Canon Statistics By Revenue, Net Sales and Facts (2025)

Updated · Nov 05, 2025

Table of Contents

- Introduction

- Editor’s Choice

- History of Canon

- Fun Fact About Canon

- Canon Financial Overview

- Canon Segmental Analysis

- Canon Net Sales and Operating Profit

- Canon Return On Capital

- Canon’s Camera Division Statistics

- Digital Camera Manufacturer Statistics

- Total Market Valuation

- Canon Momentum in Medical Innovation

- Canon Net Sales By Region

- Canon Semiconductor Lithography, AI, And Advanced Packaging

- Canon Cameras Top Model Specifications

- Canon Market Capitalisation

- Conclusion

Introduction

Canon Statistics: Canon is the renowned giant that you already recognise: the cameras, printers, medical devices, and industrial machines. The company’s gradual and strategic engagement with international markets, alongside novel inventions in medical imaging and semiconductor equipment, is a testament to its flexibility and visionary approach to the future. By balancing technology, company changes, and customer-oriented growth, Canon has demonstrated its commitment to operational excellence and shareholder value. The article presents an unambiguous view of Canon’s statistics for 2024, along with the initial 2025 results.

Editor’s Choice

- Canon’s net sales in 2025 increased to ¥4.65 trillion from ¥4.51 trillion in 2024, with operating profit rising to ¥466 billion, indicating steady financial growth over the past five years.

- The Return on Equity (ROE) for 2025 is estimated to be 9.9%, a 0.5-point increase from 2024, driven by improved asset management and the company’s effective utilisation of financial leverage.

- Canon, through continuous structural reforms and improved capital management, aims to exceed the 10% ROE mark.

- In early 2025, Canon’s sales increased by 2%, driven by growth in Asia, South America, and other emerging markets, which were also bolstered by the company’s innovative business initiatives.

- The operating profit margin was increased to 4.9%, and it is expected to reach 6.5% by year-end, as a result of the restructuring and efficiency measures implemented.

- The Americas remain the leading region in terms of global sales for Canon, with sales in the US expected to reach US$9.39 billion in 2025, followed by Europe (US$7.92 billion) and Japan/Asia-Oceania (approximately US$6 billion each).

- The market for interchangeable-lens cameras is predicted to grow by 6.6 million units by the year 2025, and Canon is expected to have a 15.5% increase in sales in Q1.

- Canon’s market capitalisation is around ₹2.238 trillion as of October 2025, making it the 895th company on the list of the world’s most valuable firms.

- Canon’s market capitalisation shows a solid long-term performance after years of expansion, and although it registered a 15.97% loss in 2025, it remains higher than in 2022.

History of Canon

- 1933 – Precision Optical Instruments Laboratory is founded in Tokyo, the origin of Canon.

- 1934 – The Prototype Kwanon 35 mm camera is developed, regarded as Japan’s first 35 mm focal-plane-shutter prototype.

- 1936 – Hansa Canon launches as the first commercial Canon 35 mm camera.

- 1937 – Company incorporated as Precision Optical Industry Co., Ltd.

- 1947 – Name changes to Canon Camera Co., Inc.; Canon cameras are designated priority exports in postwar Japan.

- 1949 – Canon shares list on the Tokyo Stock Exchange.

- 1959 – Canonflex SLR debuts, marking Canon’s move into 35 mm SLRs.

- 1964 – Canola 130 launches as Japan’s first 10-key electronic desktop calculator.

- 1969 – Company name changes to Canon Inc.; Canon enters the plain-paper copier market with the NP System.

- 1976 – AE-1 arrives, widely noted as the first mass-market, microprocessor-equipped SLR.

- 1987 – EOS system launches with the EOS 650 and all-electronic EF lens mount.

- 2000 – EOS D30 becomes Canon’s first in-house digital SLR.

- 2010 – Canon signals intent to adopt its own top-level domain .canon under ICANN’s program.

- 2014 – Canon marks 80 years since the Kwanon prototype and recounts the 1936 Hansa Canon launch.

- 2016 – Canon completes the acquisition of Toshiba Medical Systems and adds medical imaging as a core pillar.

- 2023 – Canon unveils the FPA-1200NZ2C nanoimprint lithography system for semiconductor manufacturing, targeting features at a scale equivalent to 5 nm.

- 2023 – Cumulative production of EOS system cameras reaches 110 million units, with 160 million EF and RF lenses manufactured.

Fun Fact About Canon

- The company’s first prototype camera in 1934 was named Kwanon after the Buddhist deity of mercy. Its prototype lens was called Kasyapa, referencing a disciple of Buddha.

- Canon’s first production camera, the Hansa Canon, went on sale in February 1936. It is recognized as Japan’s first high-quality 35 mm focal-plane-shutter camera.

- Early Canon cameras used Nikkor lenses and rangefinder parts from Nippon Kogaku, showing rare cross-company cooperation in Japan’s camera industry.

- Canon has held the No. 1 global share in interchangeable-lens digital cameras for 21 consecutive years (2003 to 2023).

- Canon invented thermal Bubble Jet inkjet technology, with a basic patent filed in 1977 and the first Bubble Jet printer (BJ-80) launched in 1985.

- Eye-Control AF, which lets the camera focus where the photographer looks, debuted on the EOS 5 in 1992 and returned on the EOS R3 in 2021.

- Canon’s corporate philosophy is Kyosei, meaning living and working together for the common good. It guides the company’s social and environmental initiatives.

- Canon is also a semiconductor-equipment maker. It has produced lithography systems for 50+ years and highlights nanoimprint as an emerging approach.

- In 1975, Canon built the FPA-141F, cited as the world’s first sub-micron stepper, a key milestone in chip manufacturing.

- Canon recognizes August 10, 1937 as its official founding date, when the lab was reorganized as Precision Optical Industry Co., Ltd.

- Canon entered medical imaging by acquiring Toshiba Medical Systems, announced in 2016, with the U.S. arm renamed Canon Medical Systems USA in 2018.

