATO and allied customers.

XAG (China)

| Field |

Details |

| Company Type |

Joint stock company incorporated in the PRC with limited liability. |

| Parent organization |

None (independent; legal name Guangzhou Xaircraft Technology Co., Ltd.). |

| CEO |

Peng Bin (Founder, Executive Director/Chairman/President). |

| Number of Employees |

about1,001–5,000 (LinkedIn range); 1,400 reported in 2020 CSR. |

| Established (date & year) |

2007 (founded as XAircraft; rebranded to XAG in 2014). |

| Subsidiaries |

Divisions reported: XAG Manufacture, XPlanet, XGeomatics, XAG Academy; regional entity example: XAG Ltd (UK, 2023). |

| Products |

Agricultural drones (P100 Pro, P150, V40/V50), UGV (R150), payloads (RevoSpray/RevoCast), XAG One farm app. |

| Headquarters |

XSpace, 115 Gaopu Rd, Guangzhou, P.R.C. |

| Geographical Presence |

Technology and services across 70+ countries/regions; global distributor network. |

| Website |

https://www.xa.com |

- XAG reported revenue of RMB 1.07 billion in 2024 (about $147 million) and a net profit of RMB 70.4 million, marking its first profitable year.

- The company is described as the second-largest agricultural-drone maker with roughly 20–21% share in its segment.

- XAG filed for a Hong Kong IPO in late-September 2025 (HKEX listing application / prospectus documents were submitted).

- Overseas sales accounted for about 25.2% of XAG’s revenue, and its IoT business grew about 195.8% year-on-year in the first half of 2025.

- Analysts and company materials report very strong recent top-line growth—revenue rose roughly 73% year-on-year in 2024 after the company shifted from heavy expansion to cost controls.

- Market and company profiles list XAG’s headcount in the about 1,001–5,000 range (company filings and business databases show it as a mid-to-large employer).

- XAG’s product family includes field sprayers and multi-mission ag drones such as the P100 (≈50–60 L tank), P150 (up to about 70 kg payload capability) and the V40 series, with specs designed for high-area coverage and autonomous operations.

- The company says it works with a broad global distributor network and hosted events with 150+ distributors and partners from 30+ countries while claiming service reach in 70+ countries/regions.

- XAG has added software and mapping partnerships (for example, a prescription-map feature with PIX4D) and keeps expanding its smart-farm / IoT product stack.

- Recent corporate moves include a renewed push to the capital markets (HK listing attempt after a withdrawn STAR Market filing) with Huatai International named as a sponsor in the latest filing coverage.

JOUAV (China)

| Field |

Details |

| Company Type |

Public company listed on the Shanghai SSE STAR Market (Stock code 688070.SH). |

| Parent organization |

Independent listed company (no parent disclosed; largest shareholder is CEO Ren Bin). |

| CEO |

Ren Bin (Founder, CEO & General Manager). |

| Number of Employees |

About 700+ (site); 728 as of Dec 31, 2024. |

| Established date and year |

April 8, 2010 (founded in Chengdu, China). |

| Subsidiaries |

Examples include wholly-owned units: Chengdu Zongheng Dapeng Unmanned Aerial Vehicle Technology Co., Ltd., Chengdu Dapeng Zongheng Intelligent Equipment Co., Ltd., Chengdu Zongheng Pengfei Technology Co., Ltd., Chengdu Zongheng Ronghe Technology Co., Ltd.; also Chengdu Zongheng Yunlong Unmanned Aerial Vehicle Technology Co., Ltd. |

| Products |

CW series VTOL drones (e.g., CW-15, CW-25E, CW-30E, CW-80E), multirotor/VTOL hangar (drone-in-a-box), payloads (cameras/LiDAR), and software (FlightSurv, Eagle Map, JoCloud). |

| Headquarters |

Hi-tech District, Chengdu, China — 3A-11F, Jingrong Innovation Hub, No.200, 5th TianFu St., Chengdu 610041. |

| Geographical Presence |

Products used in 40+ countries. |

| Website |

https://www.jouav.com |

- JOUAV reported annual revenue of RMB 474.2 million in 2024, up roughly 57% versus 2023.

