Realme Statistics By Revenue and Facts (2025)

Updated · Nov 17, 2025

Table of Contents

- Introduction

- Editor’s Choice

- History of Realme

- Fun Facts About Realme

- Realme Revenue Statistics

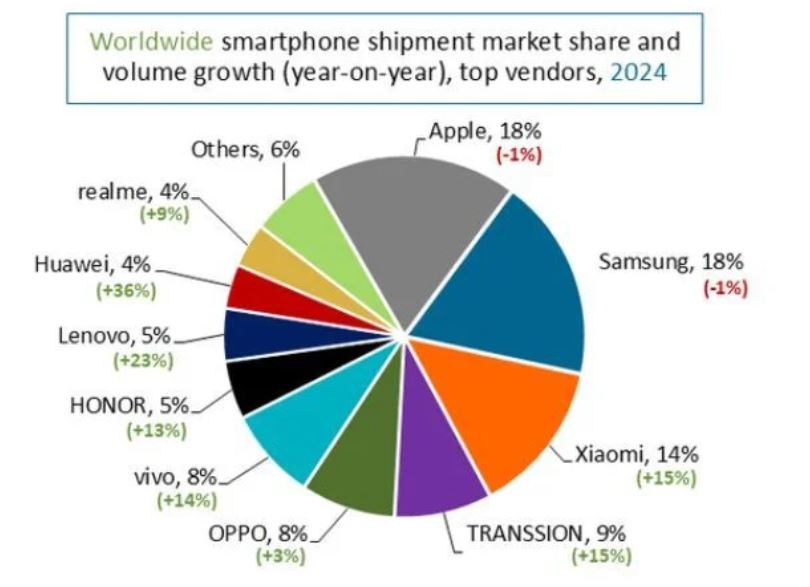

- Smartphones Shipments Market Share

- Realme Overtakes Xiaomi As India’s Smartphone Market Faces A Decline

- Realme Product Lineup, Pricing, And Premium Push

- Units, ASP, And Revenue Mix

- Regional Performance—Where Realme Shines

- Risks And Challenges

- Conclusion

Introduction

Realme Statistics: Realme began as a scrappy upstart and, within a few years, had moved from the periphery to become a participant in the global smartphone competition. Realme is also developing its gaming and entertainment collaborations by understanding the lifestyles and interests of young consumers. In 2025, the brand continues to rise, but at the same time, it faces stronger rivals. This article compiles the most recent Realme statistics, Including Shipments, market share, revenue, and performance by region.

Editor’s Choice

- The NEXT AI initiative of Realme plans to ship 100 million AI smartphones in the coming three years.

- To win over kids, Realme concentrates on AI-driven performance, imaging, and gaming technologies.

- At MWC 2025, Realme launched the 14 Pro Series 5G, which had the world’s first cold-sensitive colour-changing.

- The Realme 14 Pro+ features a periscope telephoto lens, Sony IMX896 main sensor, and 120X SuperZoom capabilities.

- The 14 Pro series is ccomesh Snapdragon 7s Gen 3 and Dimensity 7300 processors, a 6,000mAh battery, and 120fps gaming support.

- Realme has a 10.6% market share in India and moved into 4th place in Q1 2025, following a 2.2% year-over-year growth.

- The Realme 14 series, Narzo 80 series, and P3 series were the most significant drivers of sales.

- The Realme 14 Pro series was initially priced at approximately €379.99 (~US$400–US$420) globally at launch, indicating a premium market positioning.

- Realme’s price strategy comprises three tiers ely below US$150 (budget), US$150–US$399 (mid-range), and above US$400 (premium).

- Annual shipments are estimated to be between 40–60 million units.

- The rise in the average selling price (ASP) from US$140 to US$180–US$200 would increase the annual revenue from US$7B to US$9B even without any growth in units.

- There is solid growth taking place in Southeast Asia, Europe, and Africa, particularly in the low-cost segment.

History of Realme

- 2018: Realme was established as an independent brand on May 4 after starting as an Oppo sub-brand. The first product, Realme 1, was released in May for the Indian market. Sky Li announced his resignation from Oppo on July 30 to lead Realme, and a new logo was adopted on November 15.