- Beyond cameras and printers, Canon’s historical product line includes notable firsts such as Japan’s early electronic ten-key calculator (Canola 130, 1964).

Canon Financial Overview

Summary Of Operations

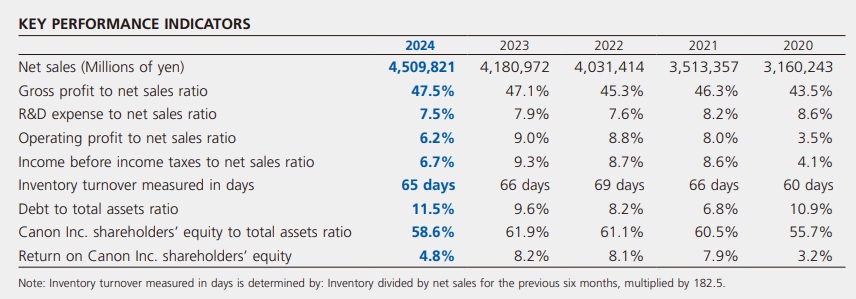

- Canon’s net sales reached ¥4,509,821 million in 2024, surpassing its previous record from 2007.

- Adjusted income before income taxes, excluding impairment losses from the Medical business unit, increased by 19.3% year-on-year, totaling ¥466,261 million.

- Although Europe and China experienced weaker demand, sales in other countries remained stable, contributing positively to overall performance.

- On the product side, semiconductor lithography equipment, network cameras, and mirrorless cameras recorded strong sales growth.

- The company’s gross profit margin rose by 0.4 percentage points to 47.5%, supported by cost reductions, improved logistics efficiency, and the yen’s depreciation.

- Total gross profit increased by 8.8% year-on-year to ¥2,143,095 million, indicating better profitability.

- Operating expenses rose by 16.9% to ¥1,863,341 million, largely due to goodwill impairment in the Medical segment and higher foreign currency expenses.

- Consequently, operating profit fell by 25.5% to ¥279,754 million, reflecting increased costs despite strong sales.

- Other income (deductions) improved by ¥6,006 million, reaching ¥21,407 million, mainly due to favorable currency exchange movements.

- As a result, income before income taxes decreased by 22.9% to ¥301,161 million, and net income attributable to Canon Inc. dropped by 39.5% to ¥160,025 million.

- Total assets rose by ¥349,669 million, reaching ¥5,766,246 million as of December 31, 2024, mainly from higher foreign currency assets and increased accounts receivable.

- Total liabilities increased by ¥310,325 million to ¥2,121,195 million, driven by new long-term debt and higher accrued expenses.

- The total equity balance rose by ¥39,344 million to ¥3,645,051 million, supported by retained earnings and foreign currency translation gains, although partially offset by dividend payments and treasury stock repurchases.

- Consequently, shareholders’ equity ratio declined by 3.3 points to 58.6%, reflecting increased liabilities during the period.