- On a trailing-12-month basis to June 30, 2025, the company’s revenue rose to about RMB 525.6 million, signalling continued fast growth.

- JOUAV recorded a net loss of about RMB 35.8 million for fiscal 2024.

- The company employed 728 people as of December 31, 2024.

- JOUAV is a publicly listed company on the Shanghai STAR Market (ticker 688070.SH).

- The product portfolio centers on VTOL fixed-wing and hybrid UAVs (CW series, e.g., CW-15 and CW-30E) plus multirotor hangars and drone-in-a-box/autonomous operation systems for mapping, inspection and emergency response.

- The CW-15 was awarded the “Chengdu Industrial Excellence Product” distinction, underlining recent product recognition and local manufacturing credibility.

- In 2025 JOUAV signed a memorandum of understanding (MOU) with Thailand’s Systronics and has hosted international delegations, showing active partnership and overseas business development.

- The company ran a major product launch in September 2025 for low-altitude economy drone solutions and continues to exhibit at industry shows (e.g., Drone World Congress), reflecting an active 2025 product & marketing push.

- Third-party profiles and industry writeups report JOUAV’s solutions are sold to 40+ countries, with particular traction in Southeast and South Asia.

Draganfly (Canada)

| Field |

Details |

| Company Type |

Public company (listed on NASDAQ: DPRO). |

| Parent organization |

None — independent public company (Draganfly Inc. is the parent of its operating subs). |

| CEO |

Cameron Chell, CEO & President. |

| Number of Employees |

54 (as of Dec 31, 2024). |

| Established date & year |

Founded 1998 (Draganfly/Draganfly Innovations); incorporated as Draganfly Inc. on June 1, 2018 (BC, Canada). |

| Subsidiaries |

Draganfly Innovations Inc., Draganfly Innovations USA Inc., Dronelogics Systems Inc. (wholly owned). |

| Products |

Commander 3XL, Commander 3XL Hybrid, Heavy Lift drones; Vital Intelligence software; UAV services/solutions. |

| Headquarters |

Saskatoon, Saskatchewan, Canada (head office); U.S. office: Tampa, Florida. |

| Geographical Presence |

Operates in Canada and the United States with sales internationally. |

| Website |

https://www.draganfly.com |

- Draganfly reported total revenue of US$6,561,055 for the year ended December 31, 2024.

- In the second quarter of 2025 the company reported revenue of US$2,115,255, a 22.1% year-over-year increase, with product sales up 37.1% versus the same quarter a year earlier.

- Trailing-12-month revenue was reported at about US$7.16 million, representing roughly +17% year-over-year growth on the latest publicly compiled basis.

- As of December 31, 2024 Draganfly employed 54 people (51 full-time and 3 part-time), reflecting a large percentage increase in headcount versus the prior year.

- Draganfly is a publicly traded company (ticker DPRO) that files SEC disclosures and publishes investor materials.

- Cameron Chell is the company’s President & Chief Executive Officer, who regularly leads investor and media briefings.

- In 2024–2025 Draganfly took financing steps including a US$3.76 million registered direct offering to support corporate activities.

- Product focus is on public-safety, government and border-security solutions; the firm has promoted systems such as the Outrider southern-border demo and modular Flex/FlexForce FPV systems for government customers.

- Independent news coverage in October 2025 reported that Draganfly’s Flex FPV system was selected by the U.S. Army (coverage noted strong market reaction to the award).

- Management describes an ongoing product-line transition toward scaled public-safety production capabilities and highlighted these strategic priorities in recent investor calls and Q4/2024 reporting.