- 2019: Realme formally entered the Chinese market with its first Beijing conference on May 15 and expanded across China, South Asia, Southeast Asia, and Europe by mid-year. Users surpassed 10 million by August. Global shipments for 2019 reached 25 million, with 808% year-over-year growth.

- 2020: Realme became the fastest smartphone brand to reach 50 million cumulative shipments in Q3 2020. Company communications also highlighted 6.3 million smartphones sold during festive sales in India and strong quarterly growth.

- 2021: The brand was identified among the fastest-growing 5G smartphone brands globally in Q3 2021, reflecting rapid adoption of 5G models in multiple regions.

- 2022: Regional leadership was strengthened, including an appointment for Realme Europe’s CEO role in May 2022, signaling deeper investment in European operations.

- 2023: The company continued international expansion and portfolio updates, maintaining presence across Asia and Europe and sustaining large user bases built since 2019 and 2020 milestones.

- 2024: Product lines in smartphones and AIoT continued, setting up for larger-battery flagships and new budget entries that were prepared for 2025 launches in India and Europe.

- 2025: Realme unveiled GT-series flagships with 7,000 mAh batteries and announced Europe and India availability. In India, the Realme C71 launched in the entry segment with a 6,300 mAh battery. Media reports also noted plans for a device with a 15,000 mAh battery, positioned to emphasize long battery life.

Fun Facts About Realme

- Realme was officially founded on May 4, 2018 by Sky Li after starting as an Oppo sub-brand under BBK Electronics.

- The company announced crossing 100 million smartphones sold in about 3 years, recognized as the fastest brand to reach this mark.

- Global shipments surpassed 200 million units by November 2023, indicating rapid scale for a young brand.

- Realme operates in over 60 markets worldwide, with a stated footprint spanning 61 markets across Asia, Europe, and Africa.

- In India, Realme accounted for roughly 12.3% vendor share in October 2025, placing it among the top manufacturers.

- Realme was identified by Counterpoint as the fastest-growing 5G Android smartphone brand in Q3 2021, with 831% year-over-year growth.

- Realme launched what media cited as India’s first 5G smartphone in February 2020 with the X50 Pro 5G, marking an early push into 5G.

- The brand’s design credentials include the GT Master Edition created with designer Naoto Fukasawa, released to celebrate the 100-million milestone.

- Realme positions itself as a youth-focused tech brand with smartphones and AIoT devices under the “Dare to Leap” philosophy.

- Recent product momentum has included the Realme 15 Pro series emphasizing AI photography, and a 7,000 mAh battery debut on the Realme 15x 5G.

- A flagship launch featuring Ricoh GR-tuned cameras on the Realme GT 8 Pro has been scheduled in India for November 20, 2025, signaling imaging ambitions.

Realme Revenue Statistics

- For the financial year ending March 31, 2024, Realme generated revenue of approximately ₹19,200 crore (roughly USD 2.3 billion), according to Tracxn’s company profile for Realme.

- For the same year ending 31 March 2024, Tofler classifies Realme India’s operating revenue range as “over ₹5,000 crore,” which is consistent with the detailed revenue figure of ₹19,200 crore being reported for this period.

- For the financial year ending 31 March 2023 (the immediate past year), Realme’s India unit recorded revenue growth of about 46.06% year on year, but public sources do not disclose the exact rupee revenue figure; only the growth percentage and other ratios such as profit decline and asset growth are available.

- Because Realme is a privately held brand, detailed global revenue numbers for 2023 and 2024 are not published in open filings; analysts and databases instead use India statutory filings and shipment data as proxies, so any global revenue estimates beyond the figures above should be treated as indicative rather than official.

(Source: telecomlead.com)

- Realme has divided its product portfolio strategically into different market segments.

- The GT series is a premium range focusing on ultra-high performance and is the brand’s flagship AI-driven line, the Number series defines the standard for mid-range smart devices, and the C series offers maximum value for money for youngsters looking for low-budget options.

- The NEXT AI initiative that centers around Realme’s vision is also the part where the brand’s commitment to AI-like imaging and gaming technology is through the initiative as mentioned above, which has been designed to make the above-mentioned accessibility available to the masses.

- By setting a daring goal of 100 million AI smartphones over the span of 3 years, Realme will ensure that the le AI will be reinvented through the use of top-notch chipsets, intelligent efficiency, and battery power that lasts across all their models.