Canon Key Performance Indicators

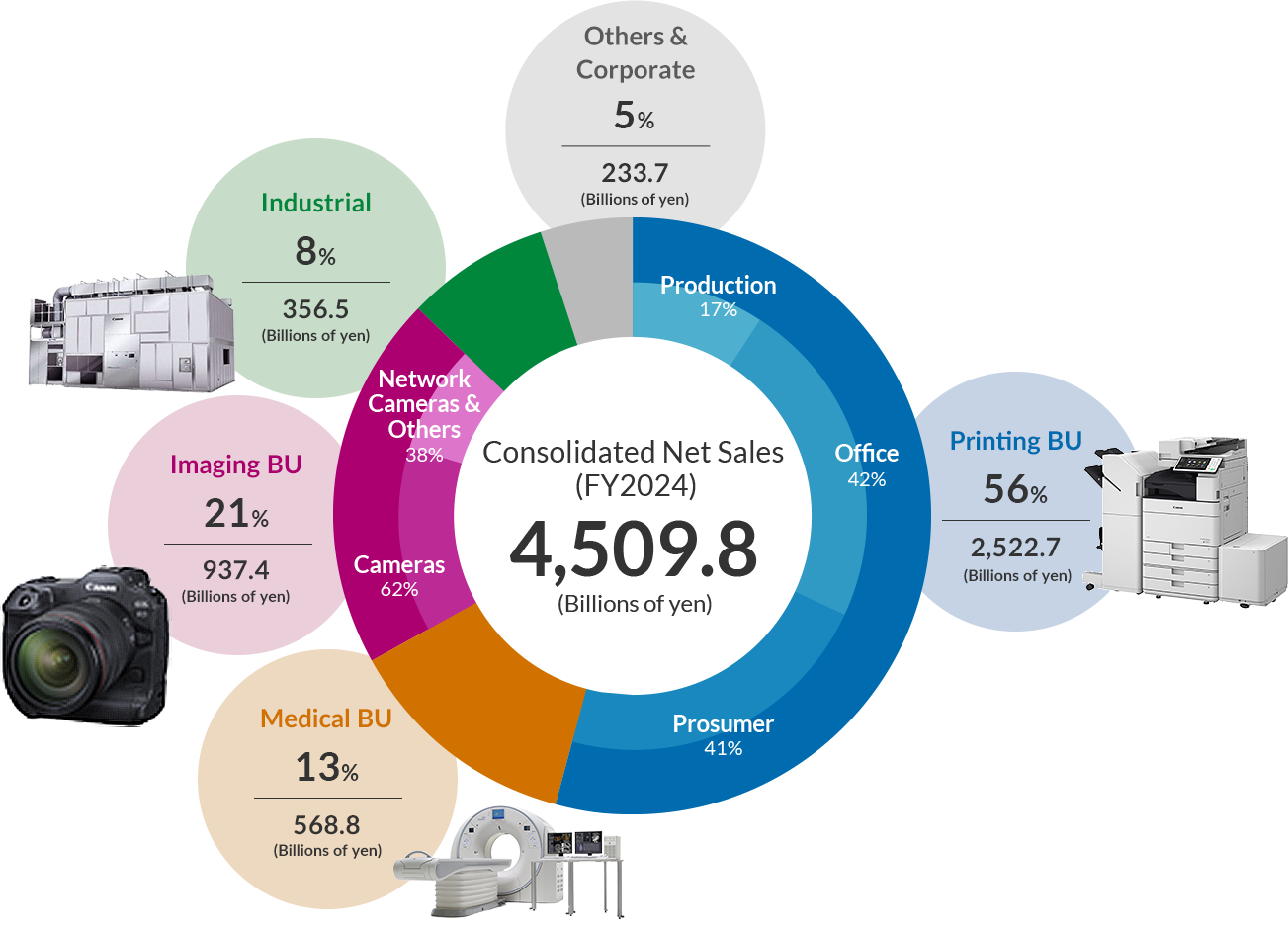

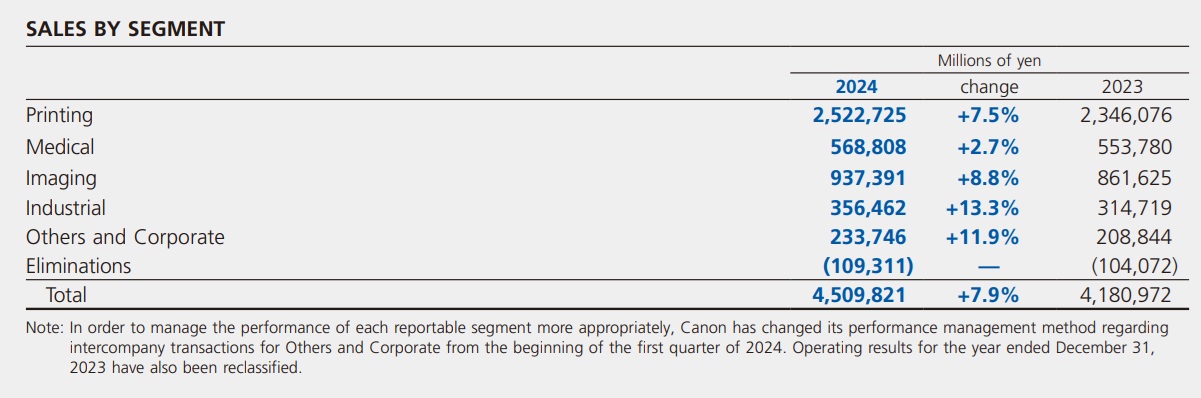

Canon Segmental Analysis

- In the Printing Business Unit, sales rose due to strong demand for imagePRESS V series and other production printing devices, particularly in the U.S. market. Additional orders from drupa, a major global printing exhibition, further supported growth. Despite weaker office printer sales in China and Europe, overall performance improved with higher sales of low and mid-speed color MFDs, such as the imageRUNNER ADVANCE DX C3900 series. Inkjet printer sales faced pressure from price competition and weak demand in China, though refillable ink tank models maintained firm sales. Laser printer sales also grew sharply after inventory issues with an OEM partner were resolved. Total sales in this unit reached ¥2,522,725 million, marking a 7.5% year-on-year increase, while income before income taxes increased by 29.4% to ¥304,146 million.

- The Medical Business Unit saw moderate growth, with higher sales of CT and MRI systems in the U.S. However, a market downturn in China and worsening financial conditions for hospitals in Japan and Europe negatively affected performance. Total sales increased 2.7% year-on-year to ¥568,808 million. The adjusted income before income taxes declined by 20.4%, reaching ¥25,592 million, mainly due to upfront investment in next-generation technologies and restructuring efforts. Additionally, an impairment loss on goodwill resulted in a total pre-tax loss of ¥139,508 million.

- In the Imaging Business Unit, sales improved following the introduction of new models such as EOS R1, EOS R5 Mark II, EOS R50, and EOS R100. Although the beginning of the year experienced a temporary slowdown in interchangeable-lens camera inventories, demand recovered strongly in the latter half.

- The Industrial Business Unit achieved solid growth of 13.3%, with total sales rising from ¥314,719 million in 2023 to ¥356,462 million in 2024.

- The Others and Corporate segment reported an 11.9% increase, with sales climbing from ¥208,844 million to ¥233,746 million.

- Total consolidated sales for 2024 amounted to ¥4,509,821 million, reflecting a 7.9% increase compared with ¥4,180,972 million in 2023.