EHang (China)

| Field |

Details |

| Company Type |

Public company (Cayman Islands exempted company), listed on Nasdaq: EH. |

| Parent organization |

Independent public company (Cayman holding company with PRC subsidiaries and a consolidated VIE). |

| CEO |

Huazhi Hu, Founder, Chairman & CEO. |

| Number of Employees |

483 employees as of Dec 31, 2024. |

| Established date and year |

Incorporated Dec 23, 2014 (Cayman Islands). |

| Subsidiaries |

Ehfly Technology Ltd. (HK); EHang Intelligent Equipment (Guangzhou) Co., Ltd. (PRC); Yunfu EHang Intelligent Technology Ltd. (PRC). VIE: Guangzhou EHang Intelligent Technology Co., Ltd.; VIE’s subs: Guangdong EHang General Aviation Co., Ltd., Guangdong EHang Egret Media Technology Co., Ltd. |

| Products |

EH216-S (passenger eVTOL), EH216-L (logistics), EH216-F (firefighting), VT-30 (long-range eVTOL). |

| Headquarters |

11/F, Building One, EHang Technology Park, No. 29 Bishan Blvd., Huangpu District, Guangzhou, Guangdong, China 510700. |

| Geographical Presence |

Operations and deployments across Asia, Europe, and the Americas; 66,000+ flights in 19 countries (cumulative). Manufacturing facility in Yunfu, China. |

| Website |

https://www.ehang.com |

- EHang generated RMB456.2 million (about US$62.5 million) in revenue in 2024, up about 289% year over year, on 216 EH216-series autonomous passenger eVTOL deliveries and with its first reported adjusted annual net profit and positive operating cash flow.

- In Q2 2025, EHang reported RMB147.2 million (about US$20.5 million) in revenue, up 44.2% year over year and roughly 4.6× quarter over quarter, on 68 EH216 deliveries and a 62.6% gross margin.

- The company had 483 employees as of December 31, 2024 (445 of them in Guangzhou), up from 367 in 2023, reflecting a rapid manufacturing and operations ramp.

- EHang trades on Nasdaq under the ticker “EH,” is headquartered in Guangzhou, China, and markets itself as a leading urban air mobility / autonomous aerial vehicle platform company.

- Huazhi Hu is the Founder, Chairman and Chief Executive Officer of EHang and serves as the public face to investors and regulators on commercialization progress.

- As of mid-2025, EHang said it held roughly RMB1.2 billion in cash and equivalents and had raised about US$23.8 million through an at-the-market equity offering to fund R&D, production expansion, and new operating hubs.

- EHang’s core products are autonomous, battery-electric VTOL aircraft: the two-seat EH216-S for passenger transport, the EH216-F for high-rise firefighting, the EH216-L for heavy logistics cargo, and the new VT35 long-range “flying taxi” aimed at intercity routes of 100+ miles per charge.

- In 2025, Chinese aviation regulators granted Air Operator Certificates for pilotless human-carrying flights, allowing EHang to begin paid sightseeing runs with the EH216-S in Guangzhou and Hefei and announce trial commercial operations.

- Management says EHang is shifting from just selling aircraft to operating them as services, citing 40+ active EH216-S operation sites, over 10,000 safe flights in the first half of 2025, stated annual production capacity of about 1,000 units, and 2025 revenue guidance of roughly RMB500 million (around US$70 million).

AeroVironment (USA)

| Field |

Details |

| Company Type |

Public company (Nasdaq: AVAV). |

| Parent organization |

None — independent public company; parent of several wholly owned subsidiaries. |

| CEO |

Wahid Nawabi, Chairman, President & CEO. |

| Number of Employees |

1,428 full-time (as of Apr 30, 2024). |

| Established date and year |

July 27, 1971 (founded 1971 by Dr. Paul B. MacCready Jr.). |

| Subsidiaries |

Arcturus UAV (Arcturus UAS), Telerob GmbH, Tomahawk Robotics (wholly owned). |

| Products |

Small UAS (Raven, Wasp AE, Puma 3 AE), VTOL fixed-wing (JUMP 20), loitering munitions (Switchblade 300/600), UGVs (telemax EVO). |