- The company not only gains but also enhances its partnerships with top gaming companies through techniques such as higher frame rates, lower latency, and immersive experiences.

- On top of that, Realme is moving in the direction of inter-industrial tie-ups with the most recognized brands for the purpose of introducing limited-edition products that represent youth culture and creativity.

- This strategy, as it blends technology, culture, and lifestyle, continues to strengthen its bond with younger audiences.

- The 14 Pro Series 5G, the world’s first cold-sensitive colour-changing smartphone premiere lineup, was showcased by Realme at MWC 2025.

- The “Unique Pearl Design” postulation, created in collaboration with Valeur Designers, changes the colour of the pearl from white to blue when the temperature drops, while the grey suede version is adorned with vegan suede leather.

- With the Realme 14 Pro+, it is no longer a matter of guessing which mid-range smartphones are the best.

- It is the only mid-range smartphone that has a periscope telephoto lens, which is supported by a 1/2” Sony IMX882 sensor with 120X SuperZoom, and a 50MP Sony IMX896 OIS main camera.

- The latter features low-light photography capabilities, including Ultra Clarity 2.0 and Super-resolution from NEXT AI.

- However, even though one of the Snapdragon 7 Gen 3 or Dimensity 7300 chipsets is used in the device, it features a 6,000mAh battery and also supports 120fps gaming.

- Counterpoint predicts that global smartphone revenue will be grow 8% and shipment volume by 4% in 2025.

Realme Overtakes Xiaomi As India’s Smartphone Market Faces A Decline

- According to the latest International Data Corporation (IDC) report, India’s smartphone market experienced a 5.5% year-on-year decline in shipments during Q1 2025, with total shipments falling to 32 million units.

- This marks the second consecutive quarter of decline, mainly due to weak consumer demand and excess inventory carried over from the festive quarter of December 2024.

- The slowdown affected several major players, particularly Xiaomi, which saw its shipments plunge by 42% year-on-year in the January–March 2025 period.

- As a result, Xiaomi’s market share dropped sharply from 12.8% in Q1 2024 to just 7.8% in Q1 2025, pushing it out of the top five smartphone brands in India for the first time in years.

- Its sub-brand, Poco, also struggled, registering a 31.1% year-over-year decline in shipments.

- In contrast, Realme managed to buck the trend. With a 2.2% year-on-year growth, Realme climbed to the fourth position in India’s smartphone rankings, securing a 10.6% market share in Q1 2025.

- The company’s consistent results were driven by the tremendous demand for its reasonably priced new products, consisting of the Realme 14 series, Narzo 80 series, and P3 series, which were considered desirable by customers with tight budgets and mid-range buyers.

- The smartphone market in India is currently experiencing a short-term correction, but the brands, particularly Realme, are still managing to survive by introducing new and affordable models, which even attract consumers in a period of low demand.

Realme Product Lineup, Pricing, And Premium Push

- With the introduction of the Realme 14 Pro series in 2025, Realme made a significant move toward the luxury smartphone segment by expanding its product range.

- The series was launched globally, with the lowest price in Europe set at approximately €379.99 (US$400–US$420).

- Realme 14 Pro and Realme 14 Pro+ are equipped with top-notch camera systems and bigger batteries, thus marking Realme’s ambition to sit at the top among the brands with a higher average selling price (ASP).

- As per Cinco Días, the brand’s perception of being budget-friendly but not the least expensive is further strengthened with this launch.

- Realme’s product range in 2025 will include three pricing levels: a budget segment, targeting beginner consumers, priced under US$150.

- Mid-range segment: between US$150 and US$399, giving the best combination of price and performance. Premium segment: above US$400, aimed at users who want flagship-like performance at an attractive price.

- The industry experts say that this varied offering enables Realme to keep the volume of sales in the budget phones and, at the same time, increase its ASP stepwise by presenting gadgets made of premium materials, equipped with the latest cameras, and coming with the fastest charging technologies.

Units, ASP, And Revenue Mix

- Industry estimates place Realme’s annual smartphone shipments in the range of 40 to 60 million units, depending on the source, while unit growth is expected to remain stable.

- One significant way the company can raise its total revenue is through the self-tuning of its ASP from US$140 to US$180-US$200.