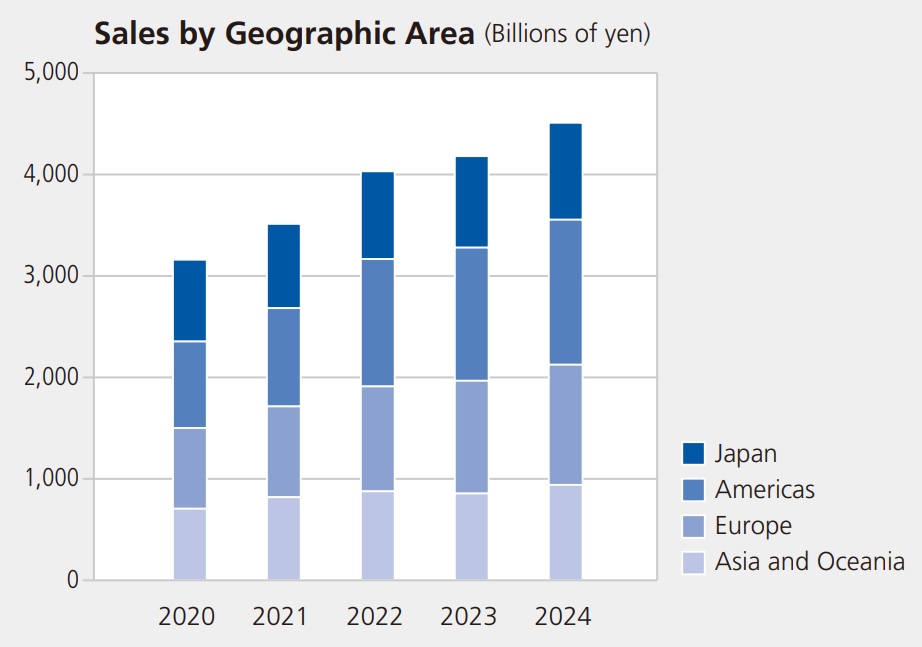

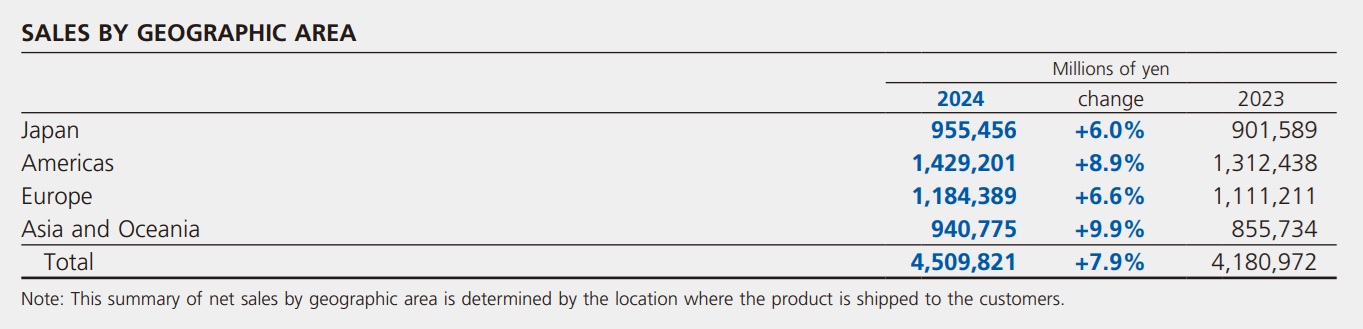

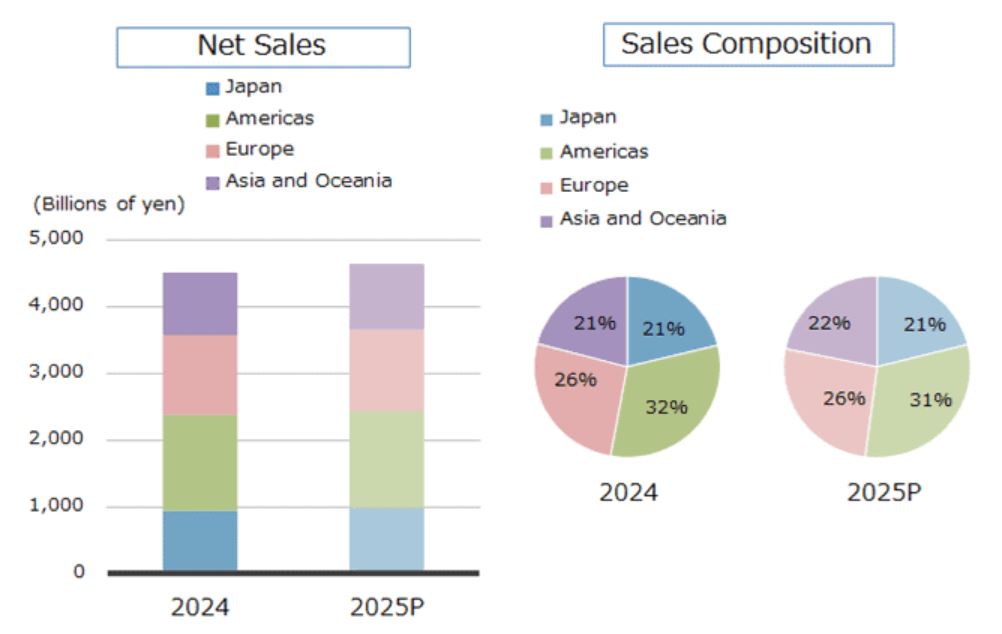

Sales by Geographic Area

- In Japan, sales reached 955,456 million yen, showing a 6.0% increase from 901,589 million yen in 2023, indicating steady domestic growth.

- In the Americas, revenue totaled 1,429,201 million yen, marking an 8.9% rise over 1,312,438 million yen the previous year, reflecting strong demand and improved market presence.

- In Europe, sales amounted to 1,184,389 million yen, representing a 6.6% gain from 1,111,211 million yen in 2023, supported by stable consumer spending and favorable market conditions.

- In Asia and Oceania, the company reported sales of 940,775 million yen, representing an impressive 9.9% growth compared to 855,734 million yen a year earlier, driven by expanding regional operations.

- Overall, total global sales reached 4,509,821 million yen, representing a 7.9% increase from 4,180,972 million yen in 2023, indicating consistent growth across all geographic segments.

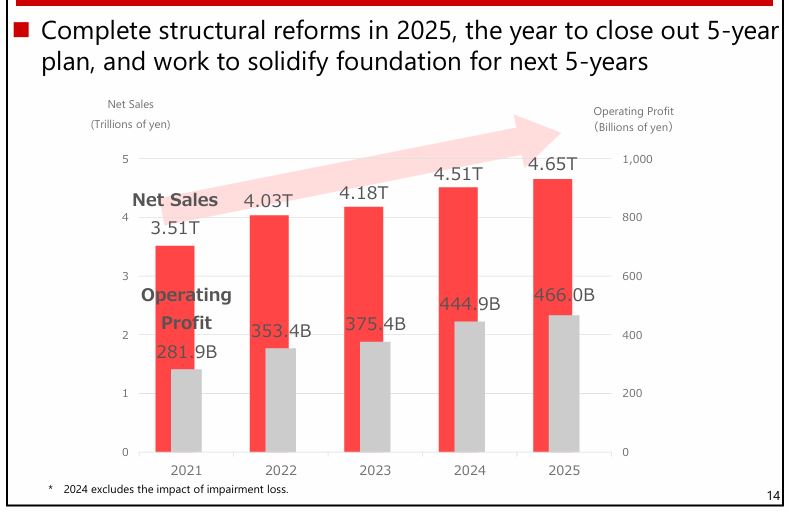

Canon Net Sales and Operating Profit

(Source: global.canon)

- In the past five years, Canon has demonstrated a financial performance characterized by the steady growth of both net sales and operating profit.