| Headquarters |

241 18th Street South, Suite 650, Arlington, VA 22202, USA. |

| Geographical Presence |

Campuses across multiple U.S. states and Germany; products sold to 50+ allied governments; expanding in Europe (new UK office, 2025). |

| Website |

https://www.avinc.com |

- AeroVironment reported total revenue of about US$820.6 million for the fiscal year ended April 30, 2025, alongside net income of roughly US$43.6 million, approximately US$1.2 billion in annual bookings, and record fourth-quarter revenue of US$275.1 million.

- In the first quarter of fiscal 2026 (three months ended August 2, 2025), AeroVironment reported revenue of about US$454.7 million, up roughly 140% year over year from US$189.5 million, driven largely by the integration of the newly acquired BlueHalo business; management reaffirmed full-year sales guidance of US$1.9–2.0 billion and raised its earnings outlook.

- As of April 30, 2025 AeroVironment reported a funded backlog of about US$726.6 million versus US$400.2 million a year earlier and said it booked about US$1.2 billion of new orders in fiscal 2025; by August 2, 2025 the company said total backlog had climbed to roughly US$1.1 billion, highlighting strong ongoing demand from U.S. and allied defense customers.

- As of April 30, 2025 AeroVironment employed 1,475 people (1,456 full-time and 19 part-time), which was about a 3.3% increase versus the prior year, reflecting continued hiring to scale production and program delivery.

- AeroVironment is a publicly traded U.S. defense technology company listed on Nasdaq under the ticker “AVAV,” headquartered in Arlington, Virginia, that builds small uncrewed aircraft systems (including Raven, Puma, Wasp), Switchblade loitering munition systems (used by the U.S. and allies such as Ukraine), and broader autonomous, counter-UAS, space, and electronic warfare capabilities across air, land, sea, space, and cyber domains.

- Wahid Nawabi serves as AeroVironment’s Chairman, President, and Chief Executive Officer, and under his leadership the company positions itself as a rapidly scaling defense prime focused on autonomous systems, loitering munitions, and fast-turn delivery to front-line units “at the speed of relevance.”

- In 2024–2025 AeroVironment announced and began integrating an approximately US$4.1 billion all-stock acquisition of BlueHalo, a space, cyber, counter-UAS, and directed-energy specialist; management says the combined business is targeting fiscal 2026 revenue of US$1.9–2.0 billion and EBITDA of US$300–320 million.

- Recent developments include major multi-hundred-million-dollar U.S. Army delivery orders under a US$990 million Switchblade loitering munition contract, ongoing international demand for Switchblade systems, and the public debut in October 2025 of the new Switchblade 400, a rocket-launched, medium-range (about65 km) loitering munition with about35-minute endurance and AI-assisted targeting – showcased to global military buyers at AUSA 2025.

- Management describes a shift from being mainly a small-drone supplier to becoming a diversified defense technology platform across air, land, sea, space, and cyber, backed by record backlog, higher-margin loitering munitions, and advanced robotics and common-control tech from Tomahawk Robotics and BlueHalo that aim to unify uncrewed systems for U.S. and allied forces.

Insitu (USA)

| Field |

Details |

| Company Type |

Subsidiary (wholly owned by The Boeing Company). |

| Parent organization |

The Boeing Company. |

| CEO |

Diane Rose, President & CEO. |

| Number of Employees |

Approx 1,000 (latest publicly cited; third-party directories also show about 1,000 in 2025). |

| Established date and year |

1994 (founded in Bingen, Washington). |

| Subsidiaries |

Insitu Pacific Pty Ltd (Australia). |

| Products |

Small UAS & VTOL systems: ScanEagle, Integrator, Integrator ER, Integrator VTOL, RQ-21A Blackjack; software: INEXA Control, TacitView, Catalina, Common Ground Control Station. |