- For instance, at 50 million units with a unit price of US$140, the revenue generated from the sale of the hardware per year is approximately US$7 billion.

- If the same number of units are sold at US$180 each, the revenue increases to US$9 billion.

- This calculation clearly reiterates that Realme, like many other smartphone manufacturers, is going the way of value enhancement rather than the other way, focusing solely on shipment growth.

- Reports from Mobile World Live indicate that Realme’s strategy for improving profitability is centred on offering higher-end, yet competitively priced, products.

Regional Performance—Where Realme Shines

- Asia (India and Southeast Asia): India is still Realme’s major market; it has been the main contributor to the company’s lifetime sales—The New Indian Express quotes over 100 million smartphones sold in India by 2023.

- The company is also making a good sale in Southeast Asia and South Asia, where sales are dominated by budget-friendly phones.

- Europe and Africa: Realme’s presence in Europe is getting stronger through the competitive mid-range models, le Africa is another fast-growing market.

- According to TechInsights, the low-cost phones of Realme are being well received in various African countries, and affordability and durability are the key factors in consumer choice.

Risks And Challenges

- Despite the positive effect of the sale, Realme still confronts hurdles, which are quite similar to the issues of the competitive smartphone landscape.

- Crowded Mid-Price Segment: The US$150–US$400 price bracket is exactly where Realme, along with its major competitors Xiaomi, Vivo, and Samsung, shares part of its market, making it pretty tough for Realme to keep or even extend its market share through heavy investments in marketing and distribution.

- Moneycontrol states that even minor shifts in market share need big promotional expenses.

- Over-Reliance on a Few Major Markets: A substantial percentage of Realme’s worldwide shipments consists of India plus,s some Asian and African countries.

- Consequently, this dependence means that a 5–10% decrease in the Indian market could lead to a serious decline in global sales.

- Analysts are cautioning that the company has to move towards more developed markets for long-term stability that won’t be shaken every now and then.

Conclusion

Realme Statistics: Realme’s strategic evolution in 2025 is an indication of its growing maturity as a global smartphone contender. With the Realme 14 Pro series, the brand is not only successfully blending innovation with affordability but also venturing into premium segments and pushing its NEXT AI initiative. By selling fewer but better products with the same volume, the company is developing a smart and eco-friendly growth model. Nevertheless, future accomplishment will revolve around the ways of lessening competition in the mid-range market and the ability to export less with reliance on a few select markets.

Sources

FAQ.

Realme in 2025 grabbed the fourth spot in the Indian mobile phone ranking with a 10.6% market share, as per IDC. Realme’s 2.2% growth, on the contrary, was surpassed by the declining shipments of major competitors such as Xiaomi, which experienced a 42% fall in its deliveries, as the overall smartphone shipments in India dropped by 5.5% year-on-year in Q1 2025.

The NEXT AI initiative has been put forth by Realme as the strategy to apply artificial intelligence technology uniformly over the product lines, especially imaging, gaming, and power efficiency. The company targets to push out 100 million AI smartphones in three years, putting AI-powered optimization to work for camera performance, system speed, and battery management.

The Realme 14 Pro Series 5G that came out worldwide in 2025 was a landmark new premium offering from the brand, priced at approximately €379.99 (~US$400–US$420). The 14 Pro+ boasts a periscope telephoto lens, Sony IMX896 sensor, and 120X SuperZoom, while being able to run games at 120fps with a 6,000mAh battery and Snapdragon 7s Gen 3 and Dimensity 7300 chipsets.

According to industry forecasts, it is expected that Realme will be able to sell around 40–60 million units a year. Even with an ASP (average selling price) increase from US$140 to US$180–US$200, the company’s annual revenue could go from about US$7 billion to US$9 billion, assuming no change in the volume of shipments.

India is the biggest market for Realme, which has sold over 100 million phones in this country since its entry. Moreover, Southeast Asia, Europe, and Africa are the other regions where the company is doing well, as stated in the reports from The New Indian Express and TechInsights.

Joseph D'Souza founded ElectroIQ in 2010 as a personal project to share his insights and experiences with tech gadgets. Over time, it has grown into a well-regarded tech blog, known for its in-depth technology trends, smartphone reviews and app-related statistics.