- In 2025, Canon’s net sales totalled ¥4.65 trillion, a 3.5% increase from ¥4.51 trillion in 2024, indicating continued growth.

- The operating profit also increased during this period and reached ¥466 billion, up from the previous year’s figure of ¥444.9 billion, indicating a stronger profit.

- The trend has been continuous since 2021, when net sales reached ¥3.51 trillion and operating profit stood at ¥281.9 billion.

- Canon’s revenue has surpassed ¥1 trillion, while its operating profit has risen by around ¥184 billion, indicating that the company has been consistently recovering and becoming more efficient.

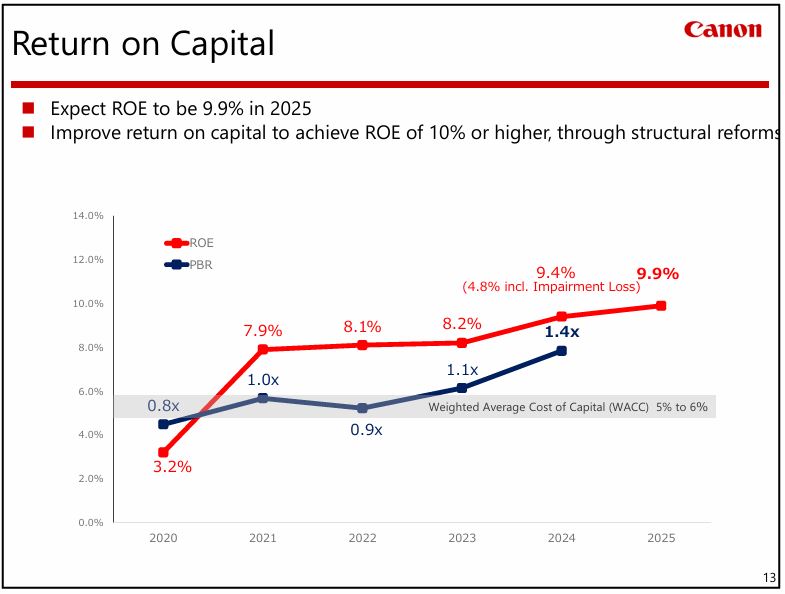

Canon Return On Capital

(Source: global.canon)

- Canon has gradually improved its return on capital, and the company is looking to achieve a 9.9%

- Return on Equity (ROE) in 2025, which represents a 0.5 percentage point increase compared to the previous year.

- The reason behind this rise is the more efficient use of assets and favourable financial leverage, although the net income ratio is expected to stay the same due to tariff influences.

- Canon’s ROE, which has fluctuated between 3.2% in 2020 and 9.9% in 2025, shows that the company has become more profitable and operationally disciplined.

- In addition, the company’s Price-to-Book Ratio (PBR) throughout this period has been in the range of 0.8x to 1.4x, indicating a gradual recovery in market confidence towards the company.

- Canon’s target return is going to be above its cost of capital as the company is operating with a Weighted Average Cost of Capital (WACC) between 5% and 6% (4.8% if impairment losses are taken into account).

- The company intends to exceed a 10% ROE goal by executing enduring structural reforms, thus increasing long-term shareholder value and capital utilization.

Canon’s Camera Division Statistics

- According to Canon’s reports, Canon has maintained the No. 1 position in the global interchangeable-lens digital camera market for 19 consecutive years, from 2003 to 2021. This achievement highlights Canon’s continued dominance and its ability to sustain consumer trust through innovation in products like the EOS Kiss Digital, EOS-1D, and EOS 5D Series.

- Based on 2022 market data, Canon continued to lead the digital camera market with nearly 50% share, while Sony accounted for 27% and Nikon held 11.3%. This consistent performance underscores Canon’s strength in technology development and global market reach.

- According to Canon’s 2022 financial report, the imaging business unit contributed 20% of the company’s total net sales. The division achieved sales of approximately ¥803.5 billion (around $6.115 billion) through strong demand for high-definition mirrorless and network cameras.

- Canon’s printing business unit generated the largest portion of revenue, holding a 56% share, followed by the medical business at 13%, the industrial business at 8%, and other corporate segments contributing 6% of total net sales.

- As per Canon’s 2023 corporate strategy, the company aims to achieve approximately ¥1 trillion (around $7.605 billion) in imaging sales by 2025. This target will be supported by the expansion of the EOS R System, introduction of EOS VR systems, and sustained leadership in interchangeable-lens and mirrorless camera segments.

- The imaging division’s main products include the Cinema EOS System, EOS R System, network cameras, camcorders, and broadcast lenses. These categories are central to Canon’s long-term goal of maintaining technological leadership and increasing profitability in the global imaging industry.