| Headquarters |

118 East Columbia River Way, Bingen, WA 98605, USA. |

| Geographical Presence |

HQ in Washington with offices in Oregon, Australia, UAE, UK; serving 40+ customers in 35 countries. |

| Website |

https://www.insitu.com |

- Private-market estimates indicate that Insitu generates several hundred million dollars in annual revenue, including a reported peak of about US$603 million in 2024 and an estimated about US$750 million in annual revenue as of September 2025, which places it among the larger U.S. tactical drone and ISR suppliers even though it is not publicly traded.

- In February 2025, Insitu (Bingen, Washington) was awarded a US$102,353,293 contract modification that increases the ceiling on a U.S. Navy / NAVAIR IDIQ to buy 21 RQ-21A Blackjack air vehicles and 47 ScanEagle air vehicles, plus payloads, spares, tools, and training, for U.S. and foreign military customers, with work running through June 2026.

- In January 2025, the U.S. Navy issued Insitu a US$25,667,674 firm-fixed-price order to provide deployed ISR services, including pre/post-deployment support, training, data coordination, and on-site operations for U.S. Department of Defense and other government agencies, with work expected to continue into March 2028.

- Insitu employed roughly 1,000 people as of September 2025, with a footprint spanning six continents, and it operates from hubs in the United States (headquarters in Bingen, Washington), Australia, the United Kingdom, and the United Arab Emirates to support allied defense customers in more than 35 nations.

- Insitu is a wholly owned subsidiary of The Boeing Company, founded in 1994, and it designs and produces runway-independent, long-endurance uncrewed aircraft systems such as the ScanEagle, Integrator (including Integrator Extended Range and VTOL/FLARES variants), and the RQ-21A Blackjack small tactical UAS used by the U.S. Navy, U.S. Marine Corps, and international partners; these platforms have accumulated nearly 1.5 million operational flight hours.

- Diane Rose is Insitu’s President & Chief Executive Officer, and she has publicly led the company’s messaging around operational autonomy, forward-deployed sustainment, and international industrial partnerships since taking the role in 2023.

- In December 2024, Insitu opened a new Uncrewed Aircraft Systems Center of Excellence at Tawazun Industrial Park in Abu Dhabi, United Arab Emirates, to localize maintenance, repair and overhaul, training, and other support for the UAE Armed Forces and to build in-country capability (including future sourcing, R&D, and potential manufacturing phases through 2030).

- On September 10, 2025, Insitu announced an Autonomy Centre of Excellence in Oxford, United Kingdom, which will act as an AI and autonomy hub focused on mission software, onboard autonomy, edge computing, and rapid deployment of “practical autonomy” to warfighters, reinforcing that software and decision advantage are now core to its offering.

- Insitu continues to market long-range, beyond-line-of-sight ISR through its Integrator platform, which now supports Proliferated–Low Earth Orbit (P-LEO) SATCOM control for up to 2,000 nautical miles of point-to-point range and about 27.5 hours of endurance, allowing control from anywhere in the world and shipboard VTOL launch/recovery via the FLARES system.

- In February-March 2025, Bloomberg and other outlets reported that Boeing was exploring a sale of Insitu for roughly US$500 million as part of a broader plan to shed non-core assets and shore up Boeing’s finances, highlighting Insitu’s battlefield relevance (including support to Ukraine) and signaling that Insitu could become a standalone or newly owned defense drone specialist.

- Management frames Insitu’s strategy as moving from “just selling aircraft” to delivering full-spectrum uncrewed autonomy and ISR services, combining deployable Navy/DoD ISR support lasting through 2028, localized sustainment and training in Abu Dhabi, and AI/autonomy development in Oxford to give allied militaries persistent, scalable intelligence at the tactical edge.

Joseph D'Souza

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.

More Posts By Joseph D'Souza

![]()