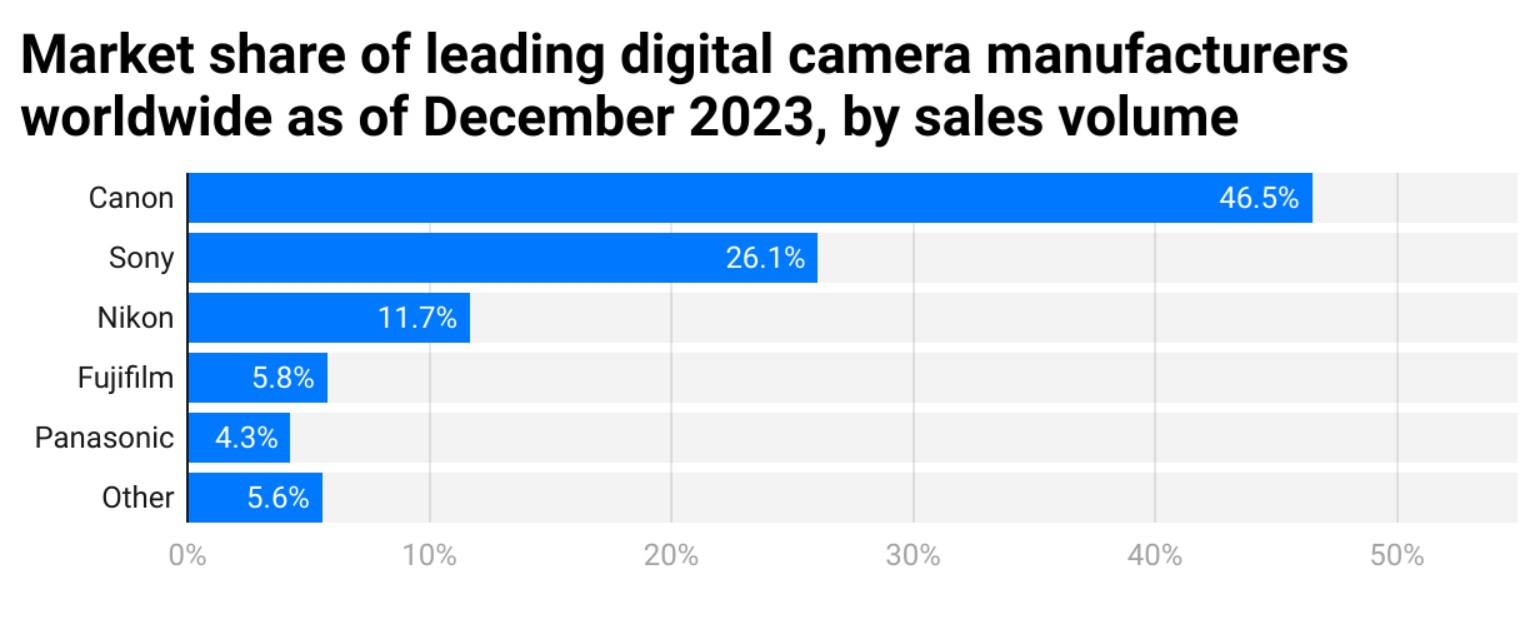

Digital Camera Manufacturer Statistics

- Canon held the largest global market share at 46.5%, making it the top manufacturer based on total sales volume.

- Sony followed with a 26.1% share, driven by its strong mirrorless camera lineup and sensor technology.

- Nikon accounted for 11.7%, maintaining a solid position among professional photographers and enthusiasts.

- Fujifilm captured 5.8%, supported by its success in compact and hybrid camera models.

- Panasonic achieved a 4.3% share, sustained by its focus on video-centric mirrorless systems.

- Other smaller manufacturers collectively represented 5.6% of the global digital camera market.

Total Market Valuation

- According to market data, Canon’s market capitalization was estimated at USD 31.82 billion on February 7, 2025, reflecting steady investor confidence.

- The company’s valuation showed remarkable growth from USD 21.96 billion in March 2023, indicating improved performance and stronger market sentiment.

- As per early 2023 records, on January 14, Canon’s total market value stood at USD 22.47 billion.

- By February 11, the value showed a minor dip to USD 22.39 billion, followed by a decline to USD 21.9 billion by February 25, suggesting temporary market correction.

- Reports indicate a modest recovery on March 18, when the valuation increased to USD 21.97 billion, maintaining stability until early May 2023.

- According to trading data, Canon experienced a strong upward phase in June, reaching USD 25.67 billion by June 3, supported by higher investor activity.

- The value continued to rise, touching USD 25.8 billion on July 8, and achieving a peak of USD 26.74 billion on July 22, signaling positive market momentum.

- A subsequent dip occurred by August 5, with valuation falling to USD 25.52 billion, and then further to USD 24.51 billion in September, reflecting short-term fluctuations.

- By late October, Canon’s market value reached USD 22.8 billion, but a recovery phase began on November 11, with valuation improving to USD 24.04 billion.

- Continued recovery was observed, with Canon valued at USD 25.92 billion by December 2, though it slightly eased to USD 25.36 billion by December 30, 2023.

- Entering 2024, the company began on a stable note, with a valuation of USD 25.42 billion on January 6, rising to USD 25.68 billion by January 13, before a small decline to USD 25.18 billion on January 27.

- As reported in February 2024, Canon’s market capitalization strengthened further, reaching USD 27.16 billion by February 13, marking a robust start to the year.

- According to its 2023 corporate strategy, Canon set a goal of achieving ¥1 trillion (approximately USD 7.605 billion) in imaging sales by 2025.

- This target is supported by initiatives such as enhancing its EOS R System, expanding deployment of EOS VR systems, and maintaining a strong position in the interchangeable lens and mirrorless camera segment.

Canon Momentum in Medical Innovation

- Canon’s sales in the first quarter of 2025 increased by 2% overall, thanks to the company’s successful and timely implementation of its strategic plan, which aimed to expand its presence in Asia, Latin America, and other emerging markets.

- The profitability also showed an upward trend as the company began to reap the benefits of the business innovation efforts from the previous year.

- Hence, the operating profit margin grew by 0.7% to reach 4.9% compared to last year.

- Canon’s plan for the future is to accelerate growth beyond the second quarter by establishing local offices in the Middle East, India, and other rapidly expanding regions where large-scale government and institutional contracts are frequently available.

- The company also looks forward to a booming market in the US, which will be backed by a more prominent sales department and the establishment of stronger connections with medical institutions.

- Canon is expecting to gain over ¥10 billion from its innovation-based efficiencies this year from its operational restructuring, like service and maintenance operations optimization and loss-making divisions reorganization, among others. This trend will likely lead to an increase in the operating profit margin to 6.5%.

- In terms of innovation, Canon launched a multi-position CT scanner that can produce images of the patient in all three positions—standing, sitting, and lying—making it possible to detect diseases earlier and more accurately, which would not have been visible with conventional imaging.

- The firm is set to introduce its highly anticipated next-generation photon-counting CT system later this year, marking another step towards strengthening its market position by steadily advancing in the medical imaging technology sector.

Canon Net Sales By Region

(Source: coolest-gadgets.com)

- The commercial statistics signify Canon’s powerful international footprint, which spans all its product categories, including SLR and digital cameras, copiers, and imaging devices.

- The North American region is expected to lead Canon’s sales performance in 2025, with an estimated USD 9.39 billion, representing a significant increase from the previous year.

- Europe is not far behind, with estimated sales of around USD 7.92 billion, which is about a quarter of the company’s global share.

- At the same time, Japan and the Asia-Oceania region are expected to secure strong sales, with each region exceeding USD 6 billion in sales, thereby accounting for around one-fifth of Canon’s worldwide market share, respectively.

- The Canon EOS R50 V camera is a versatile product for video making, aimed at content creators, as it supports RF lenses. On the other hand, the PowerShot V1 caters to non-professional users by making video shooting and streaming very easy.

- Although Canon has faced some difficulties in the compact camera segment, the company plans to increase its output to capitalise on the growing demand for devices with high imaging quality.

- In fact, this year, Canon’s highly optimistic forecast for its total camera sales stands at 5.6% which is the very reason for the company to continue its strategy of attracting new generations of creators and thereby, expanding its role in the ever-changing imaging market.

Canon Semiconductor Lithography, AI, And Advanced Packaging

- In 2025, the optical equipment division of Canon, consisting mainly of its semiconductor lithography business, is already showing good growth that is steady, while the semiconductor market is giving mixed signals.

- The semiconductor market is forecast to remain strong, avoiding a decline to last year’s high levels. Some customers have indeed postponed investments in lithography equipment because they are waiting for the memory sectors to recover slowly, but the end-users of back-end processing equipment have been the opposite; their demand is really strong.

- Canon’s lithography equipment sales in Q1 2025 peaked at 56 units, 7 more than in the same quarter last year, reflecting the demand for GPU production related to applications in generative AI.

- Also, the company’s backend processing equipment is now widely adopted in advanced packaging and has even become the de facto industry standard.

- Throughout the entire year, Canon expects to sell 289 units, which is 56 more than the previous year, and still keep the strong momentum in this particular segment.

- Additionally, Canon is continuing to develop its next-generation nanoimprint lithography systems.

- The company has sent the evaluation equipment to a leading semiconductor manufacturer as its first-quarter activities, which is a significant step in joining the verification for mass production.

Canon Cameras Top Model Specifications

| Model Names | Estimated Cost (USD) | Sensor | Video | Burst Rate | Best For |

| Canon EOS-1D X Mark III | 6,499 | Full-frame 20.1MP CMOS | 4K 60p | 16 fps (mechanical), 20 fps (electronic) | Sports, Wildlife, Journalism |

| Canon EOS 5D Mark IV | 2,799 | Full-frame 30.4MP CMOS | 4K 30p | 7 fps | Portrait, Landscape, Events |

| Canon EOS 7D Mark II | 1,499 | APS-C 20.2MP CMOS | Full HD 60p | 10 fps | Sports, Wildlife, Action Photography |

| Canon EOS 6D Mark II | 1,399 | Full-frame 26.2MP CMOS | Full HD 60p | 6.5 fps | Portrait, Low-light, Enthusiasts |

| Canon EOS 90D | 1,199 | APS-C 32.5MP CMOS | 4K 30p | 10 fps | Wildlife, Sports, Enthusiasts |

| Canon EOS 80D | 999 |

APS-C 24.2MP CMOS

|

Full HD 60p |

7 fps

|

Enthusiasts, Videography |

| Canon EOS Rebel T8i (EOS 850D) | 899 | 4K 24p | Entry-level, Family Photography | ||

| Canon EOS Rebel SL3 (EOS 250D) | 749 |

APS-C 24.1MP CMOS

|

4K 25p | 5 fps | Beginners, Travel |

| Canon EOS 2000D (Rebel T7) | 479 | Full HD 30p | 3 fps | Beginners, Budget-conscious Users |

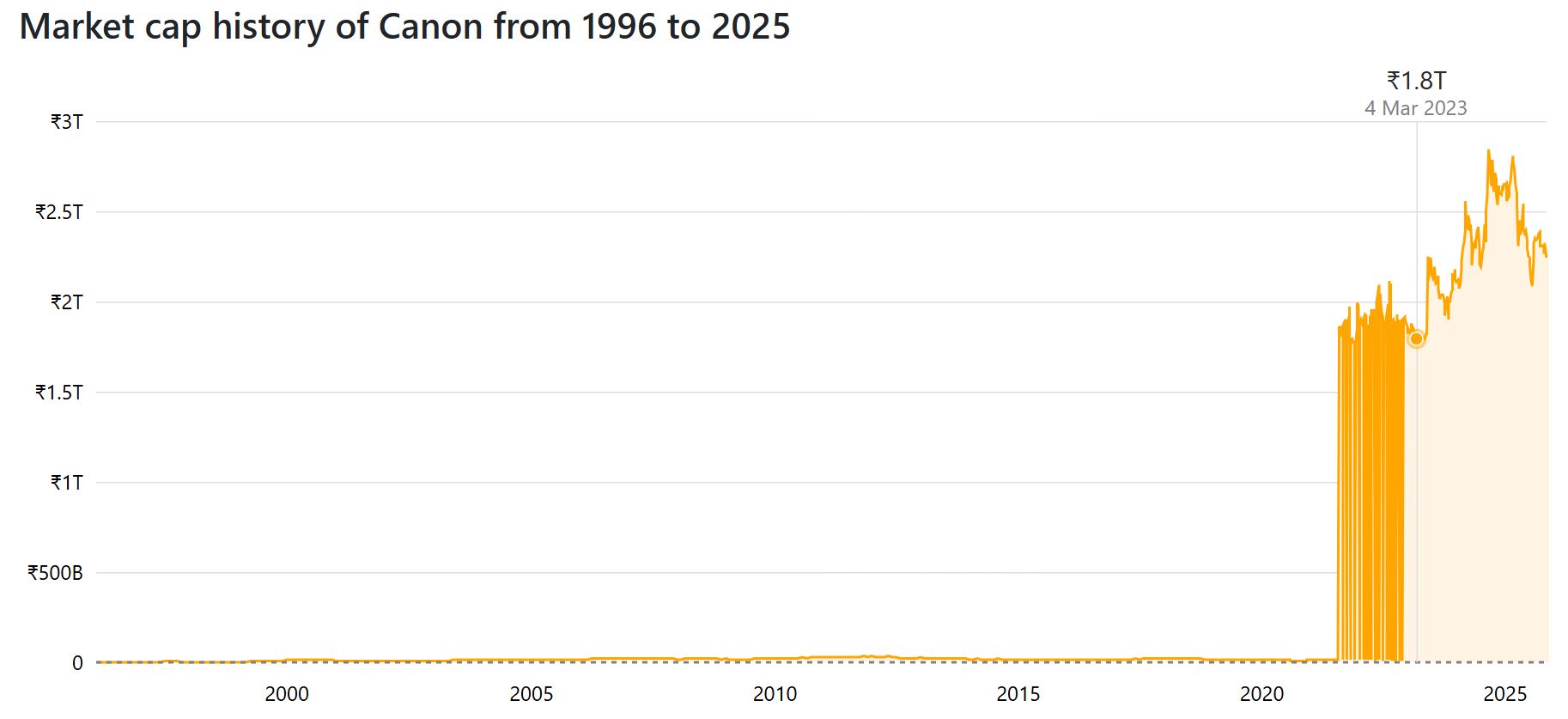

Canon Market Capitalisation

(Source: companiesmarketcap.com)

- Canon’s market cap at the end of October 2025 is ₹2.238 trillion, which puts it in the position of being the world’s 895th most valuable company.

- Market cap is equivalent to the total market value of the company’s outstanding shares and is thus a significant measure of the company’s financial strength.

- In the year 2025, the market capitalization of Canon fell by 15.97% in comparison to the prior year. In 2024, the company was valued at ₹2.664 trillion, representing a 26.21% increase from 2023.

- The year 2023 also saw a notable growth of 15.87%, with a market capitalisation of ₹2.111 trillion. Looking back even further, 2022 saw a significant surge in the market cap, which increased to ₹1.821 trillion, representing an impressive 10,963.89% rise from 2021.

- In 2021, Canon’s market value was ₹16.46 billion, representing a 15.76% increase from the previous year, 2020, when it was ₹14.22 billion—a year that saw a 25.56% decline.

- In general, the market value of Canon has experienced significant long-term growth, especially since 2022; however, the recent year marked a correction after several years of growing demand.

Conclusion

Canon Statistics: Canon’s steady performance is a testament to its ability to adapt to technological and consumer trends. The company continues to innovate and expand its markets, implementing structural reforms that collectively contribute to the strengthening of its global presence and profitability. Despite being under attack from competition and economic pressures, Canon’s compelling qualities of efficiency, sustainability, and product excellence have enabled it to remain a strong player in future growth.

Its breakthrough imaging, healthcare, and semiconductor technologies are a clear indication of its long-term intent to create value. In general, Canon’s strategic evolution reflects its resilience and willpower to remain a leader in an increasingly dynamic and competitive global market.

FAQ.

Over the past five years, Canon has consistently performed financially well, with net sales increasing from ¥3.51 trillion in 2021 to ¥4.65 trillion in 2025. Operating profit also followed a similar trend, rising from ¥281.9 billion to ¥466 billion in that time frame.

In 2025, Canon’s Return on Equity (ROE) is expected to be 9.9%, which is an increase of 0.5 percentage points compared to 2024. The main contributing factor to this change is the improvement in asset efficiency and financial leverage, even though profit margins are stable because of tariff influences. The company is targeting over a 10% ROE through continuous structural changes and effective capital deployment.

In 2025, Canon’s American region will account for the largest share of sales, around USD 9.39 billion, depicting a robust increase over 2024. The European region will be the next largest with close to USD 7.92 billion, which would make up about 26% of all Canon sales.

In the medical field, it introduced a multi-position CT scanner which not only scans the patients standing, sitting and lying but also improves the precision of diagnosis. In the semiconductor business, Canon’s lithography systems sales went up to 56 units in the first quarter of 2025, thanks to AI and data center applications as the main drivers of demand.

Canon will have a market capitalization of ₹2.238 trillion as of October 2025, which places it as the 895th most valuable company in the world. Even though this is a decrease of 15.97% compared to the previous year, the company has made up a lot of significant long-term equity in 2022. The market capitalization of Canon increased from ₹16.46 billion in 2021 to ₹1.821 trillion in 2022, thus marking a stunning rise of above 10,000% after years of expansion and recovery.

I hold an MBA in Finance and Marketing, bringing a unique blend of business acumen and creative communication skills. With experience as a content in crafting statistical and research-backed content across multiple domains, including education, technology, product reviews, and company website analytics, I specialize in producing engaging, informative, and SEO-optimized content tailored to diverse audiences. My work bridges technical accuracy with compelling storytelling, helping brands educate, inform, and connect with their target markets.